After the holidays? Beginning of the new year? Or once things settle down? What is the best time of the year to look for a new job?

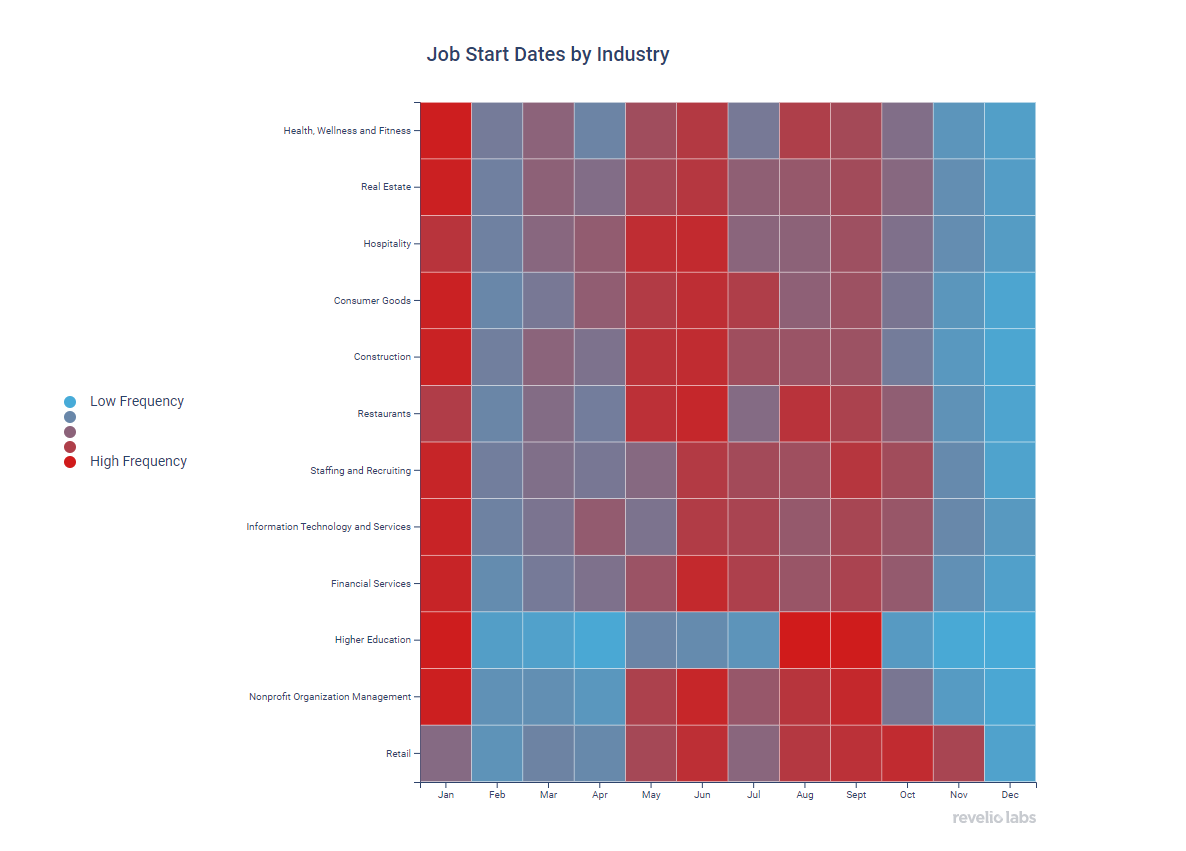

Well, by analyzing the start dates on profiles, we see that it depends a lot on the industry. The following calendar shows the frequencies of newly filled positions for each industry by month:

In many industries, we see that changing jobs is less common during the holiday season in November and December, and more common early in the year. Quite notably, in Higher Education, jobs almost always begin with the start of the academic year, or at the beginning of spring semester.

The months of November and December are the peak months for starting a new job in Retail, in line with the surge in demand for the holiday season. Interestingly, Health, Wellness and Fitness peak in January. Perhaps our collective sloth and gluttony during the holidays is reflected in the job market.

It should also be noted, per our recent partnership with Recruiter.com, that last spring and early summer, with the onset of warming weather, we saw a surge in Restaurants, Hospitality, and Construction positions.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.