As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Of all things missed during the pandemic, travel was at the top of the list for many people.

“[Travel] is a necessity, for lives and livelihoods, for families, as well as for economic and mental health,” said Gavin Tollman, CEO of the global guided tour company Trafalgar. “Never again should we forget that travel is truly one of the greatest gifts for so many reasons beyond just a vacation.”

As more people received their vaccinations, they eagerly began boarding planes and cruises.

Families felt urgency to give children fun and exploratory experiences they had missed out on for more than a year and a half. Engaging in “revenge travel,” parents made up for lost time by going on big trips to Disney World or international destinations.

By the end of second quarter, Disney reported that parks were at or “near” reduced capacity levels.

At the same time, businesses realized they could cut costs and reduce their carbon footprint by not sending professionals to far-away meetings or events. Business travel recovery isn’t expected until at least 2023, if not later. In response, airlines have changed their loyalty programs, often reducing the amount of miles needed to achieve a higher status tier.

The travel industry isn’t out of the woods yet. In the same month that the Biden Administration lifted the pandemic-era ban on international travel, the World Health Organization declared Omicron a “very high” global health risk.

Will the risk of a new covid variant be enough to deter travelers from exploring new places or visiting family members more frequently? It’s far too soon to tell, but the pent-up demand is still real.

Top travel companies are investing heavily to reach consumers who’ve shifted their priorities and feel the itch to experience the world.

MediaRadar Insights

Overall Spending and Breakdown Across Formats

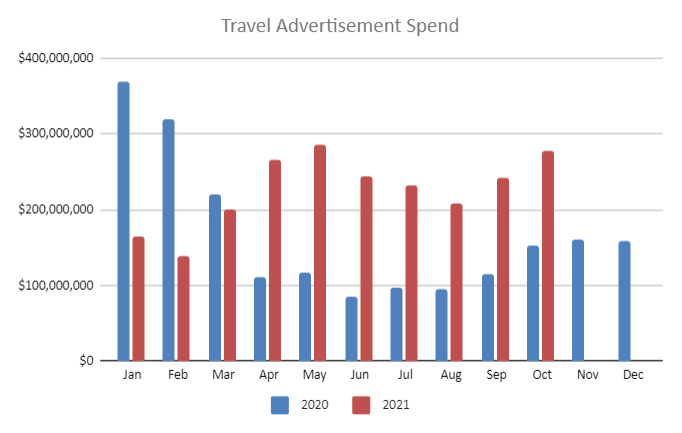

Homebound consumers and the travel industry both needed some rejuvenation in 2021. Travel marketing teams jumped on the opportunity. Overall, travel companies spent $2.29 billion in 2021.

More than $1 billion of this spending was across digital. The second largest format advertisers spend on was print, in which they spent $647 million this year. They also spent $580 million on TV this year.

Number of Advertisers

20 thousand advertisers spent $2.3 billion in 2021 compared to 20 thousand advertisers spending $1.7 billion in 2020.

Advertiser Retention

In the overall category, travel advertisers had a 48% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. The Walt Disney Company

The Walt Disney Company is the top advertiser in this category, dedicating 16% of their overall budget to ads promoting their travel brands.

The Walt Disney Company’s ad spend is up 73% in comparison to last year with their investment in digital advertising up 89% YOY. They have made significant investments in OTT advertising, which saw increased spending by over 1000% since last year.

This year, The Walt Disney Company spent over $694 million on digital advertising, with over $44 million going towards online video ads, $152 million going towards Facebook ads, and $44 million going towards Snapchat ads. They also spent over $666 million on TV advertisements, with nearly $341 million allocated for broadcast ads and $325mm for cable ads.

Below is a breakdown of The Walt Disney Company’s spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 172 key contacts at The Walt Disney Company.

2. Expedia Group, Inc.

Expedia Group, Inc. is also top advertiser in this category, dedicating 52% of their overall budget to ads promoting their travel brands. Expedia Group, Inc ad spend is up 138% in comparison to last year with their investment in digital advertising up 322% year-over-year.

They have made significant investments in Facebook, OTT, Native, and Newspaper advertising, all of which saw spending increased by over 1000% since last year.

This year, Expedia Group, Inc spent nearly $180 million on digital advertising, with nearly $132 million going towards online video ads, $27 million going towards Facebook ads, and $10 million going to display advertising.

Expedia spent over $153mm on TV advertisements, with $98 million allocated for cable ads and $55 million allocated for broadcasting ads.

Below is a breakdown of Expedia Group’s spend thus far in 2021. We predict they will likely have 2 upcoming RFPs issued. MediaRadar can help you connect with 43 key contacts at Expedia Group, Inc.

3. Airbnb, Inc.

Airbnb, Inc. is another top advertiser in this category, dedicating 100% of their overall budget to ads promoting their travel brands.

Airbnb, Inc. ad spend is up 560% in comparison to last year, with their investment in TV advertising up over 1000% year-over-year. They have made significant investments in online video, broadcast, cable, OTT, podcast, and mobile advertising, all of which saw increased spending by over 1000% since last year.

Spending on advertisements on Facebook went down, as did display ads and native advertisements.

This year, Airbnb, Inc. spent nearly $54 million on digital advertising, with nearly $44 million going towards online video ads, $6 million going towards Facebook ads, and $3 million going to OTT ads.

Airbnb spent over $51.5 million on TV advertisements, with $39 million allocated for cable ads and $11 million allocated for broadcasting ads.

Below is a breakdown of Airbnb, Inc. spend thus far in 2021. MediaRadar can help you connect with 16 key contacts at Airbnb, Inc.

4. Royal Caribbean Group

Royal Caribbean Group is another big advertiser in this category, dedicating 95% of their overall budget to ads promoting their travel brands. Royal Caribbean Group ad spend is up 9% in comparison to last year, with their spend in digital advertising up 245% year-over-year.

Most of their spending was allocated for TV advertisements, with nearly $34 million spent on broadcasting ads and $7 million on cable ads.

This year, Royal Caribbean Group spent nearly $11 million on digital advertising, with over $7 million going towards online video ads and $27 thousand on mobile ads, a 926% and over 1000% increase in spending respectively. They also invested in advertising campaigns with Snapchat and OTT .

Will this trend towards increasing digital advertising continue? Below is a breakdown of Royal Caribbean Group’s spend thus far in 2021. We predict they will likely have 3 upcoming RFPs issued. MediaRadar can help you connect with 22 key contacts Royal Caribbean Group.

5. Southwest Airlines Co.

Southwest Airlines Co. is also one of the top advertisers in this category, dedicating 100% of their overall budget to ads promoting their travel brand.

Southwest Airlines Co. ad spend is up 34% in comparison to last year, with their spend in digital advertising up 103% YOY. Most of their spending was allocated for digital advertisements, with a 405% increase in spending on online video ads.

This year, Southwest Airlines Co. spent over $28 million on digital advertising, with over $16 million going towards online video ads and $9 million on Facebook ads.

They also spent $19 million in TV advertisements, with $11 million towards cable ads and $7 million towards broadcast ads. Southwest Airlines Co. also began investing in newspaper ads and increased their spending in OTT ads by over 1000%.

Below is a breakdown of Southwest Airlines Co’s spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 21 key contacts at Southwest Airlines Co.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.