As COVID-19 cases rise in many parts of the world, especially Europe, the travel industry may be set for another period of disruption as winter encroaches and traveler sentiment worsens. Uncertainty in recent days has mounted further as the new Omicron variant has spread quickly, leading to many countries reimposing COVID restrictions.

The situation is particularly ambiguous as recent months had produced stronger levels of hotel performance with vaccination progress leading to buoyed demand, reduced restrictions and the reopening of many international borders.

In November 2021, STR undertook a new online survey using its Traveler Panel–an engaged audience of travel consumers–to examine the fortunes of the industry at this uncertain time. The research gathered the views of nearly 1,500 global travelers.

Seasonality and winter chills due to COVID-19

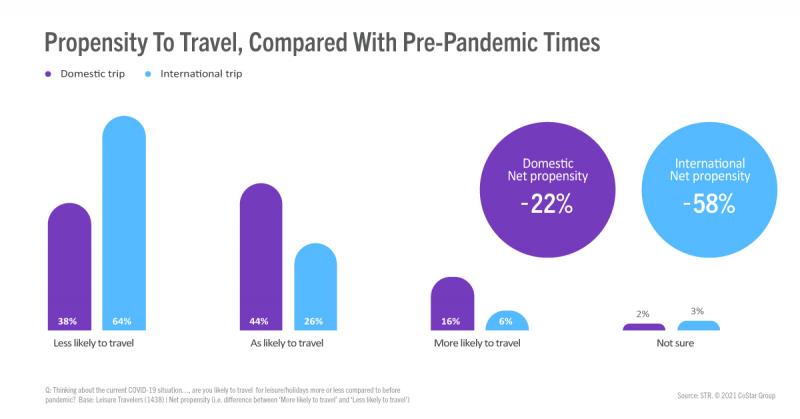

Seasonality is likely one factor behind negative propensity to travel as consumers said they were less likely to travel domestically or internationally when compared with before the pandemic. General anxiety as winter approaches was also a likely factor in reduced consumer propensity to travel.

As also seen in previous research, international travel is much less appealing than domestic travel. Well over half (64%) said that they were less likely to travel internationally in the current environment compared with before the pandemic. Using the same time comparison, only 6% thought they would travel more. As a result, net propensity to travel internationally was -58% compared with -22% for domestic travel.

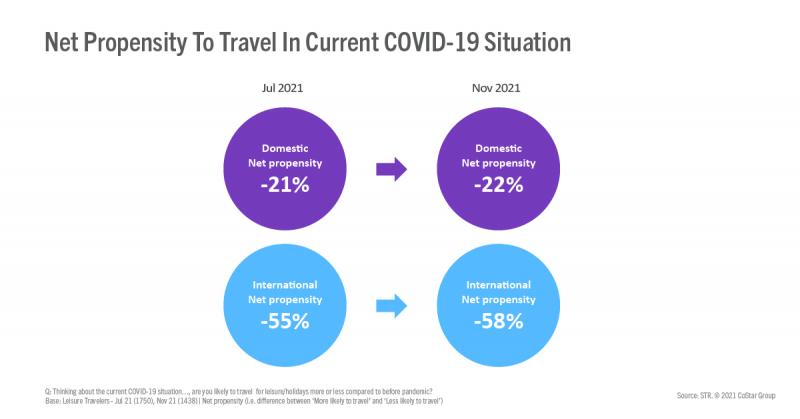

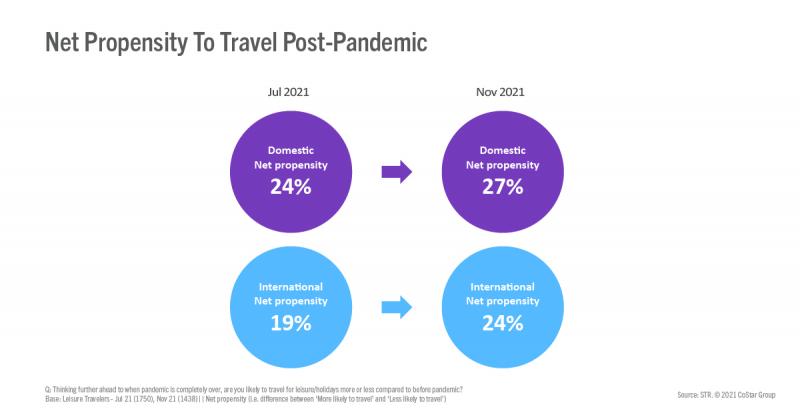

The latest results, compared with our previous research in July 2021, suggest stalling sentiment toward travel as net propensity was largely unchanged for domestic and international travel. This seemed surprising as restrictions had eased, and many countries have opened again to international tourists. However, the results highlight the continued dissuasive influence of COVID-19 on travel.

Holiday hurdles

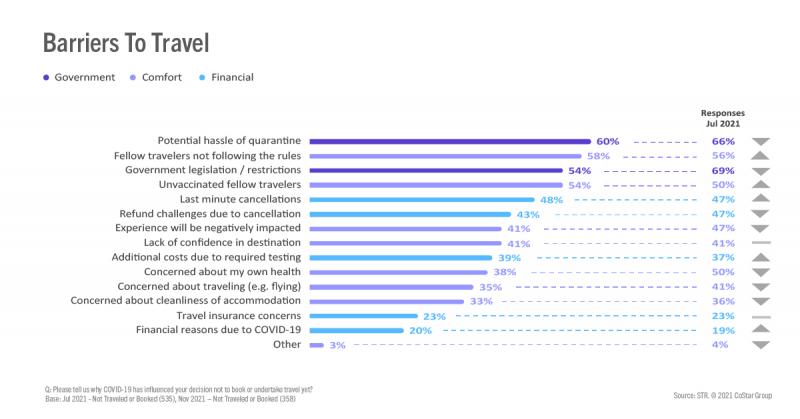

Around a quarter of respondents said issues related to COVID-19 were a reason, at least in part, for not undertaking travel since July 2021.

Government restrictions, quarantine concerns and apprehension regarding the behavior and vaccination status of other travelers were key reasons inhibiting travel.

However, government-related barriers declined in significance from July 2021 as did concerns regarding personal health, which is presumably a reflection of increased confidence due to vaccinations and booster shots.

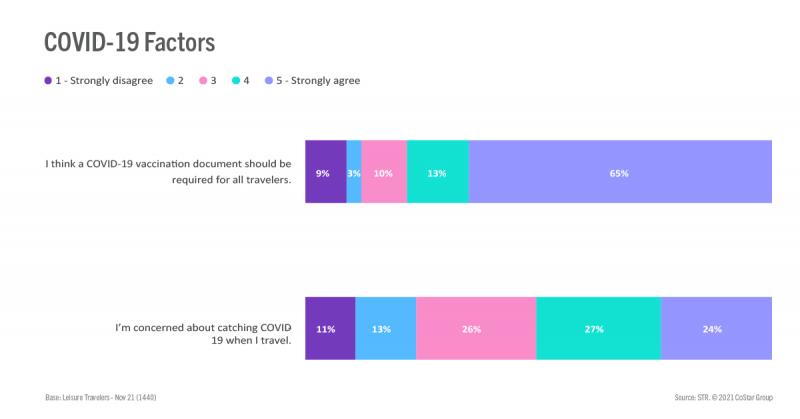

While worries about personal safety declined compared with July 2021, consumers are remaining vigilant about the virus—50% agreed they were concerned about catching COVID-19 while traveling. Meanwhile, 24% disagreed and the remainder (26%) had a neutral view.

This cautious view was reinforced as 78%, compared with 71% in July 2021, thought that a vaccination document should be required for all travelers. Combined, these findings highlight pervading hesitancy about COVID-19 which is continuing to influence consumer travel behavior.

Post-pandemic tourism boom?

The industry seems poised for a significant uplift when travel decisions are unaffected by COVID-19. Encouragingly, international tourism is set to rebound almost as strongly as domestic tourism when the pandemic is over. The latest results suggest slightly more enthusiasm and excitement for travel in a post-pandemic world compared with our July 2021 findings.

Conclusion

The current backdrop is unpredictable and complex. As countries apply new measures to tackle Omicron, consumers seem increasingly likely to take heed of the situation. This may lead to a slowdown in the recovery, which has been fast-moving in many parts of the world since the summer. However, ongoing vaccination progress combined with boosters and improving COVID-19 treatment will continue to raise consumer confidence. As a result, travel in the coming months is expected to be influenced by trade-offs in personal health concerns, government restrictions and wanderlust.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.