As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Quick service restaurants (QSR) found themselves in a unique position during the pandemic.

65% of Americans were cooking at home more often, rather than eating out. But despite the increase of home cooking, digital orders, home delivery service, and drive-through services climbed.

Digital restaurant delivery increased 123% in the United States, while 35% of all restaurant orders were made in a drive-through lane.

Drive-thru lanes have long been an option for major chains, but fast food chains are investing in digital technology to make them more efficient. They are experimenting with new QR codes, mobile tracking, license plate scanning to make personalized or recommendations, and pick up ‘cubbies.’

Companies that didn’t previously have drive-thru services, like Shake Shack, Applebee’s, Chipotle and Sweetgreen, are all experimenting with drive-thru lanes to make the ordering process easier.

At the same time, companies are exploring new ways to provide training, pay, support and a well-defined career path to attract and retain employees. With a labor shortage, advertisement creative from QSR companies hasn’t only been devoted to stirring up consumer appetites, but also to recruiting employees.

As QSR companies promote their new approaches to service or employment, who should you be making your pitches to?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

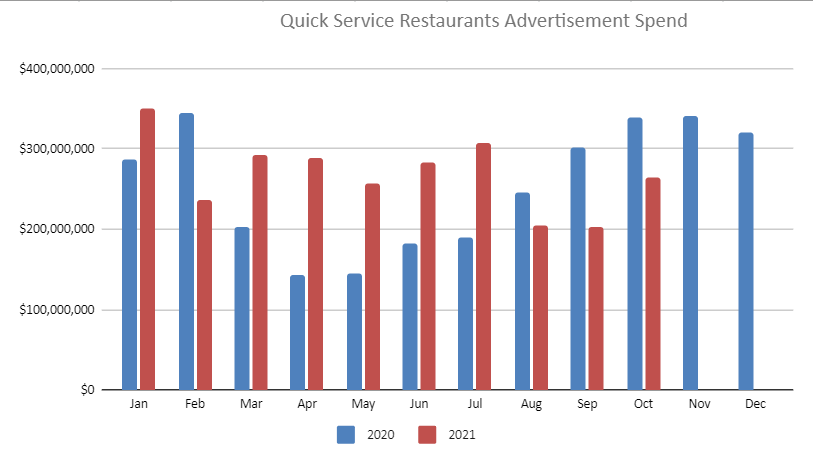

Overall, spend in the QSR category is up 13% YoY (January – October, 2021 vs 2020).

Advertisers spent the most on TV advertisements, accounting for $2.1 billion. Spending in this format remained fairly flat as it only increased 1% this year.

Digital saw the largest increase—108%. Advertisers spent $566.8 million here.

Meanwhile, they shifted investments out of print. Print spending fell 22%, reaching nearly $7.7 million.

Number of Advertisers

375 advertisers spent about $2.7 billion in 2021, compared to 363 advertisers who spent $2.4 billion in 2020.

Retention and Shift in Top Advertisers

In the overall category, QSR advertisers had a 53% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Yum! Brands, Inc.

Yum! Brands, Inc. (operator of KFC, Pizza Hut, Taco Bell, The Habit Burger Grill, and WingStreet) is the top advertiser in the quick service restaurant industry, with 99% of their overall ad budget allocated to promoting their QSR products.

Since last year, their ad spending has increased by 13%.

The main area of growth in Yum! Brands’ ad spending was in digital media, which saw an increase of 106%. Digital categories, lile online video, OTT, Snapchat and podcast ads have all seen increases of over 100%.

Below is a breakdown of Yum! Brands, Inc. ad spend thus far in 2021. We predict they will likely have 2 upcoming RFPs issued. MediaRadar can help you connect with 49 key contacts at Yum! Brands, Inc.

2. Roark Capital Group

Roark Capital Group is another big advertiser in the QSR industry, with 75% of their budget on promoting their QSR products. Their overall ad spend has increased by 35% since last year, with growth in TV, Print, and Digital advertising.

Online video, OTT, and native advertisements saw increases of 118%, 206%, and 716% respectively.

Below is a breakdown of Roark Capital Group’s ad spend thus far in 2021. We predict they will likely have 8 upcoming RFPs issued. MediaRadar can help you connect with 102 key contacts at Roark Capital Group.

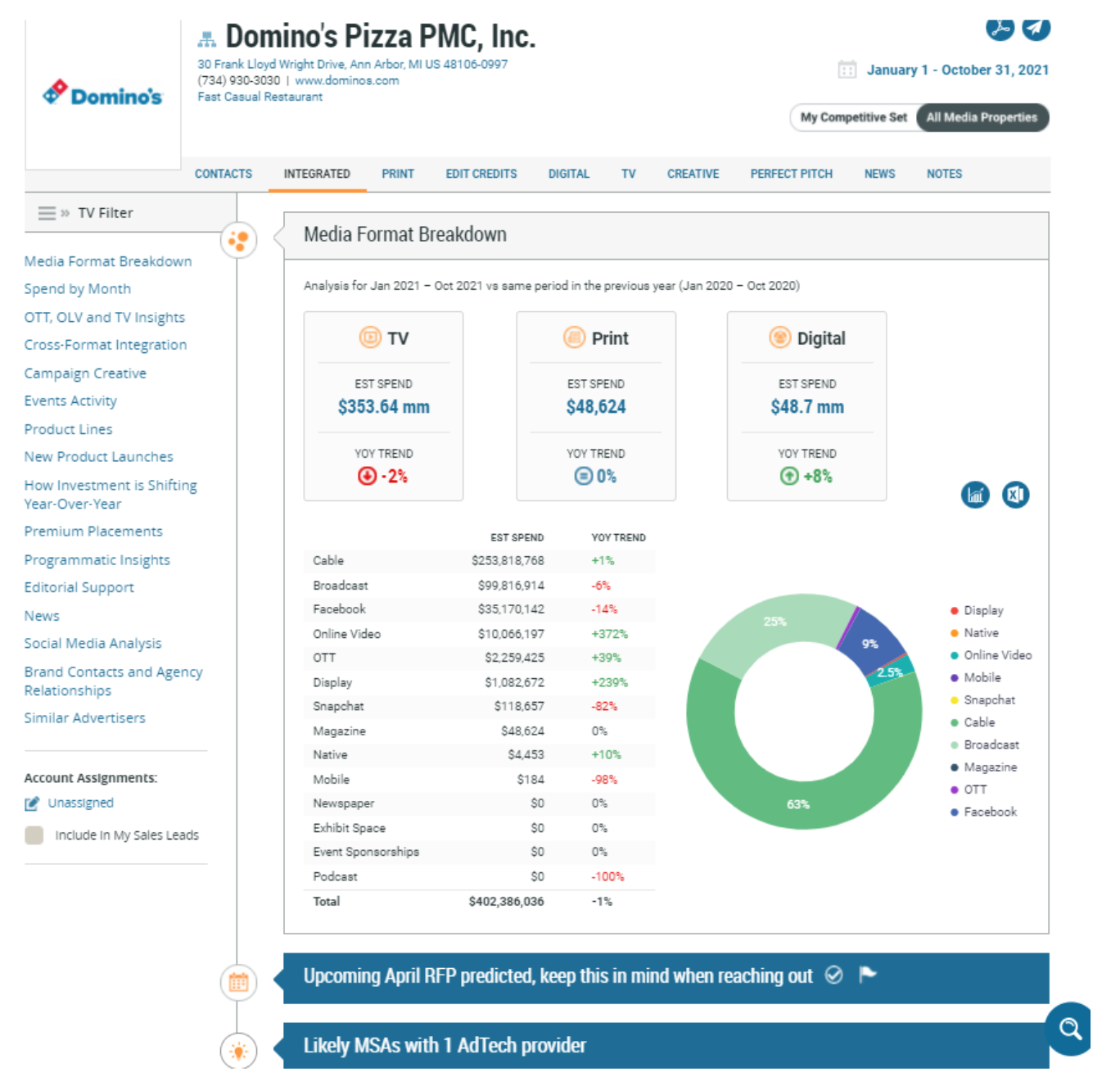

3. Domino’s Pizza PMC, Inc.

Domino’s Pizza PMC, Inc. is also a major advertiser in the quick service restaurant industry, with 83% of their overall budget allocated to promoting their QSR products.

While their advertising spend has gone down 1% since last year, digital advertising saw an increase in investment. Online video advertisements and display ads went up by 372% and 240% respectively.

Below is a breakdown of Domino’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 20 key contacts at Domino’s Pizza PMC, Inc.

4. McDonald’s Corporation

McDonald’s Corporation is a well-known advertiser in the QSR industry. 95% of their overall budget is allocated to promote their quick service brands.

While McDonald’s ad spending is down 9% since last year, they’ve increased their investments in digital advertisement 66% year-over-year. Online video ads make up for 20% of their overall ad spend, and they’ve increased their spend on Facebook ads by over 1000%.

Below is a breakdown of McDonald’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 31 key contacts at the McDonald’s Corporation.

5. The Wendy’s Company

The Wendy’s Company is another big advertiser in the quick service restaurant industry, with 97% of their budget dedicated to promoting their QSR brands.

Wendy’s has increased their ad spending by 9% since last year. Investment in digital advertising has increased 74%. Spending on Facebook ads has increased 122%, mobile ads have seen a 306% increase, and native advertising increased by over 1000% since last year.

Below is a breakdown of Wendy’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 22 key contacts at The Wendy’s Company.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.