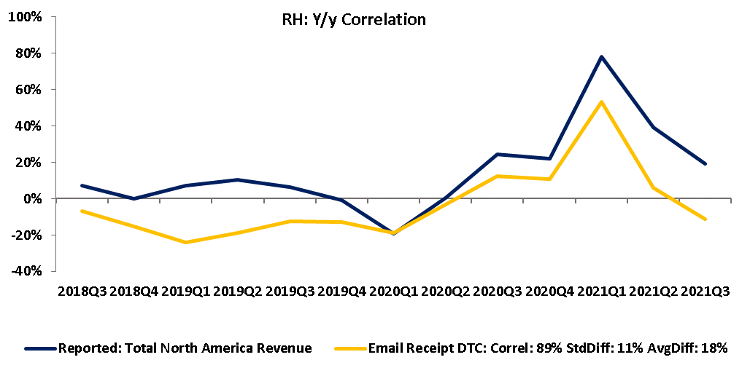

One of the areas where CE Receipt data can be a valuable tool is in analyzing the performance of Home Furnishings companies. It proved predictive of RH’s Total North America Revenue last week, as it has a wide demographic sample that fully captures all payment types and includes email receipts across a variety of inboxes including Gmail. Meanwhile, the gap between CE Transact data and company-reported growth has historically experienced volatility, including a sharper-than-reported deceleration in growth from Q2 to Q3. In today’s Insight Flash, we use CE Receipt to dig into RH’s success and see how its online operations stack up against other multichannel Home Furnishings companies.

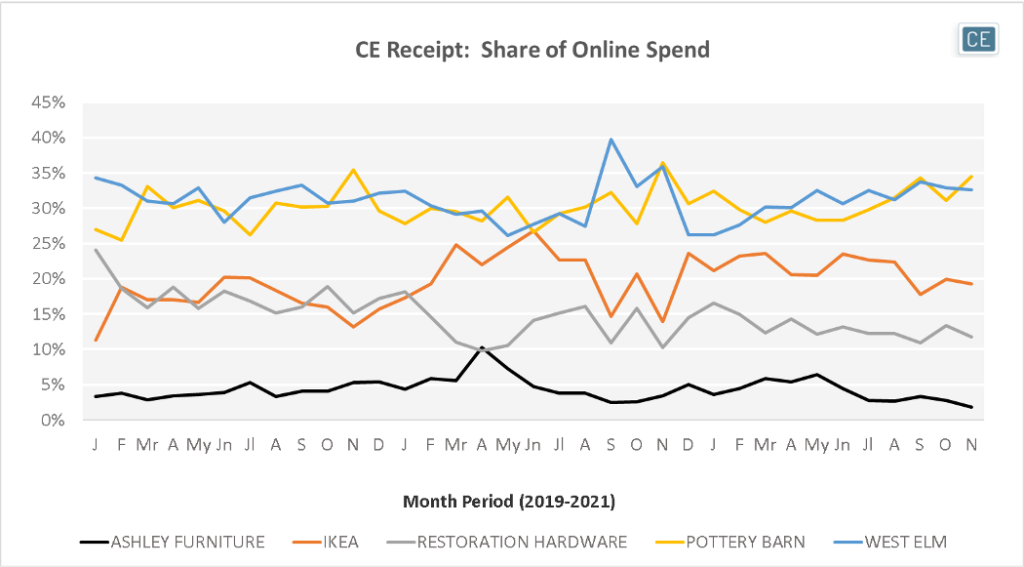

Over the last three years, the online spend at Williams-Sonoma’s Pottery Barn and West Elm have constituted over half the spend among our tracked brands, with Ikea the only other brand since 2019 to ever see higher than 25% share for one brief month in June 2020. Although Restoration Hardware and Ikea jockeyed for third place in share in 2019, Ikea has solidified the position since February 2020. Ashley Furniture has had the lowest share for almost every month since the beginning of 2019, with the exception of April 2020 at the beginning of the pandemic.

Market Share

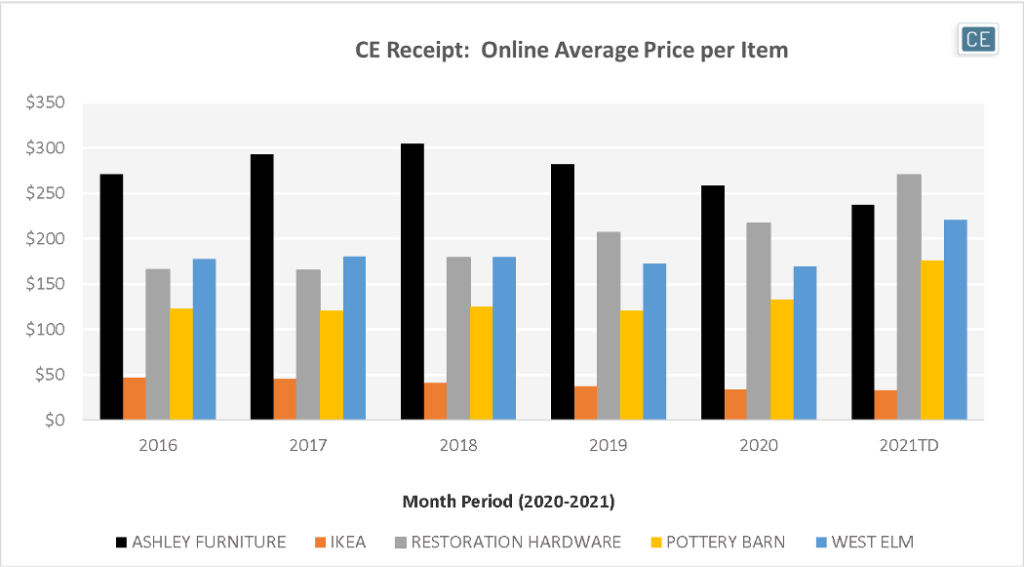

One area where Restoration Hardware has been leading competitors is in spend per item with their premium assortment. Even excluding outlier transactions over $10,000, the average item purchased online at Restoration Hardware has been over $270 in 2021-to-date. This is 63% higher than in 2016, and 25% higher than last year. Interestingly, Ashley Furniture had held the crown for highest price per item in 2016 through 2020, but the 2021-to-date price per item has sagged -22% from its 2018 high.

Online Average Price per Item

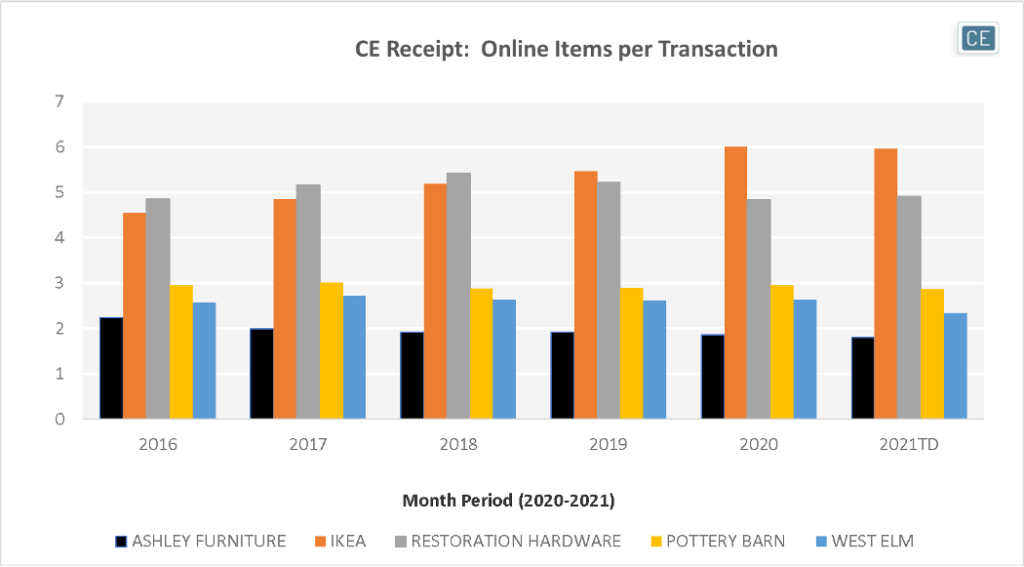

Restoration Hardware has also done a good job at driving more items in its shoppers’ baskets. It led other Home Furnishings retailers on this metric in 2016-2018, although so far in 2021 it has dipped below five items per transaction while Ikea leads with six items per transaction. The three other tracked brands have all seen baskets of three items per transaction or fewer since 2016.

Online Items per Transaction

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.