Cryptocurrency was already growing popular, but this year it clearly became mainstream.

Two major companies that enable crypto trading—Robinhood and Coinbase—went public. Major companies like PayPal, Microsoft, AT&T, WeWork, Whole Foods, Etsy, Home Depot and Starbucks all accept Bitcoin. And the “Hollywoodisation of crypto” is underway.

Regulators have passed legislation to crack down on crypto tax reporting.

Digital currencies are no longer an alternative form of currency. But many individuals still feel confused about how to purchase, hold and use digital currencies.

As more people adopt digital currencies, “it is likely advertising will prevail and be a principal driver of education, awareness, and consumption for crypto,” predicts Lawrence Wintermeyer, Co-founder of Global Digital Finance.

Crypto currencies and related companies will use advertising to promote and educate the public on their products. As we enter 2022, which companies are spending the most?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

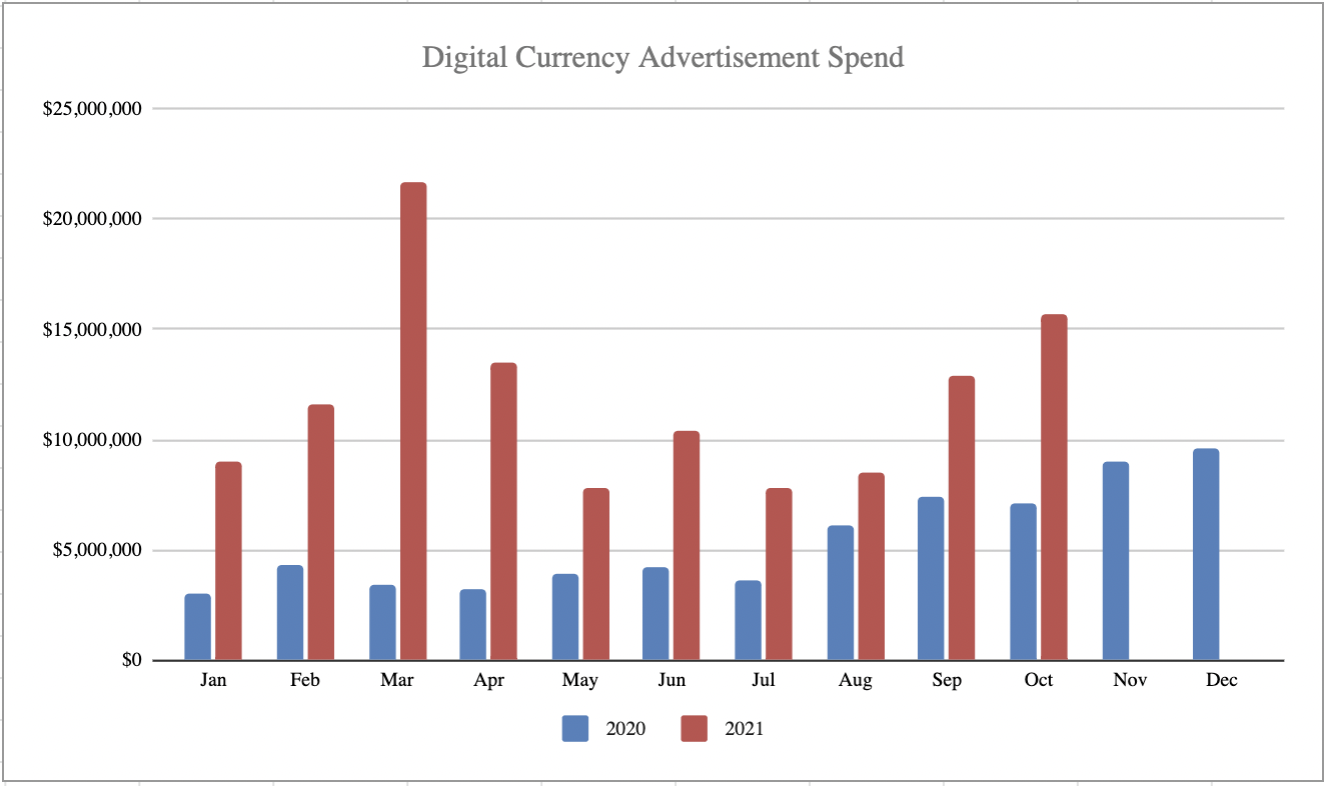

Digital currency advertisers spent $119.3 million through October 2021, which is up 159% from last year.

More than $52.1 million of this advertising spending was invested in digital placements. This is an increase of 181% year-over-year.

Advertisers spent $39.6 million in TV placements, up 172% from last year.

They also increased their print spending. Print investments totaled $27.4 million, which is 110% more than last year.

Number of Advertisers

212 advertisers spent $119.3 million in 2021 compared to 120 advertisers spending $46.1 million in 2020.

Advertiser Retention

In the overall category, advertisers had a 68% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Invesco, Ltd.

Invesco is a major advertiser in the digital currency category, with 96% of their budget dedicated to promoting their digital currency brands. Since last year, they’ve increased ad spending by 230%. Across TV, Print, and Digital media, there has been a massive increase in all categories.

Below is a breakdown of Invesco, Ltd’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 9 key contacts at Invesco, Ltd.

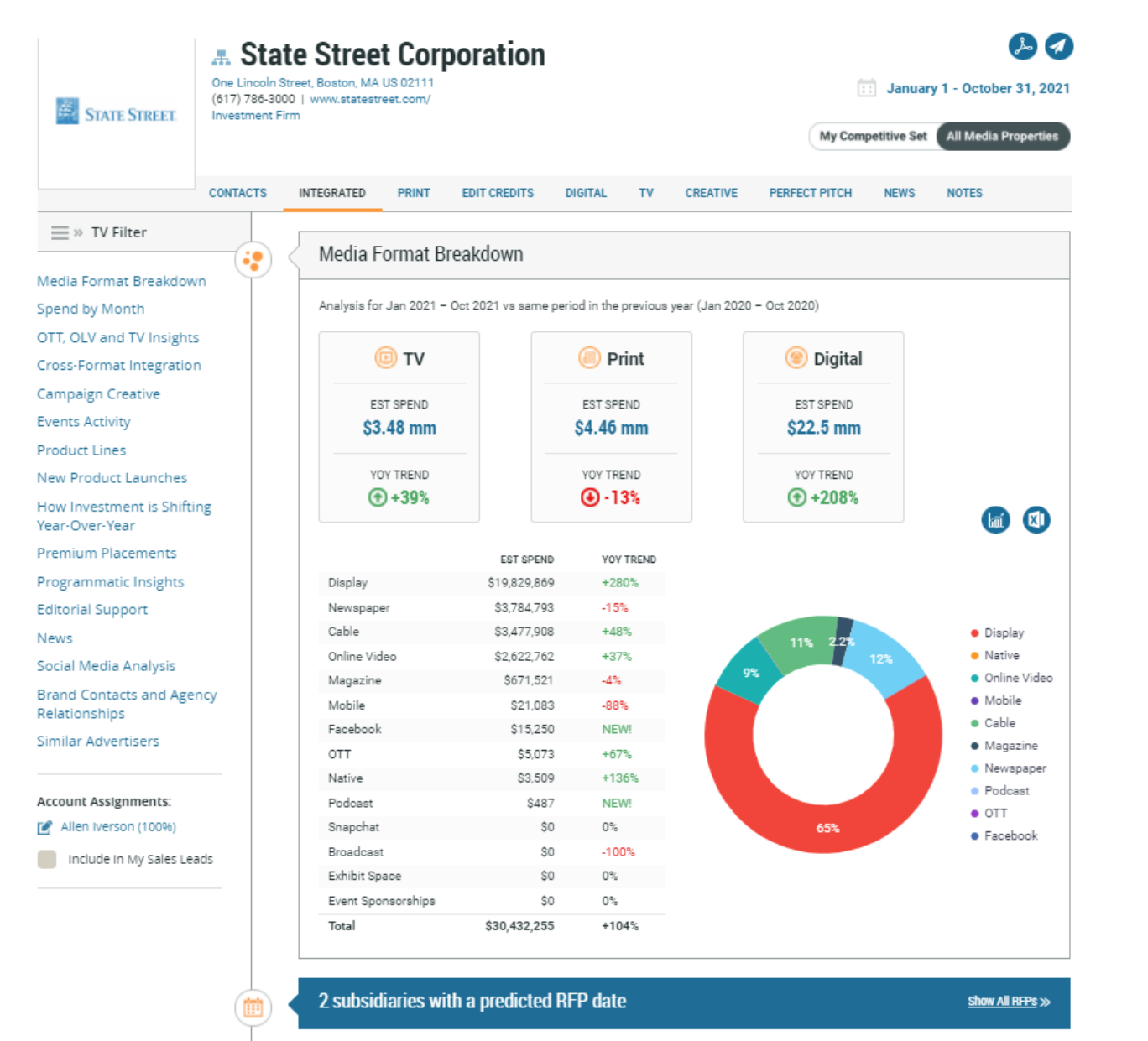

2. State Street Corporation

The State Street Corporation is another big advertiser in the digital currency market, allocating 97% of their budget on promoting their digital currency brand. They’ve increased their ad spend by 104% year-over-year.

State Street has increased investments in digital advertising by 208% since last year, focusing primarily on display advertisements, as well as starting new investments with Facebook and podcasts spots.

Below is a breakdown of State Street Corporation’s ad spend thus far in 2021. We predict they will likely have 2 upcoming RFPs issued. MediaRadar can help you connect with 15 key contacts at State Street Corporation.

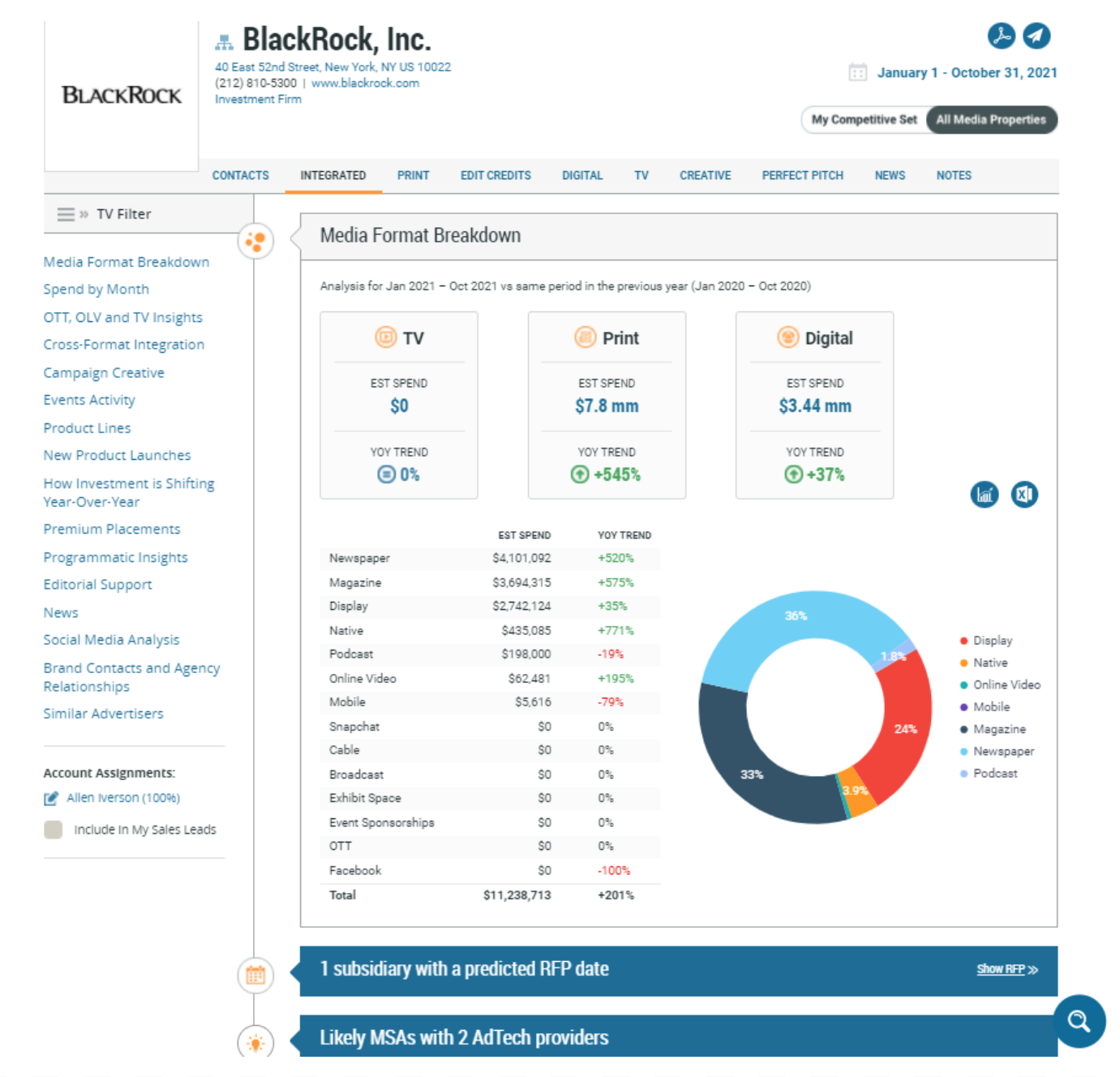

3. BlackRock, Inc.

BlackRock is another top advertiser in the digital currency category, allocating 95% of their budget promoting their digital currency brands. They saw a 201% increase in ad spending since last year.

Print advertising saw a massive increase in spending, with a 520% increase in newspaper ads and a 575% increase in magazine ads.

They also increased their spend on digital advertising by 37%.

Below is a breakdown of BlackRock, Inc’s ad spend thus far in 2021. We predict they will likely have 1 upcoming RFP issued. MediaRadar can help you connect with 28 key contacts at BlackRock, Inc.

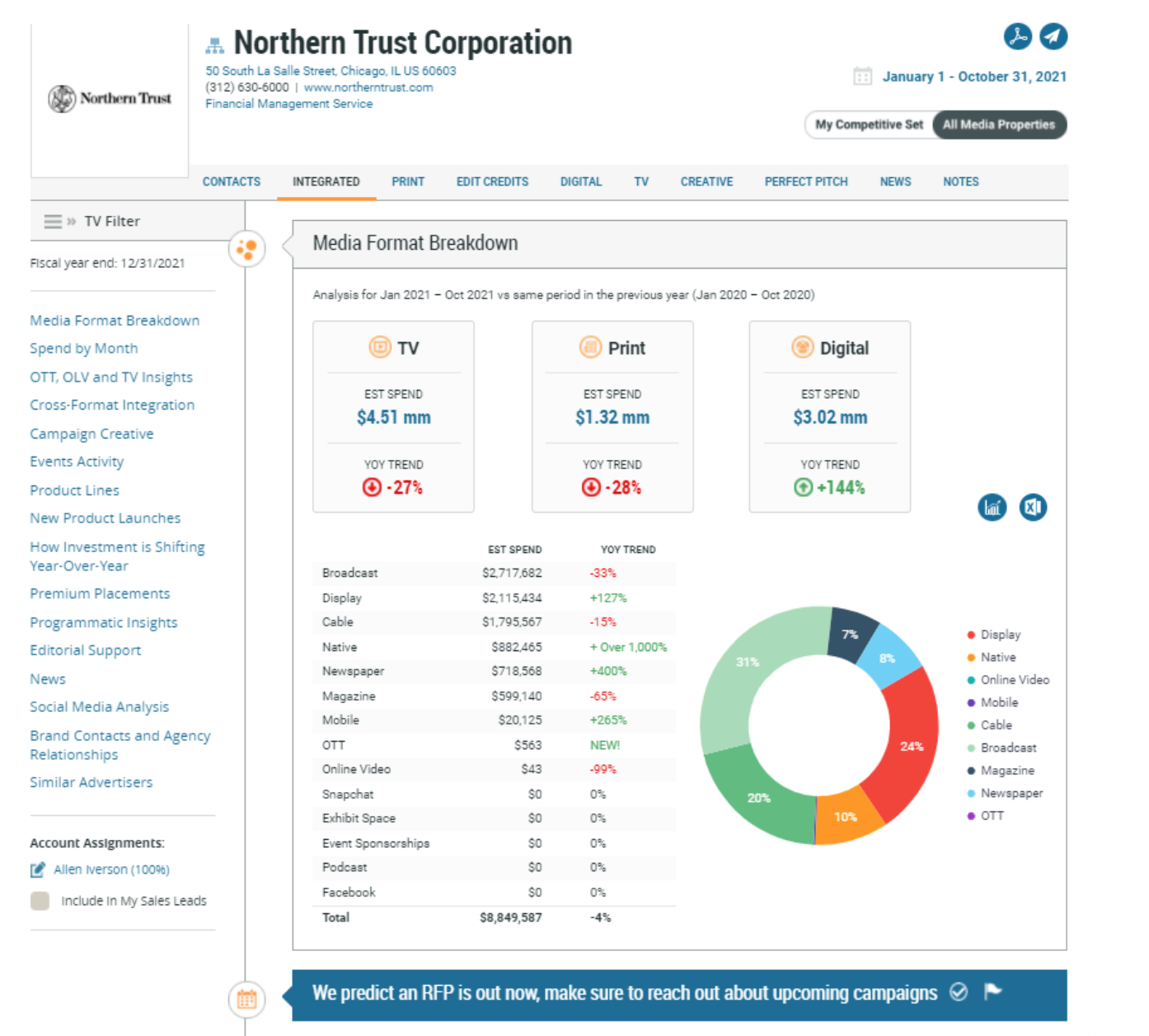

4. Northern Trust Corporation

Northern Trust Corporation is another big spender in the digital currency market. While their spending is down by 4% since last year, their investments in digital advertising have increased by 145%.

Display, native, and mobile ads saw year-over-year increases of 128%, 400%, and 265% respectively. Spending on native advertisements increased by over 1000%, and they began investing in OTT ads this year.

Below is a breakdown of Northern Trust Corporation’s ad spend thus far in 2021. MediaRadar can help you connect with 15 key contacts at the Northern Trust Corporation.

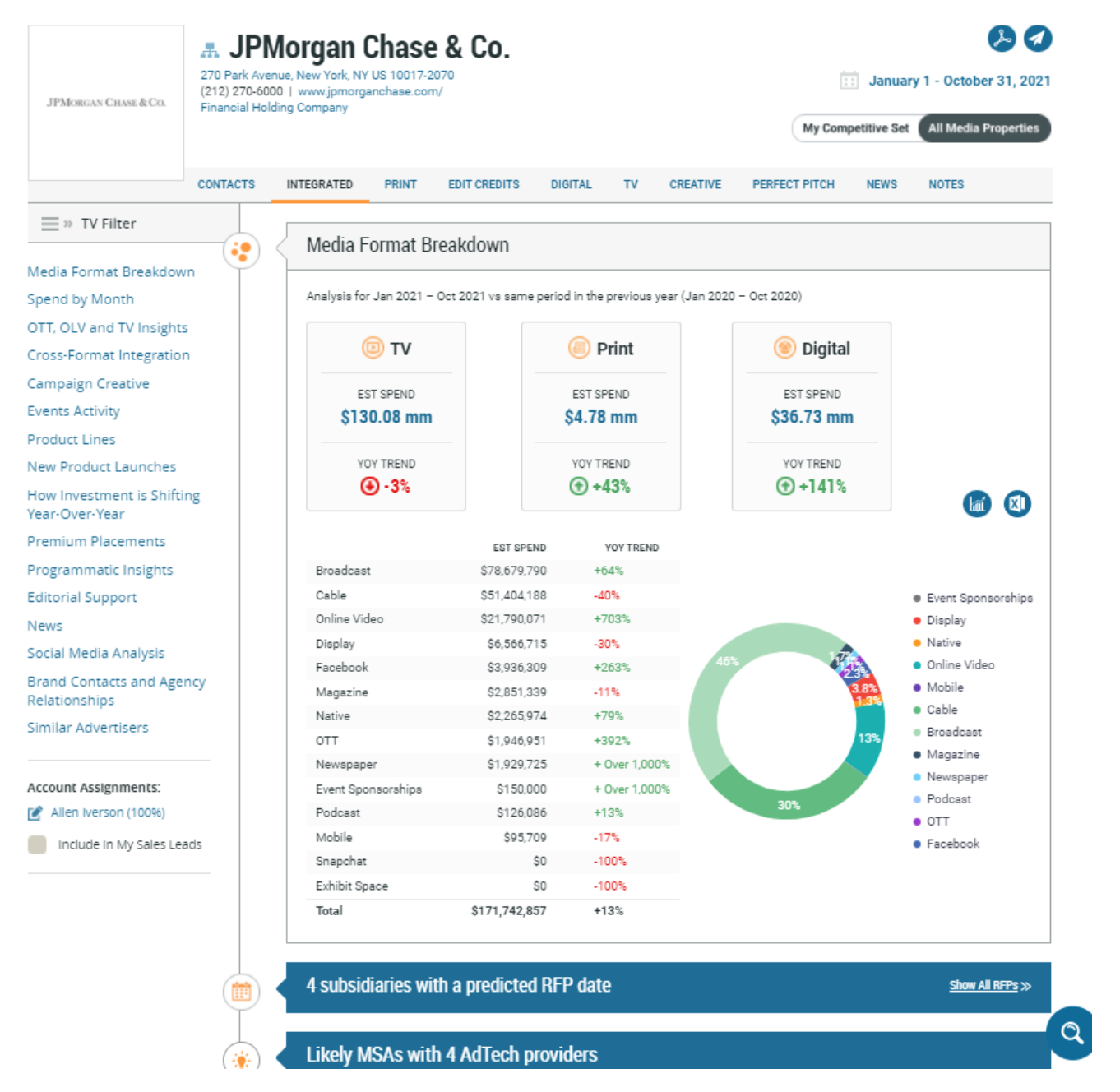

5. JPMorgan Chase & Co.

JPMorgan Chase & Co. is another major advertiser in the digital currency. Their ad spend has increased by 13% since last year.

Their digital ad spend has increased by 141% YOY, with major growth in online video, Facebook, native, and OTT advertisements.

Below is a breakdown of JPMorgan Chase & Co’s ad spend thus far in 2021. We predict they will likely have 4 upcoming RFPs issued. MediaRadar can help you connect with 34 key contacts at JPMorgan Chase & Co.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.