Through November 2021 with Forecasts through November 2022

Introduction

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through November 2021 and forecasts through November 2022.

CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes home price indices (including distressed sale); home price forecast and market condition indicators. The data incorporates more than 40 years of repeat-sales transactions for analyzing home price trends.

HPI National Change

November 2021 National Home Prices

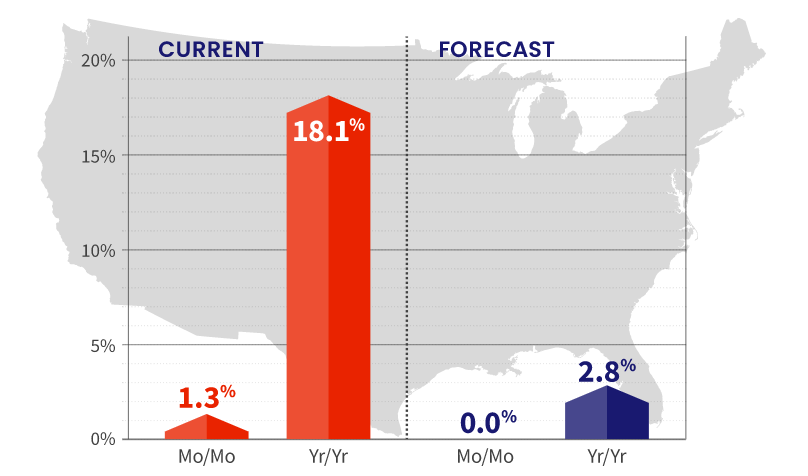

Home prices nationwide, including distressed sales, increased year over year by 18.1% in November 2021 compared with November 2020. On a month-over-month basis, home prices increased by 1.3% in November 2021 compared with October 2021 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).

Forecast Prices Nationally

The CoreLogic HPI Forecast indicates that home prices will remain flat on a month-over-month basis from November 2021 to December 2021, and increase on a year-over-year basis by 2.8% from November 2021 to December 2022.

“Over the past year, we have seen one of the most robust seller’s markets in a generation. While increased interest rates may help cool down homebuying activity, we expect 2022 to be another strong year with continuing upward price growth.”

-Frank Martell

President and CEO of CoreLogic

HPI & Case-Shiller Trends

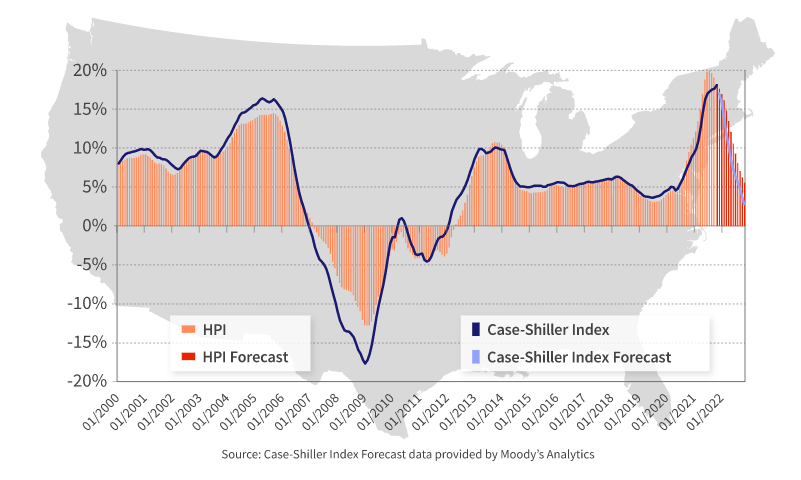

This graph shows a comparison of the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to present month with forecasts one year into the future. We note that both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

Economic Impact on Home Prices

While 2021 was a record-breaking year for U.S. home price growth, for many prospective buyers the hot housing market will continue to exacerbate ongoing affordability challenges into the new year — and beyond. Though home price growth remains at historic highs, it is projected to slow over the next year. However, economic growth and inflation will most likely lead to increases in mortgage rates, which will further erode affordability.

“Interest rates on 30-year fixed-rate mortgages averaged a record low of 2.96% during 2021, helping to keep monthly payments low in the face of record-high home prices. However, the Federal Reserve appears poised to allow interest rates to rise in 2022. Higher rates will intensify buyer affordability challenges, especially in overvalued local markets.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

HPI National and State Maps – November 2021

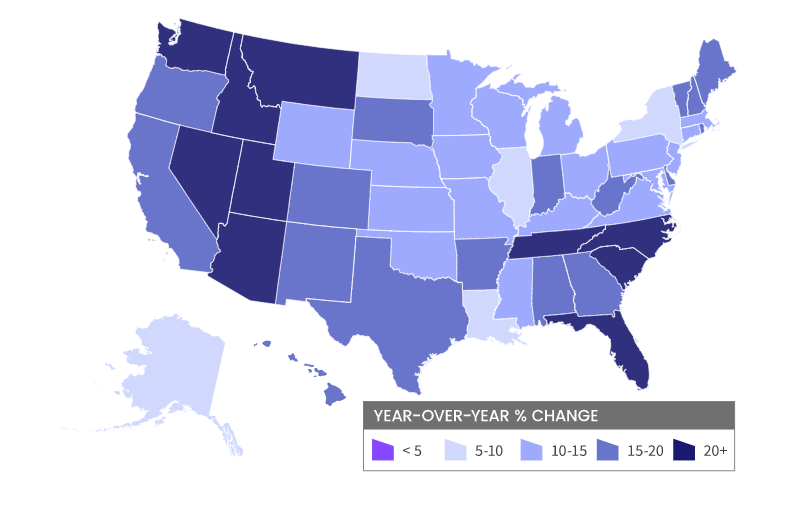

The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

Nationally, home prices increased 18.1% year over year in November. No states posted an annual decline in home prices. The states with the highest increases year-over-year were Arizona (28.6%), Florida (25.8%), and Idaho (25.5%).

HPI Top 10 Metros Change

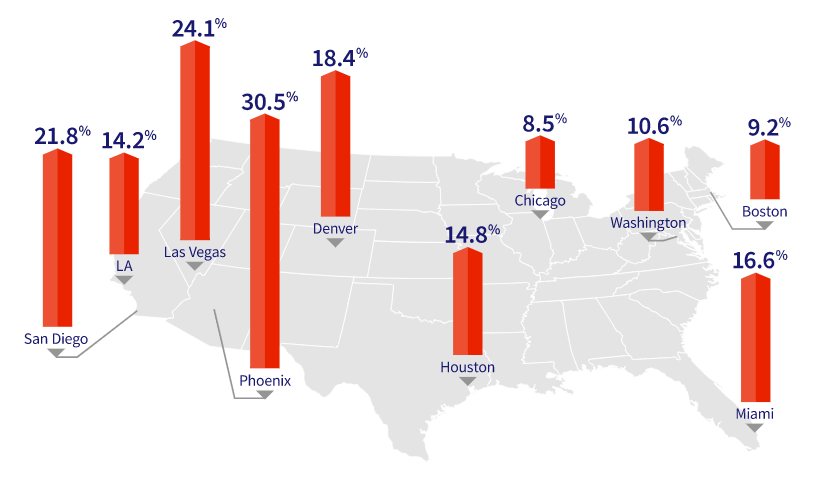

The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

These large cities continue to experience price increases in November, with Phoenix leading the way at 30.5% year over year.

Markets to Watch: Top Markets at Risk of Home Price Decline

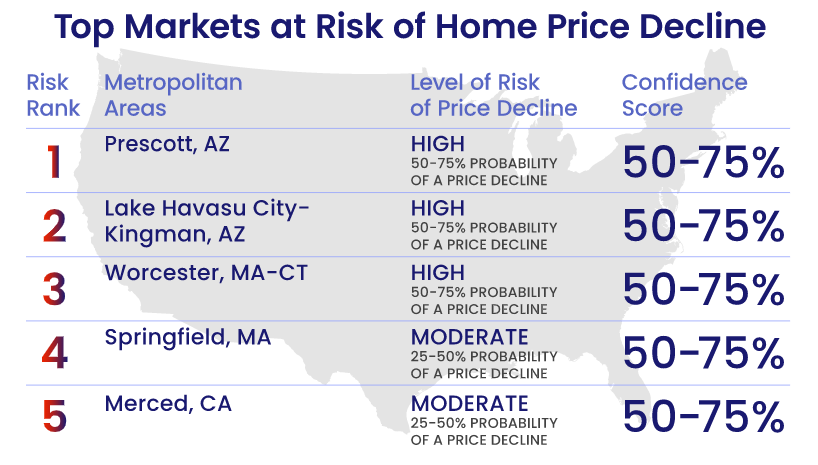

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that metros such Prescott, Arizona; Worcester, Massachusetts; and Lake Havasu-Kingman, Arizona, are at the highest risk (50-70% probability) of a decline in home prices over the next 12 months. Merced, California, and Springfield, Massachusetts, are also at moderate risk (25-50%) of a decline.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.