A new report from ForwardKeys reveals the recent lockdowns in China, imposed in response to outbreaks of the Omicron strain of Coronavirus, have cast a long shadow over Chinese New Year travel plans.

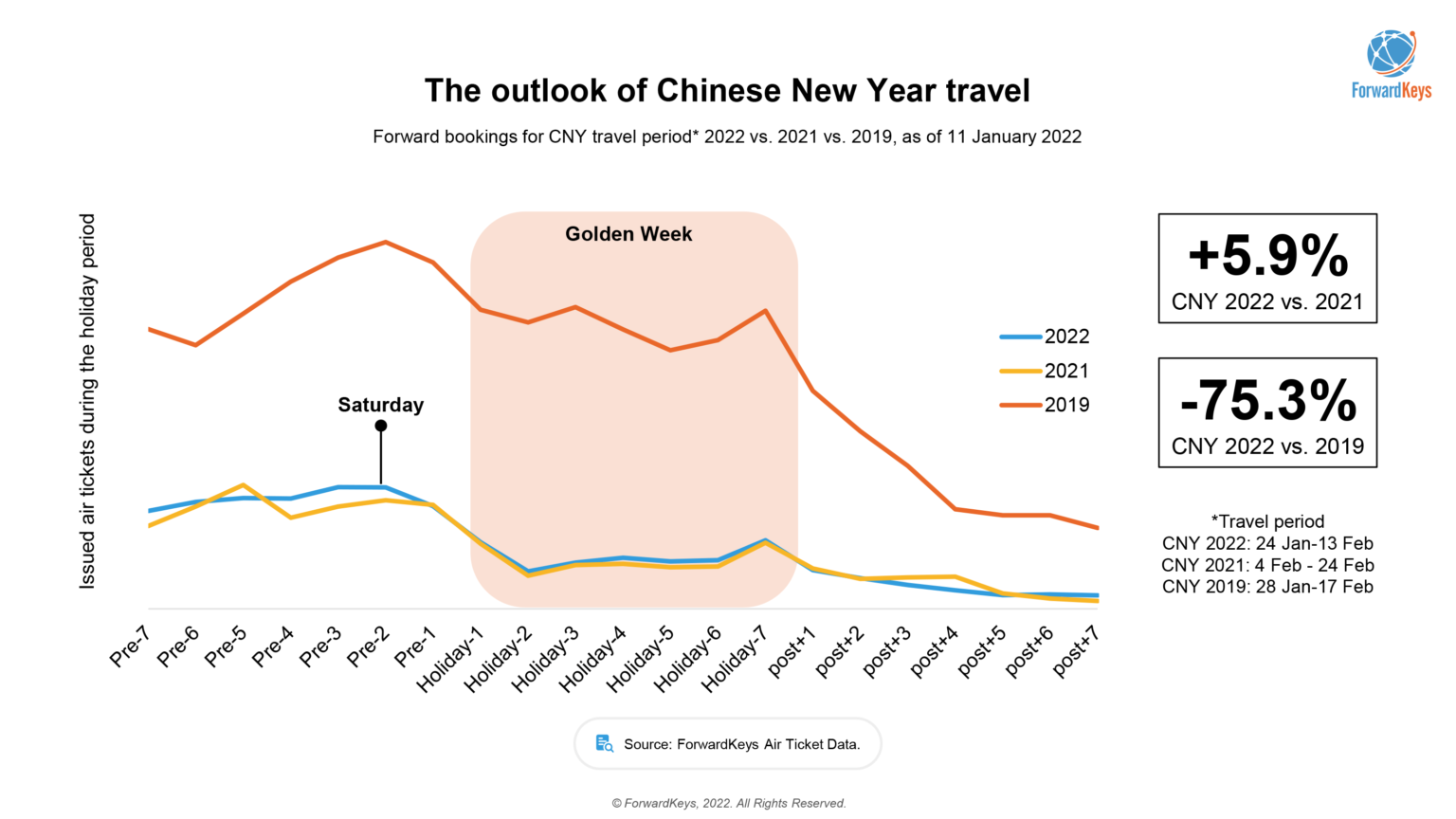

The latest data, as of 11th January, shows flight bookings for the upcoming holiday period, 24th January – 13th February, were 75.3% behind pre-pandemic levels but still ahead by 5.9% of last year’s dismally low levels.

Last-Minute booking is the New Normal

In addition to Omicron-related travel restrictions, government advice on New Year travel has also been an influential factor in dampening demand.

Last year, many local authorities advised people to “stay put”. This year, the advice is a little more lenient, with people advised to protect their health while travelling. That allows people the flexibility to wait and see how things develop and to make a last-minute travel booking.

All is not necessarily lost for the airlines and others in the travel industry in China. This is because the lead time for flight bookings has shortened dramatically during the pandemic.

“Around 60% of bookings on Chinese domestic flights are made under four days of departure. Therefore, with a fortnight between the latest data and the beginning of the peak holiday period, a last-minute surge is still possible,” says Bing Han Kee, VP of Sales (APAC) at ForwardKeys.

Whether or not that happens will depend on new outbreaks of the Omicron variant and how quickly they can be contained. This is because the pattern of domestic travel in China throughout the pandemic has been a tug of war between strong pent-up demand for travel and draconian restrictions to contain COVID-19.

“We have seen travel bouncing back strongly, as soon as travellers feel the risk of becoming stranded in an area of infection has receded,” adds Kee.

Top Chinese New Year Destinations

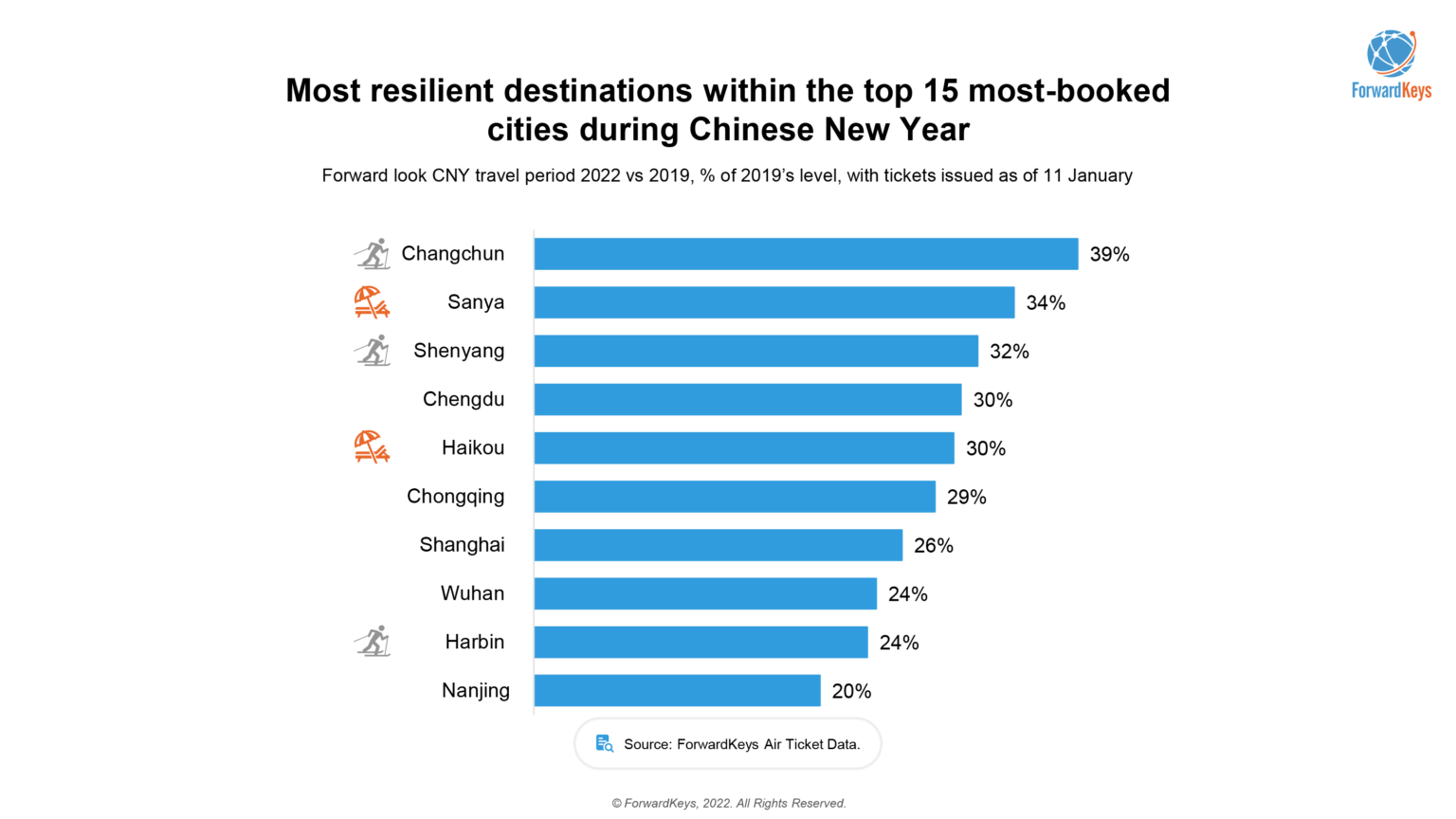

Analysis of the most-booked destinations reveals that leisure travel is the light in what would otherwise be a gloomy outlook.

Among the top 15, the most resilient destinations are Changchun, reaching 39% of pre-pandemic levels; Sanya, 34%; Shenyang, 32%; Chengdu, 30%; Haikou, 30%; Chongqing, 29%; Shanghai, 26%; Wuhan, 24%; Harbin 24% and Nanjing, 20%.

Changchun, Shenyang and Harbin contain numerous winter sports resorts – snow holidays have been a major campaign driven by the Chinese authorities ahead of the Beijing Winter Olympics. Harbin is still in the top 15 list even though it was affected by a COVID-19 outbreak in December.

Sanya and Haikou, which are both located on Hainan, have seen consistent growth in popularity throughout the pandemic, fuelled by China’s ban on international travel and special tax treatment on the sale of luxury goods. According to Hainan’s commerce department, the number of duty-free shoppers grew by 73% in 2021 and sales increased by 83%.

Bing Han Kee, VP Sales – APAC, at ForwardKeys, said: “I am not yet ready to give up hope of a last-minute recovery for Chinese New Year holiday travel.”

“The reason? Throughout 2021, travel bounced back strongly as soon as restrictions were lifted, with shorter lead times. I am also impressed by the strongly growing enthusiasm for winter sports, which I am sure has been encouraged by publicity surrounding the upcoming Winter Olympics in Beijing.”

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.