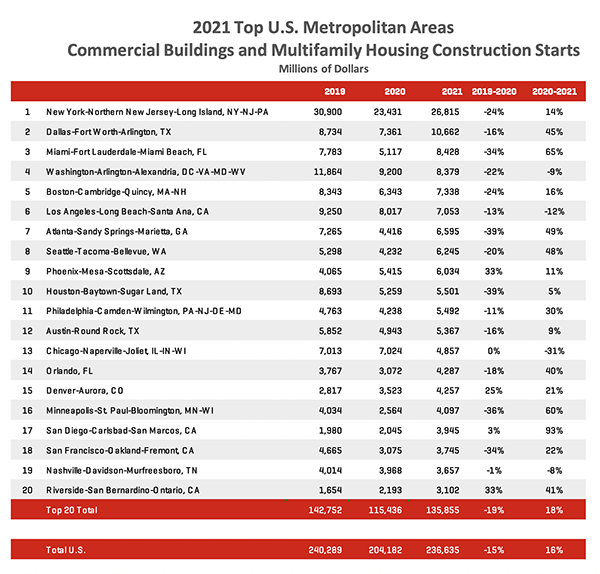

The value of commercial and multifamily construction starts in the top 20 metropolitan areas of the U.S. increased 18% from 2020 to 2021, according to Dodge Construction Network. Nationally, commercial and multifamily construction starts increased 16% in 2021. In the leading half (the top 10 metro areas), commercial and multifamily starts rose 18% in 2021, with two metro areas, Washington, DC, and Los Angeles, CA, posting a decline. In the lesser half of metro areas (those ranked 11 through 20), commercial and multifamily starts rose 17% in 2021, with Chicago, IL, and Nashville, TN, losing ground from 2020.

Commercial and multifamily construction starts staged a solid recovery in 2021 following stalled projects and growing uncertainties that plagued the industry in 2020. It bears noting, however, that commercial and multifamily construction starts remain below 2019 levels, highlighting that the sector has yet to fully recover from the impact of the pandemic. In fact, larger metro areas have struggled to gain momentum as demand for construction shifts away from denser urban areas.

In the top 20 metro areas of 2021, commercial and multifamily starts were 5% below the level recorded in 2019, and national commercial and multifamily starts were 2% below the 2019 level. In the top 10 metro areas, commercial and multifamily starts were 9% below their 2019 levels, while starts in the metro areas ranked 11-20 were up 5% from 2019. This reveals that in 2021, smaller, less dense metropolitan areas are becoming increasingly popular.

The New York metropolitan area was the top market for commercial and multifamily starts in 2021 at $26.8 billion, an increase of 14% from 2020. The Dallas, TX, metropolitan area was in second place, totaling $10.7 billion for the year, an impressive 45% gain over 2020. The Miami, FL, metro area was ranked third in 2021, with commercial and multifamily starts totaling $8.4 billion, a dramatic 65% increase over 2020.

The remaining top 10 metropolitan areas through the first half of 2021 were:

In summary, the top 10 metropolitan areas accounted for 39% of all commercial and multifamily starts in the United States, unchanged from their 2020 share.

The second-largest metro group included:

This secondary group of metro areas accounted for 18% of all commercial and multifamily starts in the United States in 2021, unchanged in share from the previous year.

The commercial and multifamily total is comprised of office buildings, stores, hotels, warehouses, commercial garages and multifamily housing. Not included in this ranking are institutional projects (e.g., educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works and electric utilities/gas plants.

In 2021, total U.S. commercial and multifamily building starts rose 16% to $236.6 billion from 2020. Nationally, commercial starts were up 8% to $120.3 billion, while multifamily starts were 25% higher at $116.4 billion. Within the top 10 metro areas, commercial building starts rose 11% to $45.1 billion in 2021, while multifamily starts gained 25% to $48.0 billion. Within the second largest group of metropolitan areas, commercial building starts declined 4% in 2021, while multifamily starts improved 42% from 2020.

“Commercial and multifamily construction starts staged a strong rebound in 2021, despite the continued impact of the COVID-19 pandemic,” stated Richard Branch, Chief Economist for Dodge Construction Network. “This recovery, however, has been fairly uneven with the focus on warehouse and multifamily activity, while office and hotel construction remain more constrained by the pandemic. Looking ahead, 2022 should bring with it a more even recovery spread across most commercial project types, while multifamily will continue to benefit from the high cost of single-family homes. While positivity abounds for the year ahead, be aware that high material prices and a shortage of skilled labor will prove to be limiting factors and will restrain overall growth.”

In the New York, NY, metropolitan area, commercial and multifamily construction starts rose 14% in 2021 to $26.8 billion. Despite this strong gain, the level of activity is 13% below the level of construction starts in 2019. Multifamily starts were up 20% in 2021. The largest multifamily projects to break ground in 2021 were the $500 million 625 Fulton Street mixed-use project, the $349 million first phase of the Bronx Point mixed-use project, and the $300 million Islablue Apartments and Condominiums. In 2021, commercial starts rose 8%, led by gains in warehouses, retail, and parking while offices and hotels posted declines. The largest commercial projects to get underway in 2021 were the $1.5 billion JPMorgan Chase office tower, the $1.2 billion Terminal Warehouse conversion and a $380 million Bronx Logistics Center.

Commercial and multifamily starts in the Dallas, TX, metro area were up 45% in 2021 to $10.7 billion and surpassing the mark set during 2019, prior to the onset of the pandemic. Commercial starts rose 41% during the year with only the retail sector losing ground. The largest commercial projects started in 2021 were the $550 million second phase of the Lowes Hotel and Convention Center, the $175 million Granite Park Six office tower and the $150 million Hardwood No. 14 office tower. Multifamily starts were 52% higher in 2021. The largest multifamily projects to get underway in 2021 were the $250 million Maple Terrace residential building, the $120 million Hall Park D4 residential tower and the $100 million Urby residential tower.

In the Miami, FL, metropolitan area, commercial and multifamily construction starts rose 65% in 2021 to $8.4 billion. The dollar value of multifamily starts more than doubled in 2021, rising 104%. The largest multifamily projects to break ground in 2021 were the $1 billion 1 Southside Park mixed-use building, the $250 million Five Park condominiums and apartments and the $206 million first phase of the Miami River mixed-use project. Commercial starts were 21% higher in 2021, led by gains in parking structures, hotels and retail. Office and warehouse starts were both lower in 2021. The largest commercial buildings to get started in 2021 were the $340 million Legacy Hotel, the $122 million second phase of the Bridge Point Commerce Center warehouse project and the $75 million Boca Raton resort.

Washington, D.C.’s commercial and multifamily building starts fell 9% in 2021 to $8.4 billion, and they remain 29% below the mark set in 2019. Commercial starts in Washington, D.C., lost 18% due to pullbacks in office, retail and warehouse starts. Starts for parking structures and hotels, however, both posted a gain in 2021. The largest commercial projects to break ground in 2021 were the $450 million Sterling 144 MW EdgeCore data center, the $225 million Vantage data center and the $200 million 20 Massachusetts Ave. renovation project. Multifamily building starts rose 1% in 2021. The largest multifamily project to get underway in 2021 was the $267 million 1900 Crystal/1851 S. Bell South & North residences, the $230 million Mather Senior Living Community and the $174 million 4000 Wisconsin Ave. NW/Upton Place mixed-use project.

Commercial and multifamily starts in the Boston, MA, metropolitan area rose 16% in 2021 to $7.3 billion. Despite the strong gain, starts were still 12% shy of their pre-pandemic high in 2019. Multifamily starts were particularly robust during the year, increasing 29%. The largest multifamily projects to break ground in 2021 were the $200 million 60 Kilmarnock St. residential building, the $200 million DOT Block Residences and the $165 million Union Square/USQ residential tower. Commercial starts rose 5% in 2021, led by increases in warehouse and parking structure starts, while office, hotel, and retail starts each fell. The largest commercial projects to break ground in 2021 were the $466 million North Andover Amazon distribution center, the $350 million Amazon Seaport Square office tower and the $225 million 171 Dartmouth St. office building.

Los Angeles, CA, commercial and multifamily starts were down 12% in 2021 to $7.1 billion and were down 24% from the pre-pandemic peak in 2019. Commercial starts in Los Angeles were down 32% over the year — entirely due to the office and hotel sectors, which saw several large projects break ground in early 2020. Meanwhile, retail and warehouse starts increased. The largest commercial projects to get underway in 2021 were the $200 million Spectrum Terrace office campus, the $102 million OCSD headquarter project and the $100 million Ovation Hollywood mixed-use building. Multifamily starts improved 6% in 2021. The largest multifamily projects to break ground were the $250 million 520 S. Mateo Arts District mixed-use, the $215 million Broad Block mixed-use building and the $125 million The Line at Burbank apartments.

In Atlanta, GA, commercial and multifamily starts were up 49% to $6.6 billion in 2021. Despite the gain, commercial and multifamily starts were still 9% below the level of starts in 2019. Multifamily starts rose 46% in 2021 thanks to large projects such as the $400 million 1018 West Peachtree apartments, the $300 million first phase of the High Street Atlanta mixed-use development and the $175 million Hanover apartments. Commercial starts gained 52% in 2021, with all categories except for parking structures gaining ground over the year. The largest commercial projects to get underway in 2021 were the $271 million Signia Hilton Hotel at Georgia World Congress Center, the $202 million CDC Chamblee campus buildings and the $100 million The Cubes at River Park warehouse building.

Seattle, WA, commercial and multifamily construction starts were 48% higher in 2021 at $6.2 billion and were 18% higher than in 2019. Commercial starts were up 44% in the office, warehouse and retail sectors, while hotel and parking posted declines. The largest commercial projects to get underway in 2021 were the $355 million Project Roxy distribution center, the $325 million Amazon Bellevue 600 Tower One and the $270 million The Eight office building. Multifamily starts rose 51% in 2021 with the $150 million Google Campus development, the $131 million First Light mixed-use project and the $113 million SkyGlass Tower apartments among the largest multifamily projects to break ground.

In Phoenix, AZ, commercial and multifamily starts were up 11% to $6 billion in 2021, up 48% from the pre-pandemic high set in 2019. Multifamily starts, however, fell 8% in 2021. The largest multifamily projects to get underway in 2021 were the $170 million Culdesac Tempe apartment building, the $91 million first phase of the Milhaus North apartments and the $87 million Skye on 6th apartments. Commercial starts moved 27% higher in 2021 due to increases in warehouse, retail and office starts, while hotel and parking structure starts fell. The largest commercial projects to break ground in 2021 were the $800 million first phase of the Facebook Eastmark Parkway data center campus, the $100 million first phase of The Cubes at Glendale warehouse project and the $75 million NTT data center.

Commercial and multifamily building starts in Houston, TX, rose 5% in 2021 to $5.5 billion but were 37% lower than the level of activity before the pandemic in 2019. Commercial starts increased 4% in 2021 due to gains in warehouse, hotel and retail starts, while office and parking structures declined. The largest commercial projects to get underway in 2021 were the $135 million second phase of the Empire West Business Park, the $125 million 1550 on The Green office building and the $70 million TGS Cedar Port warehouse. In 2021 multifamily starts rose 6% with the largest multifamily projects to get underway including the $89 million The Hawthorne condo tower, the $61 million West Dallas apartment building and the $60 million Oleanders at Broadway residential building.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.