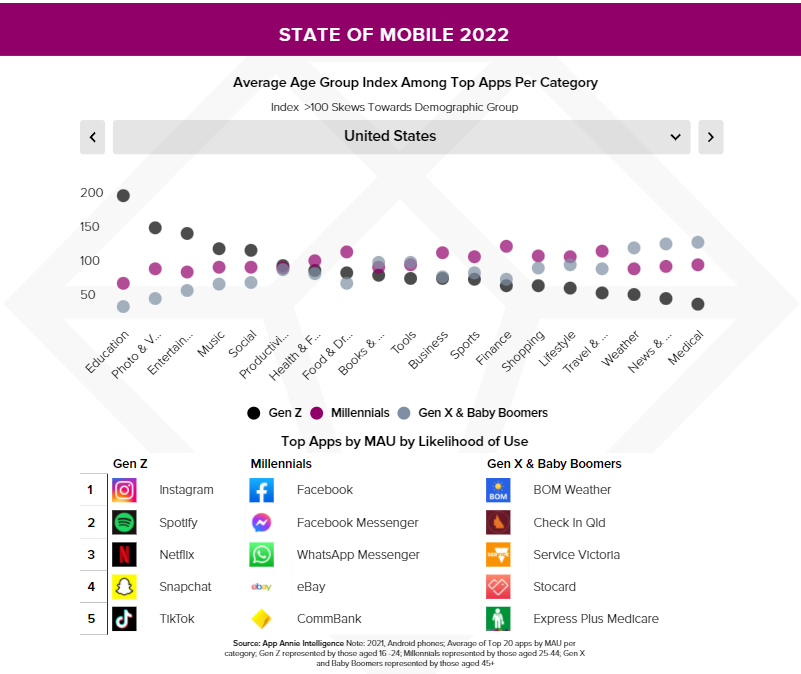

Photo & Video apps skew towards Gen Z, whereas Finance and Shopping skew towards millennials. There’s plenty of demographic insight in App Annie’s State of Mobile 2022 report, but the data isn’t always predictable.

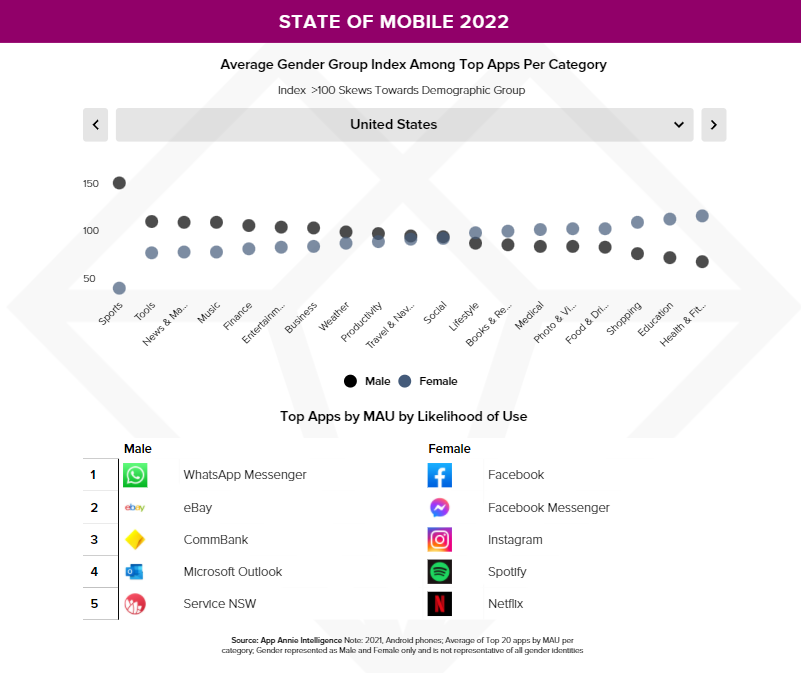

Across demographic cohorts, by age and gender, we’ve seen clear indications of preferences emerge. While some trends hold true, However, the intensity of the skew varies by country, along with the apps most likely to be used by each demographic cohort.

However, it is important to note that our analysis is limited to males and females only and is not representative of all gender identities.

Yes, Gen Z really is the Instagram (and TikTok) Generation

The State of Mobile 2022 report also contains demographic data by age. The main focus for many readers will be the app preferences of Gen Z. Why? Because 16-24 year olds are the first smartphone-native cohort – and they are now entering the workplace and thus increasing their spending power.

What the data shows is that Gen Z skews heavily in favor of Photo & Video, Entertainment, Education and Social apps. An index above 100 means the category skews more towards that demographic base (Index - 100 = % more likely to use). Anything below an index of 100 skews less towards that demographic base (Index - 100 = % less likely to use). In Japan, for example, the index for Education is Gen Z (246), Millennial (69) and Gen X/ Baby Boomers (62), meaning Gen Z users in Japan are 146% more likely to use Photo & Video apps than the average population. Conversely, Millennials and Gen X/ Baby Boomers are 31% and 38% less likely to use Photo & Video apps than the average population, respectively.

Gen Z’s favorite apps are also overwhelmingly social in nature. Interestingly Instagram wins out (it is ranked #1 or #2 in all 7 markets) by MAU by likelihood of use. But watch out for the ascendant TikTok. It appears in the top 5 lists of 6 out of 7 markets for Gen Z. We forecast that it will pass 1.5 billion monthly active users in 2022 – indicating it is still trending upwards.

At the opposite end of the age range, the app preferences of Gen X / Baby Boomers are similar among all markets. Weather, News and Medical score highest in virtually all countries for the older age group. What changes is the extreme, or how much these apps skew. In some markets, categories were more modestly skewed towards a demographic cohort, meaning they are more similar to the population overall. However, the gap is especially high in Western markets for. In Canada, the index for Weather is Gen X/ Baby Boomer (148), Millennial (101) and Gen Z (56), meaning Gen X/ Baby Boomers are 48% more likely to use Weather apps than the average population.

Differences Emerge for Gender, Yet Top Apps Buck the Trends

The data in our State of Mobile 2022 report suggests there are concrete disparities in the app choices of men and women. For example, across seven of the largest regions, the Sports category consistently yields the biggest gender divide, skewing heavily towards a male user base. In the UK the ‘index skew’ for Sports apps (where 100 is an equal split) shows a figure of 183 for men and 33 for women, meaning Men are 83% more likely to use a Sports app in the UK compared to the average population.

At the other side of the graph (where the index for women skews highest), Health & Fitness and Shopping are the categories that display the largest skew towards females. But it should be noted that the gaps are generally much smaller. In France, for example, the widest difference in app demand in favor of women (for Shopping apps) is just 115 (women) to 85 (men) — meaning women are 15% more likely to use Shopping apps in France than the average population. It is interesting to note that apps buck the category trends — indicating the importance of both benchmarked market data alongside granular app level estimates. Combined, they show a robust picture and can inform your user acquisition, marketing and partnership activities. Amazon skews more male in Japan, the UK, Germany, France and Canada despite Shopping apps on the whole skewing more female in each market analyzed. Only in the US does Amazon skew more female.

For Most App Categories, the Gender Divide is Negligible

It’s also worth noting that, within the majority of categories, the app preferences of males and females don’t differ much at all. This is especially true in western countries. Take the US, for example. Across 10 categories (Business, Weather, Productivity, Travel, Social, Lifestyle, Books, Medical, Photo, Foot & Drink) there is virtually no difference by gender preference. The biggest gap – in the Business category – is merely 91 (women) to 110 (men), or leaning only slightly more male. Each country is unique, and it is important to factor these differences into a comprehensive mobile strategy.

What’s more, there are some intriguing anomalies buried in the data. The State of Mobile 2022 report lists the top apps by monthly average user (MAU) by likelihood of use by gender. In virtually all markets, the most used apps that are more likely to be used by females are Social apps – Facebook (US, Australia, Canada), WhatsApp (France, Germany, UK) LINE (Japan), KakaoTalk (South Korea), compared to the #1 app by MAU that is most likely to be used by males, which span many categories including Health & Fitness, Shopping, Music, and Social.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.