Introduction

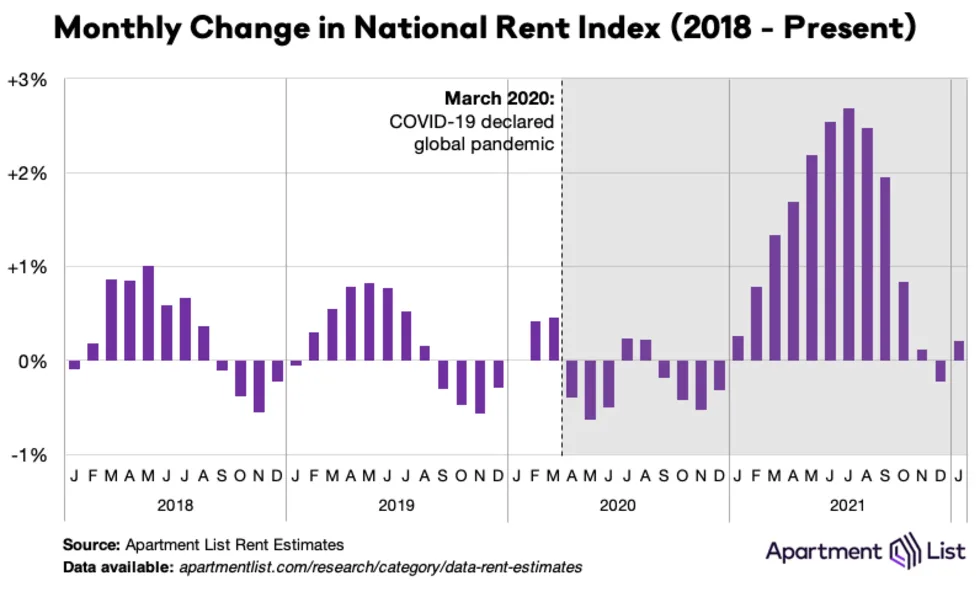

Welcome to the February 2022 Apartment List National Rent Report. After a slight dip to close out 2021, our national index ticked back up by 0.2 percent over the course of January. Even though month-over-month growth has moved back into positive territory, rent growth has still cooled substantially from last year’s peak. Year-over-year rent growth currently stands at a record-setting 17.8 percent, but over the past four months, rents have increased by a total of just 0.9 percent. Much of this cooldown is likely related to seasonal factors; it remains to be seen if rapid rent growth will return as moving activity picks back up in the spring and summer.

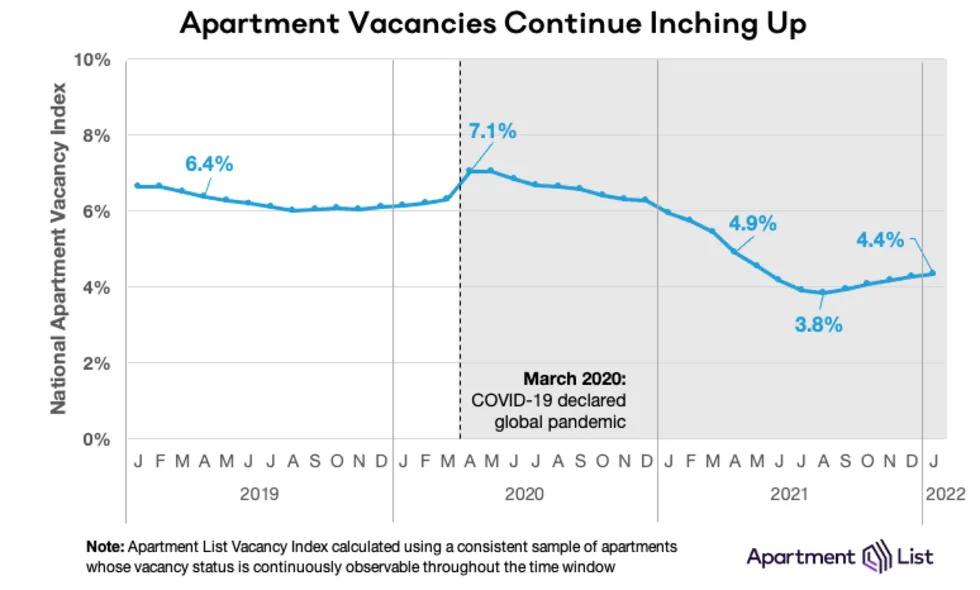

41 of the nation’s 100 largest cities saw rents fall this month, and just five cities saw prices increase by more than one percent. In contrast, from last March through September, all 100 of these cities saw rents grow virtually uninterrupted, and some cities were experiencing month-over-month growth topping five percent. Consistent with this environment of cooling rent growth, our national vacancy index is also continuing to gradually tick up, indicating that the tight market conditions that characterized 2021 are easing, albeit slowly.

Rents up by a record-setting 18% YoY, but growth has slowed

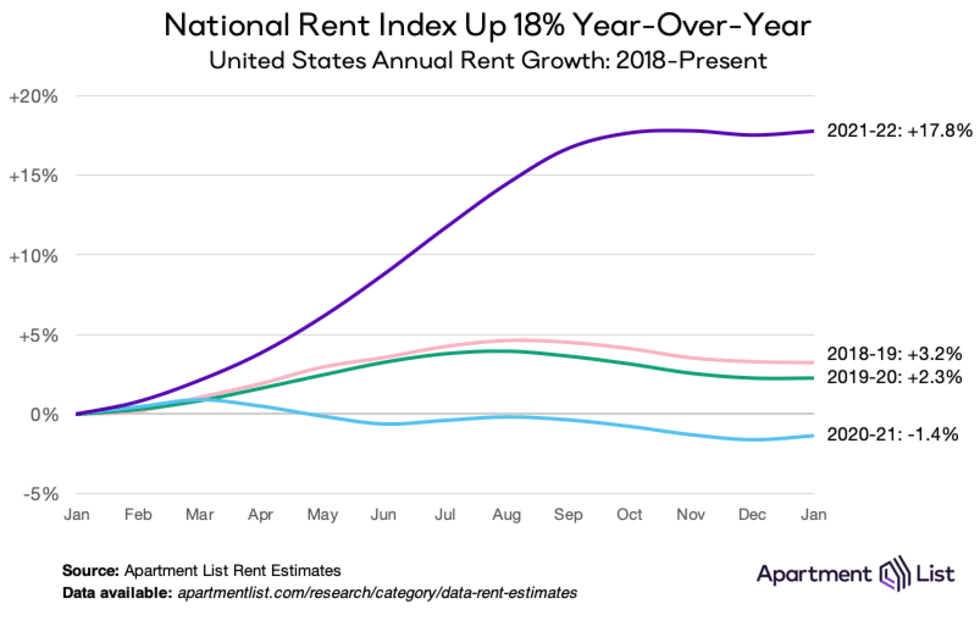

Over the past 12 months, rent prices spiked by an unprecedented 17.8 percent nationally. The early stages of the pandemic led to a modest decline in rents from January 2020 through January 2021 (-1.4%), but the staggering growth of 2021 more than made up for the lost ground. In fact, the national median rent ($1,312) is now $120 greater than where we project it would have been if rent growth since the start of the pandemic had been in line with the average growth rates we saw in 2018 and 2019. Rent growth over the past year has far outpaced that of any prior year in our estimates, which go back to 2017. For comparison, year-over-year rent growth in January averaged just 2.3 percent in the three years preceding the pandemic.

Although many renters may be rightfully dismayed by last year’s record-setting rent growth, the situation has shown signs of easing in recent months. From last March through September, the national median rent grew by an average of 2.1 percent per month – nearly the same amount that they increased over the entire year of 2019. However, over the most recent four months, monthly growth has averaged just 0.2 percent, with a total increase of less than one percent over that period. In December, rents actually fell by 0.2 percent, the only time they did so in 2021. That price dip proved to be short lived, but this month’s increase was still a modest one.

It’s worth noting that a slowdown in rent growth during the fall and winter months is expected due to seasonality in the market. In fact, in the years preceding the pandemic, it was typical to see rents actually fall slightly at this time of year. In other words, even though rent growth has been essentially flat over the past three months, it’s still pacing a bit ahead of the pre-pandemic trend. It’s likely that rent growth will pick back up in the coming months, though it’s still unclear just how much we should expect rents to rise in the year ahead. As discussed in more detail below, vacancy rates have been gradually easing, but the market remains tight. Even if prices don’t rise as rapidly as they did in 2021, we could still be in for a year of above-average growth.

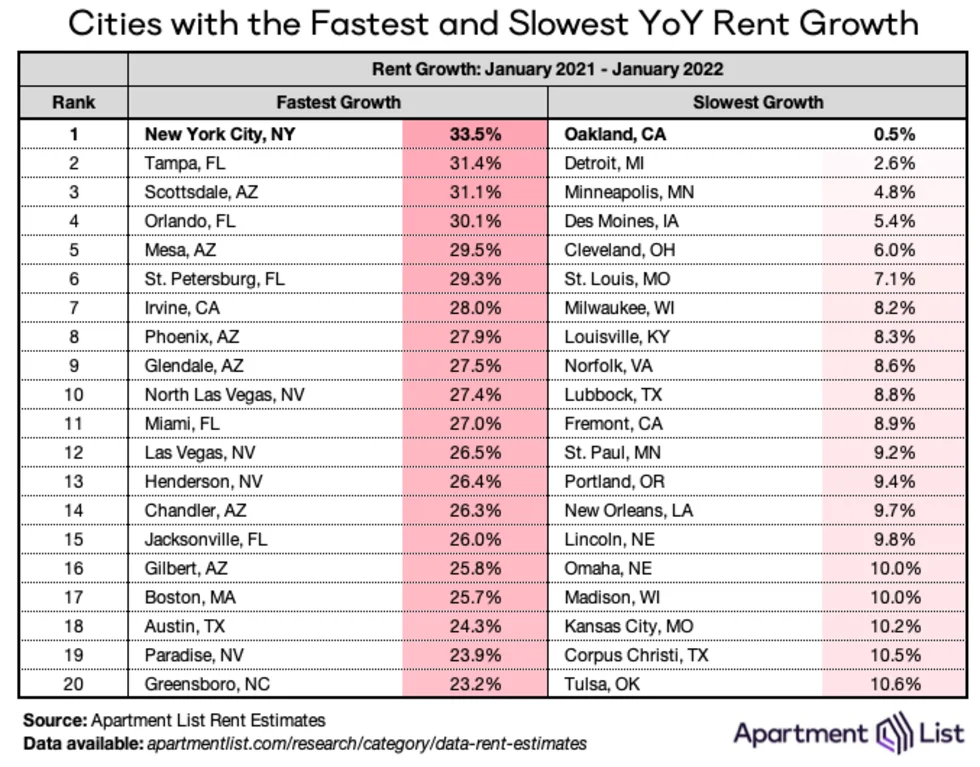

NYC had the nation’s fastest rent growth over the past year

The nation’s largest city is also the place where rent prices have grown the fastest over the past 12 months. In New York City, the median price for an apartment increased from $1,575 one year ago to $2,101 today, a massive jump of 33.5%. NYC narrowly edged out a number of smaller but rapidly-growing cities that absorbed significant rental demand throughout the pandemic, including Tampa, FL (+31.4%) and Phoenix, AZ (+27.9%). Below are the 20 cities that saw the fastest (and slowest) rent growth over the past year.

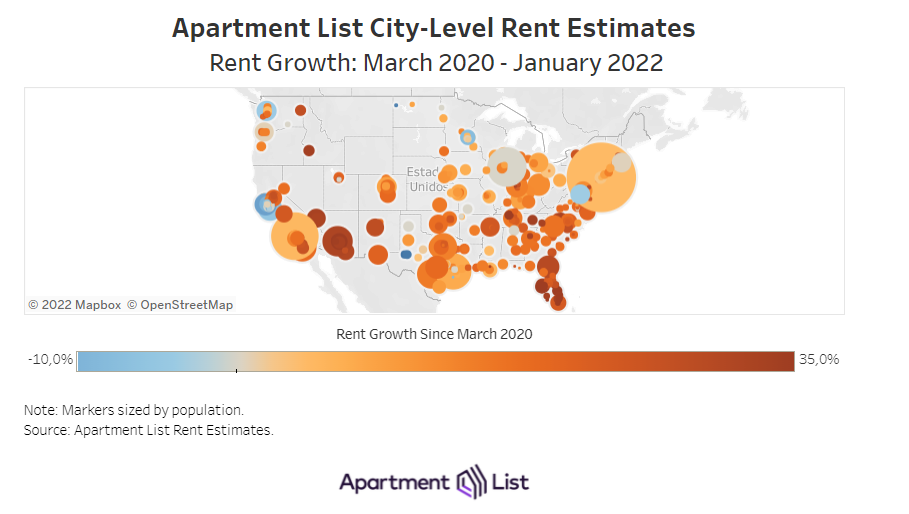

What differentiates New York City from most other cities at the top of this list is that the rapid growth of the past year has mostly served to offset a sharp decline in rents during the first year of the pandemic. Even after the astronomical growth of the past 12 months, rents in NYC are now just 4.4 percent higher than they were in March 2020. In contrast, Tampa never experienced a meaningful decline in rents at the start of the pandemic, and rents there are now 34.3 percent higher than they were in March 2020.

On the other end of the spectrum, Oakland, CA has seen the nation’s slowest rent growth over the past year, with a meager increase of just 0.5 percent. Notably, even among most of the cities with “slowest” rent growth, prices are actually still increasing rapidly by historic standards. There are only 15 cities among the 100 largest that have seen prices rise by less than 10 percent over the past 12 months. For context, in January 2020, before the onset of the pandemic, there wasn’t a single city with year-over-year rent growth exceeding 10 percent.

Rents fell month-over-month in 41 of 100 largest cities

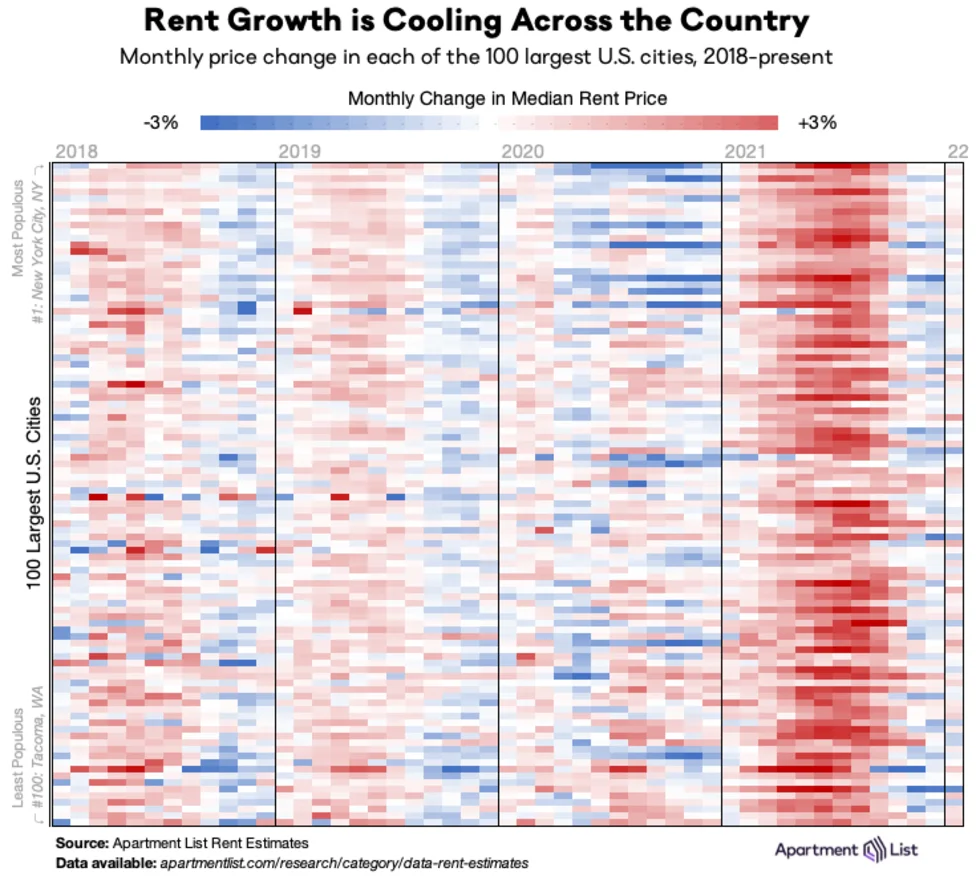

If 2020 was characterized by price convergence (expensive cities getting cheaper and cheaper cities getting more expensive), 2021 was characterized by price inflation: cities large and small getting more expensive, rapidly. This can be seen in the chart below, which visualizes monthly rent changes in each of the nation’s 100 largest cities from January 2018 to present. The color in each cell represents the extent to which prices went up (red) or down (blue) in a given city in a given month. The band of dark red in 2021 depicts last year’s massive rent boom, which peaked in July and August 2021 when all 100 cities in this chart saw prices go up. Meanwhile, the four rightmost columns show that the recent cooldown in rents is also geographically widespread. In January, prices fell in 41 of the nation’s 100 largest cities.

While rent growth has slowed down across the board in recent months, not every city has actually seen a dip in prices. Most of the cities in the chart above have seen at least one month of falling rents over the past four months, but in 29 of these cities – including many of the hot Sun Belt markets in the table above – prices have continued to trend upward, even if the pace has slowed. At the other end of the spectrum, there are 11 cities where rents have now fallen for four consecutive months. The largest decline has been in Spokane, WA, where rents are down by 8.9 percent since last September. Whereas 2021 saw rapid rent growth across the U.S., different parts of the country are now seeing prices trend in opposite directions.

Vacancy index shows rental market tightness continuing to ease

As we’ve explored in detail, much of the 2021 rent boom was attributed to a tight market in which more households are competing for fewer vacant units. Our vacancy index spiked to 7 percent last April, as many Americans moved in with family or friends amid the uncertainty and economic disruption of the pandemic’s onset. After that, however, vacancies began a steady decline, eventually falling below 4 percent.

After bottoming out at 3.8 percent in August 2021, our vacancy index has now slowly ticked up for five consecutive months and currently stands at 4.4 percent. Although the recent vacancy increase has been modest and gradual, it represents an important inflection point, signaling that tightness in the rental market is finally beginning to ease. The vacancy situation remains historically tight, but the gradual easing of recent months has likely been contributing to the slowdown in rent growth.

Conclusion

After the first and only national rent decline of 2021, January brought a return to positive rent growth, with a modest 0.2 percent increase. That said, our national rent index has still been essentially flat for the past three months, representing a welcome cooldown from the astronomical growth that characterized last year. While the apartment market remains tight – the national vacancy rate sits just above 4 percent compared to 6 percent pre-pandemic – the winter season continues to bring signs that pressure is gradually beginning to ease. That said, at least part of the recent slowdown in rent growth is attributable to seasonality in the market, and the spring is likely to bring with it a return to faster price increases. Despite a recent cool-down, many American renters are likely to remain burdened throughout 2022 by historically high housing costs.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.