With 2021 behind us, we dove into foot traffic trends at CVS, Walgreens, and Rite Aid to analyze how these pharmacy players performed and uncover changes to consumer behavior.

Walgreens and CVS Still Riding the Wave

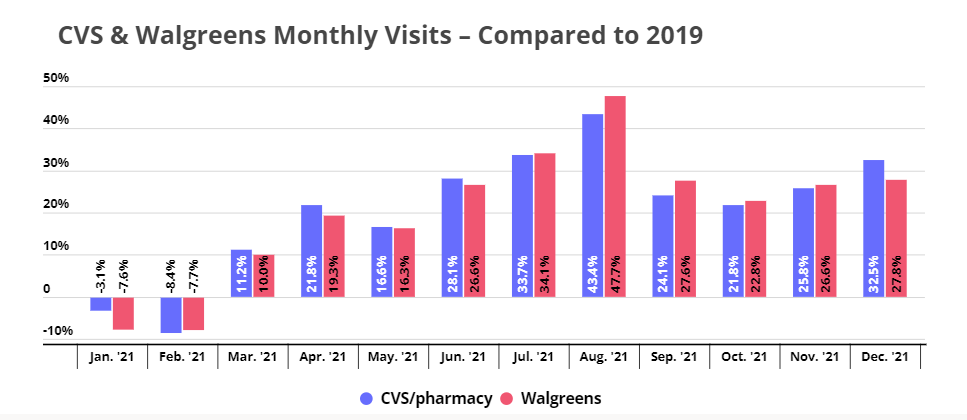

A lot happened in the pharmacy sector over the past year. CVS and Walgreens announced some major strategic shifts, with CVS intending to downsize its store fleet while Walgreens will expand and diversify its physical footprint. And since the spring, the two category leaders have seen significant year-over-two-year (Yo2Y) visit increases, driven by the heightened demand for wellness products as well as the pharmacies’ ability to administer COVID vaccines and tests.

And visit data from recent months confirms that CVS and Walgreens are still very much riding the wave. Neither brand suffered any noticeable dip in visits from the Delta or Omicron surges, and both finished the year far ahead of their 2019 visit numbers. In December alone, CVS saw a 32.5% Yo2Y foot traffic increase, while Walgreens pulled in 27.8% more visits than it had the same months two years prior.

So, however these brands decide to optimize their brick-and-mortar strategy, one thing is sure – Walgreens and CVS are incredibly well positioned for offline success in 2022.

Increasing Cross-Shopping Between Walgreens and CVS

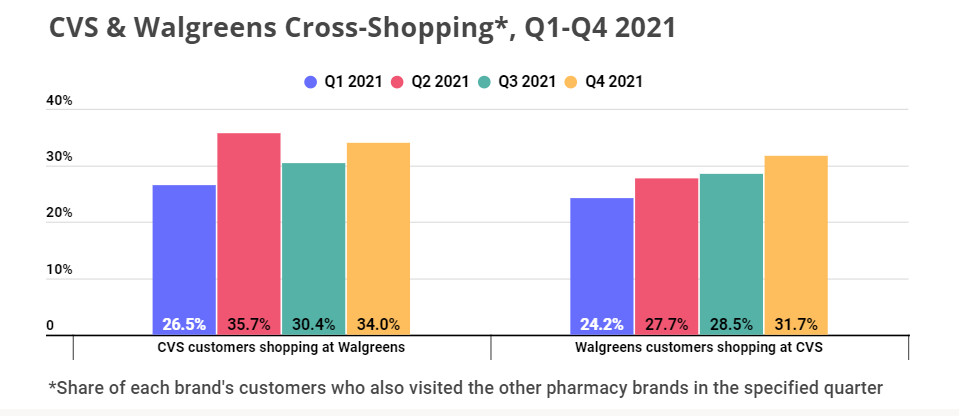

Cross-shopping data confirms that neither brand’s success is coming at the expense of the other. The share of CVS customers who also visit Walgreens grew from 26.5% in Q1 2021 to 34.0% in Q4 2021, while the share of Walgreens customers who also visit CVS grew from 24.2% in Q1 to 31.7% in Q4.

Since both CVS and Walgreens are seeing hefty visit increases, there is clearly enough consumer demand to support both brand’s strength and expansion. But the increasing cross-shopping data between the two can also explain why Walgreens and CVS are now heavily focussed on building out their healthcare offerings.

Customers are more likely to be loyal to their healthcare provider than to their local pharmacy, so the transition to healthcare provision may well cut down on cross-shopping – while opening up robust, long-term revenue streams that can cement the current pandemic visit boom.

Rite Aid Finishes Strong

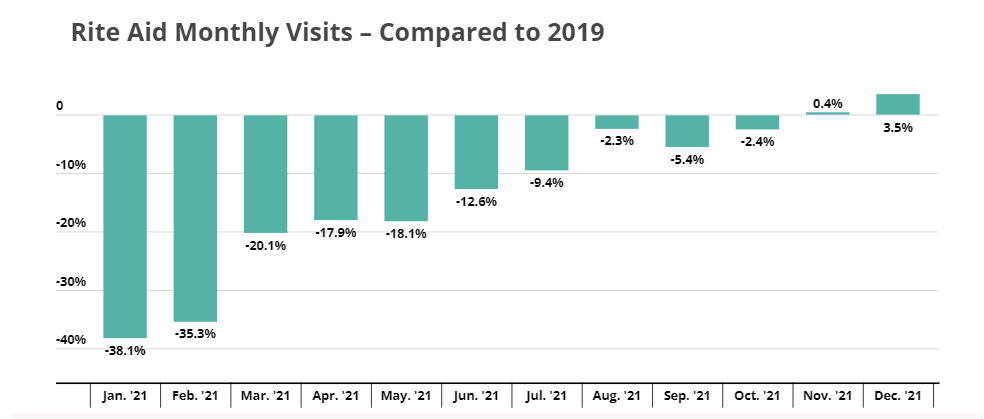

While Walgreens and CVS enjoyed their massive visit bumps, Rite Aid foot traffic – which was more severely impacted by the pandemic – seemed to struggle to catch up to its peers. But towards the end of the year, the Pennsylvania-based brand pulled through to end the year on a high note.

Rite Aid started off the year with a 38.1% Yo2Y visit gap. And while this visit gap did narrow throughout the first half of the year, June visits were still 12.6% lower than they had been the same month in 2019. But Rite Aid’s recovery began picking up steam in the second half of the year, and by November the brand reached 0.4% Yo2Y visit growth. In December, Rite Aid posted a 3.5% increase compared to pre-pandemic visit levels.

While this visit increase may seem modest compared to CVS and Walgreens’ huge foot traffic jumps, it is still an incredibly positive indication of the brand’s potential. And Rite Aid recently announced that it is expanding its partnership with RELEX “to include space and floor planning, as well as space-aware replenishment for more than 2,400 stores across the country,” which can help the brand take a larger slice of the growing pharmacy visit pie in the coming year.

Rite Aid’s 2021 recovery may have taken longer because of stores closures, but the brand seems well positioned for a turnaround in 2022.

Is Friday the New Errands Day?

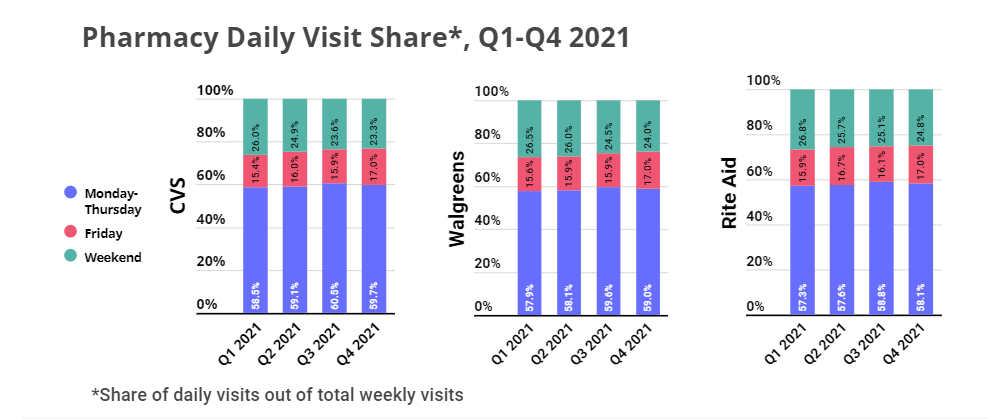

Despite the differences between CVS, Walgreens, and Rite Aid, one consumer behavior trend held true across the three brands – a decrease in weekend visits and an increase in Friday visits. Indeed, while weekend visits to pharmacies decreased across the board – a trend seen in almost every retail category this year – and weekday visits remained more or less constant, all the brands saw a significant jump in Friday visits.

Understanding customers’ current visitation patterns can help local pharmacy managers provide high level customer service in the most efficient manner. The fact that customers are now increasingly visiting pharmacies during the week – and specifically on Fridays – is critical information for brands looking to build out their healthcare offerings while struggling with a labor shortage.

Consumer behavior patterns have already begun to crystallize into a “new normal.” Pharmacy brands that succeed in catering to the needs of today’s customers can gain a leg up in this fast growing retail category.

Want to stay informed on the latest data-driven retail insights?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.