Source: https://www.corelogic.com/uncategorized/forbearance-rate-rises-with-loan-credit-risk%ef%bf%bc/

Evidence from Mortgage Loans originated during 2018-2020

Since March 2020, the COVID relief program under the CARES Act allowed millions of homeowners to temporarily pause or reduce their mortgage payments. However, for many of these homeowners, the forbearance plans already expired or are expiring soon. The maximum forbearance period was 18 months for most of the programs. Thus, a loan that entered forbearance during April 2020 would have had to exit forbearance no later than October 2021. According to the Mortgage Bankers Association (MBA), the share of mortgage loans in forbearance decreased to 1.41% in December 2021, a drop of 26 basis points from 1.67% in the prior month.

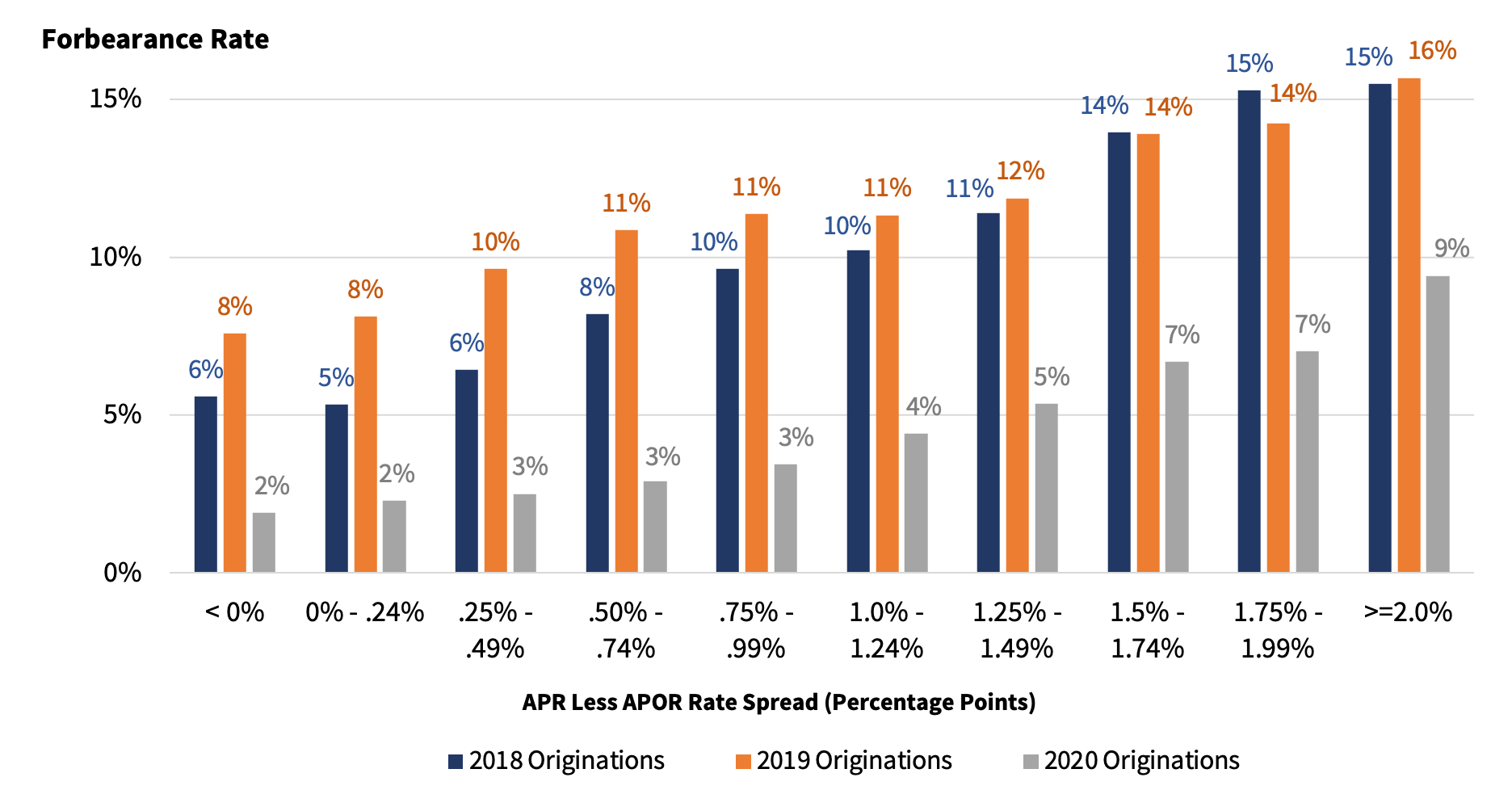

The CoreLogic data shows that the forbearance rates were higher for higher-priced loans. In this blog, we examine the forbearance rate by APR (Annual Percentage Rate) and Average Prime Offer Rate (APOR) spread for all conventional loans. APOR is a weekly market index of the average loan APRs offered by a selection of lenders across several mortgage products offered to highly qualified borrowers. The difference between a loan’s APR and the APOR is referred to as the “rate spread.” In general, loans with a rate spread of 1.5 percentage points or more are considered higher-priced loans.

As forbearance and delinquency are highly correlated, the finding is consistent with our prior analysis. Our previous analysis had shown that loan delinquency increased as rate spread increased. Figure 1 displays forbearance rates for conventional loans for vintage years 2018-2020. The forbearance rates in the figure are displayed by rate spread category, in increments of 0.25 percentage points. The figure shows that the forbearance rate was lowest for loans with a rate spread of 0% – 0.25% and highest for the loans with rate spreads above 2%, based on servicing data through November 2021. There were notable increases in forbearance as rate spreads increased. Especially, the variation in forbearance rates is depicted between the loans with 1.25% – 1.49% and 1.50% – 1.74% rate spread categories. The forbearance rate for loans with 1.50% – 1.74% rate spread is higher by 2 to 3 percentage points than the loans with 1.25% – 1.49% rate spread.

Figure 1: Forbearance Rate by Spread Above APOR and Vintage: Conventional Loans Active as of November 31, 2021

Cumulative forbearance rates of 9%, 8%, and 2% for vintage year 2018, 2019 and 2020, respectively

Higher-priced loans were more likely to experience forbearance than lower rate spread loans in this analysis. However, not all forbearance loans are in some form of delinquency. About 54% of the homeowners with conventional loans in active forbearance plans in November 2021 were current on their mortgage payments. Some homeowners may have applied for forbearance in case their financial hardship worsened even though they were able to remain current in their payments.

A surge in foreclosures as the forbearance plan ends is unlikely. As reported by CoreLogic, the foreclosure inventory rate was at a 22-and-a-half-year low of 0.2% in October 2021, down from 0.3% in October 2020. The very rapid home price appreciation in 2020 – 2021 has boosted home equity. Record levels of home equity will help limit the number of homeowners that experience foreclosure.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.