First Take-Two bought Zynga. Then, Microsoft acquired Activision Blizzard. Now, Sony is going after Bungie. The video game world seems to be consolidating more quickly than a Minecraft God Bridge. But will these acquisitions bring in the new customers and strengthen the loyalty that the new parents expect? In today’s Insight Flash, we answer these questions through our newly launched CE Transact Subscription Metrics dashboard and CE Receipt data, focusing on customer loyalty, new versus repeat user mix, and average price per item.

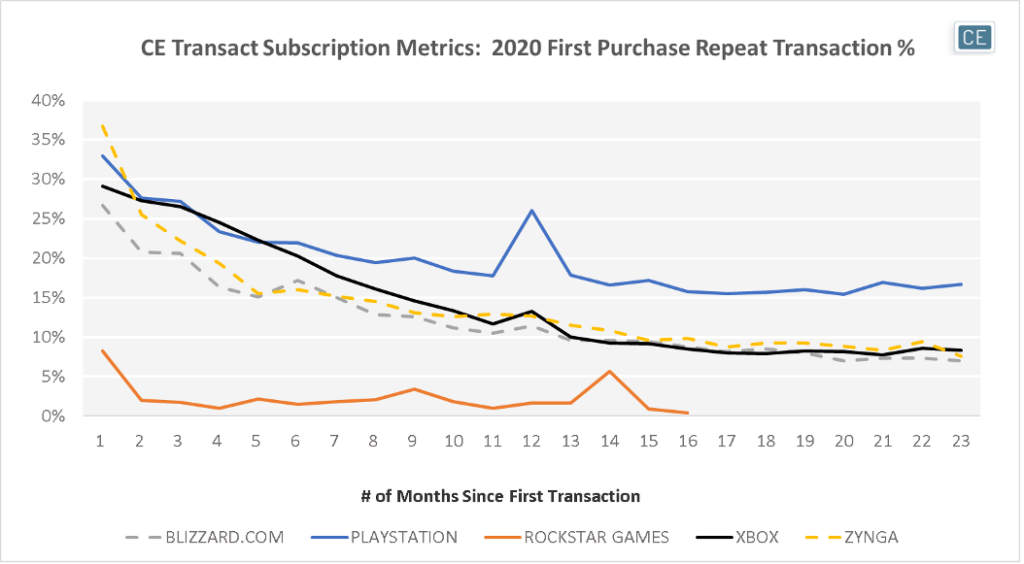

A primary reason for these acquisitions is likely a desire for new content to power gaming subscription services like Microsoft’s GamePass (tagged in our data to the Xbox brand) or Sony’s PlayStation Plus. Looking at repeat purchase curves by cohort of players whose first purchase was in 2020 shows that continuing purchasing for these sites dips over time. Sony’s PlayStation has the strongest retention with a third of customers making another PlayStation purchase just a month after their first time shopping the company’s DTC outlets. However, this percentage is cut in half two years later. Xbox sees just under 30% of shoppers making a purchase one month after their first, but only 8% of shoppers purchasing again two years later. Take-Two’s Rockstar Games only sees 8% of shoppers returning one month after first purchase, with close to zero repeat purchases a year and a half after that. Although these numbers are only capturing DTC spend from the companies and there is some cross-shopping among a parent company’s brands, they are a strong directional guide that a continued stream of new content is necessary to maintain engagement.

Retention

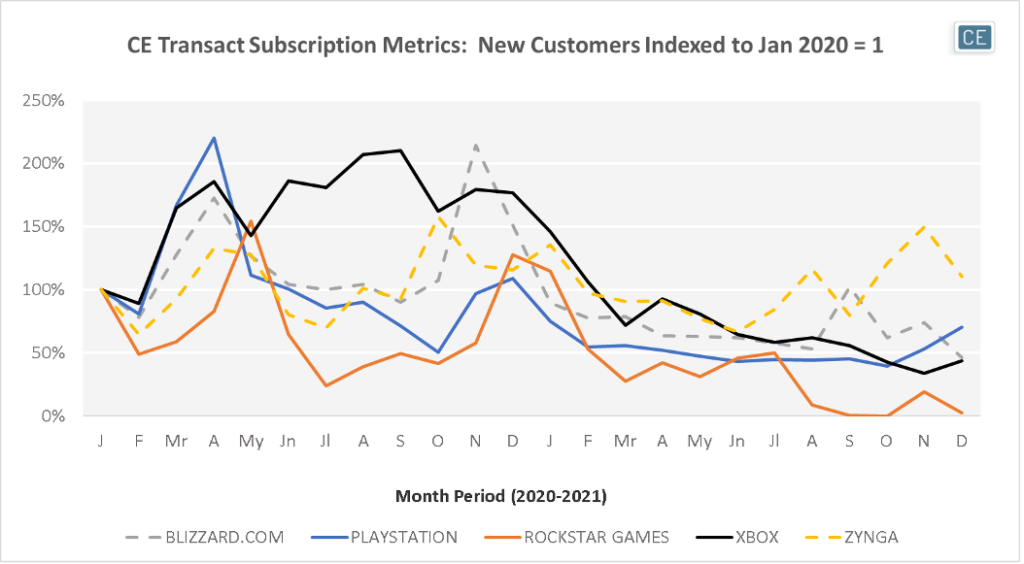

New customer patterns provide further support for the idea that a steady stream of new content is important for growth. New shoppers for video game DTC businesses come in waves based on when new content is generated. Activision Blizzard stands out with the biggest spike. The November 2020 releases of Call of Duty: Black Ops Cold War and World of Warcraft: Shadowlands more than doubled the usual number of new shoppers buying from Blizzard.com.

New Customers

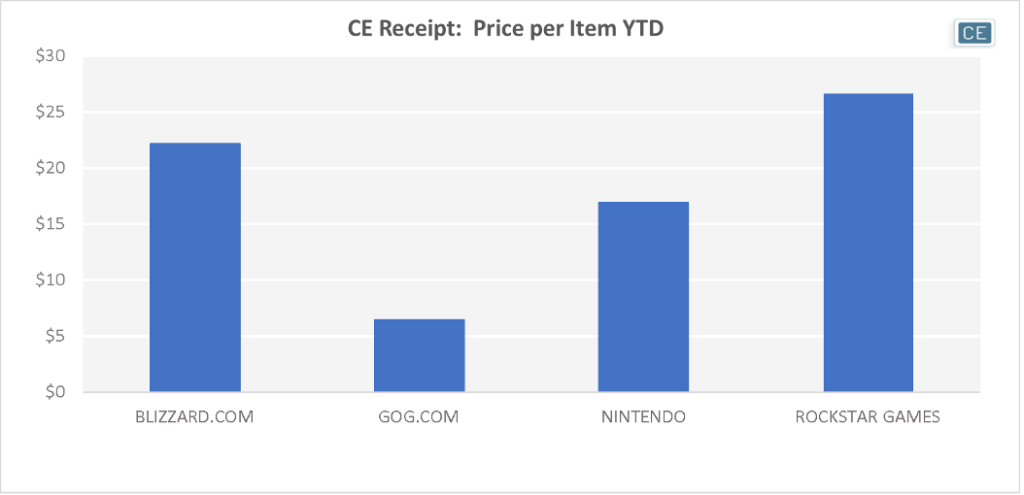

Along with number of repeat purchases, the size of those repeat purchases can also be important in an acquisition. Among the top video game brands tracked in our CE Receipt data, Take-Two’s Rockstar Games has the highest average price per item so far this year at $26.63. Blizzard.com is just behind at $22.14.

Average Price per Item

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.