It should be no surprise that the home of Buckingham Palace and the Crown Jewels is no stranger to luxury sales. But what are luxury trends like across different countries in the UK, and which price points are most appealing to UK shoppers? In today’s Insight Flash, we dig into these questions using our new UK Cohort dashboards to track luxury sales by country, average price point by country for US-based brands like Tommy Hilfiger and Ralph Lauren, and how Tommy Hilfiger and Ralph Lauren sales are distributed across ticket buckets.

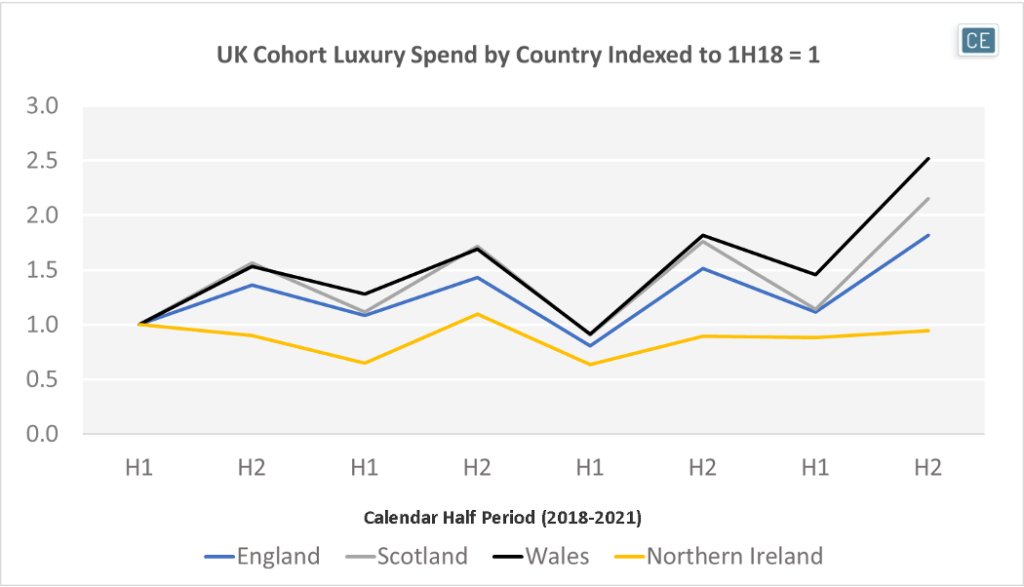

UK Luxury industry sales across countries tends to be strongest in the second half of the year due to the holiday shopping season. Over the last four years, direct-to-consumer Luxury spend in Northern Ireland has stagnated, with sales in 2H21 only 90% of what they were in 1H18. In contrast, the rest of the UK saw a substantial lift in Luxury spend in the second half of 2021, with Wales exhibiting the strongest growth at 2.5x 1H18 levels.

Spend Growth Versus Industry and Subindustry

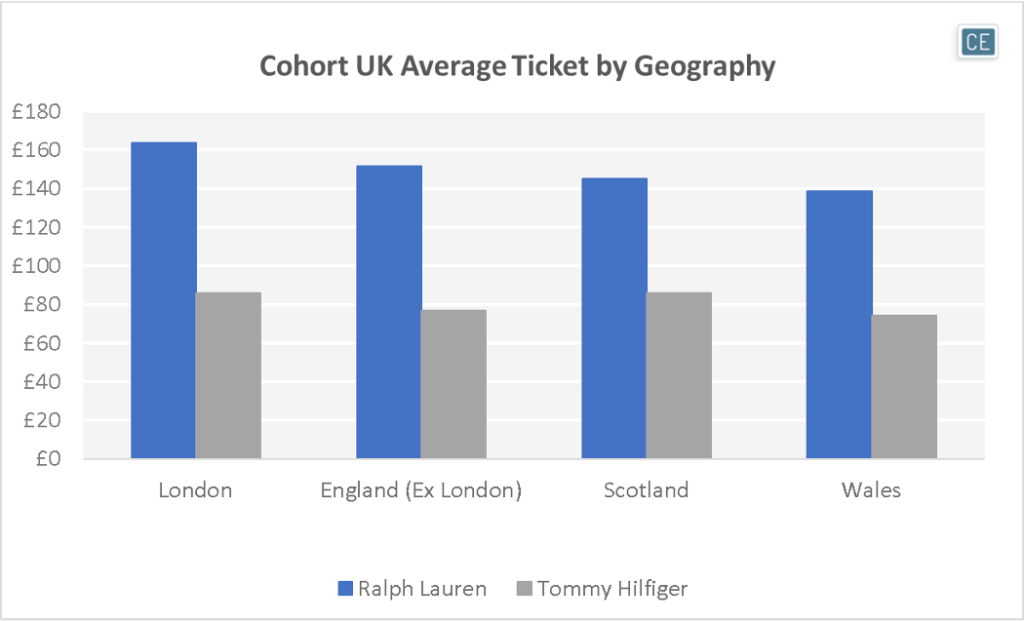

Comparing the average ticket across geographies can also be enlightening. For instance, although Ralph Lauren and Tommy Hilfiger are both US-based luxury brands, Ralph Lauren purchases had a much higher average transaction size than Tommy Hilfiger in the UK in the second half of 2021. Ralph Lauren’s ticket was almost twice as high as that of Tommy Hilfiger in England. Indeed, Ralph Lauren purchases overall have the highest average ticket in London where the average purchase is £163.66, while Tommy Hilfiger garners the largest basket in Scotland where the average ticket is £86.01.

Average Ticket

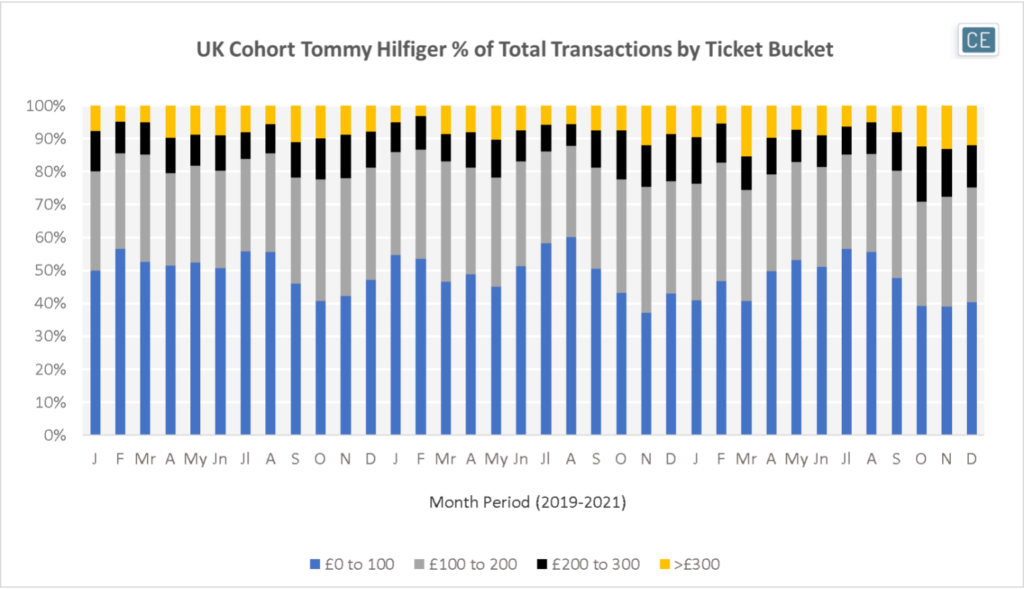

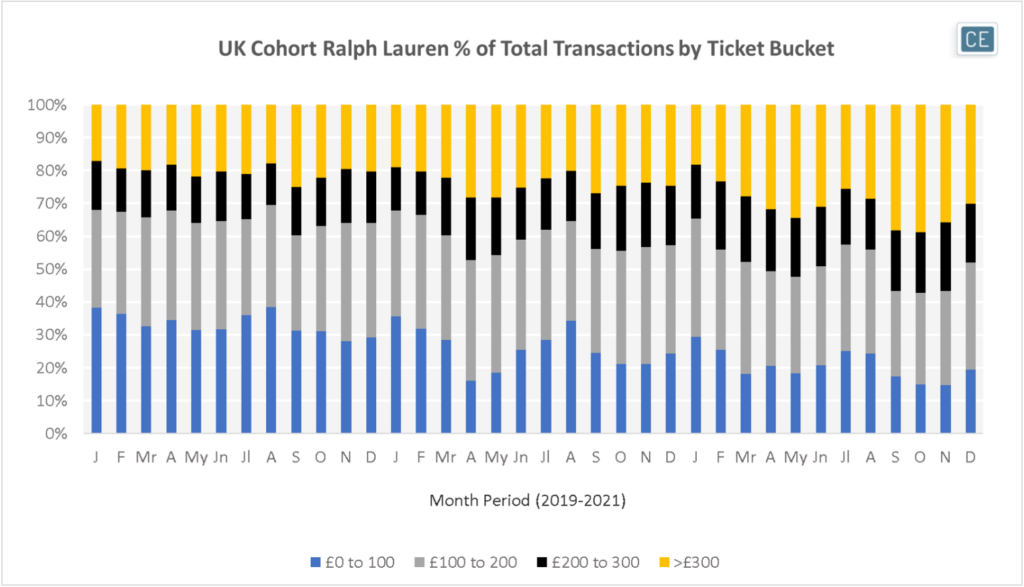

Analysis of average ticket doesn’t always tell the whole story. Our ticket bucket dashboard allows users to see exactly how the components of that average break up. For instance, over the last twelve months transactions over £300 averaged less than 10% of total Tommy Hilfiger purchases. Yet, they were over 25% of the total for Ralph Lauren every single month, going as high as 60% of all transactions in September.

Ticket Buckets

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.