The records keep tumbling. data.ai’s new State of Mobile Gaming 2022 Report reveals the astonishing public appetite for smartphone games.

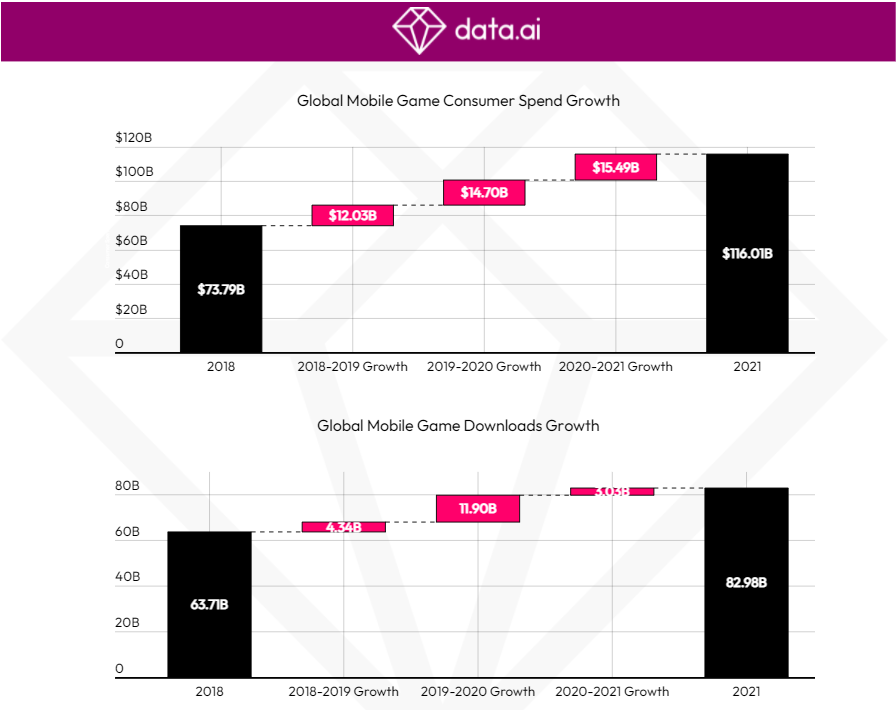

Mobile games sustained strong momentum from the pandemic surge — reaching new heights at $116 billion in 2021 alone.

2022 Brought More Mobile Gamers Than Ever Before

Prior to 2020, mobile gaming was already in a league of its own — with record breaking levels of downloads and consumer spend across the app stores. But the following two years took engagement to new heights. Read our latest State of Mobile Gaming 2022 Report to uncover the phenomenal year gaming had on mobile:

Here are the top level numbers from data.ai’s newly released State of Mobile Gaming 2022 report:

Needless to say, the app ecosystem as a whole has benefited from the public’s COVID-fueled desire to seek out digital forms of entertainment. Still, gaming has always been the dominant force in the market – and this remains the case.

The $116 billion it generated represents 64% of the $170 billion total app spend in 2021. Meanwhile games represented 15% of the 2 million new app releases in 2021.

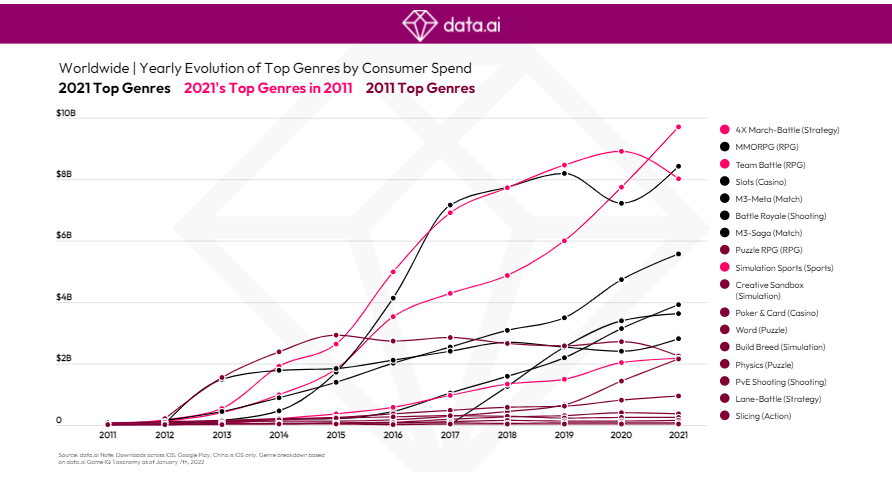

While gaming remains consistently popular with the public, earlier games genres matured and peaked in their appeal. So what’s making all the noise right now?

Without a Doubt: The Hypercasual Genre.

The State of Mobile Gaming 2022 report reveals the astonishing growth of this playing genre. Hypercasual games succeed because they remove virtually all the friction that would stop someone from playing. They are lightweight, have virtually no gameplay mechanics and are usually free to play.

Many believe that the trend towards hypercasual began with the success of Flappy Bird in 2014. At this point, the market was dominated by casual games like Candy Crush, Temple Run and Subway Surfers. But hypercasual soon attracted gamers that even these blockbusters couldn’t reach.

Our report proves it: last year, gamers downloaded nearly 13 billion hyper casual games across the top four sub-genres: Action,Puzzle, Simulation and .io.

As an indication of how far they have come, total downloads across these four sub-genres in 2018 were just around 2.4 billion.

Mobile’s Ubiquitous Nature Democratizes Gaming — Widening the Gaming Audience by Demo and Across Gender Identities

Historically, in the pre-mobile days, game consumption was predominantly driven by younger males. Mobile had democratized gaming and empowered every smartphone owner with a gaming console in their pockets. Mobile gamers span all demographic cohorts, from Gen Z to Baby Boomers and across all gender identities. While we do see subgenres of games appeal more to male gamers, we have seen other subgenres appeal to female gamers. In reaction to a wider, more diverse gaming population, and perhaps in some cases a precursor to, we’ve seen an expansion of themes, mechanics and IP of mobile games.

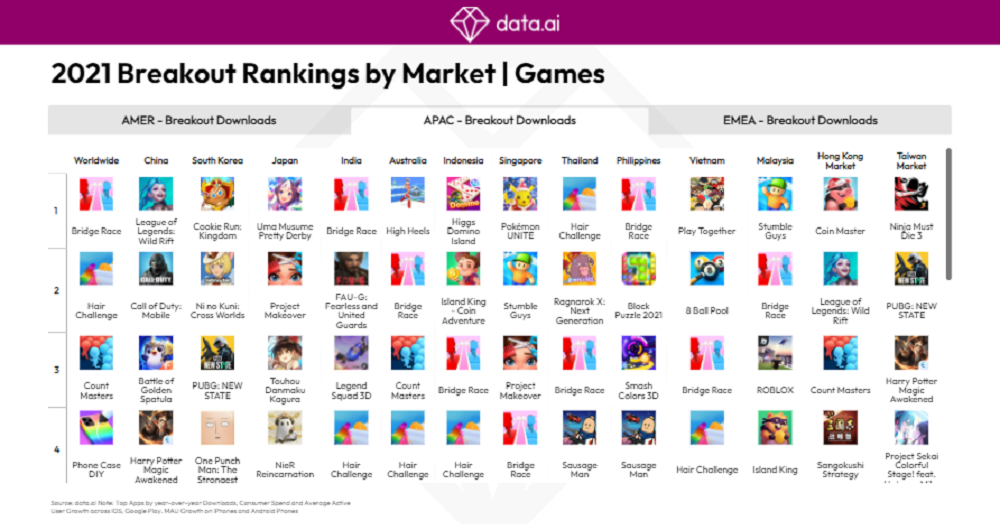

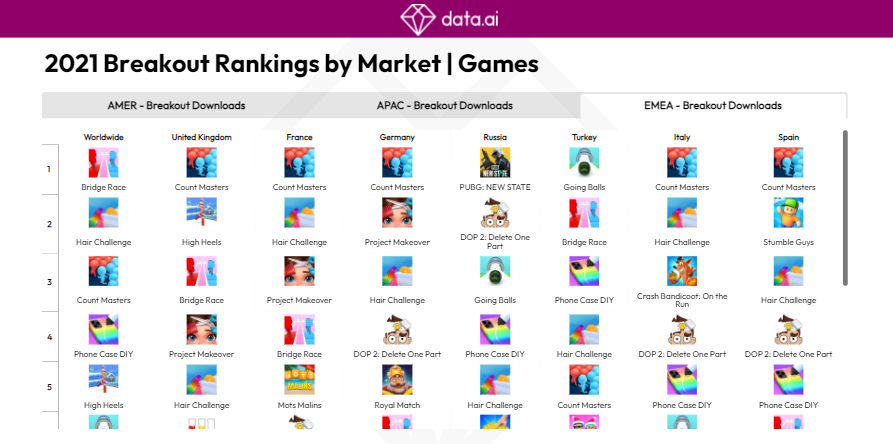

The data.ai State of Mobile 2022 report reveals that 3 of year’s top 5 breakout products by download were hypercasual and contained more feminine themes: Hair Challenge, Phone Case DIY and High Heels, expanding the subject matter to appeal to wider and more inclusive audiences.

The State of Mobile Gaming 2022 report includes a deeper analysis of the gaming preferences of male and female players. It is important to note that our analysis in this report is limited to males and females only and is not representative of all gender identities. It reveals, for example, that in the United States, France and Japan, female gamers are around 1.3x more likely to play M3-Saga (Match) games, and male gamers in the US are 1.5x more likely to play Build-Battle (Strategy) games than the general population. Interestingly, it also discloses that the huge hits Among Us! and ROBLOX have a higher tendency to be played by female audiences.

4X March-Battle (Strategy) Games Lead the Way in Monetization

While hypercasual games set a new bar for downloads, they typically don’t figure at all in terms of direct consumer spend (since most of their income comes from ads). Instead, it’s RPGs and Strategy Games that dominate the monetization chart.

In 2021, 4X March-Battle (Strategy) games earned the most. 4X games (an abbreviation of Explore, Expand, Exploit, Exterminate) are the opposite of hypercasual. They require time and commitment to play. But as a result, they accumulate committed audiences that are willing to spend big to support their hobby. Last year, they grossed $9.7bn – up nearly $2 billion on the year prior.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.