Key takeaways:

Total spending growth slowed in the weeks after the Ukraine-Russia War began

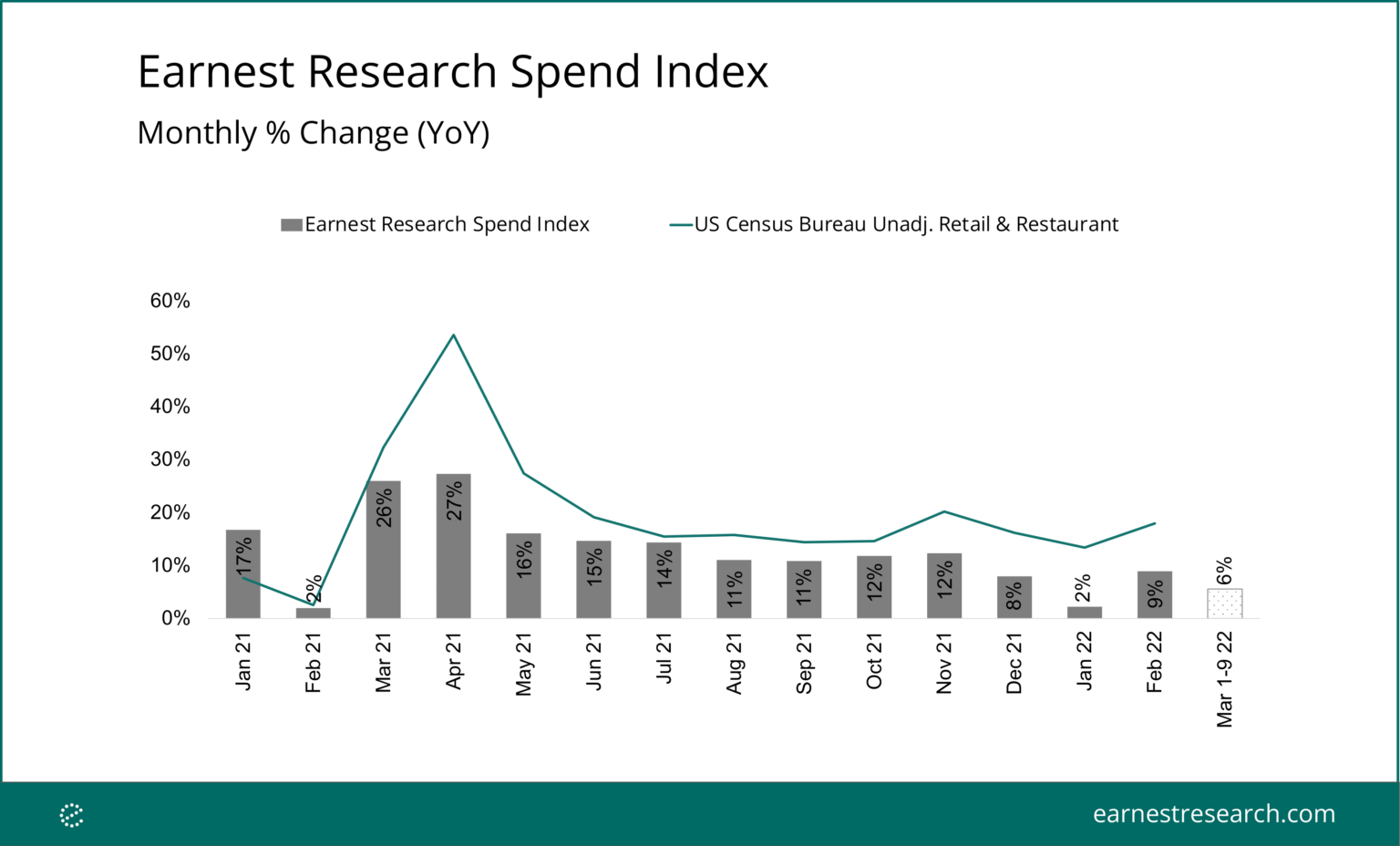

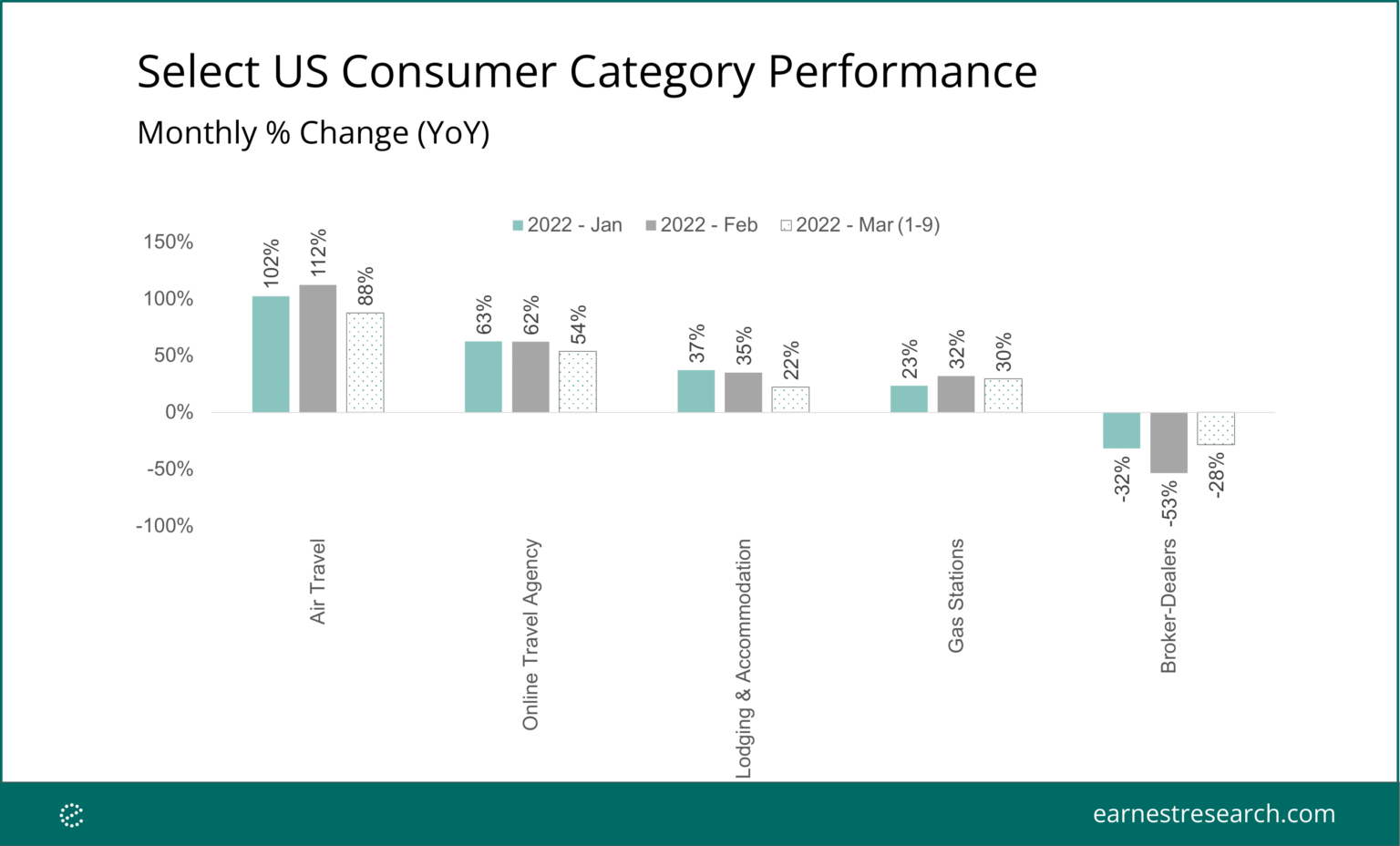

Consumer credit and debit spending grew YoY in February, despite the systemic shock of the Ukraine-Russia War. However spending decelerated 3 points from February to the preliminary period between March 1st and 9th. This suggests that US consumers could already be adjusting their behavior based on the economic outlook of the war.

Investment platforms gained

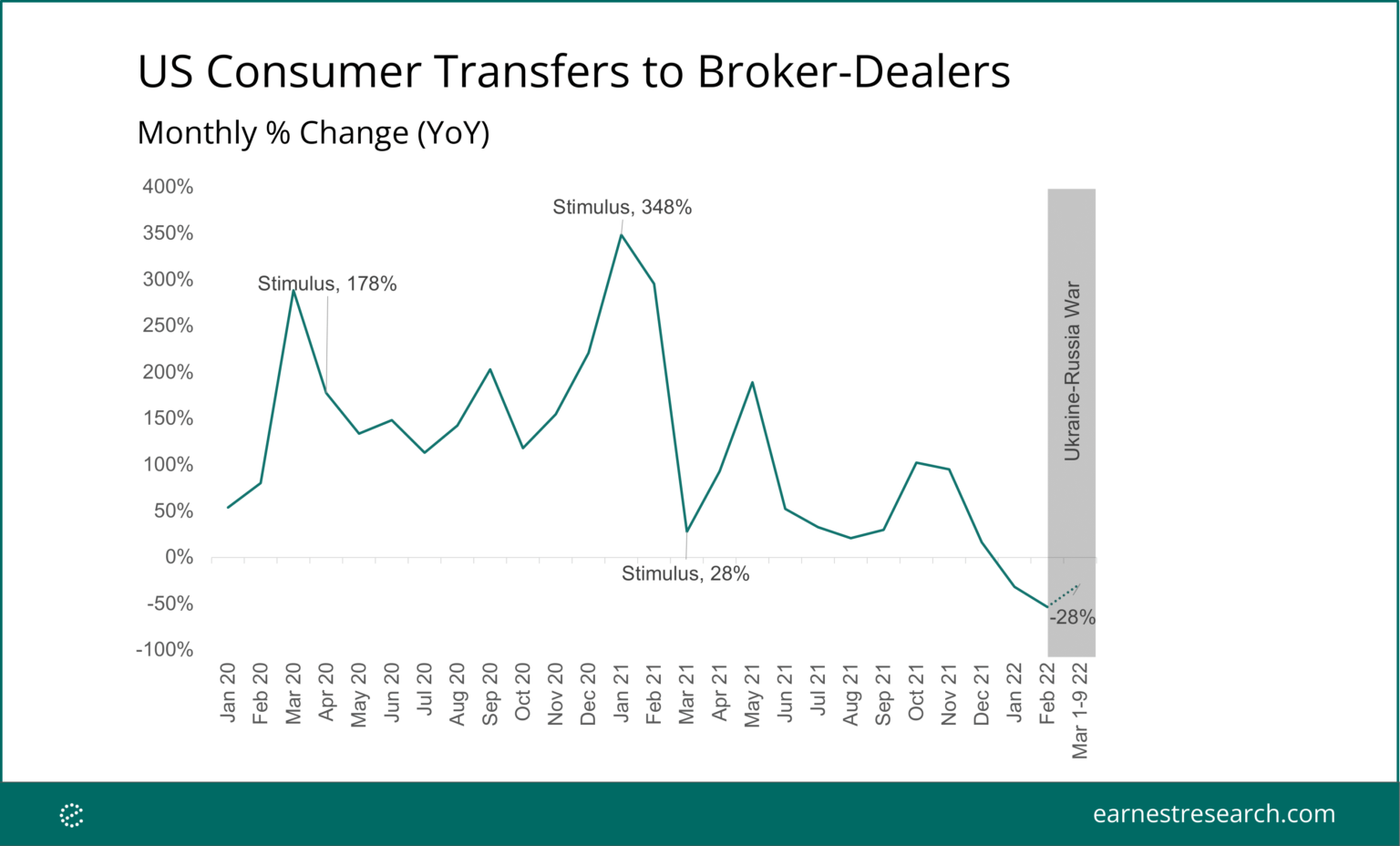

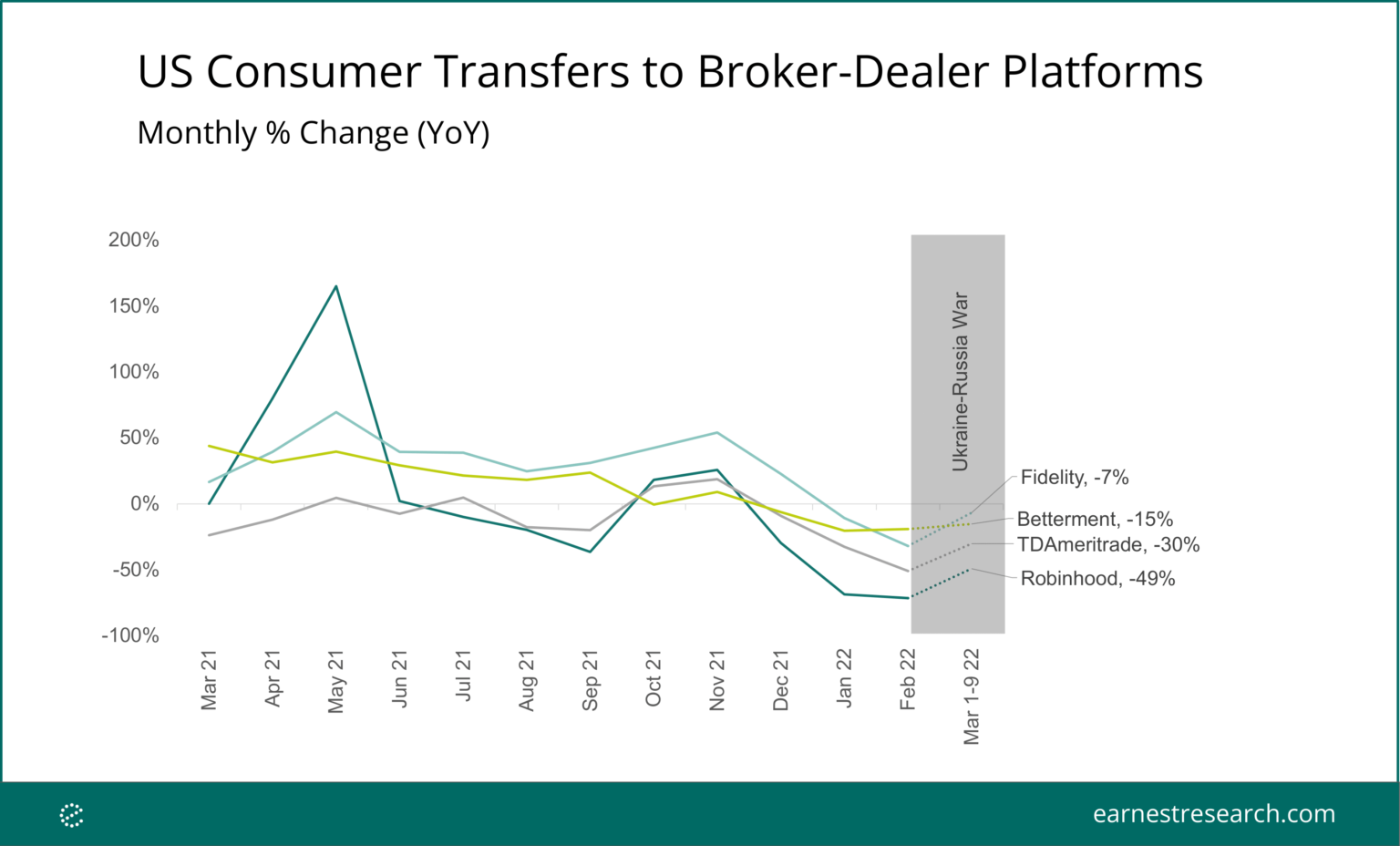

Spending growth across most major subcategories decelerated from February to the preliminary March period (1-9), with one notable exception. Transfers to Broker-Dealer platforms such as Fidelity, Robinhood, and Coinbase reversed their YoY decelerations in the preliminary March period despite surveys suggesting many consumers plan to delay investments as a result of economic uncertainty.

Consumer transfers to Broker-Dealers reached record highs in 2020 and 2021 as they invested stimulus checks into stocks they perceived to be trading at depressed values due to the pandemic. As a result of these tough comps, total transfers decelerated, until eventually falling below year-ago levels from December 2021 onwards. Nevertheless, in the preliminary March period, transfers began to tick up again. This is possibly due to consumer investors seeing opportunity in depressed market valuations after the outbreak of the war. Overall the return in consumer interest investing on falling indices may result in positive news for the platforms that were struggling to grow past pandemic levels.

Among large Broker-Dealers and platforms, transfers onto Fidelity and Robinhood improved the most from February lows, followed by TD Ameritrade. Most platforms remained below year ago levels when the retail trading platform frenzy reached a fever pitch on Coinbase and Robinhood’s IPO’s as well as the last round of stimulus checks.

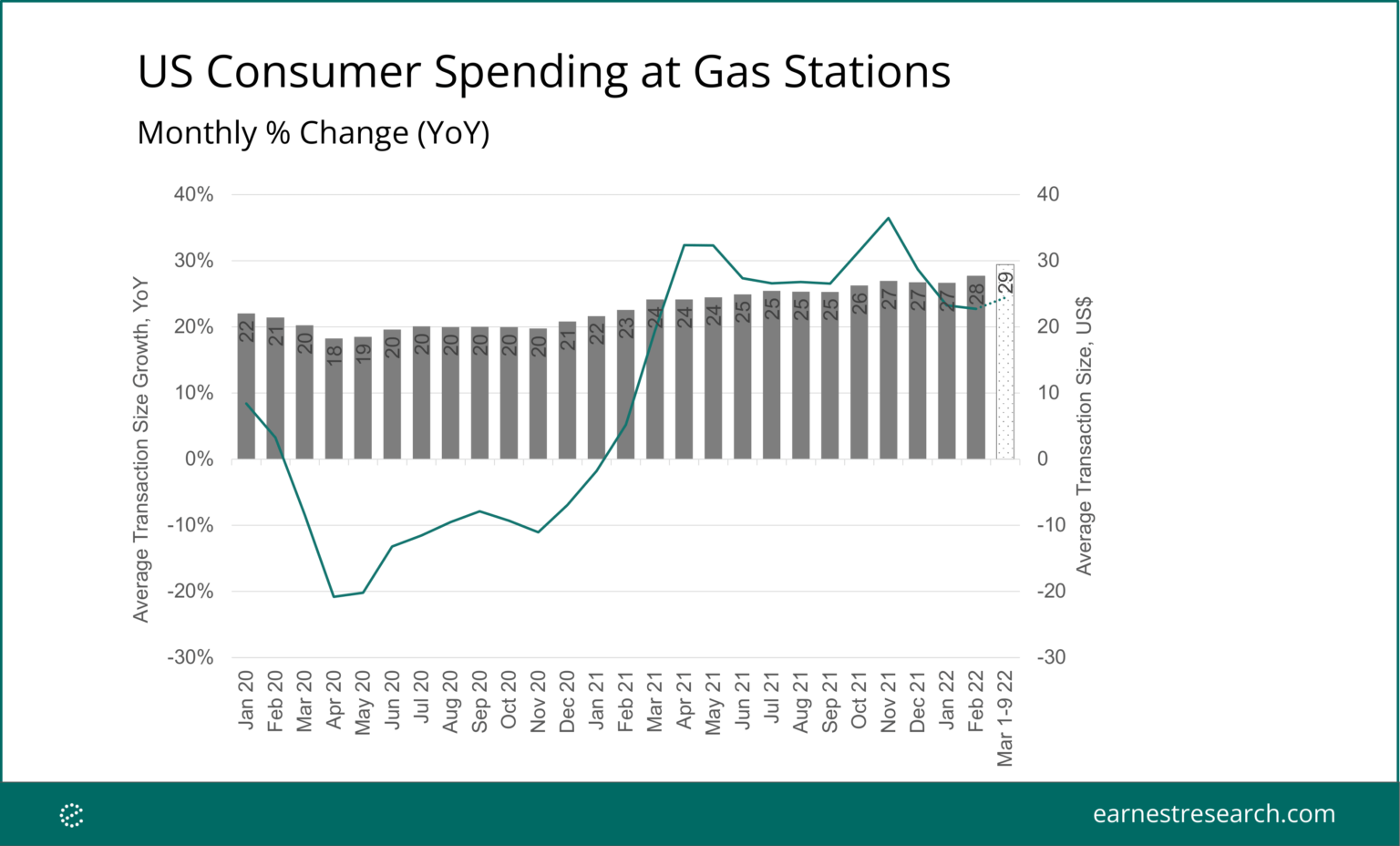

Gas prices climbed, but growth slowed

Prices at the pump were already climbing when Russia invaded Ukraine on February 24, 2022. Total spending at Gas Stations grew 40% YoY, 23% YoY, and 32% YoY in December, January, and February, respectively, suggesting strong demand as consumers resumed some pre-pandemic travel behavior. So far in March, average transaction sizes at Gas Stations grew around $1, an historic high in recent months. The good news is that the rate of that growth slowed in the preliminary period of March, suggesting price pressure may be easing.

Consumers slowed down their travel spending

The most stark spending decelerations occurred in Air Travel, Online Travel Agency (OTA), and Lodging & Accommodation.This is a reversal from months of accelerating spend for Air Travel and OTA, as those depressed industries continue to recover from pandemic challenges. The sudden deceleration suggests that consumers could be putting off future discretionary spending, supporting research that says consumers may already be adopting more conservative spending outlooks based on Ukraine-Russia war uncertainty. Consumer spending at Gas Stations, a proxy for near term travel, also decelerated slightly. This is likely due to increased prices at the pump offsetting fewer transactions.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.