ATTOM’s February 2022 U.S. Foreclosure Market Report revealed that lenders started the foreclosure process on 16,545 U.S. properties in February 2022. That figure was up 40 percent from January 2022 and 176 percent from February 2021.

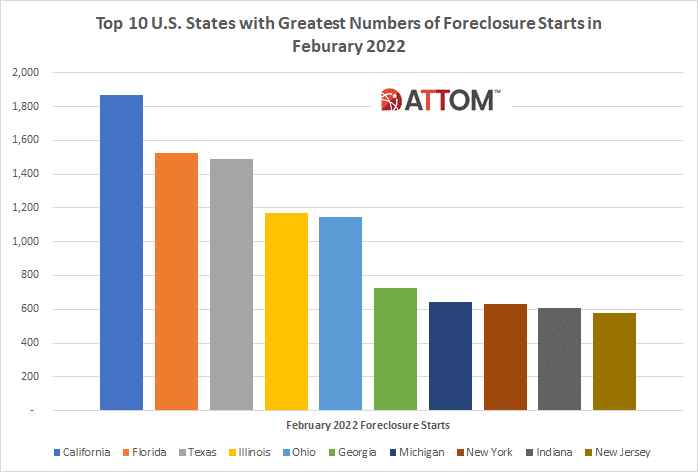

According to ATTOM’s latest foreclosure activity analysis, those states that saw the greatest numbers of foreclosures starts in February 2022 included: California (1,868 foreclosure starts); Florida (1,527 foreclosure starts); Texas (1,488 foreclosure starts); Illinois (1,168 foreclosure starts); and Ohio (1,144 foreclosure starts).

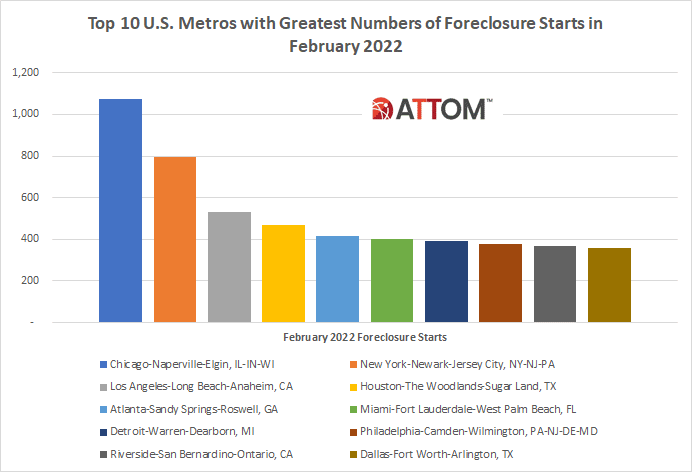

The report also noted that among the 220 metro areas with a population of at least 200,000, those that had the greatest numbers of foreclosure starts in February 2022 included: Chicago, IL (1,075 foreclosure starts); New York, NY (793 foreclosure starts); Los Angeles, CA (530 foreclosure starts); Houston, TX (471 foreclosure starts); and Atlanta, GA (415 foreclosure starts).

In this post, we dig even deeper to uncover the complete lists of both the top 10 states and larger metros with the greatest numbers of foreclosure starts, as well as those top 10 U.S. counties that saw the most foreclosure starts in February 2022.

Top 10 States

Rounding out the top 10 states that saw the most foreclosure starts in February 2022, following Ohio included: Georgia (724 foreclosure starts); Michigan (645 foreclosure starts); New York (628 foreclosure starts); Indiana (606 foreclosure starts); and New Jersey (577 foreclosure starts).

Top 10 Metros

Rounding out the top 10 metro areas with a population of at least 200,000, those that saw the most foreclosure starts in February 2022, following Atlanta, GA, included: Miami, FL (400 foreclosure starts); Detroit, MI (394 foreclosure starts); Philadelphia, PA (375 foreclosure starts); Riverside, CA (367 foreclosure starts); and Dallas, TX (360 foreclosure starts).

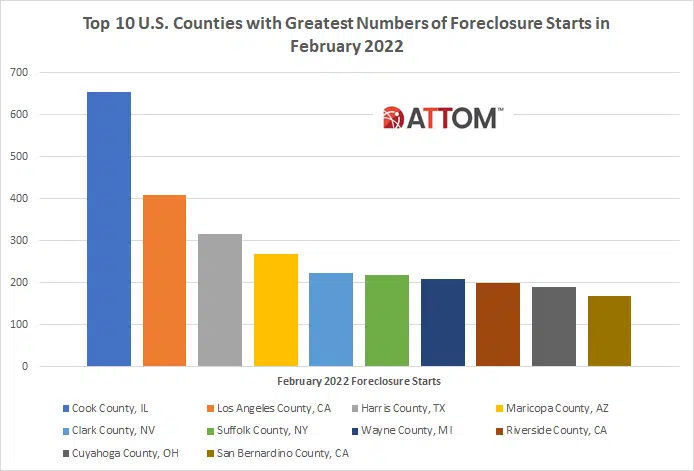

Top 10 Counties

Those the top 10 U.S. counties leading the nation with the most foreclosure starts in February 2022, included: Cook County, IL (653 foreclosure starts); Los Angeles County, CA (408 foreclosure starts); Harris County, TX (317 foreclosure starts); Maricopa County, AZ (268 foreclosure starts); Clark County, NV (224 foreclosure starts); Suffolk County, NY (219 foreclosure starts); Wayne County, MI (208 foreclosure starts); Riverside County, CA (199 foreclosure starts); Cuyahoga County, OH (190 foreclosure starts); and San Bernardino County, CA (168 foreclosure starts).

ATTOM’s latest foreclosure market analysis also reported that lenders repossessed 2,634 U.S. properties through completed foreclosures (REOs) in February 2022. That figure was down 45 percent from January 2022 but up 70 percent from February 2021.

The report noted that among states that had at least 100 or more REOs, those that saw the greatest monthly decreases in completed foreclosures in February 2022 included: Michigan (down 81 percent); Texas (down 58 percent); California (down 52 percent); Florida (down 43 percent); and New Jersey (down 27 percent).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.