Global tourism receipts were well below the pre-pandemic level in 2021 as travel restrictions and uncertainty persisted, and changing consumer behavior dented economic recovery. But now, in the spring of 2022, some two years since COVID-19 forced governments to impose lockdowns and severe travel restrictions, there are plenty of signs of optimism for the future of tourism. This is true even with potential macroeconomic and geopolitical headwinds.

STR has evaluated consumer views and behaviors throughout the pandemic, and our latest survey, conducted in February 2022, canvassed opinion from a global audience to gauge sentiment and the outlook on travel.

Omicron hangover is there, but the future is bright

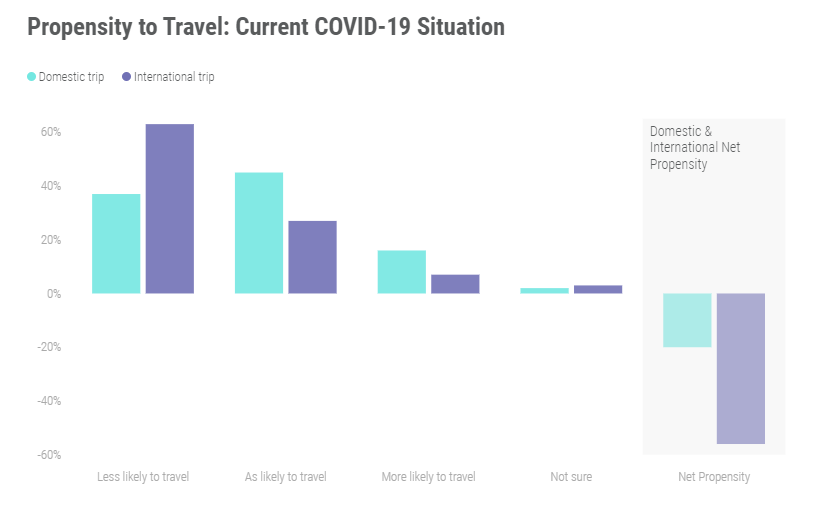

High COVID case rates and consumer wariness are two key factors which have likely influenced negative sentiment for travel in the short-term as net propensity remained in negative territory in our last survey.

Echoing a trend seen throughout the pandemic, international travel was again much less appealing than domestic travel with a backdrop of uncertainty and caution.

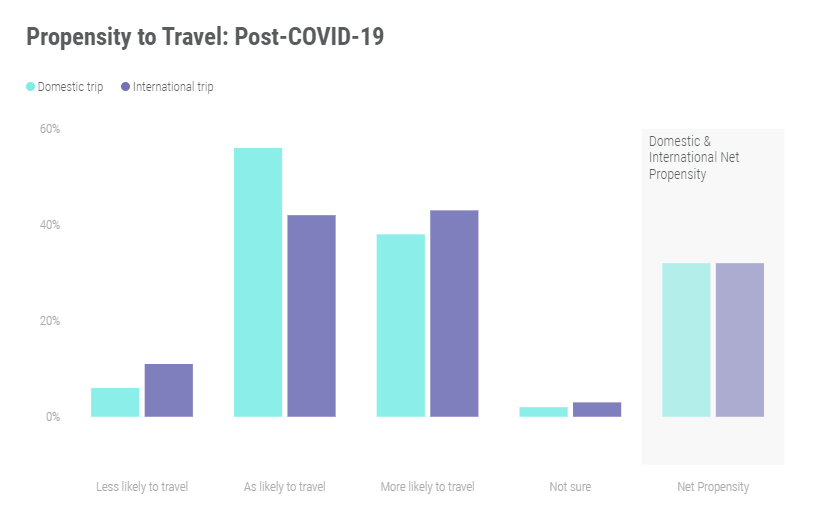

Meanwhile, the response to a post-pandemic travel outlook was markedly different. Net propensity to travel was +32% for domestic and international travel, which was an improvement from July and November 2021 findings. This demonstrates optimism for the industry and underscores a strong consumer appetite to travel in the future. Furthermore, parity in the views regarding domestic and international tourism signaled a boost for international travel as those trips have generally been considered less appealing than domestic travel during COVID-19—even when the pandemic is over.

The fate of travel could be in the hands of governments

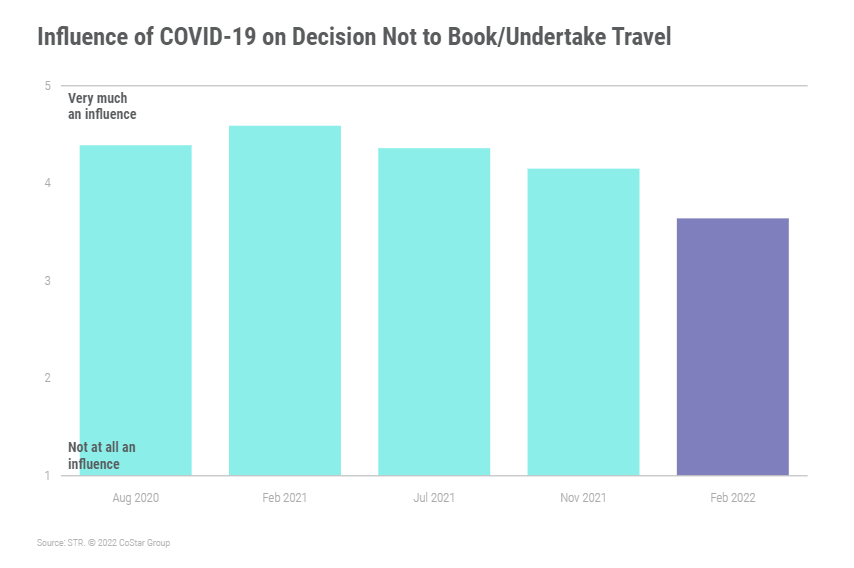

COVID-19 as a barrier to travel continued to decline in significance although consumers overall maintain a cautious attitude toward the virus.

Among those who had not booked or undertaken travel recently, 42% said that COVID-19 was a major reason for not doing so compared with 56% in November 2021 and 67% in July 2021.

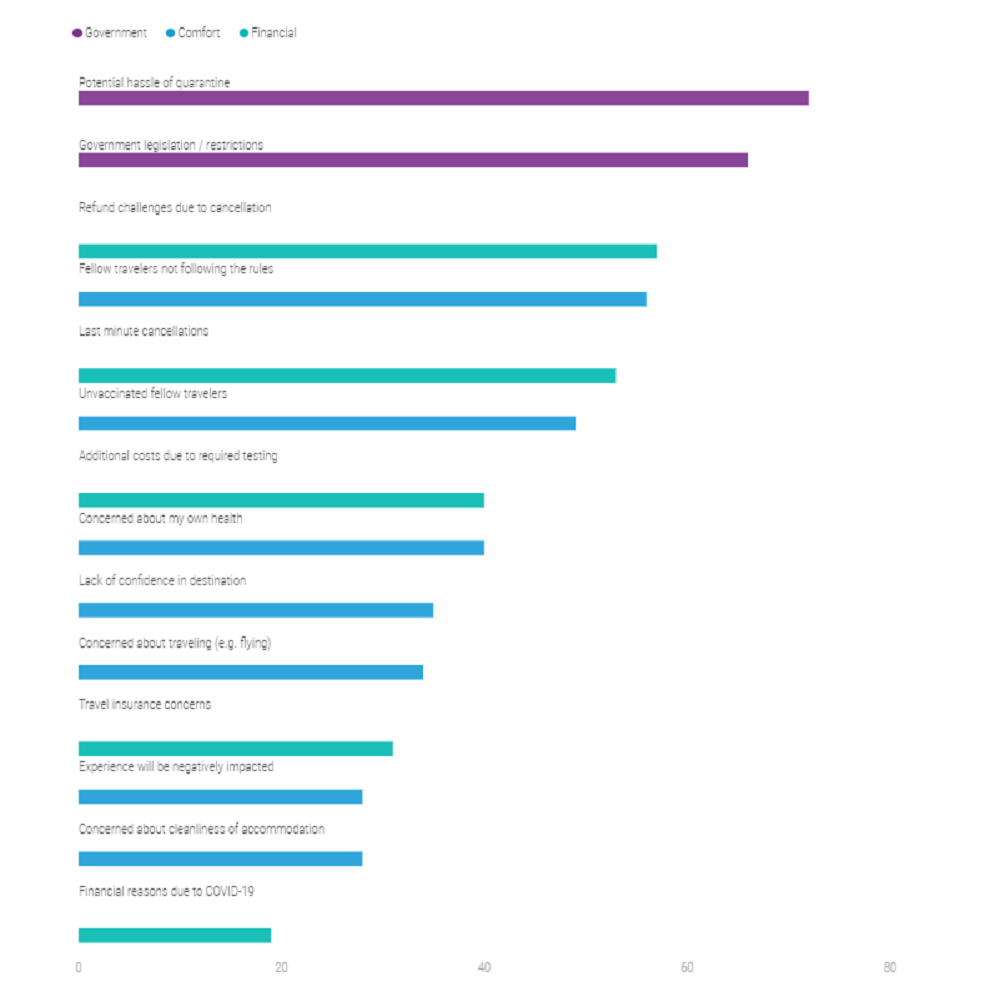

The sense that concerns about the virus are diminishing was echoed when consumers were asked to consider potential COVID-19 barriers to travel in the next 12 months. Comfort barriers, which include concerns regarding infection, and financial barriers, were of a lesser significance than government barriers. These findings suggest that the decisions of governments may pose the greatest risk to tourism recovery and not the views and behaviors of consumers.

City breaks gaining popularity

Assessing attitudes on city breaks could be one approach to monitor tourism recovery. Prior to the pandemic, it was estimated that almost half of all international tourists each year visited urban destinations. However, the pandemic has led to an aversion toward these destinations as consumers have sought increased space and minimized their interactions with others.

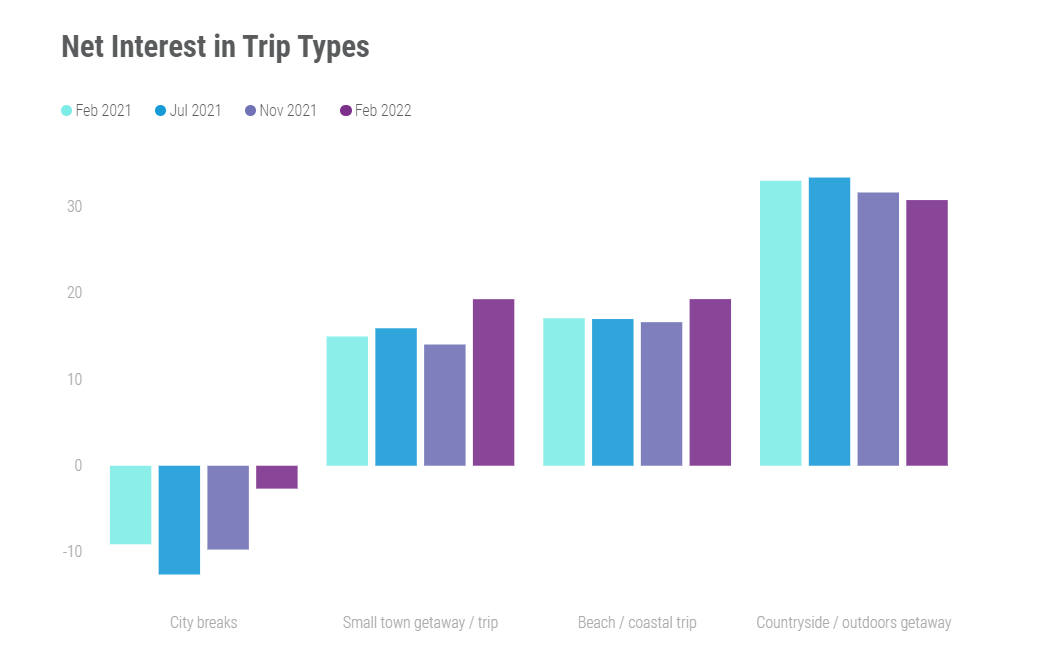

Now there are signs now that urban destinations are gaining in popularity, although these destinations continue to be less appealing overall than those with natural landscapes. Net interest in city breaks was -3%, while other urban locations came in at +19%. These responses in February 2022 were significant improvements from November 2021 results. Improving hotel performance data, in the U.S. for example, also aligns with improvement in the major metro areas as well.

Biophilia is a well-documented trend of the pandemic as consumers have wanted to interact more with nature and the outdoors. Data shows that interest in these types of trips may have peaked with net interest at +31% in February 2022 versus +32% and +33% in November and July 2021, respectively.

Increasing importance of other global factors

The emergence of the Omicron variant slowed recovery in Q4 2021 and Q1 2022 as restrictions were reimposed in some countries and higher infection rates invariably led to an increase in travel cancellations and uncertainty. However, by the end of Q1 2022, COVID-19 restrictions have largely been relaxed globally. This marked a significant shift in government response to the virus and hints that we’ve entered a new phase of the pandemic with increased tolerance of COVID-19. It remains to be seen though how other global factors, such as the squeeze on household income and the war in Ukraine, will influence consumer behavior and, ultimately, the recovery path for tourism in the coming weeks and months.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.