In this Placer Bytes, we dive into the recent performances of RBI, Bloomin’ Brands, and Yum! Brands – three companies operating some of the biggest dining concepts in the United States.

Restaurant Brands International (RBI) – Compared to Previous Year

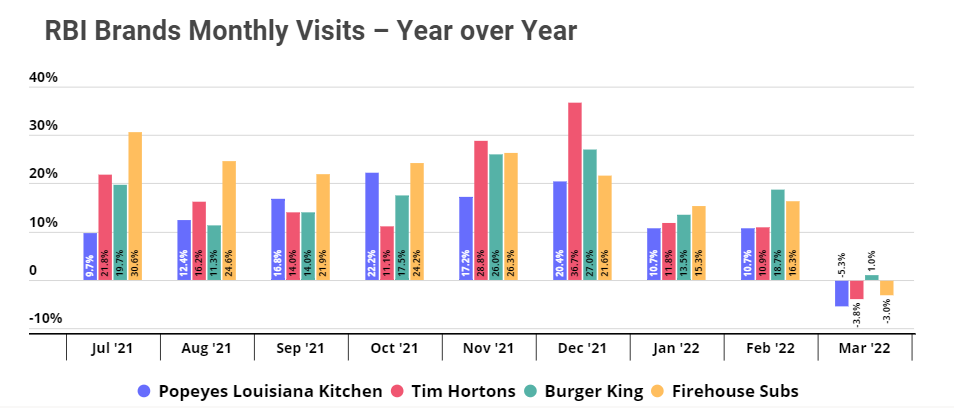

Following a difficult 2020 for in-location visits, many restaurant concepts – including Popeyes, Tim Hortons, Burger King, and Firehouse Subs – saw their foot traffic increase in 2021. Between July ‘21 and February ‘22, monthly visits for all four RBI brands analyzed were up by double digits compared to the equivalent month in the previous year. But inflation and rising gas prices put a dent in the YoY recovery; Popeyes, Tim Hortons, and Firehouse visits dipped below 2021 levels in March ‘22.

Only Burger King maintained its YoY lead, with a 1.0% increase in foot traffic compared to March ‘21. The relative success of the home of the Whopper is likely the result of the brand’s concerted efforts. In addition to optimizing its store fleet by shutting down underperforming locations, Burger King is also revamping its loyalty program. It now offers free weekly fries for the rest of 2022 for anyone who downloads its app before June 20th – which may have been enough to push YoY March visits into growth.

Restaurant Brands International (RBI) – Compared to 2019

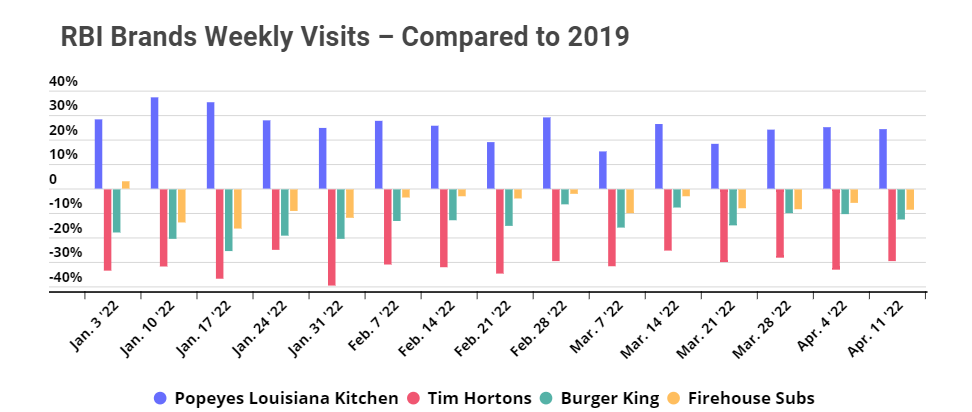

While looking at visits on a YoY basis tells a story of strong recovery followed by a (hopefully temporary) March drop, diving into foot traffic on a Yo3Y basis shows a slightly grimmer picture. Aside from Popeyes, visits to Tim Hortons, Burger King, and Firehouse Subs have been below 2019 levels all year, with foot traffic the week of April 11th down 29.3%, 12.3%, and 8.3%, respectively, when compared to 2019.

Some of the drop is due to branch closures. Recently, RBI has been consolidating store fleets across some of its brands. And critically, these visit numbers don’t include all drive-thru and digital takeaway orders – a major growth channel for Firehouse Subs and Tim Hortons, and a possible explanation for why both Tim Hortons and Firehouse Subs have recently announced expansion plans despite low offline visit numbers.

As for Popeyes, comparing the two RBI graphs shows a striking difference between Popeyes YoY and Yo3Y foot traffic numbers. And the reason is likely due to the brand’s introduction of its now iconic chicken sandwich in late 2019, which has given the brand a long-term visit boost. Foot traffic to Popeyes has been consistently higher post-chicken sandwich launch than it was before. So the strong Yo3Y visit numbers when comparing Q1 2022 and Q1 2019 (before the chicken sandwich launch) is likely due to the enduring popularity of this menu item.

Bloomin’ Brands

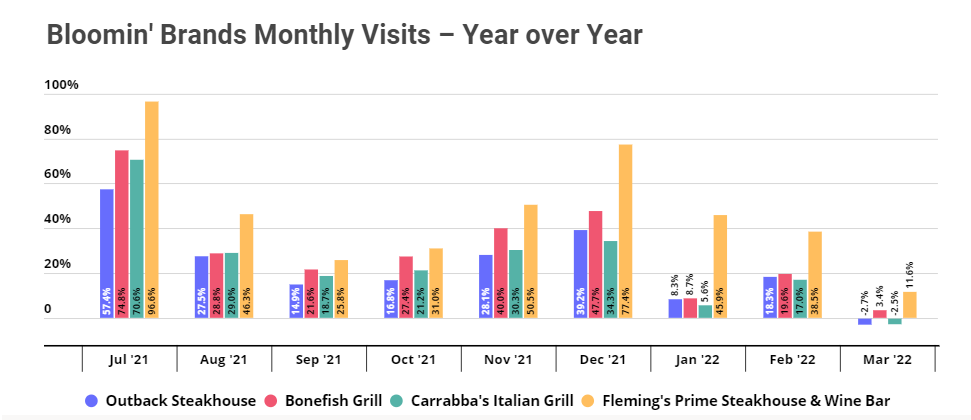

In contrast with RBI’s QSR chains, Bloomin’ Brands operates mostly full-service restaurants. Bloomin’ Brands saw a YoY visit pattern similar to RBI, with strong increases between July ‘21 and February ‘22 followed by a drop in March. But the YoY increase in visits in Q3 and Q4 2021 was much more significant for Bloomin’ Brands than for RBI. This likely reflects the harder hit taken by full-service concepts in 2020 along with the pent-up demand that benefited many full-service restaurants as the country began opening back up.

Bloomin’ Brands – Compared to 2019

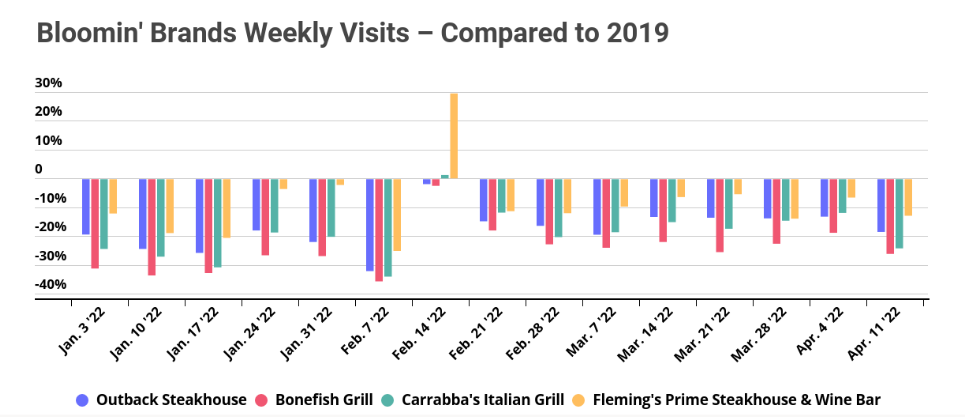

Despite the success of other steakhouse concepts in the first couple months of the year, visits to all four Bloomin’ Brands analyzed fell on a Yo3Y basis. Aside from a brief respite over the week of Valentine’s Day, visits to the four chains stayed well below 2019 levels. Visits to Outback, Bonefish, Carrabba’s, and Fleming’s were down 18.3%, 25.9%, 24.0%, and 12.7%, respectively, for the week of April 11th. But the graph below shows that the visit gap was slightly smaller in late February through early April, which may indicate that the resurgence of Omicron in early 2022 played a big part in keeping patrons away. And now that the latest COVID wave has died down, these brands may be slowly progressing towards recovery once more.

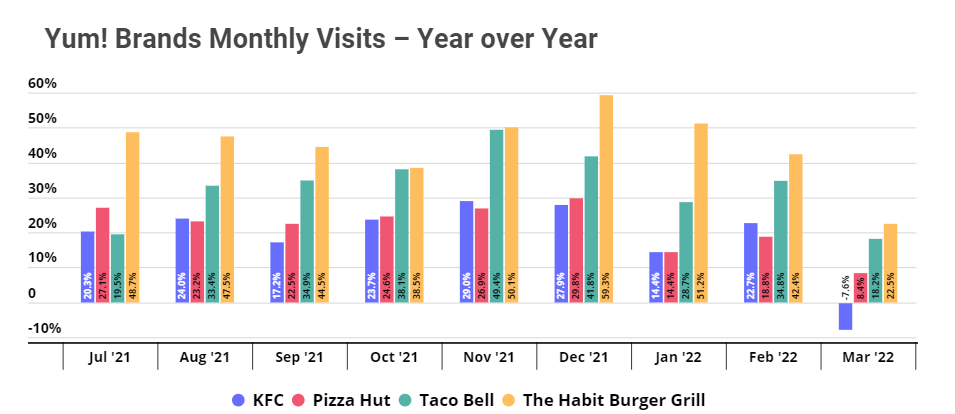

Yum! Brands – Compared to Previous Year

YoY visits Yum! Brands were also high compared to the previous year, with KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill posting a 22.2%, 18.8%, 34.8%, and 42.4% increase in visits in February 2022 compared to February 2021. And unlike for RBI and Bloomin’ Brands, most of the brands continued the growth streak into March, with Pizza Hut, Taco Bell, and The Habit enjoying a 8.4%, 18.2%, and 22.5% increase in visits compared to March 2019.

Yum! Brands – Compared to 2019

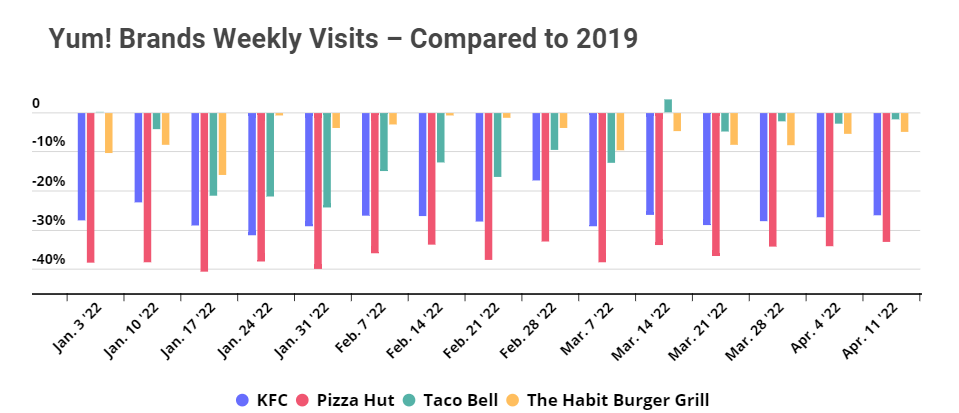

Visits were down for all four Yum! Brands concepts analyzed on a Yo3Y basis, but like for RBI, low offline traffic doesn’t necessarily reflect poor performance. KFC has recently been experimenting with dual drive-thru lanes and a special entrance for online orders, following the brand’s soaring digital sales in 2021. Likewise, Pizza Hut added drive-thru lanes and digital-only pick-up windows (similar to Chipotle’s Chipotlanes) to many of its branches in 2021, and not all these visits are reflected in the offline traffic numbers cited below.

Taco Bell has also accelerated its digital development since the onset of the pandemic. One of the brand’s more recent online innovations is the introduction of $10 monthly taco subscriptions, available for purchase since early January on the Taco Bell app. And as of late February, the taco subscription has become a permanent service. In an era of high prices for everything – including food – the ability to get lunch every day for $10/month could explain Taco Bell’s March success.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.