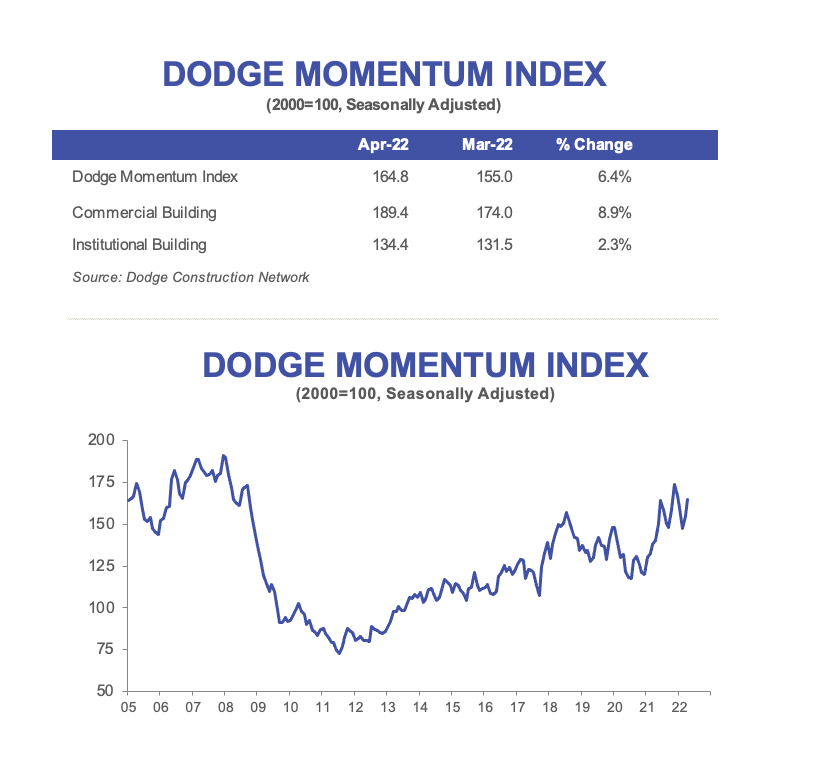

The Dodge Momentum Index (DMI) moved 6% higher in April to 164.8 (2000=100), up from the revised March reading of 155.0. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning shown to lead construction spending for nonresidential buildings by a full year. In April, the commercial component of the Momentum Index rose 9%, while the institutional component moved 2% higher.

With the gain in April, the Dodge Momentum Index was just 5% shy of the all-time high set in the fall of 2021. The main impetus behind this trend is the commercial sector, which has been driven by a growing number of data center, warehouse and hotel projects entering the planning queue. The institutional component has made moderate improvements as well, as more education, healthcare and recreation projects begin the planning process. On a year-over-year basis, the Momentum Index was 17% higher than in April 2021. The commercial component was 15% higher, while the institutional component was 22% higher than a year ago.

A total of 25 projects with a value of $100 million or more entered planning in April. The leading commercial projects were the $208 million Colo 1 data center in Ashburn, VA, and the $150 million QTS data center in Fort Worth, TX. The leading institutional projects were the $300 million Banner Hospital in Buckeye, AZ, and the $287 million IU Health Saxony Hospital in Fishers, MN.

The planning backlog for nonresidential building projects continues to fill, which should provide optimism that construction activity should remain solid in the months to come. However, rising interest rates and the continued increase in material prices will moderate any rising trend throught the remainder of 2022.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.