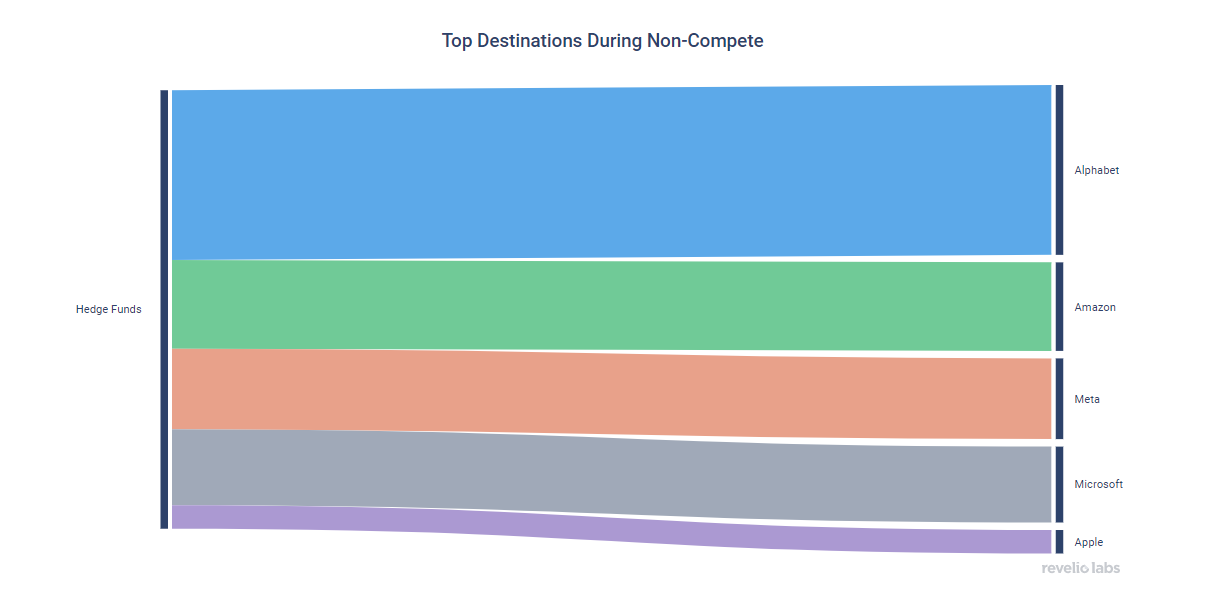

In our recent collaboration with Business Insider, we studied talent flows from quant hedge funds and prop trading firms to the tech industry. This week we focus on who exactly is hiring this technical talent during the hefty non-compete period.

While rival funds and trading firms are frequent destinations, Alphabet, Amazon, Facebook, and Microsoft are still the most common destinations for engineers, data scientists, and researchers.

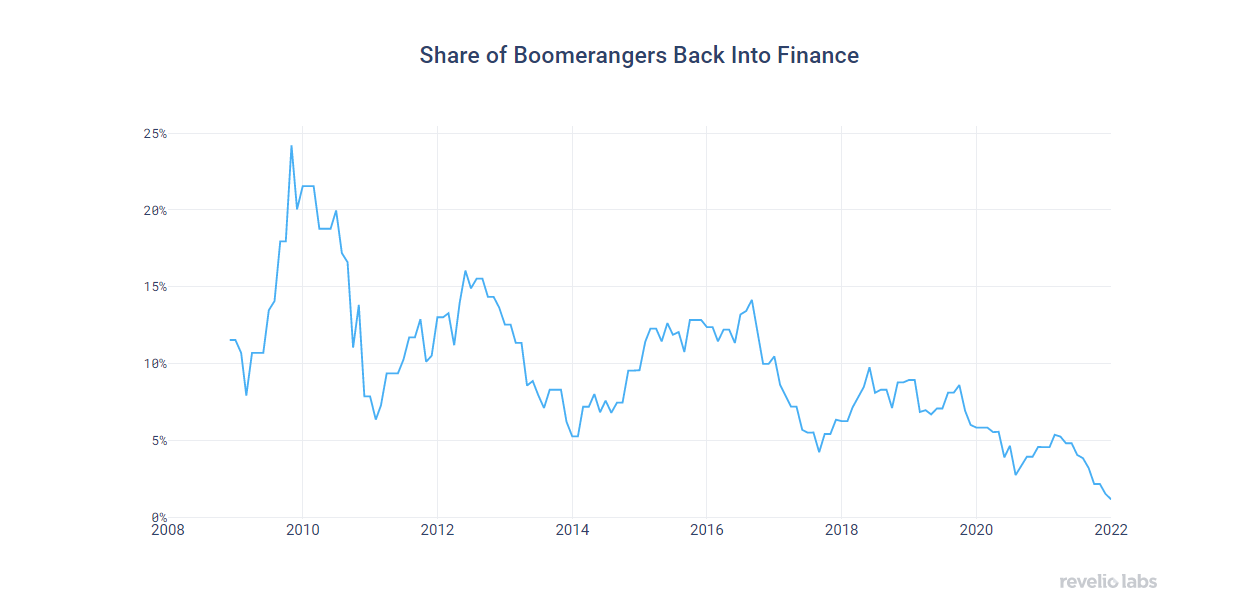

But is this talent flow from hedge funds to tech permanent, or is there a boomerang effect as well? Interestingly, there does appear to be a boomerang effect, but it has been declining over the last decade.

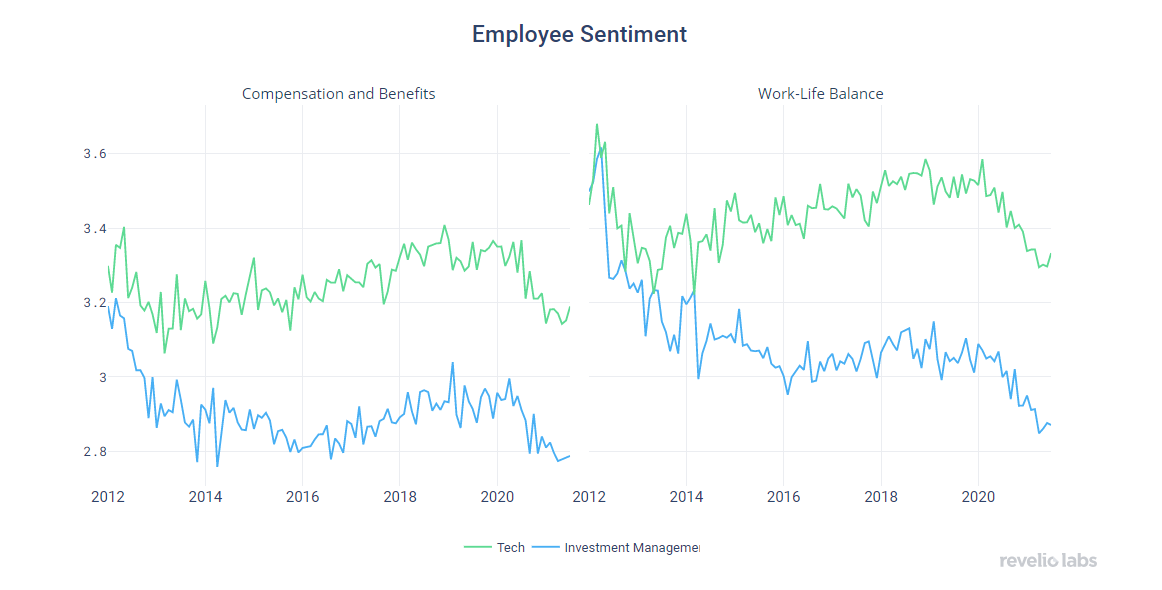

We can explore what is driving this decreasing boomerang rate by comparing employee sentiment in Investment Management and Technology industries. Based on these reviews, we see a widening gap between employee sentiments between Tech and Investment Banking over time, both in Compensation & Benefits, and Work-Life Balance.

Finance has lost its edge in compensation over tech, and it is no secret that work-life balance in tech dominates that in finance - so no wonder employees are increasingly choosing to stay in tech after leaving finance.

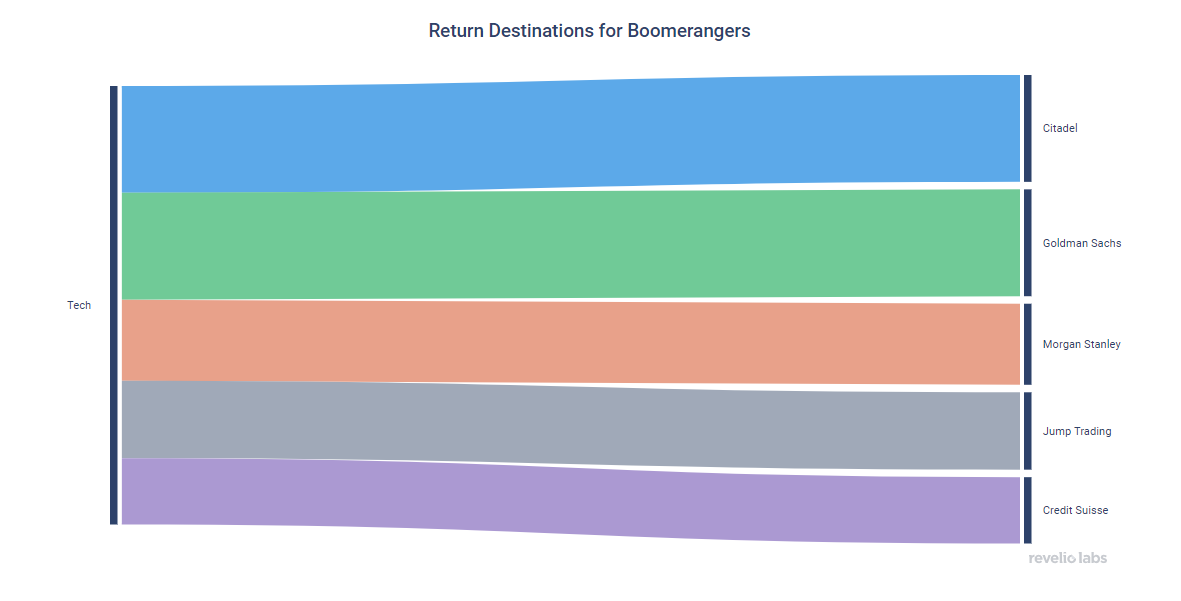

Finally, focusing on those who come back into the financial industry, top destinations are Citadel, Goldman Sachs, and Morgan Stanley.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.