A couple of years—and variants—later, the world appears to be going back to normal and people are understandably excited about the ability to travel.

On June 1, 2022, 1.9mm people went through TSA, which is in line with pre-pandemic numbers.

Travelers aren’t the only ones excited, though.

Advertisers in the travel industry, including U.S Tourism, Rental Car, Lodging and Airlines, are looking forward to clawing back some of the $2 trillion in lost revenue last year.

We dove into our data to look at how these advertisers are heating up as we approach the historically busy summer travel season and what the insights can potentially tell us about their future advertising strategies.

Most Travel Advertisers Are Back

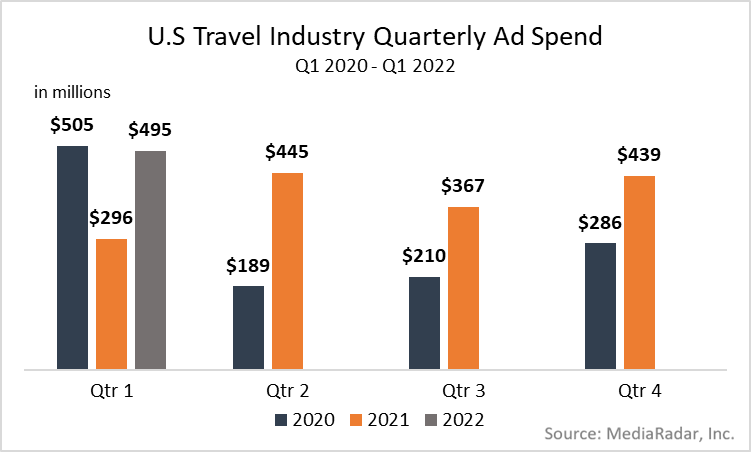

Through April of this year, travel advertisers have spent nearly $623mm, representing a 43% YoY increase from the same period in 2021 and 98% of what they spent in Q1 2020.

Those numbers alone are leading indicators that travel advertisers are back, but what’s even more telling is that the increased spending came despite COVID-19 cases skyrocketing during January and February.

While advertisers are at the whim of mandates, and the circumstances that influence their spending are mostly out of their control, their perseverance during Q1’s surge should be all the proof you need that travel advertisers are back—at least most of them.

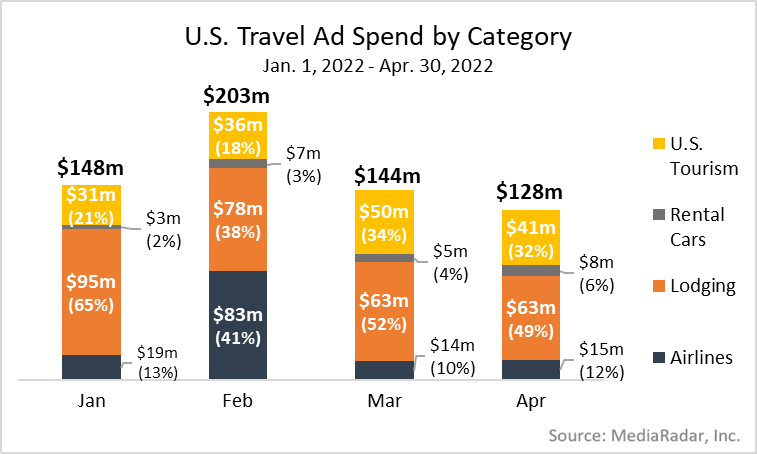

Despite the travel rush, ads from airlines and car rental companies have been largely absent.

For airline advertisers, the lack of spending—although they did spend a lot in February—is likely a result of the existing uncertainties surrounding air travel and the industry’s unstable infrastructure. As the industry solidifies, expect ad spending to increase.

The outlook of their car-rental colleagues isn’t so promising.

With gas prices at record highs and showing no signs of dropping, fewer people will be hitting the road, giving these advertisers no reason to open their wallets.

No Vacancies for Lodging Advertisers

While travel advertisers are collectively cheering, one category is taking it to another level: Lodging.

Although the industry spent nearly $623mm on ads through April, half came from advertisers in the Lodging category.

A layer deeper, 64% of the ads bought by Lodging advertisers came from 6 companies, including Airbnb, Expedia (Vrbo), Hard Rock Entertainment (The Guitar Hotel), Hilton, Marriott, and Unique Travel Corp (Sandals Resorts).

For Airbnb, the spending was undoubtedly an effort to promote a redesign that includes new features—such as a search tool in which users can sort listings into categories, and a new way to split time between two properties.

For Expedia (Vrbo), the ads are one way to keep Airbnb at bay.

But for Hard Rock Entertainment, Hilton, Marriott and Unique Travel Corp, the big bucks are coming at an inflection point for the industry.

The vacation rental market continues to grow—revenue is expected to reach $81b this year and is predicted to grow at an annual rate (CAGR 2022-2026) of 7.29%.

While that pales in comparison to the hotel and resort sector’s market size, which peaked at $1.5t in 2019, there’s no doubt that giants like Hard Rock Entertainment, Hilton, Marriott and Unique Travel Corp recognize the shifting sands.

Their ad spend is proof of that.

Have Traditional Ads Overstayed Their Welcome?

For better or worse, there are times when circumstances outside of our control force us to change.

At first glance, that appears to be happening to how Lodging advertisers look at TV and Print ads.

Through April 2020, TV comprised 46% of their spending while 34% went to Print.

But during the first few months of 2021, TV spending dropped to 27% while Print fell to 14%.

Video ads were the beneficiary, increasing from 3% to 42% of total spending through April 2020 and 2021, respectively.

The decrease in spending on TV and print and the increase in video spending would lead one to believe that these advertisers are modernizing their strategies, but that may not be the case.

Through April of this year, they’re back to where they started. TV accounts for nearly half of the ad buys, making it look like the increase in video spending was just an attempt to take advantage of the increased consumption of video during the pandemic.

Still, this move may be telling.

While this may seem like a regression, if we look at traditional spending so far in 2022, we see that it’s fallen from 80% of total spending through April 2020 to 65% of total spending through April of this year.

The quick decrease in traditional spending could indicate that some of these advertisers experienced success during their brief foray into digital formats.

If that’s the case, expect spending on formats like video, Facebook and display to increase as we move through 2022.

OTT and Native Advertising Check In

Through April 2022, OTT and native ads represented just 2% and 1% of total spending, which begs the question: Why talk about them?

The answer: because the introduction of OTT and native ads could be the start of something new. Advertisers will likely look to take advantage of the popularity of OTT and the ability of native ads to deliver the kind of seamless experiences people are demanding from companies.

For now, these formats represent just a sliver of spending, but as OTT becomes even more popular, OTT platforms improve their ad capabilities and native ads become the norm, especially with the rise of travel media networks, the future for these two formats is bright.

It’s Full Steam Ahead for Most Travel Advertisers

After an unprecedented and unpredictable couple of years, all signs point to travel regaining its place in everyday life.

As people pack their bags and ship out to locations near and far, advertisers will follow suit with campaigns to help them make up for the lost time.

Lodging advertisers are already doing that.

Others, namely those working for airlines and car rental companies, are taking a more reserved approach—either by their own doing or due to forces outside their control.

Still, as the world returns to normal and more people hit the roads, travel advertisers will respond with a mix of old and new tactics aimed at eager travelers.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.