According to ATTOM’s Q1 2022 U.S. Residential Property Mortgage Origination Report, 2.71 million mortgages secured by residential property were originated in Q1 2022 in the U.S. – down 18 percent from Q4 2021, the largest quarterly decrease since 2017, and down 32 percent from Q1 2021, the biggest annual drop since 2014.

The report noted that the decline in residential mortgages, which marked the fourth straight quarterly decrease, resulted from double-digit downturns in purchase and refinance activity – even as home-equity lending rose.

ATTOM’s latest report stated that overall, lenders issued $892.4 billion worth of mortgages in Q1 2022, down quarterly by 17 percent and annually by 27 percent. The report noted that as with the number of loans, the quarterly and annual decreases in the dollar volume of loans were the largest in five and eight years, respectively.

The report also noted that the biggest contributor to the downturn was a decrease in refinance deals, with just 1.45 million residential loans rolled over into new mortgages in Q1 2022. That number was down 22 percent from Q4 2021 and 46 percent from Q1 2021 – the fourth straight quarter of declines – while the annual drop was the largest since 2014. Also according to the report, the dollar volume of refinance loans was down 20 percent from Q4 2021 and 42 percent from Q1 2021, to $470.7 billion.

ATTOM’s latest mortgage origination report mentioned that purchase-loan activity shrank in Q1 2022 as lenders issued 1.01 million mortgages to buyers, down 18 percent quarterly and 12 percent annually. The report also mentioned that the dollar value of loans taken out to buy residential properties dipped to $371.3 billion, down 16 percent from Q4 2021 and 1 percent from Q1 2021.

Also according to the report, in the one category bucking the trend, home-equity lending went up 6 percent quarterly and 28 percent annually, to 249,900. The report noted that HELOC mortgages were up 6 percent from Q4 2021 and 27.6 percent from Q1 2021. ATTOM’s latest report found that HELOC activity increased for the third time in four quarters after decreasing in each of the prior six quarters. The report showed that the $50.4 billion Q1 2022 volume of HELOC loans was up 8.2 percent from $46.6 billion in Q4 2021 and 26.3 percent from $39.9 billion in Q1 2021.

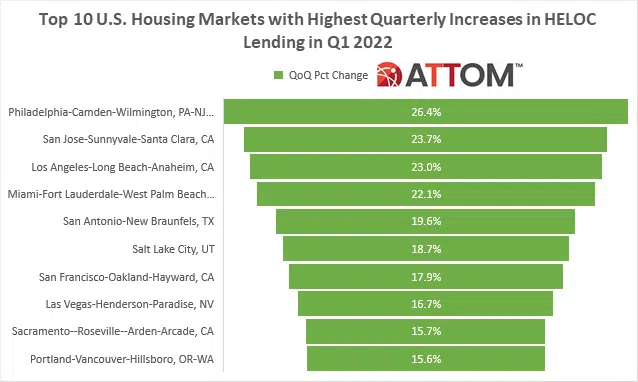

The report noted that HELOC mortgage originations increased from Q4 2021 to Q1 2022 in 62 percent of metros analyzed, with the largest increases, among metro areas with a population of at least 1 million, in Philadelphia, PA (up 26.4 percent); San Jose, CA (up 23.7 percent); Los Angeles, CA (up 23 percent); Miami, FL (up 22.1 percent) and San Antonio, TX (up 19.6 percent).

In this post, we take a deep data dive among U.S. metro areas with a population greater than 1 million, to reveal the complete list of the top 10 metros with the largest quarterly increases in HELOC lending in Q1 2022. Those top metros rounding out that list include: Salt Lake City, UT (up 18.7 percent); San Francisco-Oakland-Hayward, CA (up 17.9 percent); Las Vegas-Henderson-Paradise, NV (up 16.7 percent); Sacramento–Roseville–Arden-Arcade, CA (up 15.7 percent); and Portland-Vancouver-Hillsboro, OR-WA (up 15.6 percent).

ATTOM’s Q1 2022 mortgage origination report also found that the national median down payment on homes purchased with financing again decreased slightly in Q1 2022 – the second straight quarterly drop-off – while the typical amount borrowed rose for the fourth quarter in a row, to another new high. At the same time, the ratio of median down payments to home prices also inched downward.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.