The impact of rising inflation and gas prices has reached consumer spending. In May 2022, US retail sales fell by 0.3% relative to April as shoppers thought twice about spending their increasingly tight budget. But while some spending might be down, certain categories are thriving. One of the clear beneficiaries are those companies gaining from consumers “trading down” from higher-priced products and services in favor of cheaper alternatives. To better understand this phenomenon, we looked at year-over-year (YoY) foot traffic patterns for major retail, dining, and hospitality sub-sectors.

Fast Food and QSR vs. Full-Service Restaurants

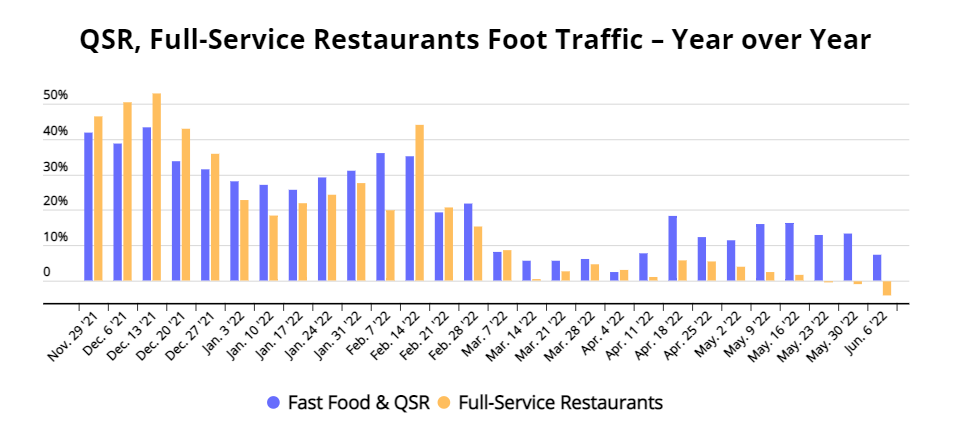

Following the ebb of the COVID Delta wave, YoY foot traffic to full-service restaurants picked up in late 2021, and in late November and December, YoY visits to full-service restaurants outpaced YoY foot traffic to fast food and QSR chains. And while visits to full-service restaurants fell again in January 2022 due to the rise of the Omicron variant, foot traffic to the category had recovered by mid-February 2022, with YoY visits to these locations outpacing fast food and QSR YoY foot traffic for 3 out of 4 weeks from mid-February to mid-March.

But as inflation and gas prices continued to rise, YoY visits to full-service restaurants fell dramatically. Since the week of March 14th, 2022, YoY QSR visits have outperformed equivalent foot traffic to full-service restaurants. For the week of June 6th, fast food foot traffic was up 7.3% whereas visits to full-service restaurants were down 4.0% on a YoY basis.

McDonald’s and Chipotle’s Success

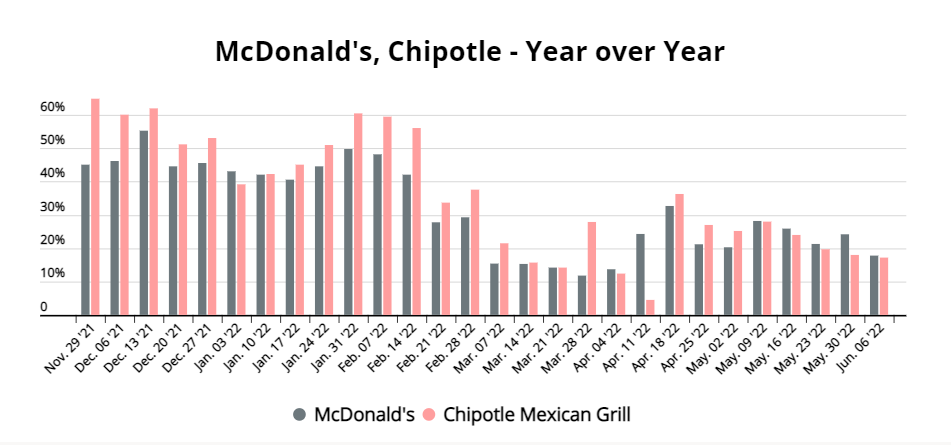

Certain QSR heavyweights, such as McDonald’s and Chipotle, are even outperforming the already high QSR YoY visit average. Visits for the week of June 6th, 2022 were up 17.8% for McDonald’s and 17.2% for Chipotle relative to the equivalent week in 2021, even though both Chipotle and McDonald’s have raised their prices in recent months to offset the increased cost of goods. It seems, then, that consumers are still looking to dine out – they just want a restaurant experience that is better suited to their new inflation-stretched budget.

Grocery and Superstores

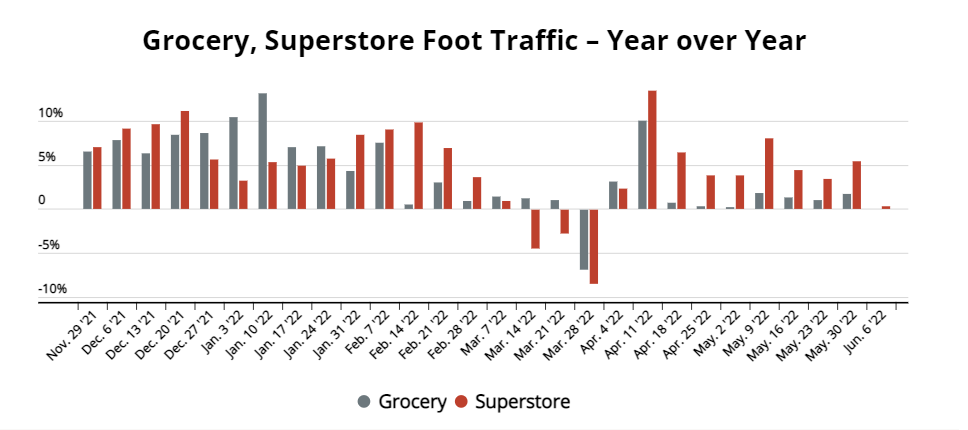

For much of 2021, YoY visits to the grocery sector were growing faster than those to superstores. And throughout late 2021 and early 2022, YoY visits to grocery stores and superstores were neck and neck. Some weeks, superstores pulled ahead of grocery, and in others, grocery outperformed superstores.

Since the week of April 11th, however, YoY superstore foot traffic has consistently outpaced grocery visit increases by a wide margin. The week of May 30th, 2022, superstore visits were up 5.4% and grocery visits were up 1.7% compared to the equivalent week in 2021. Those looking to save money on their routine shopping may be drawn to superstores for the lower prices and their one-stop-shop nature which helps customers consolidate their shopping and save on gas.

Grocery Still Growing

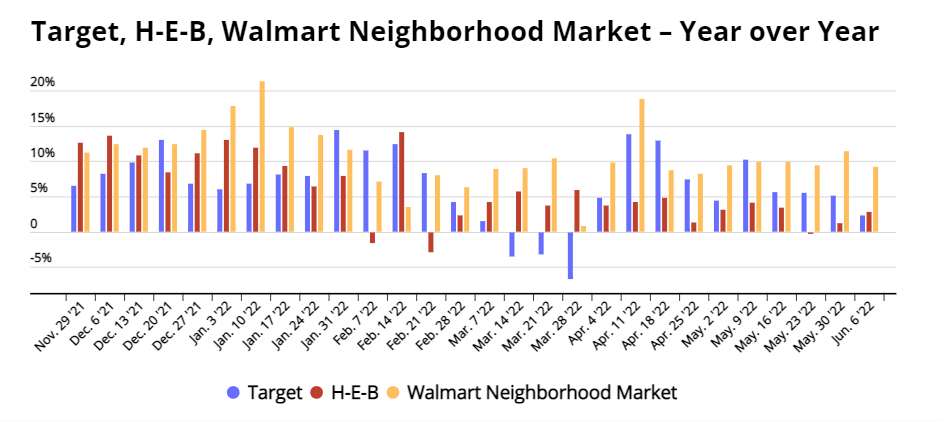

Of course, some grocery brands – specifically chains known for their emphasis on low prices – are still seeing an increase in visits. And the grocery category as a whole is still seeing positive YoY visit trends despite the overall retail downturn, which indicates that this space is still benefiting from grocery’s value orientation.

The grocery sector may also be seeing an increase in consumers trading down restaurant outings in favor of gourmet home-cooked meals. This could explain the success of certain value-focused grocers, such as H-E-B and Walmart Neighborhood Market that saw a 2.8% and 9.2% increase in YoY weekly visits, respectively, for the week of June 6th, 2022.

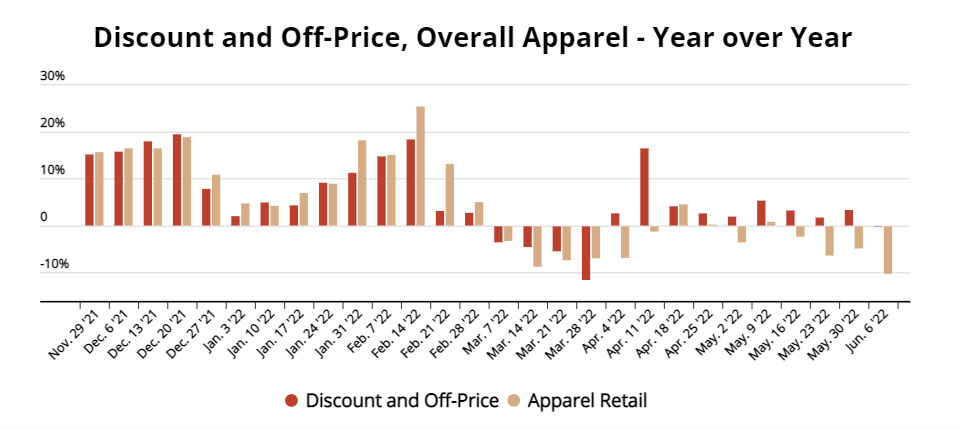

Discount and Off price vs. Overall Apparel

Apparel consumers are also showing clear signs of trading down. From December 2021 to Mid-February 2022, foot traffic to the off-price category more or less followed the same visitation patterns as foot traffic to the wider apparel sector, with overall YoY apparel visits slightly outpacing YoY off-price foot traffic growth. And in March 2022, as the shock of inflation first set in, visits to both apparel categories dropped. But, since the week of April 4th, 2022, visits to off-price retailers have exceeded visits during the equivalent week in 2021 while YoY overall apparel visits have remained down.

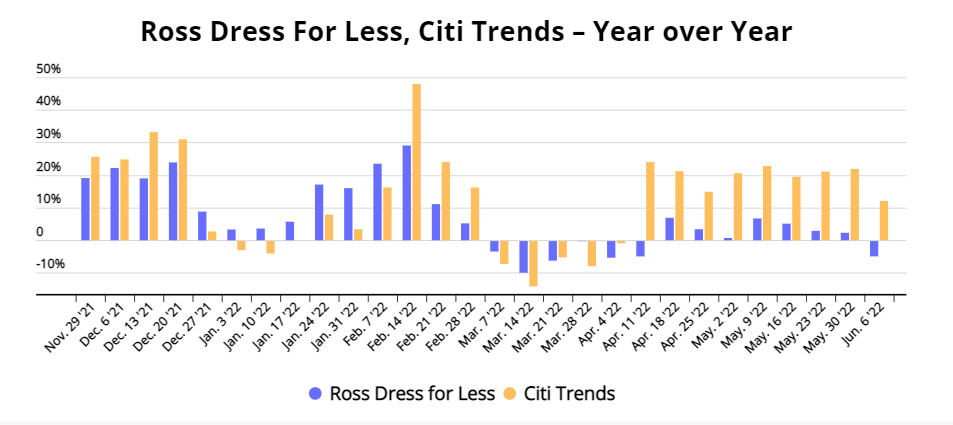

Apparel Consumers Trading Down

Off-price apparel performed particularly well in 2021 – and the category is still seeing visit growth, while YoY overall apparel visits are declining. Some brands, such as Citi Trends, have seen its YoY weekly visits increase by double-digits in recent weeks. And although consumers are reigning in their non-essential spending, Ross Dress for Less also saw YoY visit increases almost every week of April and May, with Ross YoY foot traffic up 2.9% for the week of May 23 2022. When it comes to apparel, the data also indicates that consumers are trading down in the face of the ongoing economic uncertainty as these players significantly outperform the wider apparel space.

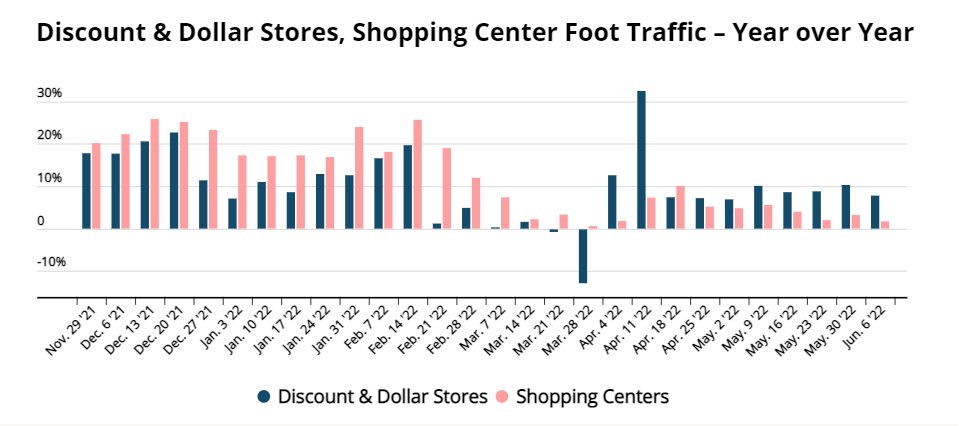

Discount and Dollar Stores vs. Shopping Centers

Many consumers regularly visit dollar and discount stores to buy basic consumables for cheap. But some visit discount retailers to purchase products available at any local shopping center such as party supplies, toys, and even apparel – so comparing YoY visits to dollar stores and shopping centers can provide some insights into consumers’ trading down spending behavior.

(Note that shopping center foot traffic represents visits to thousands of shopping centers throughout the United States, and should not be confused with the Placer.ai Mall Index, which only tracks visits to large, leading malls.)

In late 2021 and early 2022, the shopping center COVID recovery looked like it was pulling ahead of YoY visits to discount and dollar stores. Some of the shopping centers’ relative YoY strength was due to the category’s particularly low visit numbers in 2020 and early 2021, in contrast with dollar and discount stores that had essentially recovered already in late 2020.

But shopping centers’ YoY visit increases at the end of 2021 and beginning of this year also reflected consumers’ reinvigorated interest in visiting malls once the lockdowns and movement restrictions were lifted. In recent months, however, YoY visits to dollar and discount stores have overtaken YoY shopping center foot traffic – which could indicate that consumers are favoring dollar stores over shopping centers as a venue for budget-friendly browsing and product discovery.

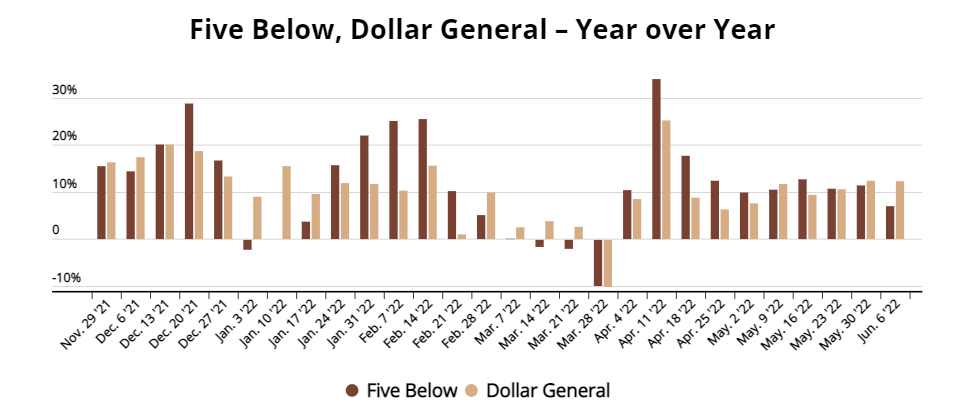

Dollar Stores’ Grocery Offerings Boost the Category

Dollar stores may also be encroaching on some of superstores’ and grocery’s visit share. During the recession of 2008 and 2009, many dollar stores expanded and increased their foodstuff selection in response to the increased demand. Now, as visits to the category continue to grow, some dollar stores are diversifying their grocery offerings even further and adding fresh fruits and vegetables.

Five Below and Dollar General are two of the discount and dollar stores that have seen impressive growth in recent weeks, with YoY visits for the week of June 6th, 2022 up by 7.0% and 12.3%, respectively. This performance is particularly noteworthy given that this time last year, visits to both brands were already up by double-digits relative to pre-pandemic. Should dollar stores continue to invest in building out their grocery division, foot traffic may rise even further.

Consumers Looking for Cheaper Alternatives to Their Regular Shopping

The data from the grocery, dining, apparel, dollar stores, and shopping center sectors indicates that consumers are “trading down.” As the cost of living increases, consumers are substituting their regular stores and restaurants with lower-priced options in an effort to stretch their new budgets.

The change to consumer behavior may have a long-term impact on the retail space. After all, one of the catalysts for dollar stores’ recent growth was the 2008 recession which drove many value-focused customers to visit these stores for the first time. And once the recession lifted, many of these new customers continued shopping at Dollar General, Dollar Tree, and other discount brands. Some of the consumers who now realize that they can get similar items at superstores or off-price retailers may think twice about visiting grocery stores or department stores once the economic outlook brightens.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.