A volatile economic environment has caused large swings in performance for many companies, making it more important than ever to understand the macroeconomic trends affecting all merchants. In today’s Insight Flash, we highlight several analyses that are part of Consumer Edge’s unique suite of macro products, looking at y/y growth in total spend, spend cut by demographics, and which industries and subindustries are most impacted by spending trends in a particular demographic.

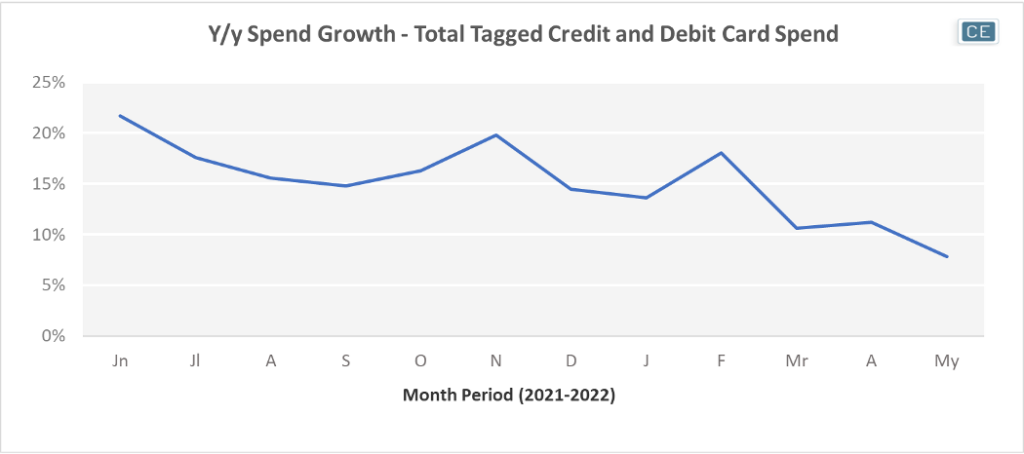

Over the last year, spend growth has slowed substantially on US credit and debit cards. Spend growth tagged to our universe of over 10,000 brands decelerated from 18% in February to 11% in March and April to just 8% in May. Although some of the slowdown may be due to lapping the vaccine rollout last year, rising interest rates and prices are likely also having an impact. Given today is the last day of June, it will be interesting to see if the downward trajectory persists when the full month of data becomes available next Wednesday, well ahead of the US Census Bureau’s Retail Sales report.

Total Panel Spend

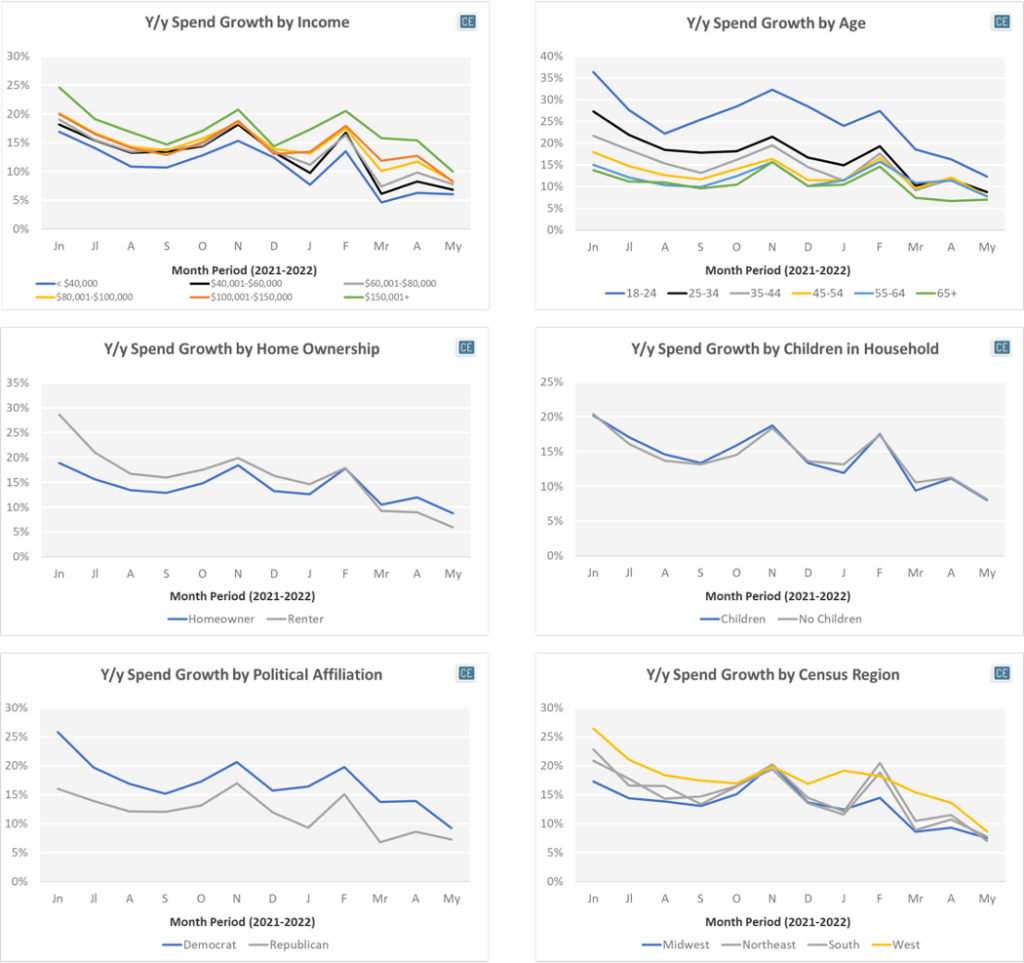

Following spend by demographic group can provide insight into which factors are driving the larger overall trends and a more nuanced view of when they might turn around. Among the nine demographic variables offered by Consumer Edge, different levels of income and varying ages have seen the largest divergences in spend growth. Unsurprisingly, the highest income group making over $150,000 per year has consistently seen the highest spend growth over the last year. However, while April spend growth was 2.5x the rate of the lowest income group making under $40,000 per year, May spend growth was only 1.7x, showing a much faster deceleration. Among different age groups, 18-24 year olds have consistently seen the biggest increases in spend as they enter the workforce. However, spend growth decelerated by -4% from April to May among all three age groups 35-64. Among other demographics, homeowners in May grew spend 3% higher than renters, households with children grew spend at about the same rate as households without children, and Democrats grew spend 2% higher than republicans. Geographically, spend growth was highest on the West Coast and lowest in the Northeast.

Spend by Demographic

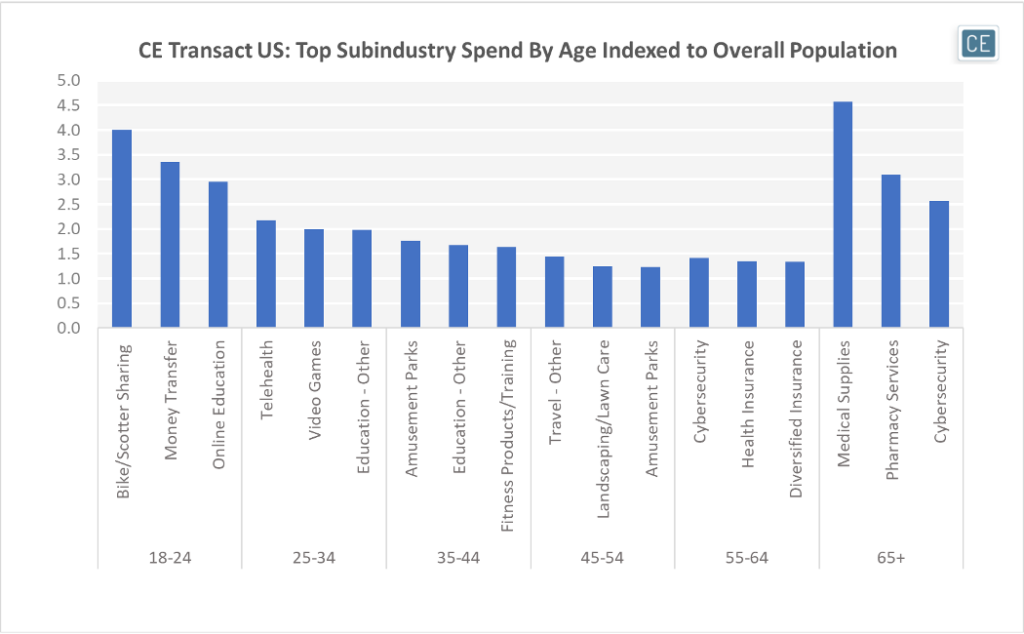

An analysis of which subindustries see the largest percentage of their sales from a demographic group can help explain which companies are likely to be affected by changes in spend for that group. For instance, if 18-24 year olds were to increase spending even more, Bike/Scooter Sharing services would likely benefit the most. However, if 35-44 year olds were to cut back on expenses, Amusement Parks might see the largest decline in overall spend.

Demographic Exposure

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.