June was a difficult month for brick-and-mortar retail visits.

The combination of lingering inflation and high gas prices clearly took a toll. In addition, the comparisons to a stronger period in 2021 and to the beginning of the summer shopping season in 2019 only deepen that perspective. But looking at June numbers without the proper context can create a skewed view that may miss many key takeaways.

So how did June performance really look and what might this mean for the upcoming Back to School shopping season?

Visits Down in June

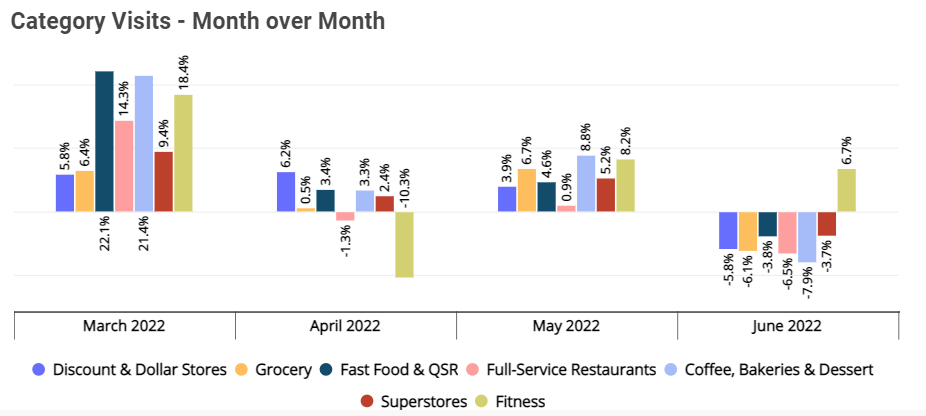

Looking at high-performing segments like grocery, superstores, and dollar stores shows a decline in visits seen between May and June. All the segments – apart from Fitness – saw a drop after seeing consistent month-over-month (MoM) growth since March.

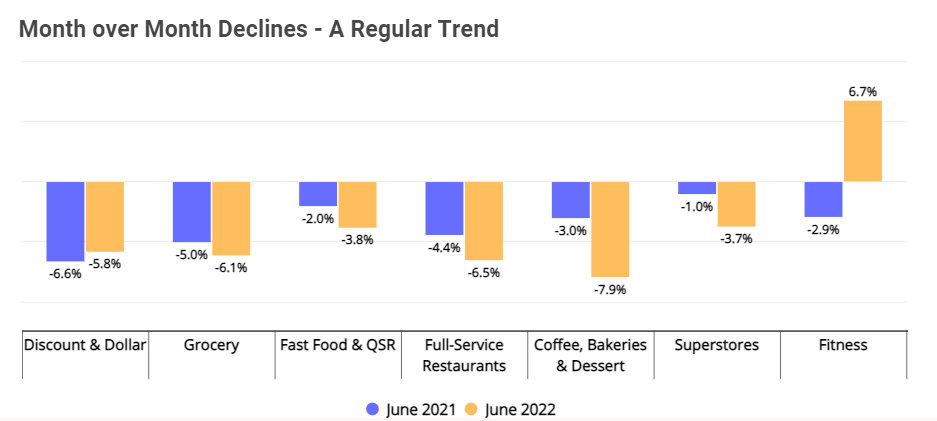

Yet, context is critical. While the impact of wider economic headwinds clearly had a role to play, all of these segments also saw MoM declines between May and June in 2019, as well. While some of these sectors did see larger declines in 2022 than they did between the equivalent periods in 2019, the differences were certainly within an expected range.

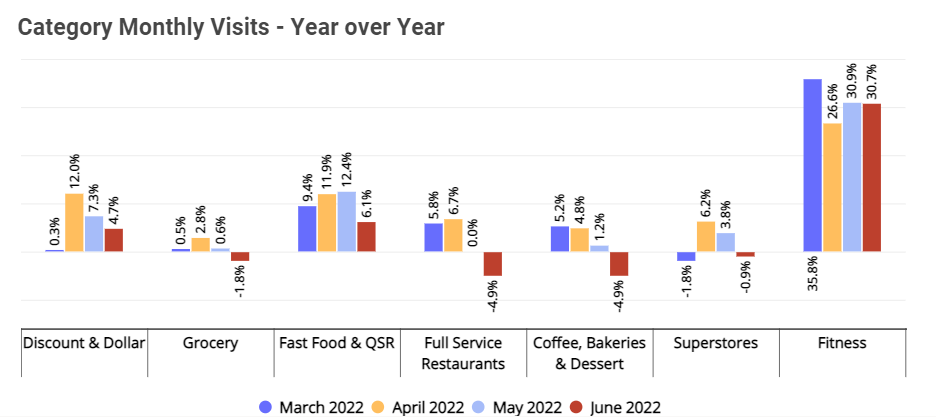

And, looking at a year-over-year (YoY) comparison presents similar takeaways. Whether it be more limited growth than previous months or declines where segments had seen visit increases, comparing June 2022 to the same month in 2021 displayed the challenges facing the sector. Yet, here too, the comparison to June 2021 demands context. While retail was reopened by the spring of 2021, the true recovery really began to hit in June. The result was the beginning of a period that showed unique strength through July and August. So relative performance declines between the spring and June when looking at visits must be understood within that context.

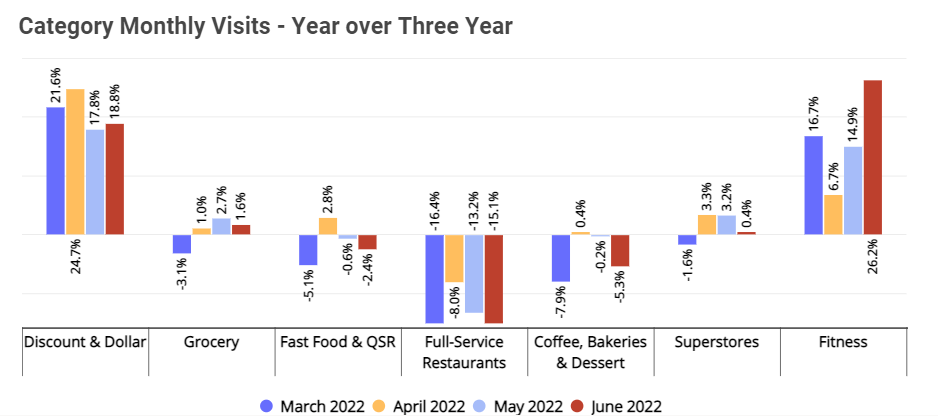

For these reasons, looking at visits compared to 2019 – even with the challenges that expansions in the dollar sector and others present – still offers the most nuanced performance view.. And through this lens we see a far wider range of results.

The grocery and superstore segments maintained their growth compared to 2019, though the traffic increases were more limited than earlier in the year. Full-service restaurants took an expected step back as visits to this sector were uniquely impacted by the current array of challenges, while QSR and coffee-oriented chains saw much more minimal declines. Fitness maintained its unique strength in a post-pandemic environment that has clearly emphasized the segment’s unique offering.

So what does this mean moving forward?

The impact of economic headwinds like inflation and high gas prices cannot be overstated as they affect consumer behavior in a significant way. However, it’s also critical to remember that oftentimes these effects tend to be defined by short-term spikes that quickly normalize. In addition, the summer Back to School season has been a powerful visit driver in recent years, and the combination of increasing costs and travel issues could end up creating an even bigger opportunity in 2022.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.