data.ai’s mobile data reveals that as gas prices rise, Tesla app experiences 100% growth in total sessions

What’s Happening:

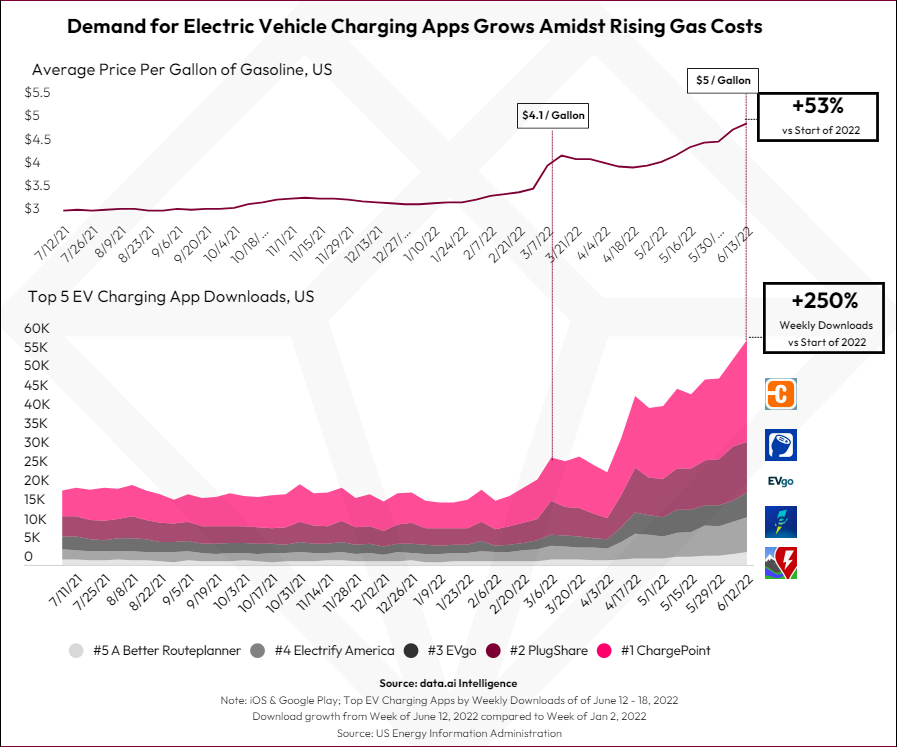

Heading into July, the US national average price of gas has surpassed $5 per gallon. Earlier this summer, we noted that one way consumers are striving to beat back rising gas prices is through the use of apps like GasBuddy, which saw 190% YoY increase in downloads as of June 2022. Now, amidst rising gas prices and concern over the climate crisis, there is a stark increase in demand for electric vehicles, according to data.ai’s mobile data.

As of June 13, 2022 weekly downloads of the top 5 Electric Vehicle Charging apps increased 250% compared to the start of the year. The first spike in downloads happened in conjunction with US gas prices hitting $4 per gallon.

ChargePoint was the #1 ranked Electric Vehicle Charging app in the US year to date (June 18, 2022). The app has seen 1.8 million lifetime downloads in the US. ChargePoint also saw a dramatic rise (+270%) in weekly downloads for the week of June 12- 18, 2022 compared to the week of January 2-8, 2022. Electrify America, saw even faster growth of 315% during the same period, ranking #3 for US downloads year to date. It is clear demand for electric vehicles is growing amidst rising gas prices as consumers flock to mobile for EV charging apps in record numbers.

Why It Matters:

Major automotive brands are prioritizing EV development. In April 2022, Ford released its all-electric Ford-150 Lightning and cited unprecedented demand with 200,000 preorders. Kia and Hyundai released electric models (EV6 and Ioniq 5, respectively) in the US earlier this year, selling 21,467 cars through May combined — surpassing the Mustang Mach-E at 15,718. In June 2022, Honda and Sony announced a collaboration to begin selling EV cars in 2025. In fact, Bloomberg reports EV vehicle sales are expected to triple by 2025.

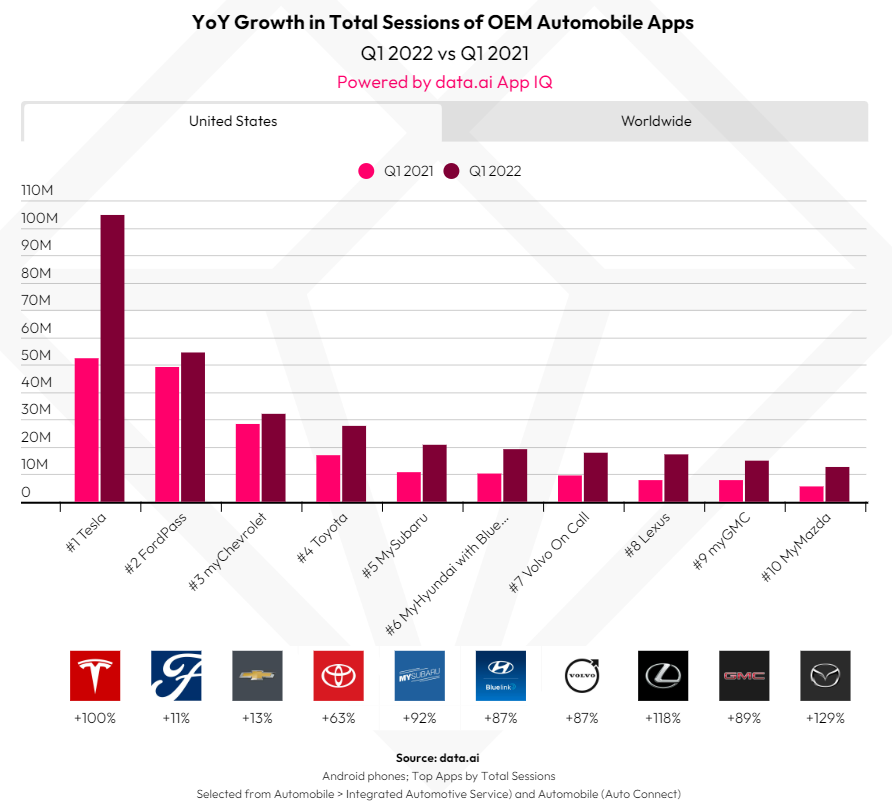

Looking at the top 10 Original Equipment Manufacturer (OEM) Automobile apps in the US, 4 of the mobile apps have elements related to electric vehicles: Tesla (#1), Fordpass (#2), MyHyundai (#6), and Volvo On Call (#7).

Across the top 10 OEM automobile apps, total Sessions increased 60% YoY in the US. Tesla, which exclusively makes EV cars, ranks #5 in the US by downloads but ranks #1 in total sessions, showing drivers are heavily engaged in the mobile experience. The app increased its total sessions by 100% YoY, 1.7x as fast as the market. This means that while other apps are being downloaded more frequently, Tesla drivers are engaging more in the app.

Worldwide, Tesla still ranks #1 in total sessions, by a sizable margin (4.4x the next highest app), but saw less growth globally (+13% YoY) than in the US (+100% YoY). It is also important to note that all 10 OEM Automobile apps saw an increase in usage in both the US and worldwide — an important indicator of consumer demand for connected mobile experiences as a tenet of car ownership.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.