While 2021 was a banner year for the overall housing market, it proved particularly strong for luxury home purchases. Sales of luxury homes — defined as homes priced at or above $2 million — jumped 72% in 2021 compared to the year prior and 116% when compared to 2019.

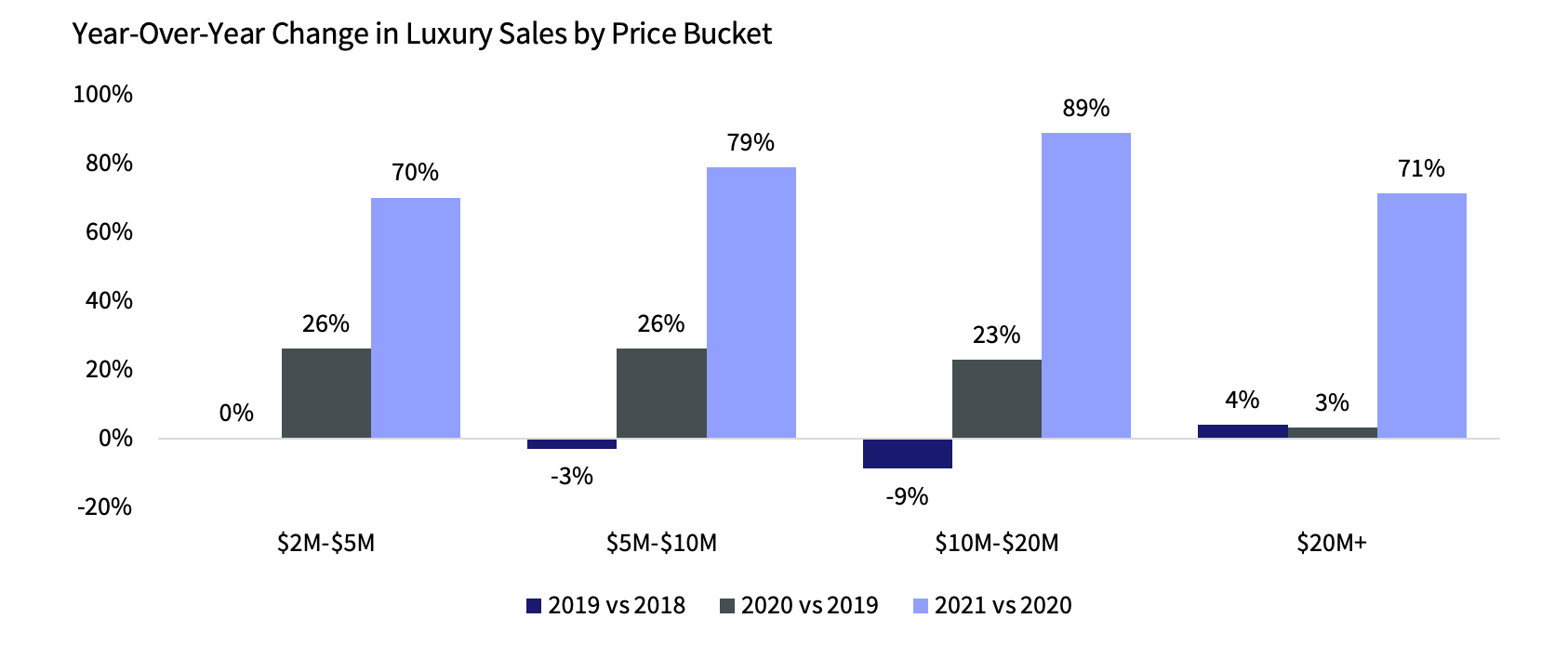

Figure 1: Luxury Home Sales Jump 72% in 2021

Although all price segments within the luxury home market saw a substantial jump, the largest increase occurred for homes priced between $10 and $20 million, a segment which was up 89% in 2021. As a result, the share of luxury sales reached 1% of the overall number of home sales, an increase from the 0.4% average recorded prior to the pandemic.

The surging trend in luxury sales was also seen internationally.

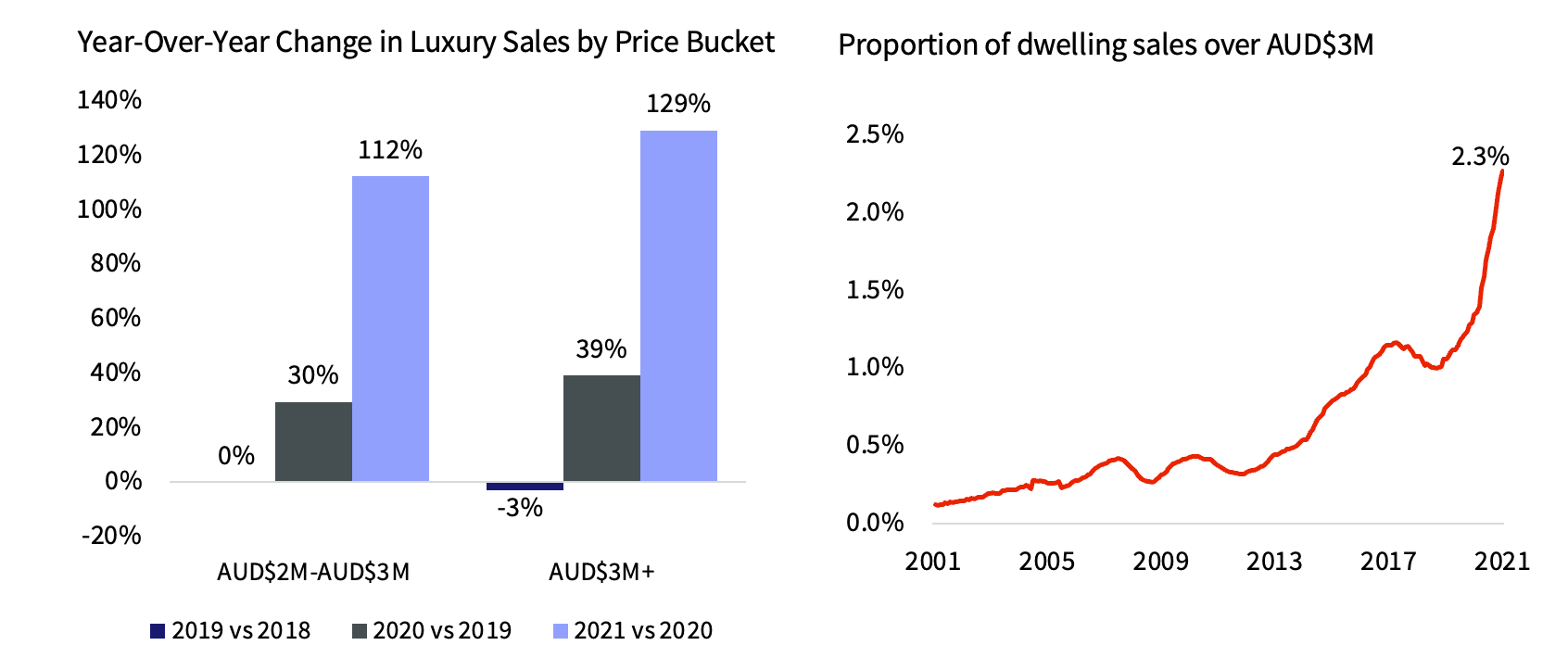

Figure 2: Similar Surge in Luxury Sales in Australia

In Australia, luxury home sales (those over US$2 million) soared 129% in 2021, pushing the share of luxury homes to 2.3% of total sales, up from an average of 1% in the years before the pandemic. Other international markets, including Singapore, Dubai, France and Spain, experienced similar increases in demand for luxury properties.

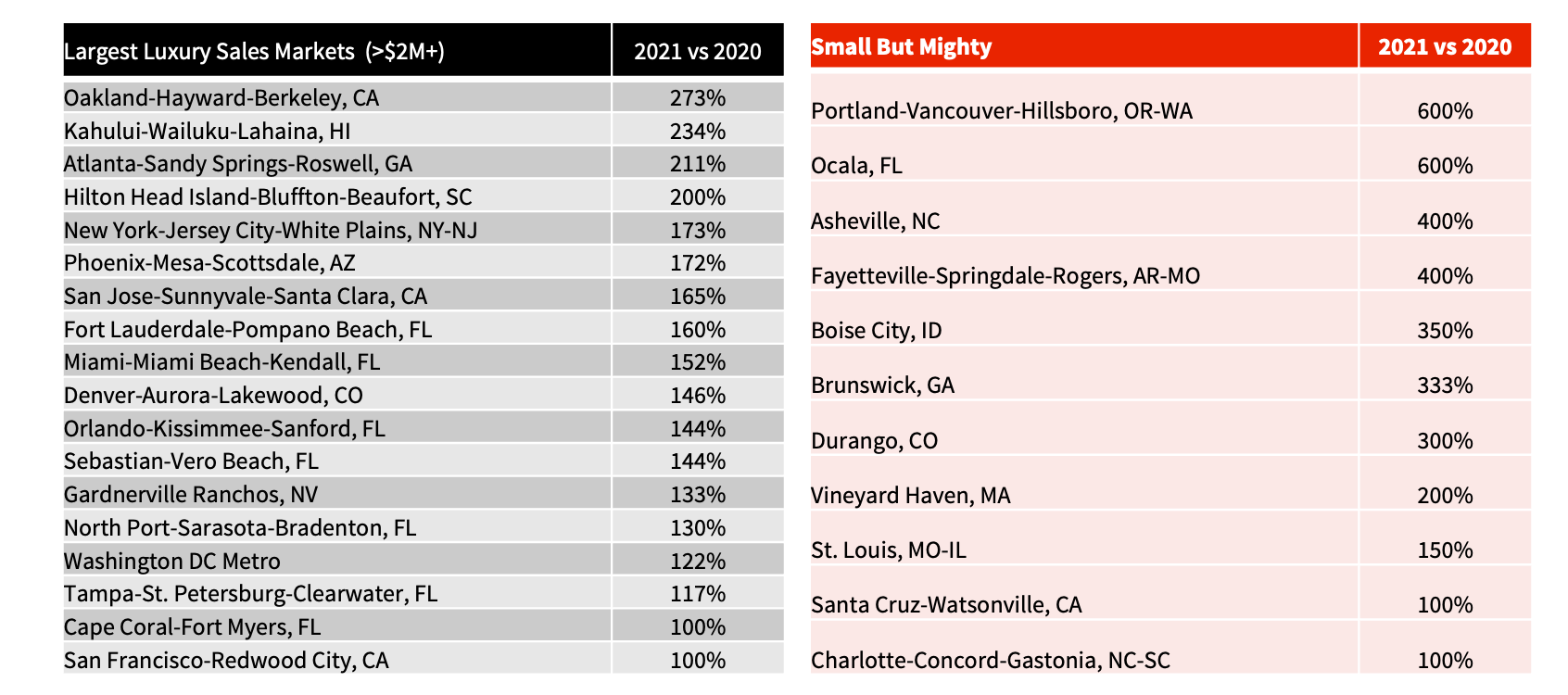

In the U.S., demand for luxury homes reached new markets in addition to those that are traditionally considered high-end, such as California, Florida and New York. While these three states still accounted for 63% of all luxury home purchases in 2021, states such as Colorado, Arizona and North Carolina saw an increasing share of total luxury sales.

In Durango, Colorado, luxury sales were up 300% in 2021. In Asheville, North Carolina, they grew 400%. In Phoenix, sales of luxury homes increased 172%. For properties priced between $10 and $20 million, some of the new markets with the largest increases, albeit from a low base, included the Kahului Metro Area in Hawaii; Austin, Texas; and Gardnerville, Nevada, which encompasses Lake Tahoe. All these areas experienced a 400% increase in ultra-luxury home sales. There are several reasons for this surge in luxury homes in the U.S. and abroad. The rallying stock market, high valuations of cryptocurrencies and escalating real estate prices all allowed affluent individuals to multiply their net worth as well as permit new investors to attain significant net worth milestones. Consequently, the number of individuals in the U.S. with a net worth of $5 million or more increased by 25% in 2021. Globally, this figure increased by 20% and now represents a population of 3.5 million. As a result, luxury home sales, despite facing inventory shortages, will likely see continued robust demand and strong price growth going forward.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.