Prime Day usually takes place in June or July, and gives Amazon and other retailers a chance to entice shoppers with the promise of steep discounts for Back to School and other items in a period traditionally devoid of major sales events. The context for Prime Day 2022, however, was the significant inventory surplus that led many retailers to offer massive discounts before Prime Day even rolled around.

Walmart, a major player in the Prime Day space since 2015, announced that it would not hold a rival event to Prime Day this year since much of its merchandise is already on sale. But other retailers, including Best Buy, Target, and of course Amazon, continued the tradition with a two-day (or in the case of Target, three-day and in case of Best Buy, four-day) sales event. Most Prime Day activity takes place online, but the event also has a significant offline impact as consumers pick up their digital orders in-store or browse the shelves to try out products prior to buying.

Comparisons to Previous Years

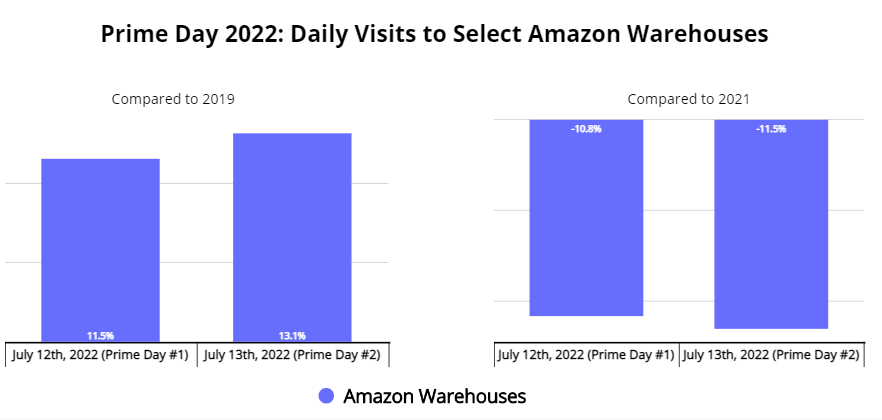

Prime Day has become a major asset for Amazon’s online sales, quickly becoming one of the most important retail holidays on the calendar. And data from 2022’s event indicates that Amazon’s preparedness for Prime Day has grown accordingly, enabling it to better meet this growing demand. Average daily visits to a sample of Amazon warehouses were up 11.5% and 13.1% on Tuesday and Wednesday of Prime Day, respectively, when compared to the pre-pandemic iteration – indicating an uptick in demand, and perhaps more importantly, an increased capacity to handle that demand increase. The result is a testament to Amazon’s skill in not just driving excitement, but in evolving its capabilities to better handle that spike in interest.

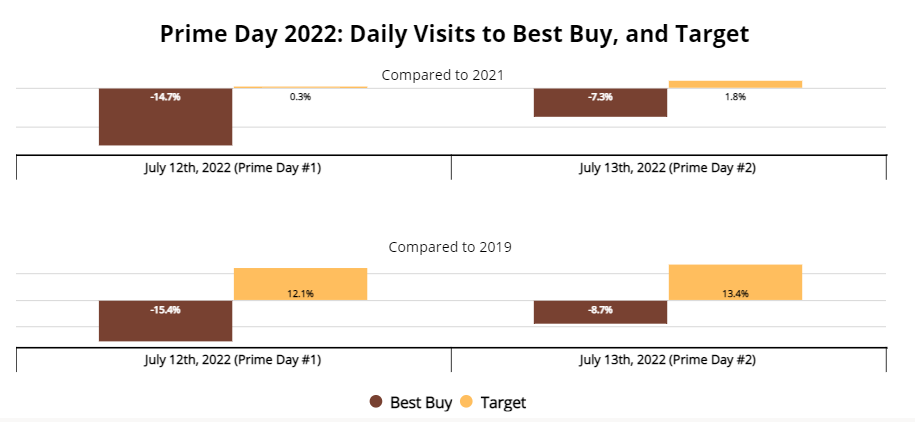

On a year-over-year (YoY) and year-over-three-year (Yo3Y) basis, the big winner of Prime Day 2022 was Target. The retailer ran its three-day sales event between July 11th and 13th, and although the savings were exclusive to the Target app and website, the Deal Days had a clear offline impact. Nationwide visits to the brand’s locations grew relative to both 2019’s and 2021’s Prime Day, even though Target was already offering discounts for weeks before the event. The retailer’s performance is especially impressive considering the wider YoY visit declines seen across much of the retail landscape driven by a combination of significant economic headwinds like inflation and high gas prices, and a comparison to a uniquely strong Back-to-School season in 2021.

Best Buy, which ran a rival “Black Friday in July Event” between July 11th and July 14th, starting one day before Prime Day and ending one day after – but the retailer, which has been offering a Prime Day lookalike sale for several years now, did not beat its 2019 or 2021 Black Friday in July visit numbers.

Comparing to Recent Mid-Week Performance

The relative impact of the recent economic challenges and the comparisons to the strong retail performance of July 2021 comes into focus when comparing Prime Day 2022 foot traffic to more recent visit trends. For example, traffic to Best Buy – which saw visits down 15.4% and 8.7% YoY on Prime Day – was up 16.3% and 20.8% on the Tuesday and Wednesday of Prime Day 2022 when compared to visit averages for those same weekdays the previous five weeks. A similar boost was seen for Amazon Warehouses, while Target saw a healthy 4.5% and 3.5% increase in Tuesday and Wednesday visits, respectively, compared to the average for those same weekdays over the previous five weeks. The better visit performance relative to recent weeks is especially important in that it shows the ability of a key ‘retail holiday’ to drive an uptick even within a difficult environment. The ability of Best Buy, Target and others to leverage the opportunity demonstrates a powerful ability to adapt and drive strength even against wider economic headwinds.

Prime Day has become a critical part of the retail calendar, and Amazon has shown a growing capability to maximize its impact. Yet, the rising importance of these dates have also pushed other retailers to get involved in similar processes driving strong success for their own campaigns.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.