Get on 2022’s Summer Wellness trend with App IQ’s enhanced Health & Fitness taxonomy and new subgenres.

Consumer needs for their health & fitness regimens continue to evolve and mobile apps play a major part in serving them. Downloads and revenue across Health & Fitness apps continue to grow into the summer, even surpassing the “New Year Resolution” spike in January 2022. As consumers dropped “New Year, New Me” and adopted ‘Everybody is a Summer Body,’ there is a clear opportunity for health & fitness brands to become embedded in people’s wellness routines and find ways to retain existing customers.

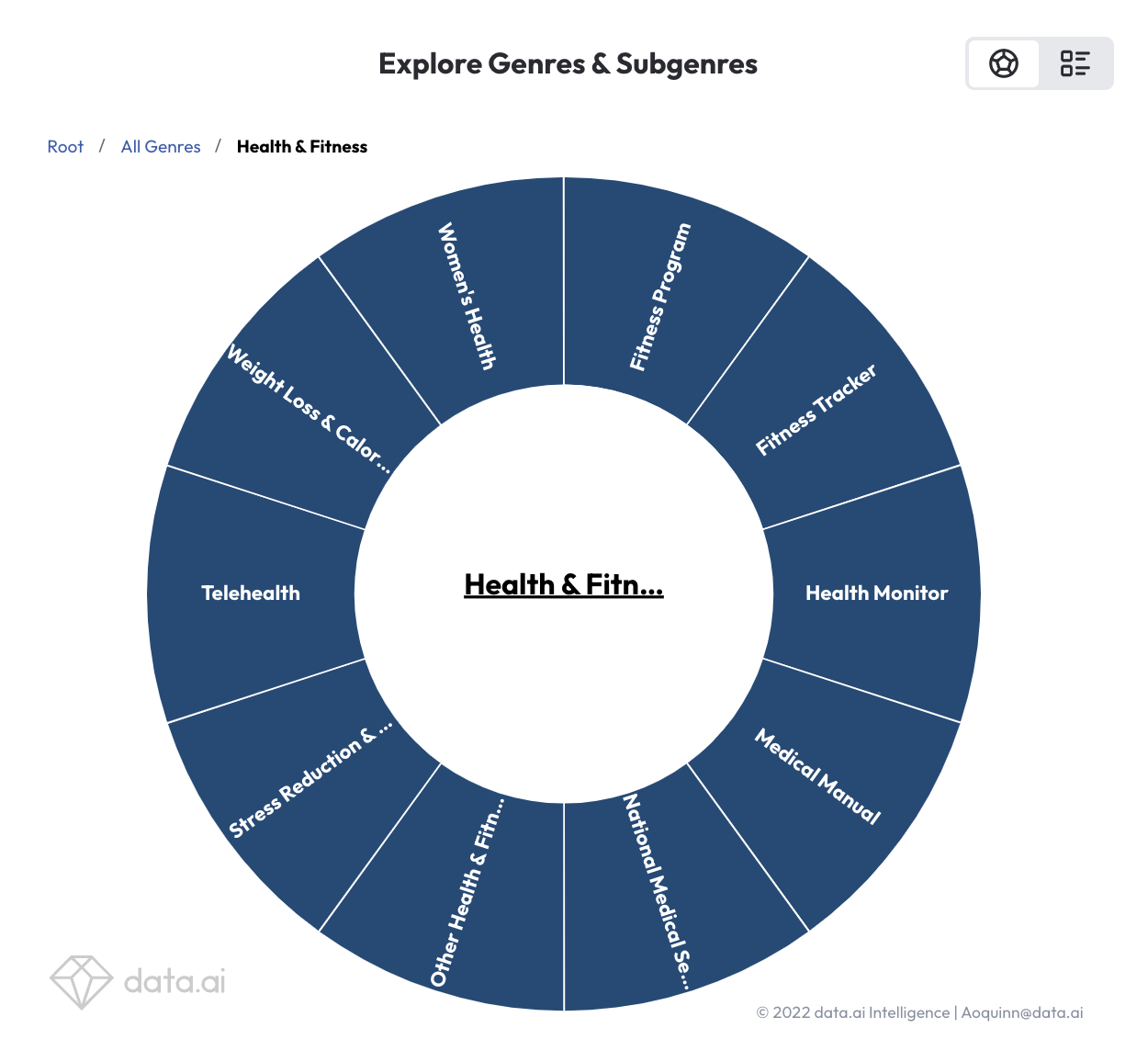

What is the Wellness app segment? Who is winning in most downloads and revenue? data.ai’s enhanced Health & Fitness taxonomy in App IQ can help you discover where you fit into your customers’ full spectrum wellness plan. You already know your customers tackle their health from multiple avenues: they use medical services, track their diets, monitor their sleeping habits, work out, meditate, and seek help from medical professionals. Using App IQ, you can better identify your top competitors based on your app offering. With more granularity, wellness apps now fall into the following subgenres: Fitness Program, Fitness Tracker, Health Monitor, Medical Manual, National Medical Service, Stress Reduction & Meditation, Telehealth, Women’s Health, Weight Loss & Calorie Tracker.

Staying Top of Mind with Wellness

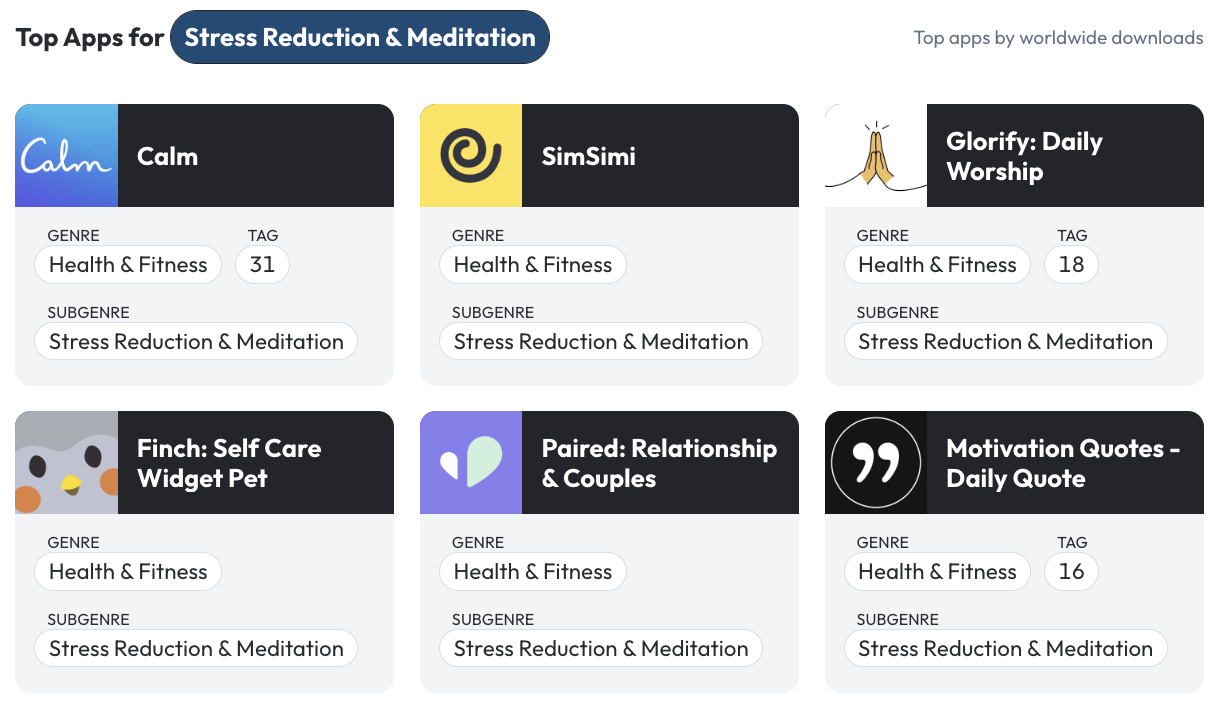

Wellness is holistic, and it all begins with what is going on in your head. The “Stress Reduction and Meditation” subgenre tracks 180 unified apps where users meditate and relax using natural soundscapes and mindful practices; or providing white noises and tips for users to calm down, relieve stress, or better sleep. With App IQ, you can identify the top apps your target audience uses for their mental wellness, and dig in to understand their app store optimization strategy to better compete for downloads. As a competing stress reduction and meditation app, understanding who is winning consumer downloads and their best practices can help inform your app’s growth and user acquisition strategy.

Fit In with Fitness

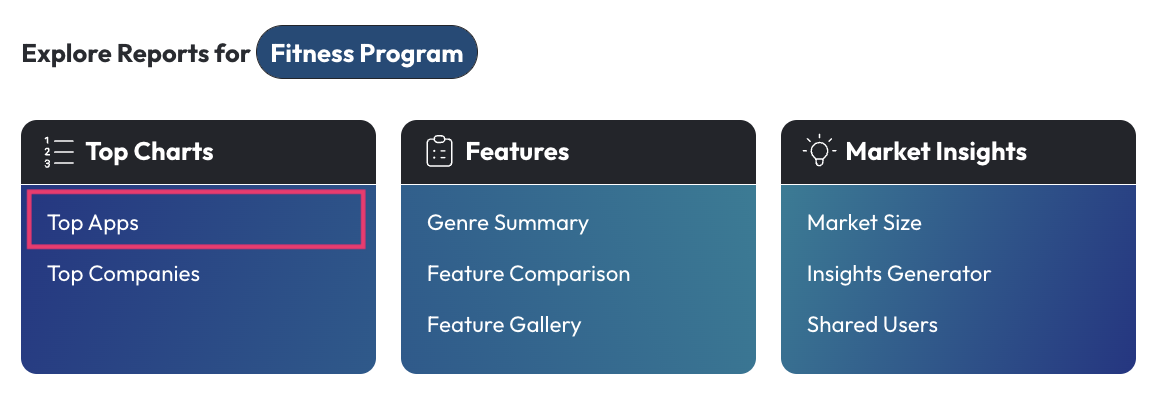

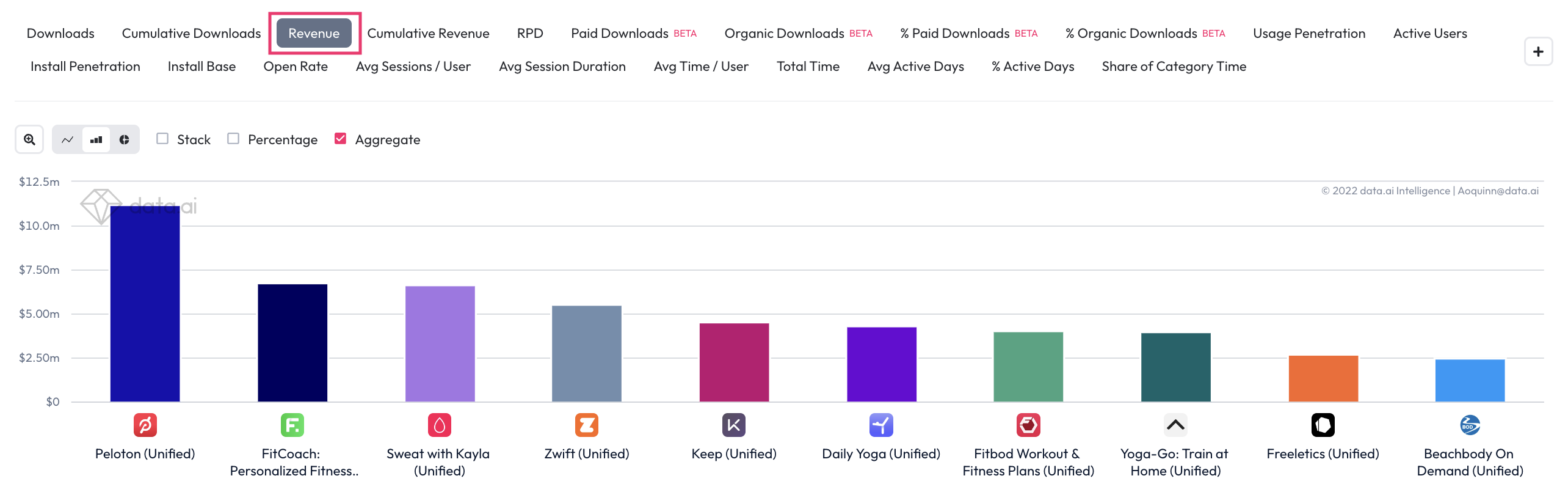

Consumers aren’t just strengthening their minds this summer, they are also trying to get active and aren’t shy about spending money to achieve their fitness goals. Let’s say you are a product manager for a new Fitness Coaching app entering the market. You now can look at other Fitness Programs and identify the top revenue-driving fitness program apps.

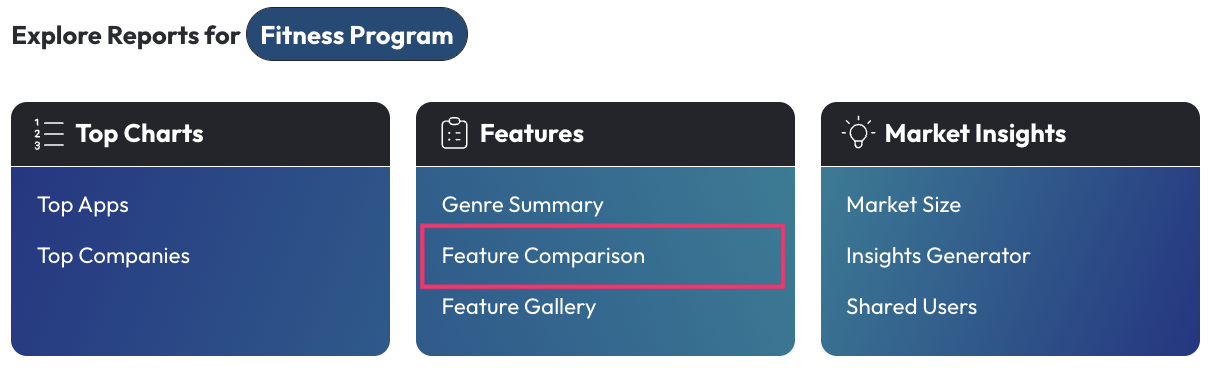

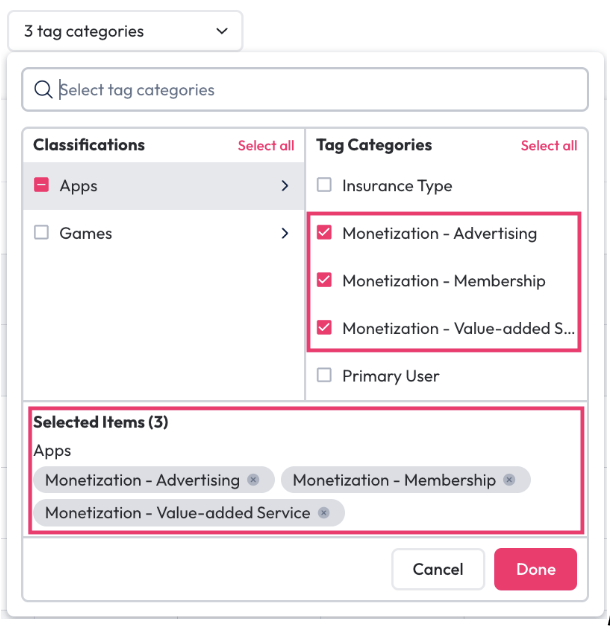

After learning which top competitors are driving the most revenue, you can use data.ai to quickly look under the hood and discover their monetizable features by using the Feature Comparison report. Understanding your competitor’s feature set is a powerful way to optimize your monetization strategy and capitalize on the fitness trend.

In the Feature Comparison report, you can easily filter feature tags and select tags for monetization.

Meet Your Customers Where They Are

You know a consumer’s approach to wellness is multifaceted, and the improved Health & Fitness subgenre taxonomy reflects that complexity. Knowing your target audience is leveraging multiple apps to achieve their wellness goals allows you to reach new customers via advertisements and partnerships.

If you want to bring a new health monitor app to market, use the App IQ taxonomy in the Shared Users report to identify potential partnerships that can help drive new customers to your app. Users of health monitor apps are 2.9x more likely to use Stress Reduction & Meditation apps and 2.8x more likely to use weight loss and calorie tracker apps!

The App IQ taxonomy will continue to evolve to reflect the complexity of your customers’ lives and their relationship with technology.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.