Source: https://secondmeasure.com/datapoints/discount-retailers-competitive-analysis-five-below-dg-dltr/

As inflation continues to rise, many consumers are reportedly turning to discount stores for household essentials. Our competitive analysis of major discount retailers—including Five Below (NASDAQ: FIVE), Dollar General (NYSE: DG), Dollar Tree, Inc (NASDAQ: DLTR), and 99 Cents Only Stores—found that Five Below had the highest average transaction value, but Dollar General had the highest quarterly transactions per customer and quarter-over-quarter customer retention in the second quarter of 2022.

Among major discount retailers, customers at Five Below (NASDAQ: FIVE) spent the most per visit in Q2 2022

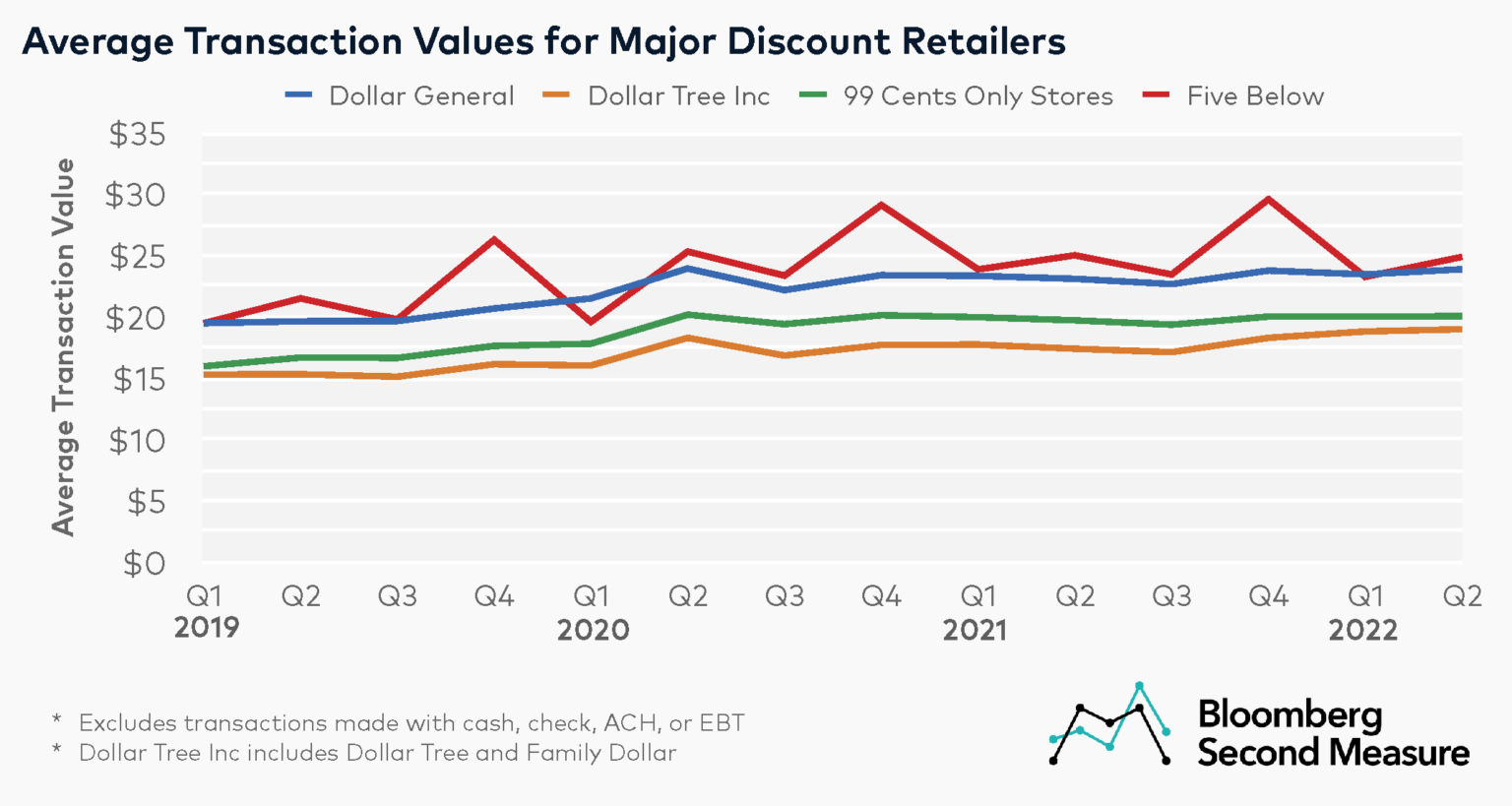

In the second quarter of 2022, Five Below had the highest average transaction value among major discount store competitors. Our consumer transaction data shows that Five Below customers spent $25 on average per transaction, compared to $24 at Dollar General, $20 at 99 Cents Only Stores, and $19 at Dollar Tree, Inc (which includes both Dollar Tree and Family Dollar).

Another notable trend for discount retailers is their increasing average transaction values during the COVID-19 era. Between Q2 2019 and Q2 2022, average transaction values grew 24 percent at Dollar Tree, Inc, 22 percent at Dollar General, 20 percent at 99 Cents Only Stores, and 16 percent at Five Below. One factor that might contribute to rising average transaction values over the past few years is the potential shift of some cash, check, ACH, or EBT transactions (all of which Bloomberg Second Measure does not observe) to debit or credit card transactions during the pandemic.

Five Below, which is known for selling toys and seasonal goods among its discounted merchandise, also experiences a notable uptick in average transaction value in the fourth quarter, coinciding with the holidays. The average transaction value in Q4 2021 was $30, a 26 percent increase from the previous quarter.

Despite their budget-friendly names, in recent years these companies have been expanding to a wider range of prices, which may also be a factor in their growing average transaction values. For example, only about 20 percent of Dollar General’s merchandise is priced at $1 or less and in early 2022, Dollar Tree changed its main price point from $1 to $1.25. In response to rising inflation, Five Below also launched its Five Beyond category, which sells some items above $5. Likewise, Dollar General launched its Popshelf concept store in late 2020 to target wealthier, suburban shoppers.

How does shopping frequency stack up among discount retailers?

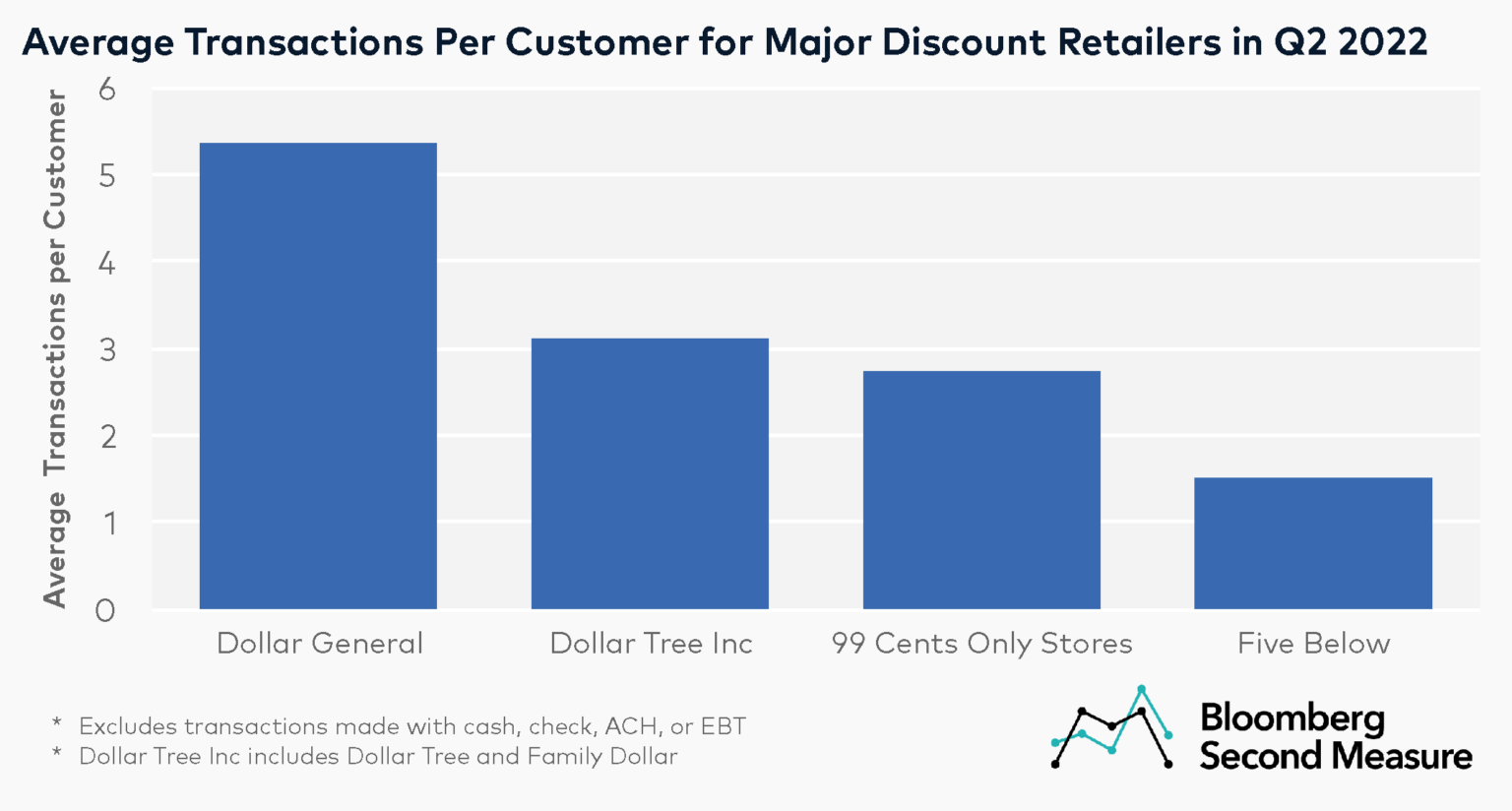

Our competitive analysis further shows that among major discount retailers, customers at Dollar General shopped the most often during the second quarter of 2022. In Q2 2022, Dollar General had an average of 5.4 transactions per customer. Dollar Tree, Inc followed with 3.1 transactions per customer, then 99 Cents Only Stores with 2.7 transactions per customer. Five Below had the lowest average transactions per customer among these companies, with 1.5 transactions per customer in the second quarter of 2022.

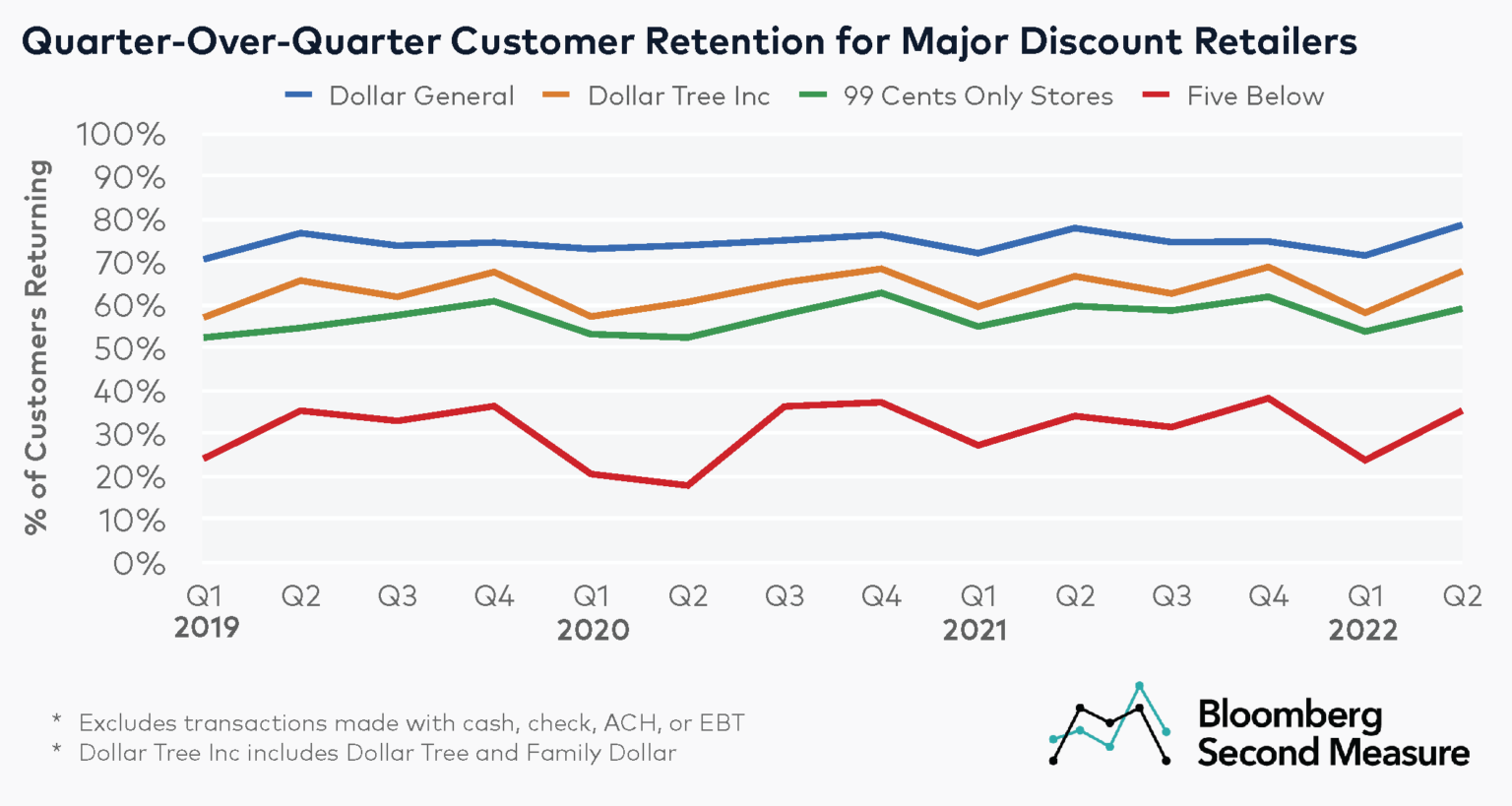

A similar pattern emerged for customer retention, with Dollar General and Dollar Tree, Inc having the highest quarter-over-quarter customer retention rate. Between the first and second quarters of 2022, 79 percent of Dollar General customers and 68 percent of Dollar Tree, Inc customers were retained. For 99 Cents Only Stores, 59 percent of customers from Q1 2022 made a repeat purchase in Q2 2022. Five Below had the lowest quarter-over-quarter retention rate among the companies, with 35 percent of customers in Q1 2022 returning in Q2 2022.

For all companies in the analysis, quarter-over-quarter customer retention dipped in the first quarter of each year. At Five Below specifically, the quarter-over-quarter customer retention rate in Q1 2022 was 24 percent, compared to 38 percent in Q4 2021.

Some factors that may affect retention rate and transactions per customer are each company’s target audience and product mix. For example, Five Below’s primary audience is teens and tweens, and it mainly sells products in categories like games, sports, toys, tech, beauty, home goods, seasonal goods, and snacks. By contrast, discount retailers like Dollar General also sell household items and groceries, including frozen, refrigerated, and perishable goods.

Earlier this year, Five Below announced a plan to triple its store count by 2030, following the trend of discount retailers expanding their retail footprint during the pandemic.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.