Source: https://www.corelogic.com/intelligence/us-rent-price-growth-slows-in-june-corelogic-reports/

CoreLogic©, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

Single-family rent prices remain elevated, up 13.4% from one year earlier, but have continued to relax compared with growth seen earlier this year. This deceleration could be partially due to worries over an impending economic slowdown, even though the job market added 528,000 positions in July, returning the employment rate to its level prior to the COVID-19 outbreak. Still, as the cost of owning a home continues to grow significantly, many Americans are shut out of the housing market, forcing them to keep renting.

“While the annual growth in single-family rents is nearly double that of a year ago and is still near a record level, price growth began decelerating in June,” said Molly Boesel, principal economist at CoreLogic. “Nationwide, both year-over-year and month-over-month growth were slower in June than they were earlier this year, and roughly half of the largest U.S. metro areas experienced a slowdown in annual growth in June.”

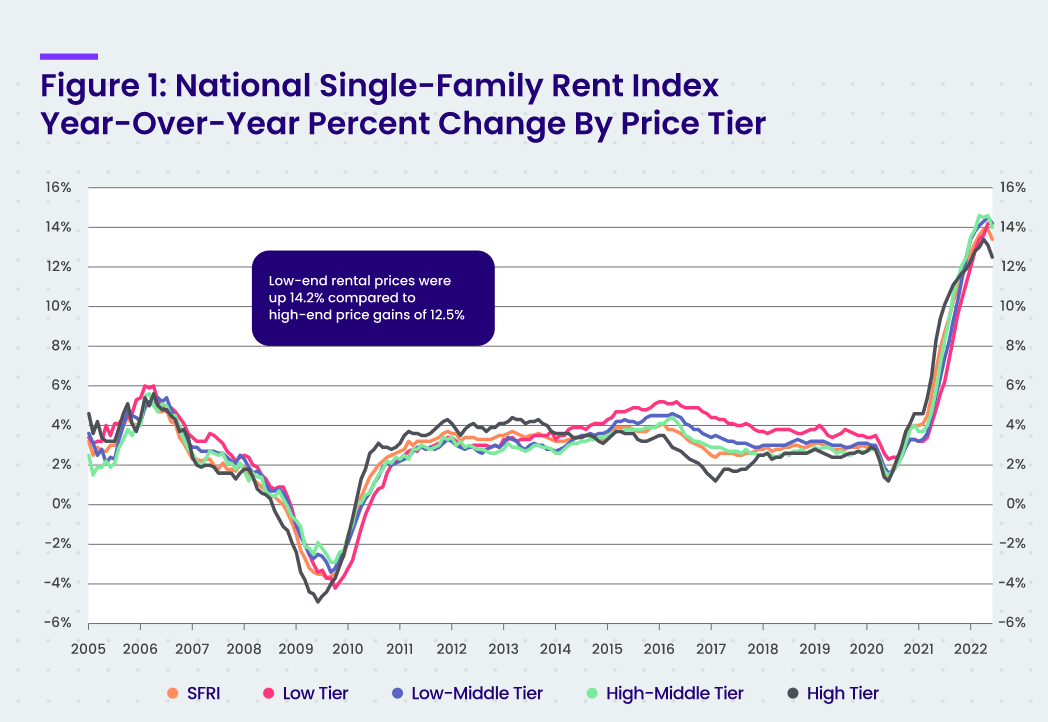

To gain a detailed view of single-family rental prices, CoreLogic examines four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

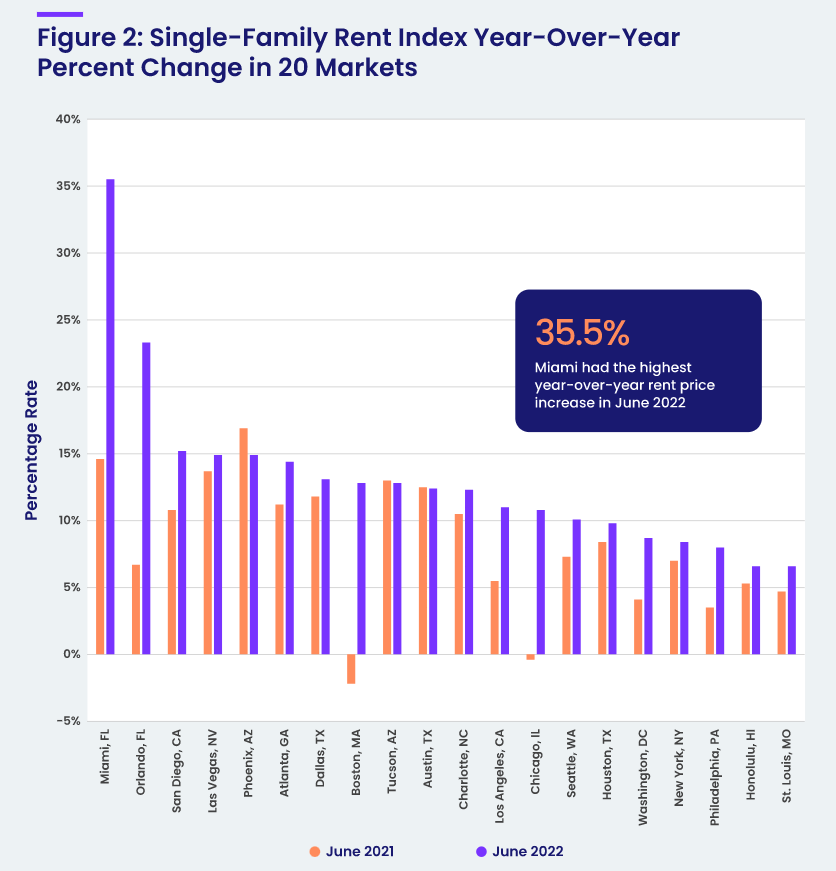

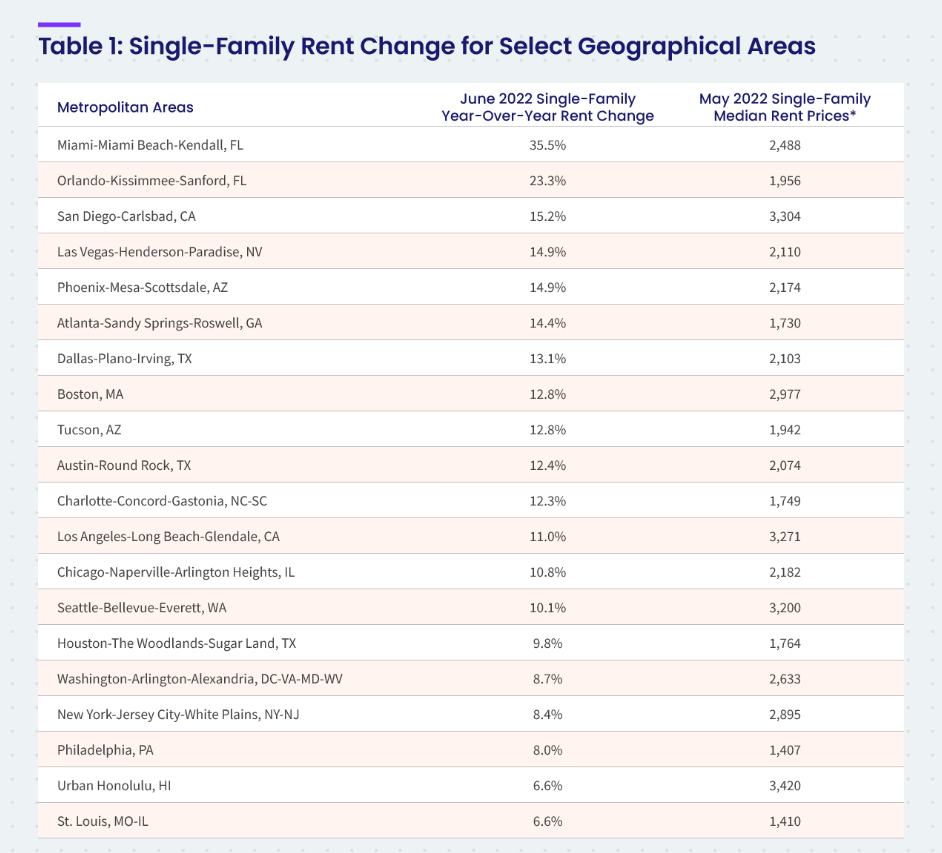

Of the 20 metro areas shown in Table 1, Miami posted the highest year-over-year increase in single-family rents in June 2022 at 35.5%, the 11th consecutive month it has topped the nation for growth. Orlando, Florida and San Diego recorded the second- and third-highest gains at 23.3% and 15.2%, respectively. Honolulu and St. Louis posted the lowest annual rent price gains, both at 6.6%

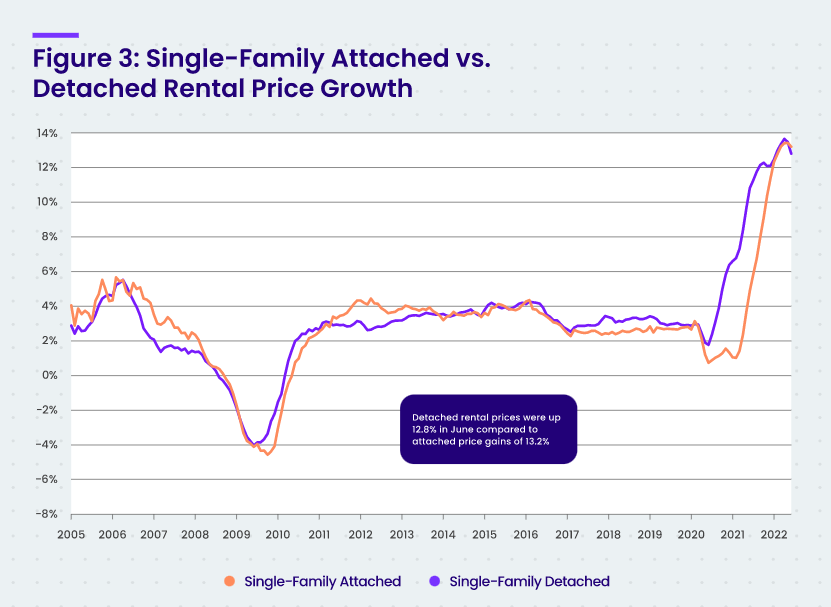

Differences in rent growth by property type emerged after COVID-19 took hold, as renters sought standalone properties in lower-density areas. This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate. However, in June 2022, this trend shifted, as attached rental property prices grew by 13.2% year over year, compared to the 12.8% increase for detached homes, the first time since February 2020 that attached rental price growth outpaced detached rental price growth. Still, the overall rent price growth for detached homes (24.9%) versus attached homes (18.8%) remains much stronger on a two-year basis.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.