The plus-size fashion industry is one of the fastest growing apparel sectors in the U.S. – valued at $24 billion per year and sales revenue for the category grew about three times faster than consumer spending on the rest of the women’s apparel market between 2019 and 2021. With the strength of the body-positivity movement growing, we took a look at the recent foot traffic performance of three leading plus-size retailers – Destination XL, Lane Bryant, and Ashley Stewart.

Yearly Performance Finding Stability

2021 was a banner year for plus-size fashion, with visits to retailers outperforming the overall apparel sector nearly all months analyzed. Ashley Stewart, a retailer that filed for bankruptcy in 2014, saw an impressive turnaround following a management revamp and investment into its core customer base. Lane Bryant, in business for over 100 years, undertook a significant store consolidation plan in 2020 following its parent company’s bankruptcy filing, closing around 150 locations. And Destination XL ended 2021 with its first profitable year after nearly a decade of losses, a result of savvy navigation of the pandemic and cost-cutting initiatives, including closing 12 stores in 2020.

2021’s elevated foot traffic figures, fueled in part by stimulus checks and pent-up demand, slowed into the first half of 2022. But despite the economic challenges and inflation concerns consumers are facing, these brands are maintaining impressively minimal visit gaps. July 2022 saw year-over-year (YoY) visit declines of 4.6%, 7.6%, and 8.6% to Destination XL, Lane Bryant, and Ashley Stewart, respectively – and these numbers are all the more impressive given the comparison to a particularly strong 2021 and the wider challenges felt across similar retailers. Visits per venue, meanwhile, slightly outperformed 2021’s overall monthly YoY foot traffic numbers, likely a result of the brands’ rightsizing and store fleet optimization efforts.

Pre-Pandemic Comparison Highlights Sector’s Strength

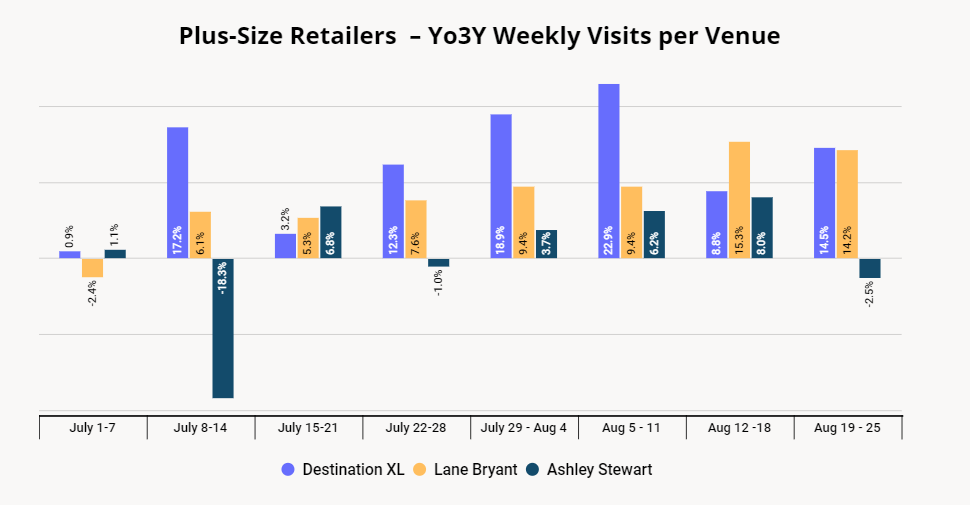

The impact of these rightsizing efforts becomes more apparent when looking at the year-over-three-year (Yo3Y) data. Lane Bryant closed over 150 stores in 2020, leading to lowered overall foot traffic, but much higher visits per venue, with July 2022 seeing a 9.9% increase in average visits per venue.

Destination XL also consolidated its store fleet, albeit on a smaller scale than Lane Bryant. Both monthly visits and visits per venue performed well above 2019’s numbers in all but one of the analyzed months. July 2022 saw its visits per venue up by 12.9% Yo3Y, while monthly visits were elevated by 14.0%.

Inflation seems to have hit Ashley Stewart the hardest, and the brand saw its visit gap grow in May and June 2022 – but its foot traffic now appears to be back on track. The company, which recently welcomed former Tommy Hilfiger executive Gary Sheinbaum as its new CEO, saw its average monthly visits per venue up nearly 1.0% Yo3Y in July 2022.

Back to School Providing an Additional Boost

With back-to-school shopping season in full swing, foot traffic to Lane Bryant, Destination XL, and Ashley Stewart seems to be heating up even more. Visits per venue have been ramping up weekly, with visits the week of August 12 up 8.8%, 15.3%, and 8.0% for Lane Bryant, Destination XL, and Ashley Stewart, respectively.

While these three retailers are seeing positive visit trends, the wider brick-and-mortar plus-size apparel category is still struggling with supply-chain issues, consumer demand, and a tendency for its target audience to shop online. Ashley Stewart, Lane Bryant, and Destination XL’s success indicates that playing the long game, understanding your customers, and a sharp eye for trends can ensure retail longevity – and may provide a blueprint for other retailers hoping to get into the plus-size game.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.