Source: https://secondmeasure.com/datapoints/fashion-retailers-sales-growth-nyse-anf-aeo-nasdaq-urbn/

A combination of inflation, changing consumer tastes, and inventory challenges have reportedly hit clothing companies hard in 2022. In fact, several fashion retailers—including Abercrombie & Fitch Co. (NYSE: ANF), American Eagle Outfitters (NYSE: AEO), and Urban Outfitters, Inc (NASDAQ: URBN)—missed revenue estimates in their second quarter earnings reports. We analyzed consumer spending trends at these fashion retailers, as well as competitor Aeropostale Inc, to see how sales performance, average monthly spending per customer, and ecommerce trends fared in recent months and compared to before the pandemic.

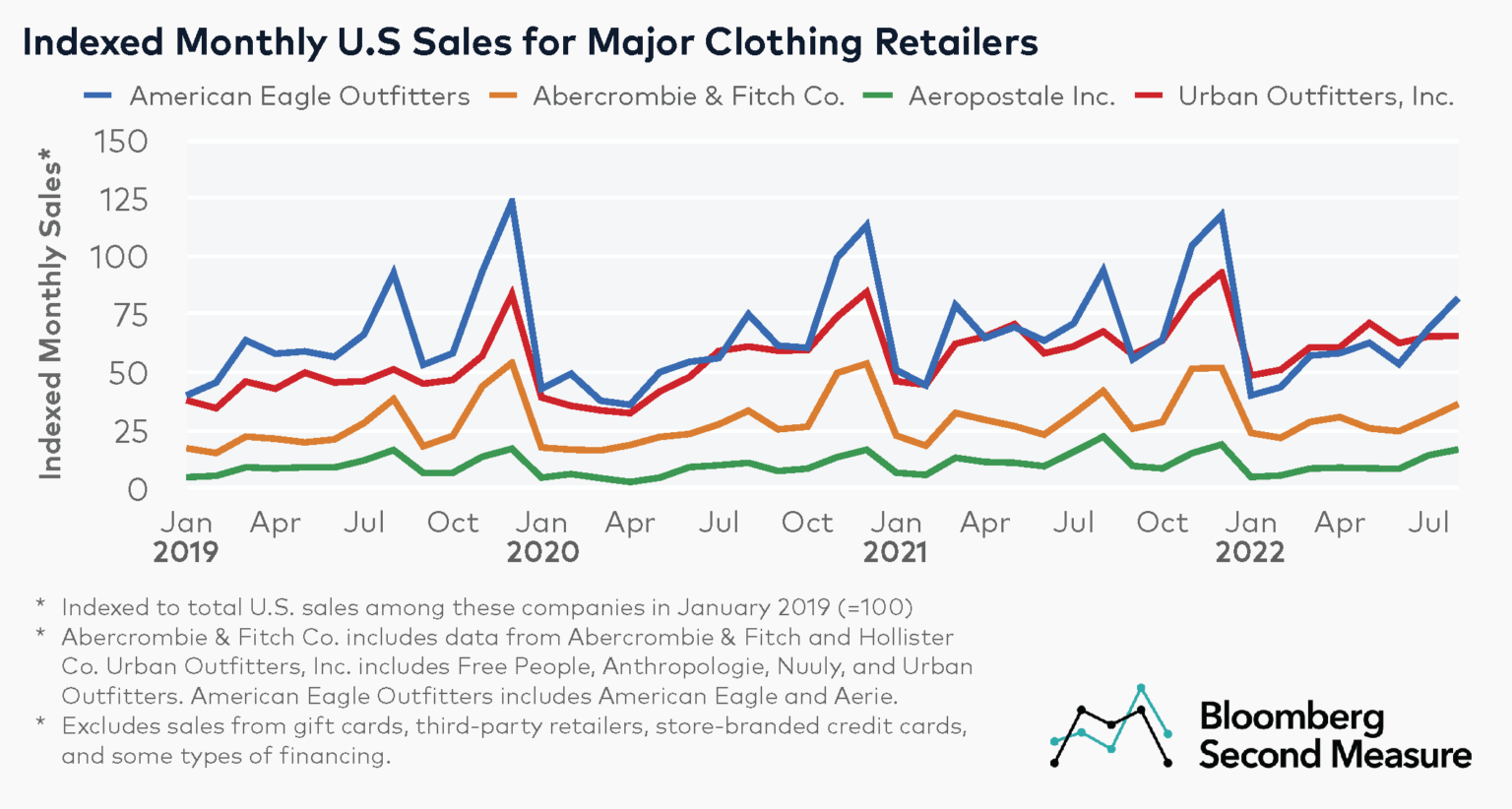

In August 2022, Urban Outfitters Inc (NASDAQ: URBN) saw the most sales growth compared to pre-pandemic levels

All four companies in our analysis follow a similar sales pattern, experiencing a significant boost in sales in August (likely related to back-to-school shopping) and during the holidays each year. Compared to the same month in 2019, August 2022 sales were 28 percent higher at Urban Outfitters, Inc (which includes data from Free People, Anthropologie, Nuuly, and Urban Outfitters), 1 percent higher at Aeropostale Inc, 6 percent lower at Abercrombie & Fitch Co. (which includes Abercrombie & Fitch and Hollister Co.), and 12 percent lower at American Eagle Outfitters (which includes Aerie and American Eagle). Our data excludes sales from gift cards, third-party retailers, store-branded credit cards, and some types of financing.

These clothing competitors also had lower sales year-over-year in August 2022, with decreases of 3 percent at Urban Outfitters, Inc, 13 percent at American Eagle Outfitters, 14 percent at Abercrombie & Fitch Co., and 25 percent at Aeropostale Inc. When looking at sales in August 2021, the four companies experienced elevated sales compared to the same month in the previous two years, perhaps impacted by returns to the office and the classroom.

While all of these fashion retailers have brands that target teens and young adults, they have also expanded their offerings in recent years. In 2019, Urban Outfitters introduced a fashion rental service called Nuuly, and launched Nuuly Thrift in 2021 as a secondhand marketplace. American Eagle Outfitters is also reportedly continuing to experience strong growth with Aerie, its underwear and lingerie brand.

In recent years, Abercrombie & Fitch has revamped its brand and offerings to target older teens and young adults rather than younger teens, as well as offer more inclusive sizing. At the same time, Aeropostale doubled down on following Gen Z style trends and transitioned some of its focus away from graphic tees and toward other products like denim. Aeropostale’s parent company, Authentic Brands, previously planned to go public, but withdrew its IPO plans in early 2022.

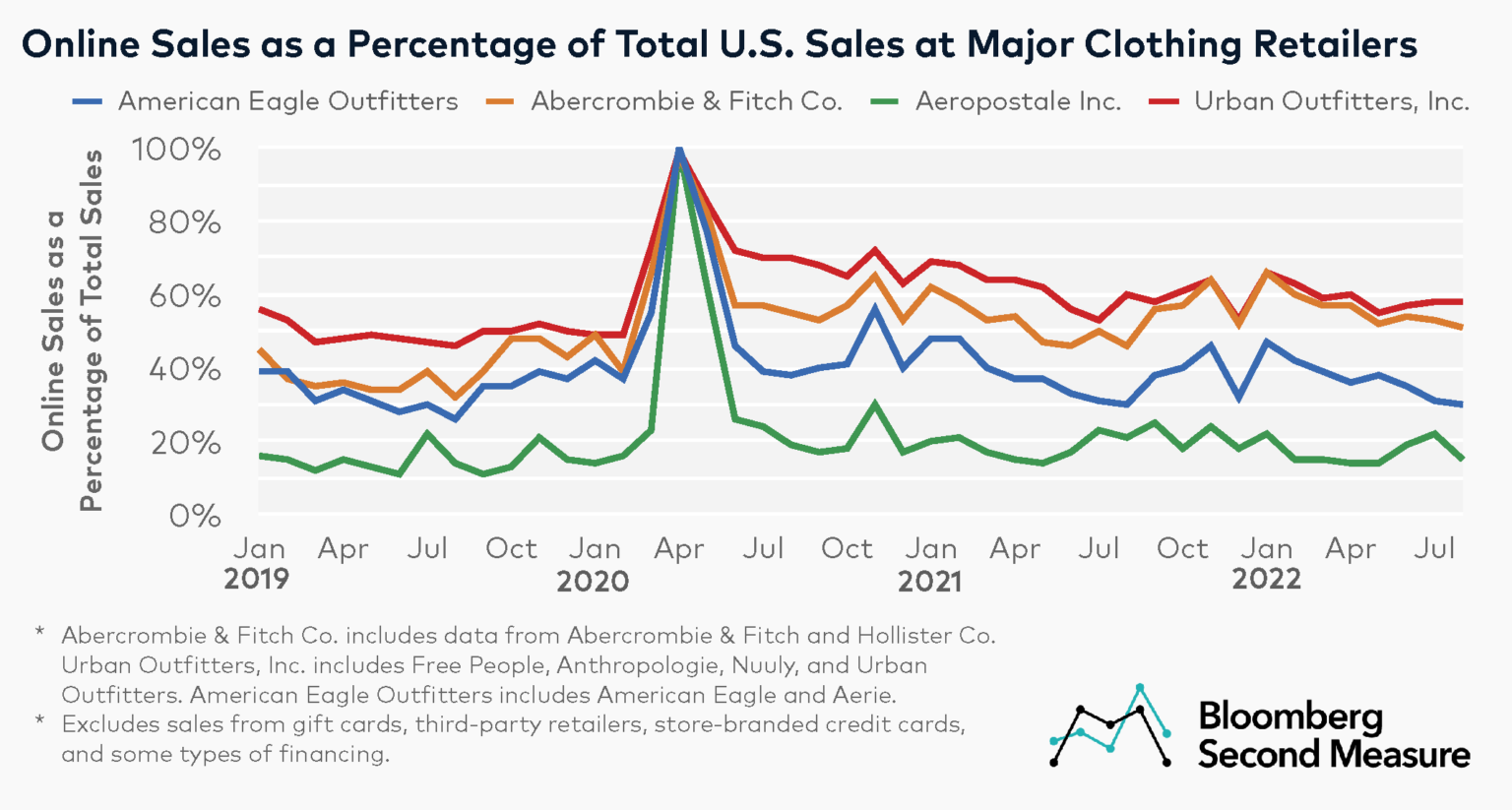

Ecommerce accounts for more than half of sales at Urban Outfitters Inc and Abercrombie & Fitch Co. (NYSE: ANF)

An analysis of sales by purchase channel reveals these clothing competitors had a higher percentage of their sales taking place online in August 2022 than before the pandemic. Compared to August 2019, the share of online sales increased 19 percentage points at Abercrombie & Fitch Co., 12 percentage points at Urban Outfitters, Inc, 4 percentage points at American Eagle Outfitters, and 1 percentage point at Aeropostale, Inc.

Among these companies, Urban Outfitters, Inc has the highest share of online sales as a percentage of total sales. In August 2022, 58 percent of Urban Outfitters, Inc sales took place online, compared to 51 percent for Abercrombie & Fitch Co., 30 percent for American Eagle Outfitters, and 15 percent for Aeropostale, Inc.

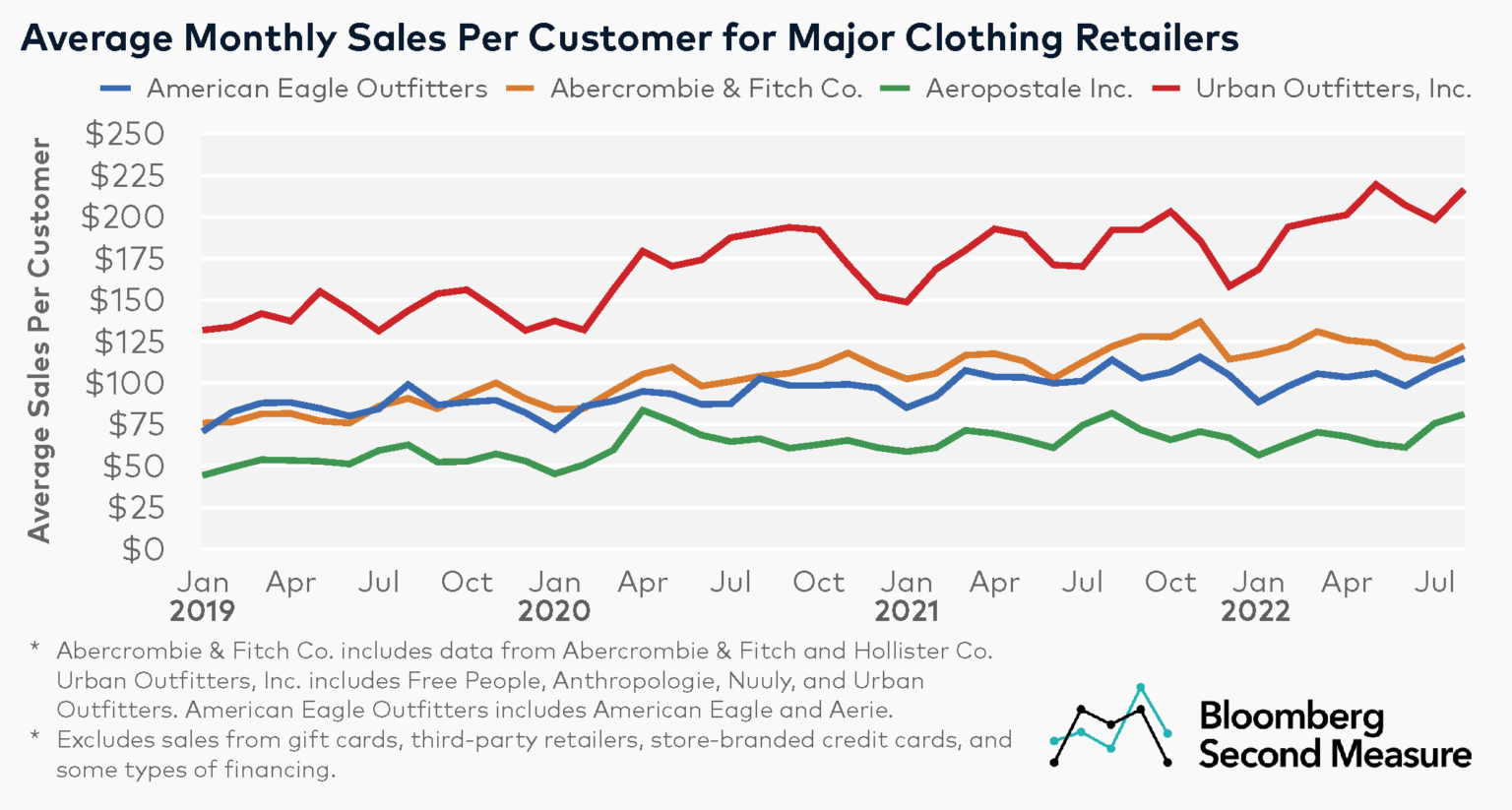

Urban Outfitters Inc has the highest average sales per customer

In August 2022, the average sales per customer was $216 at Urban Outfitters Inc, $122 at Abercrombie & Fitch Co., $114 at American Eagle Outfitters, and $80 at Aeropostale Inc. Compared to August 2019, each of these companies experienced a double-digit increase in average sales per customer in August 2022. The average monthly spend per customer during this time frame increased 51 percent at Urban Outfitters, Inc, 35 percent at Abercrombie & Fitch Co., 30 percent at Aeropostale Inc, and 16 percent at American Eagle Outfitters.

In August 2022, average sales per customer remained relatively consistent at American Eagle Outfitters, Abercrombie & Fitch Co., and Aeropostale Inc. year-over-year. However, the average sales per customer increased 13 percent year-over-year at Urban Outfitters, Inc.

Looking at annual spending trends, these companies tend to have their lowest monthly sales per customer in January. A potential reason could be that customers shift more of their shopping at these retailers to November and December instead to take advantage of holiday sales like Black Friday and Cyber Monday.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.