Our latest white paper draws on Crexi’s commercial real estate data insights and Placer.ai’s foot traffic intelligence to show how recent migration trends and overall population growth are uniquely impacting the local retail space in six growing cities. Below is a taste of our findings. To find out which up-and-coming markets made the cut, what is driving retail recovery in each area, and unique ways CRE players can capitalize on these changes

The Resurgence of Brick-and-Mortar Retail

Brick-and-mortar retail is back. More than two years after the first COVID-induced lockdowns, occupancy of new retail assets is now at an all-time high. Storefronts made up the bulk of new retail inventory added in Q2 2022, and cities with growing populations are seeing a particularly marked retail resurgence.

The increase in residents is driving certain similar real estate patterns across the six cities featured in this report. But as each region has its own unique character, their growth is also creating commercial opportunities specific to each locale. Certain cities are seeing movie theater visits surge, while other areas are seeing a strong office recovery – and some districts are simply seeing grocery visits skyrocket.

Population Growth

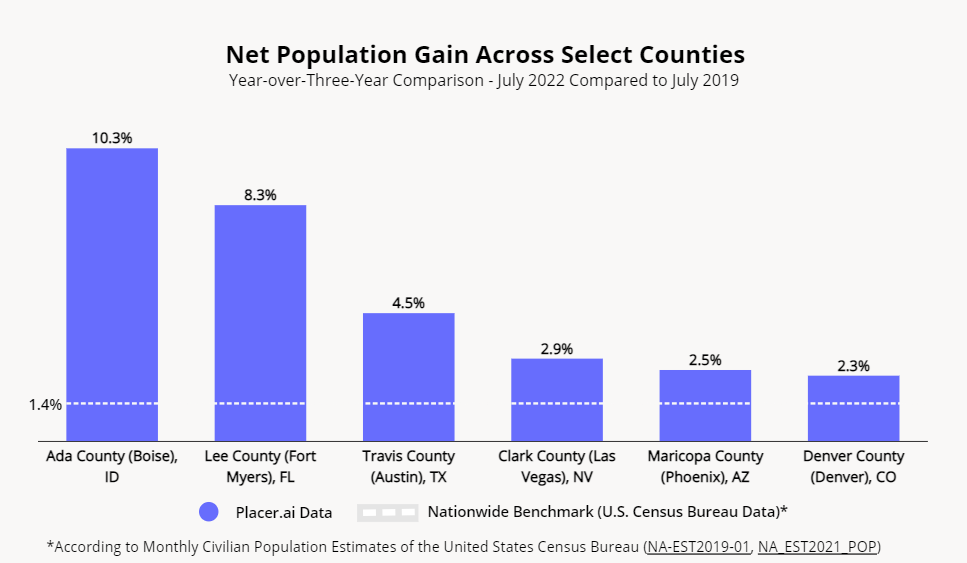

Each city selected for this report is located in a county that has experienced a substantial population increase over the past three years. Though some gained more residents than others, all counties saw growth rates significantly above than the average nationwide rate of 1.4%. And, as this report shows, all six cities featured are seeing different facets of their retail space impacted by the recent migration.

Denver County, CO, Maricopa County (Phoenix), AZ, and Clark County (Las Vegas), NV, saw their populations increase between 2.3% and 2.9% from July 2019 to July 2022. During the same period, the population of Travis County (Austin), TX grew by 4.5% and the populations of Lee County (Fort Myers), FL and Ada County (Boise), ID, climbed a whopping 8.3% and 10.3%, respectively.

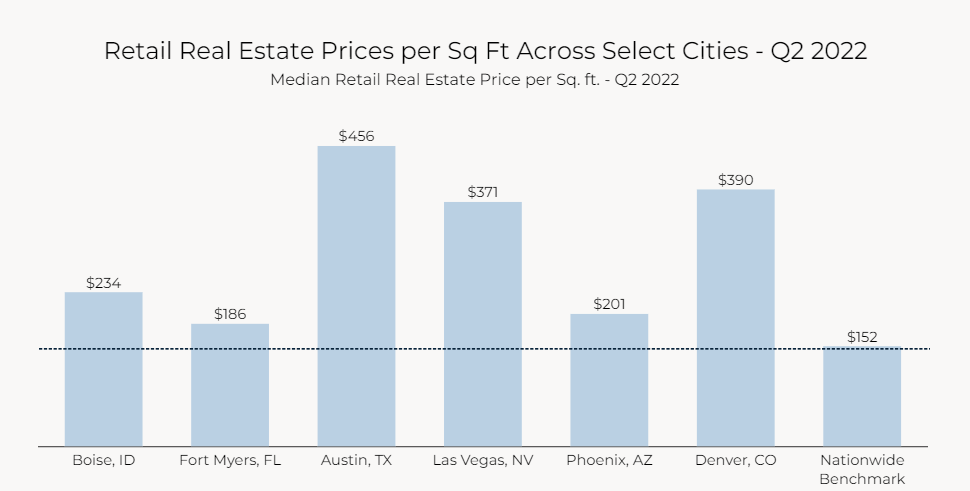

Retail Real Estate Market

All six cities featured here have more in common than just their growing population – according to Crexi data, the median asking price per square foot for retail real estate in all six markets exceeded the national median in Q2 2022. Austin tops the list at $456 per square foot, followed by Denver at $390 and Las Vegas at $371. And in Boise, Phoenix, and Fort Myers, retail real estate was sold at a median price of $234, $201, and $186 per square foot in Q2 2022 – well above the nationwide median price of $152 per retail square foot during the same period. Phoenix and Denver also have some of the highest demand for industrial real estate, which includes warehouses and distribution centers that cater to e-commerce shoppers – indicating a high demand for both offline and online retail in the area.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.