Advertisers build their strategies based on current events.

When online gaming grew in popularity during the pandemic, some advertisers allocated more of their budget to YouTube’s gaming channels.

The rising cost of buying cars led advertisers for new and used dealerships to do the opposite.

Advertisers for firearms and accessories companies are no different.

Given the divisive nature of their products, however, these advertisers walk on a thinner sheet of ice.

What does firearms advertising look like in 2022? Have the headlines and a push for gun reform impacted spending?

We looked at our data to find out.

Firearms & Accessories Advertisers Are Spending More

The ever-increasing calls for gun reform haven’t stopped millions of Americans from buying firearms.

In fact, Americans bought nearly 20mm of them in 2021, representing the industry’s second-busiest year on record.

Firearms manufacturers are understandably ramping up production to keep pace with demand.

The advertisers working for them are doing the same.

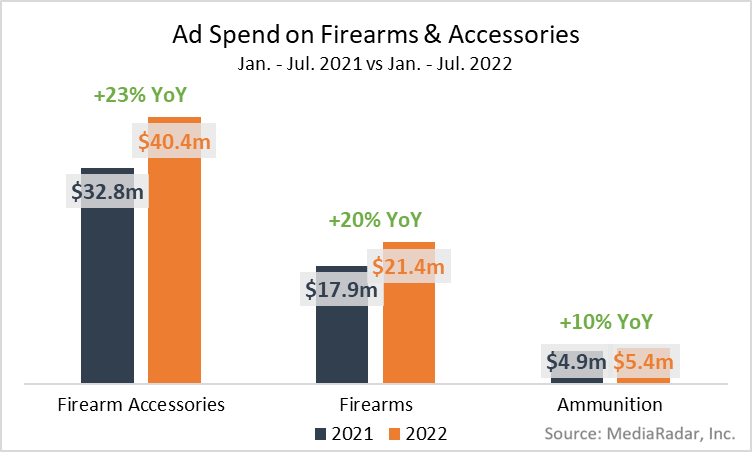

In H1 2022, firearms and accessories advertisers spent more than $67mm to promote their products across online and offline channels—a 21% YoY increase compared to the same period in 2021.

Ironically, some of the biggest spenders aren’t promoting guns.

Those promoting body armor, for example, including Armored Republic, Ops-Core and Safe Life Defense, collectively spent $12.5mm.

For these advertisers, the increase in spending comes on the heels of rising safety concerns and the desire for personal protection expressed by millions.

The spending likely also has to do with increased police funding and new safety procedures instituted by schools, retailers and other public locations.

Advertisers promoting handguns and rifles/shotguns also increased their spending.

In H1, these two advertising subcategories increased their spending by 39% and 8% YoY, respectively. The overall ammunition category—across handguns and shotguns—also increased substantially.

Although gun control laws will impact how this subset of advertisers spend moving forward, their pivots will be far less drastic than those selling other types of firearms.

Still, current events and headlines, as well as forthcoming gun laws, will force these advertisers to remain agile; what was acceptable today may not be tomorrow.

Semi and Automatic Weapons Advertisers Are Spending Less

While overall spending on firearms and accessories increased in H1, that increase didn’t make it to advertisers promoting semi and automatic weapons.

These advertisers, including AHL, M&A Parts and Tristar Arms, spent 72% less YoY than they did during the same period in 2021.

AHL and Tristar Arms, two historically big spenders, stopped spending altogether as calls to ban—or significantly limit—their products grew louder.

The decreases across the board from these advertisers are far from a surprise.

As the US looks to pass bills and reforms—the House recently passed a bill to ban assault rifles—these advertisers have no choice but to dry up their ad reserves.

While gun reforms and restrictions related to semi and automatic weapons will undoubtedly continue to impact these advertisers, that doesn’t mean the company as a whole will stop spending.

TriStar Arms, for example, manufactures firearms for the hunting and shooting industry. The company also manufactures handguns and shotguns, which both saw more ad spend allocated to them in H1.

So, in response to new laws and public sentiment, ad teams at companies like this one will likely shift their budget to promote other products in their catalogs.

Some Firearms Advertisers Are Running Out of Options

A growing list of laws and public outcry aren’t the only two forces impacting how these advertisers are spending—the channels themselves have a say, too.

Facebook was one of the first major players to move on this front, banning ads for weapon accessories and protective equipment in the days preceding and following then-President-elect Joe Biden’s inauguration.

More recently, Hulu blocked ads on abortion and gun control after a group of Democratic organizations attempted to launch a campaign.

YouTube’s official policy on promoting “dangerous products or services” essentially puts the kibosh on ads for “functional devices that appear to discharge a projectile at high velocity.” Of course, that includes handguns, rifles and shotguns.

There’s no way around it: Most digital channels prohibit ads promoting firearms.

When these doors close, advertisers walk through other ones.

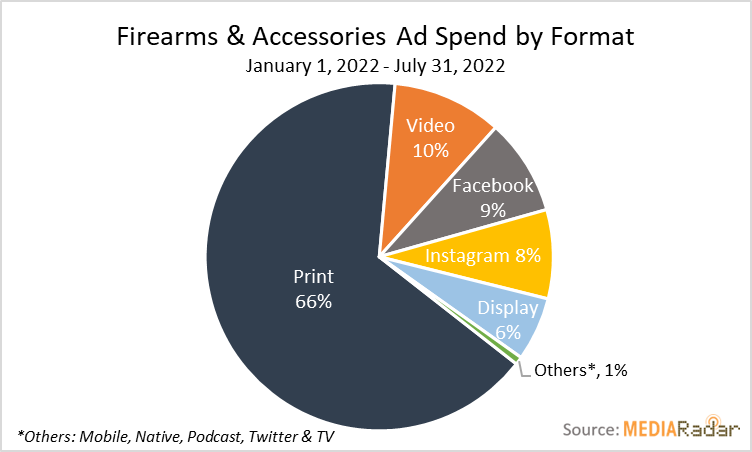

Through July, firearms and accessories advertisers spent more than $44m on print ads in publications like Guns & Ammo, American Rifleman and Shooting Illustrated, which collectively received 54% of the print ad investment.

Generally, the digital ads that do land on screens appear on niche websites like Gun Broker, Police and Security News, Get Zone, Guns & Ammo, Petersen’s Hunting, and Game & Fish. In H1, 72% of the total display ad spend went to niche websites like these.

As the world continues to take away these advertisers’ options, their success will rely on finding alternatives—think podcasts and native ads.

For now, these “less traveled” options will remain in play. Public scrutiny, however, will continue to make their jobs difficult.

An Inflection Point for America and Firearms Advertisers

Firearms and accessories advertisers are at a crossroads.

Down one path is more budget to promote their products.

Down the other one is the opposite.

For better or worse, these advertisers don’t have a choice of which path to go down.

For advertisers promoting actual firearms, especially of the semi and automatic variety, their options are dwindling, making niche websites and print publications two of their only options.

At the same time, advertisers promoting just about everything else are walking on thin ice, but at least they won’t fall through (yet).

While most digital channels prohibit ads promoting firearms, those promoting accessories are still largely in play, which is why Meta saw advertisers invest nearly $11.5mm on its platforms.

Meanwhile, YouTube attracted nearly $5mm or 70% of the total online video ad spend.

Overall, firearms and accessories advertisers are in a unique—and perpetually fluid—situation. Some will keep spending, while others will have to think outside the box.

The one point to remember, however, is that most of these advertisers work for the same companies. So, while they may be unable to launch a campaign promoting a specific product, there’s likely another one in their inventory that doesn’t cross any advertising and legal lines.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.