Source: https://www.corelogic.com/intelligence/us-rent-growth-continues-to-slow-in-august-corelogic-reports/

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

U.S. single-family home rental costs posted an 11.4% year-over-year increase in August, marking the fourth straight month of annual deceleration. Even so, rental costs remained elevated, with annual growth running at about five times the rate than in August 2020 in the midst of the COVID-19 pandemic. A shortage of available rental units continues to fuel price growth, although inflation and worries over a looming recession should begin to temper increases.

“Single-family rent prices in August were 26% higher than before the onset of the pandemic, adding an average of $400 per month to tenants’ monthly costs and compounding other household expenses caused by inflation,” said Molly Boesel, principal economist at CoreLogic. “While annual rent growth is projected to continue increasing throughout the rest of 2022, those gains will likely moderate further in 2023.”

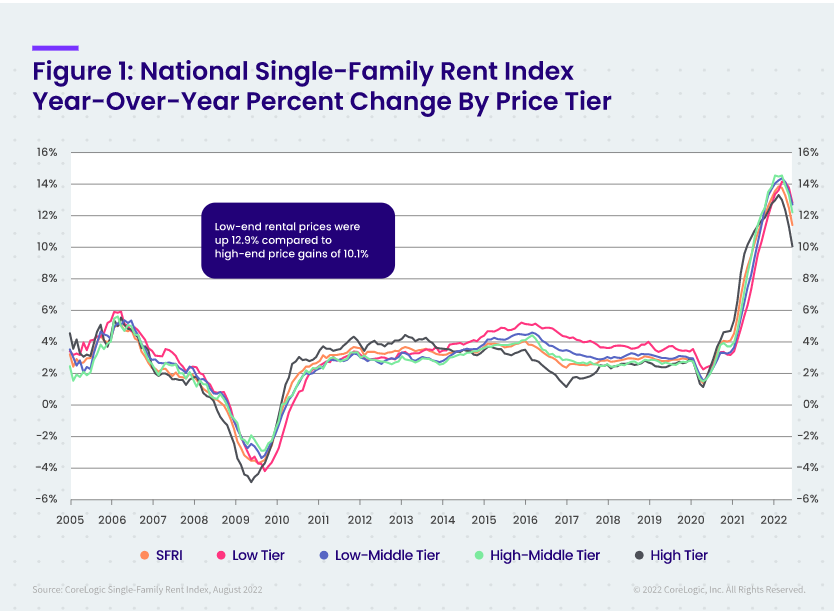

To gain a detailed view of single-family rental prices, CoreLogic examines four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

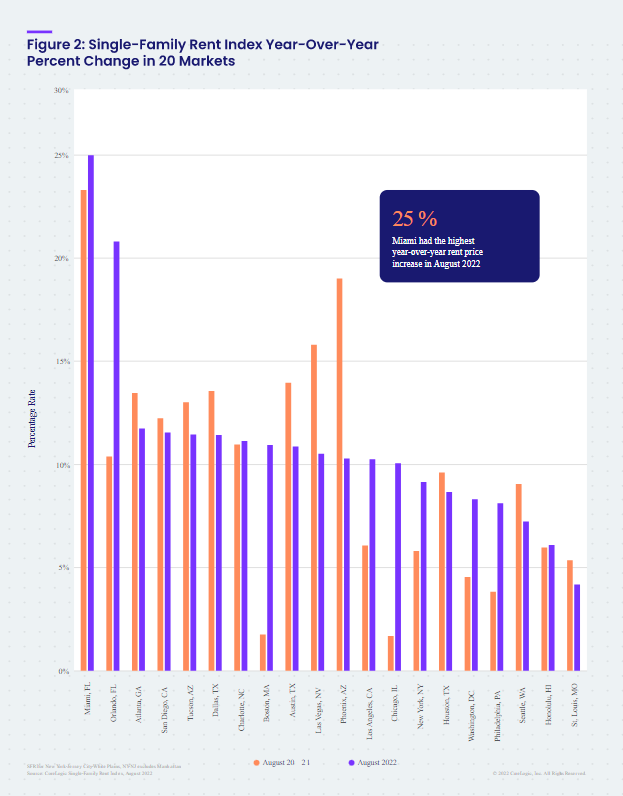

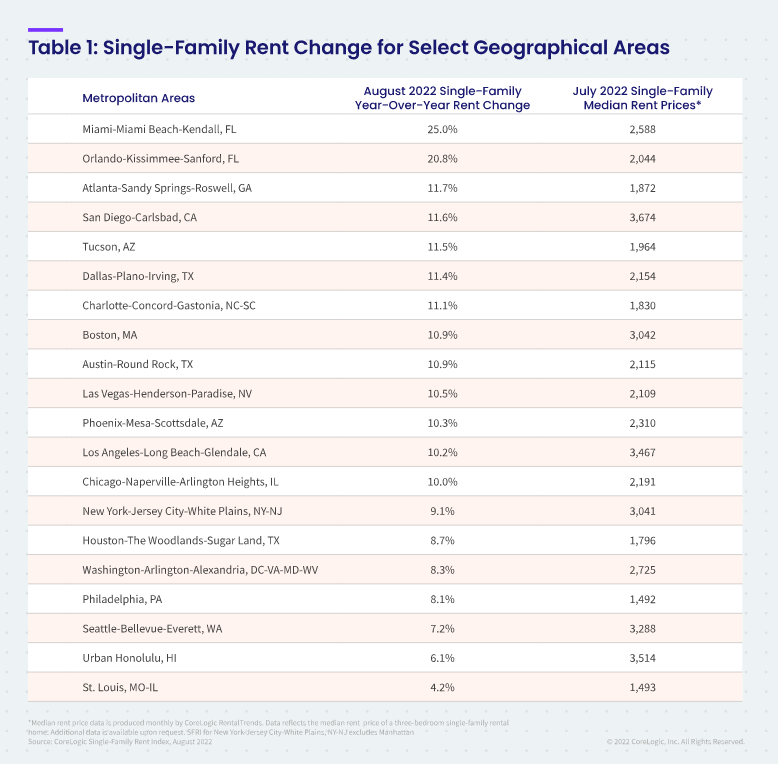

Of the 20 metro areas shown in Table 1, Miami posted the highest year-over-year increase in single-family rents in August 2022 at 25%, continuing its year-plus streak as the country’s hottest rental market. Orlando, Florida recorded the second-highest gain at 20.8%, while Atlanta ranked third at 11.7%. St. Louis posted the lowest annual rent price gain at 4.2%.

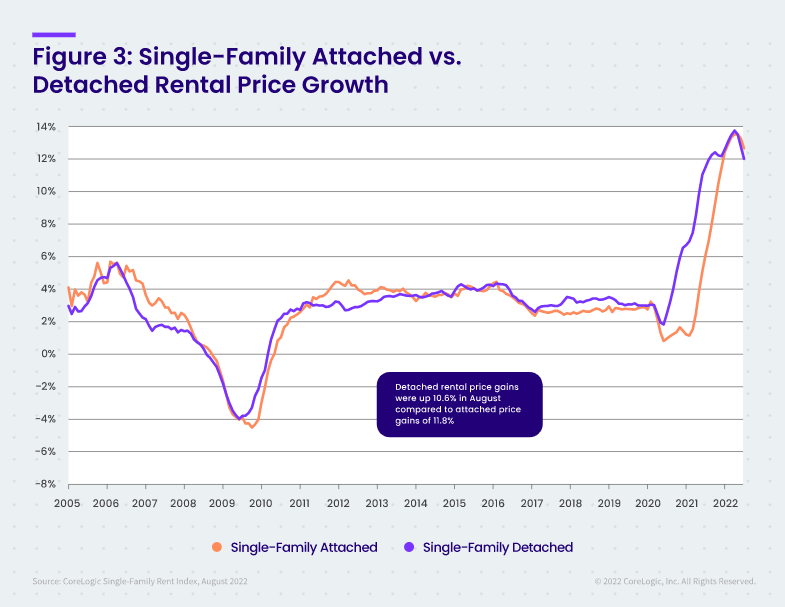

Differences in rent growth by property type emerged after COVID-19 took hold, as renters sought standalone properties in lower-density areas. This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate. However, this trend has recently shifted, and attached rental property prices grew by 11.8% year over year in August, compared to the 10.6% increase for detached homes. However, detached rental price growth is still outpacing that of attached homes on a two-year basis, a respective 23.7% compared with 19.5%.

Methodology

The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. CoreLogic constructed the SFRI for close to 100 metropolitan areas — including 47 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by CoreLogic RentalTrends. RentalTrends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.