As the acute phase of the pandemic has waned and life has returned to normal, leading players in the pharmacy space have been forced to confront the challenging retail environment – characterized by inflation and consumer trading down – facing other sectors. Traditional drugstore giants CVS Pharmacy, Inc. and Walgreens Co. have also had to contend with increasing competition from Amazon, Walmart and others. A look at foot traffic for the past few months confirms, however, that despite these challenges, both chains are still experiencing strong performances.

CVS’ Offline Engagement Continues to Thrive

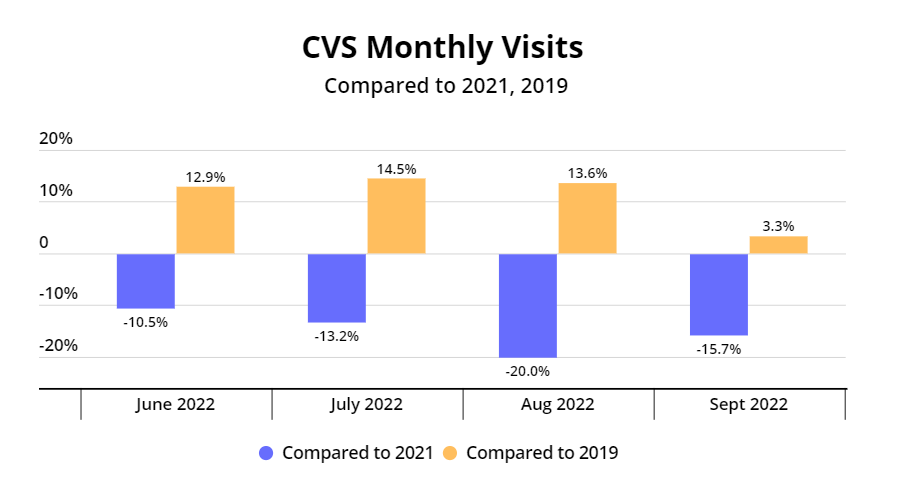

While foot traffic to CVS remained lower this year than in 2021 – when it was significantly buttressed by vaccine drives and other COVID-related consumer needs – it has continued to out-perform 2019 by a significant margin. Throughout the summer, the chain enjoyed visit increases ranging from 12.9% to 14.5%, even as the consumer price index surged. And although foot traffic growth dipped somewhat in September, visits remained higher than they were three years ago.

As key destinations for a wide range of essential items, drugstores are better positioned to weather economic headwinds than other, more discretionary, categories. CVS, which reported better-than-expected earnings for the second quarter of 2022, has sought to soften inflationary pressures through its loyalty program, which offers discounts and personalized coupons, and its cheaper, private-label brand. The company also made headlines last month when it announced steps to combat the “pink tax” – the higher cost often attached to women’s products – slashing prices on its own-brand menstrual line by 25% and assuming the sales-tax cost for period products in several states.

CVS’ continued draw can also be understood against the backdrop of its deepening involvement in the healthcare arena. Since purchasing insurer Aetna in 2018, CVS has been steadily expanding its healthcare offerings – including a growing number of MinuteClinics and HealthHUBs. In May this year the company launched an online platform for on-demand virtual doctor visits, and in September, it announced an $8 billion deal to buy Signify Health, a network of more than 10,000 clinicians specializing in home-based care. At the same time, the chain has redoubled its efforts to rightsize its fleet, with the goal of shutting down 900 underperforming stores by 2025.

Walgreens’ Visit Boom

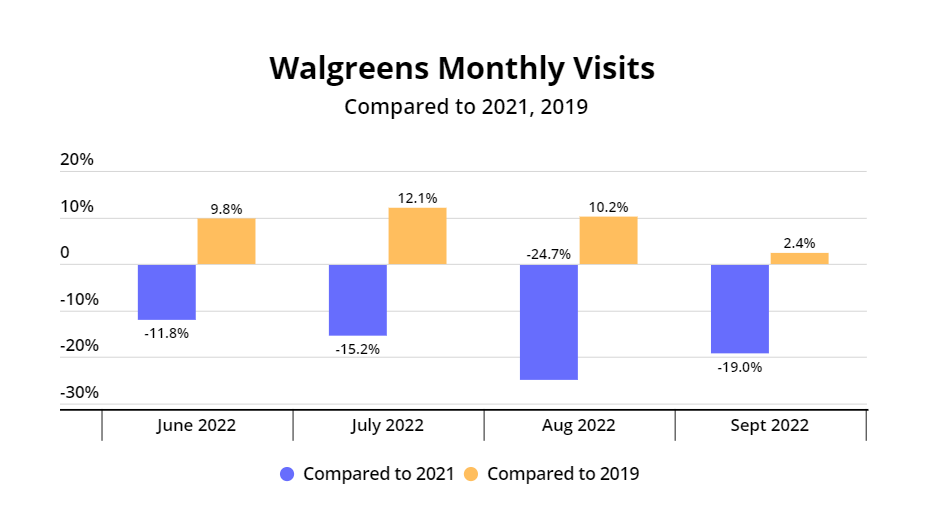

Walgreens, too, continued to see higher foot traffic in 2022 than it did in 2019. The trend has persisted, even if somewhat less markedly, into September, with visits up 2.4% relative to September 2019. These metrics align with the sales numbers the company reported last month: While U.S. retail sales were slightly down for the chain year over year for the quarter ending September 2022 – reflecting last year’s increased pandemic activity – same-store retail sales, excluding tobacco, were up 13% compared to 2019.

Even when prices are high, people still need medicines, toiletries, and other basic necessities – and Walgreens’ “hyper-localized” footprint makes it a popular destination for consumers who may remain eager to cut back on gas, even as prices begin to decline. With a 102M-member loyalty program and plans to ramp up its own-brand strategy, the company appears poised to remain on a positive trajectory.

Like CVS, Walgreens has also accelerated its foray into healthcare, partnering with Village Medical to provide full-service primary care practices at select Walgreens locations, and launching “Health Corners” to give customers more general wellness support. According to the company’s most recent earnings report – which reported better-than-expected quarterly results – 152 Walgreens branches currently boast a co-located Village Medical practice, a number on track to reach 200 by the end of the calendar year. In October, Walgreens announced its acquisition of the rest of home-care provider CareCentrix, and in recent months has indicated plans to utilize its well-placed retail locations to facilitate participation and diversity in drug trials.

A Strong Start to October

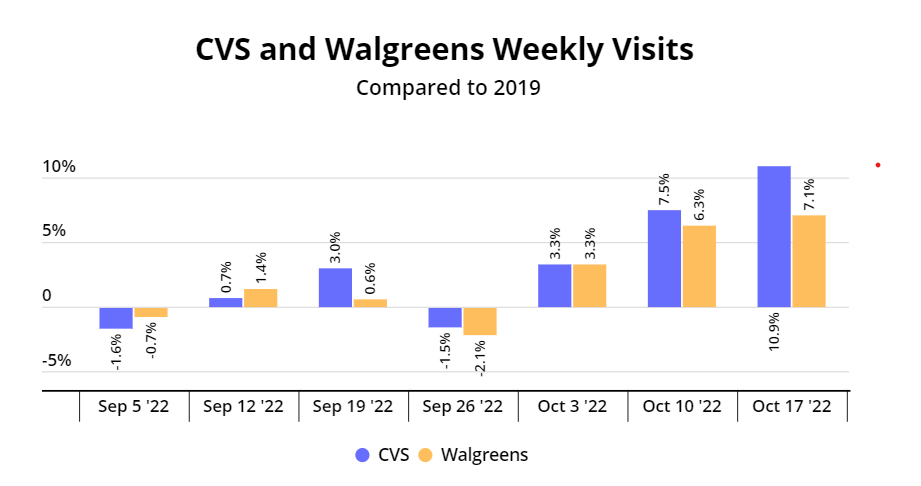

Drilling down into weekly foot traffic patterns for September and October, visit growth remained strong for both pharmacy chains. While Labor Day retail patterns likely contributed to a dip the first week of September, the numbers began to surge again as shoppers stocked up on candy, decorations and other Halloween gear. According to National Retail Federation data, people planned to spend a whopping $10.6B on Halloween-related goods this year – more than they did in 2019 – and 8% of them planned to shop at drugstores.

Looking Ahead

Despite promising signs of recovery, inflation will likely continue to impact the retail sector in the coming months. As both CVS and Walgreens up their healthcare games and deepen customer ties, the encouraging foot-traffic trends highlighted above serve as a strong indication that the industry giants remain well-positioned to succeed in difficult times.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.