Peloton was already in trouble when we wrote about its ad strategy earlier this year.

Fast forward a few months, and things are considerably worse.

Here are a few headlines that have hit the presses since May:

For the pandemic darling, these headlines seem unbelievable.

Unfortunately for Peloton and its advertisers, they’re not.

It’s Been a Rough Year for Peloton’s Advertising Budget

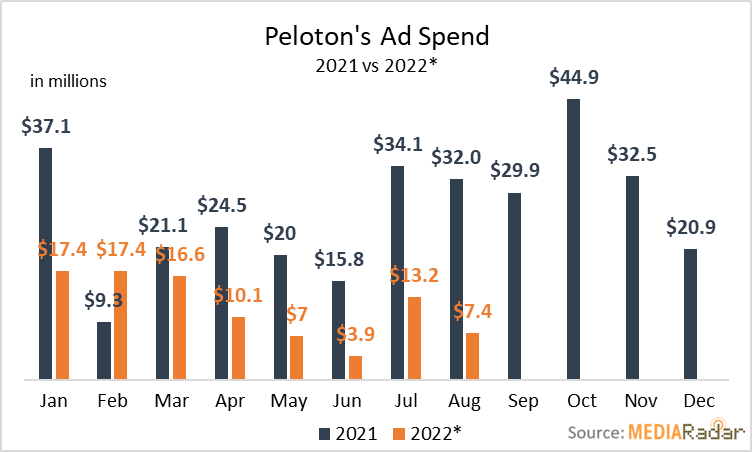

Peloton spent more than $322mm on ads in 2021, splitting it between TV (70%) and digital channels (30%).

The company’s growth, thanks to gym closures and quarantines, justified that level of spending as well as the massive surge leading up to the holidays.

Peloton spent nearly $45mm on ads in October alone.

However, plummeting profits and mass layoffs have restricted ad spending significantly.

Through August, advertisers for Peloton have invested around $93mm, representing a 52% YoY decrease compared to the same period in 2021 when it invested nearly $194mm.

They’re spending 57% less each month than they did in 2021 ($11.6mm vs. $26.8mm).

The only glimmer of hope this year came in February when spending increased by 87% to $17.4mm. Spending held relatively steady into March, decreasing by just 4.6% MoM.

Despite what the numbers may lead one to believe, the increase in spending didn’t stem from any positive momentum.

In fact, February was a rough month for Peloton.

The company halted production, saw its CEO resign, laid off thousands of employees, and watched its stock tumble after a brief spike following the CEO change.

There were even rumblings that Amazon and Nike were exploring an acquisition.

There’s no doubt that the increase in spending in February and March aimed to drown out the endless stream of bad press.

But, based on its stock price, which has declined steadily since February’s high, the strategy didn’t help.

Since February, Peloton’s marketing team has decreased spending rapidly, bottoming out at $3.9mm in June (a 61% decrease YoY).

There was a 241% MoM increase in July and a relatively sizable investment in August of $7.4mm. But that’s likely a hint at how the company will spend leading into the holidays rather than a sign that it’s rebounding financially.

In August, Peloton reported “widening losses and slumping sales” for its fiscal fourth quarter.”

Going Down a Different Path

Peloton’s future advertising plan is pure guesswork, but there’s no doubt it’ll look different than it did during its rise to the top of the fitness world.

Earlier in October, news broke that it was laying off 500 employees, mostly from its marketing department, including its acclaimed leader, Dara Treseder.

For all intents and purposes, Peloton’s marketing department is dead.

For a company having an identity crisis, slashing the marketing budget was a bold, even questionable, move.

Allen Adamson, co-founder and managing partner of marketing agency Metaforce, said, “Peloton’s struggles to redefine itself with consumers is likely to get tougher.”

Peloton’s new identity centers around a move away from its historic direct-to-consumer (DTC) model.

In September, the company announced that it’d start selling bikes and treads at Dick’s Sporting Goods.

That announcement came on the heels of a similar one about expanding its distribution network to Amazon.

Peloton’s new identity also includes selling used bikes to “value-minded customers” and a rental program that significantly expands its target market to more price-conscious consumers.

The ad dollars Peloton spends for the rest of the year will undoubtedly promote its new business model.

As doom and gloom as the situation may seem, Peloton still has a valuable business.

With nearly 3mm connected fitness subscriptions, the Peloton army is still very much alive.

So, while the company is bleeding, its ad reserves won’t dry up completely. Instead, they’ll be allocated in new ways, likely including an enhanced focus on digital ads.

Switching Gears to Digital Ads

So far in 2022, Peloton increased its investment in digital ads to 39%, up from 30% the year before.

With digital ad spending rising, Peloton pulled back on TV ads, decreasing spending on this format from 70% to 58%. (Peloton also added a few print ads to the mix.)

For Peloton, the shift is likely all about efficiency.

“TV spend isn’t as granularly measurable as digital, which likely explains the shift,” said Todd Krizelman, CEO, MediaRadar. “Peloton isn’t just cutting spend, they are putting dollars in the online channel where they can better evaluate performance and outcomes.”

A smart move, but with no one leading the marketing charge, it’ll be interesting to see the impact of the shift, especially as it enters the holiday season that has historically ignited spending for the company.

In the lead-up to the holiday season last year (Q3 and Q4), Peloton spent more than $190mm.

While this year’s holiday-spending surge likely won’t come close to last year’s, don’t be surprised if Peloton’s make-shift marketing team does invest the ad dollars it can find in the couch cushions.

Allen Adamson said, “It’s easier to cut marketing because the negative effects aren’t immediate…They have to sell a concept, especially given the recent pivot to ‘experiences’ versus selling equipment. To do that well, it needs a focused marketing team.”

For these reasons, Peloton’s ad strategy will persist, but by golly, it will look a whole lot different than last year.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.