Black Friday.

It’s a word pairing capable of producing an almost Pavlovian response. Simply hearing its name in the wind can have us reaching for our wallets, pulling out our credit cards, and making a beeline for that “Buy Now” button.

And it’s almost here. Yep – the seductive siren song of Black Friday is back for another year on November 25, ready to lure bargain-hungry consumers back into the arms of its irresistible discounts.

Below, you’ll find everything you need to know about Black Friday statistics, from 2020 and 2022 through to Black Friday’s history.

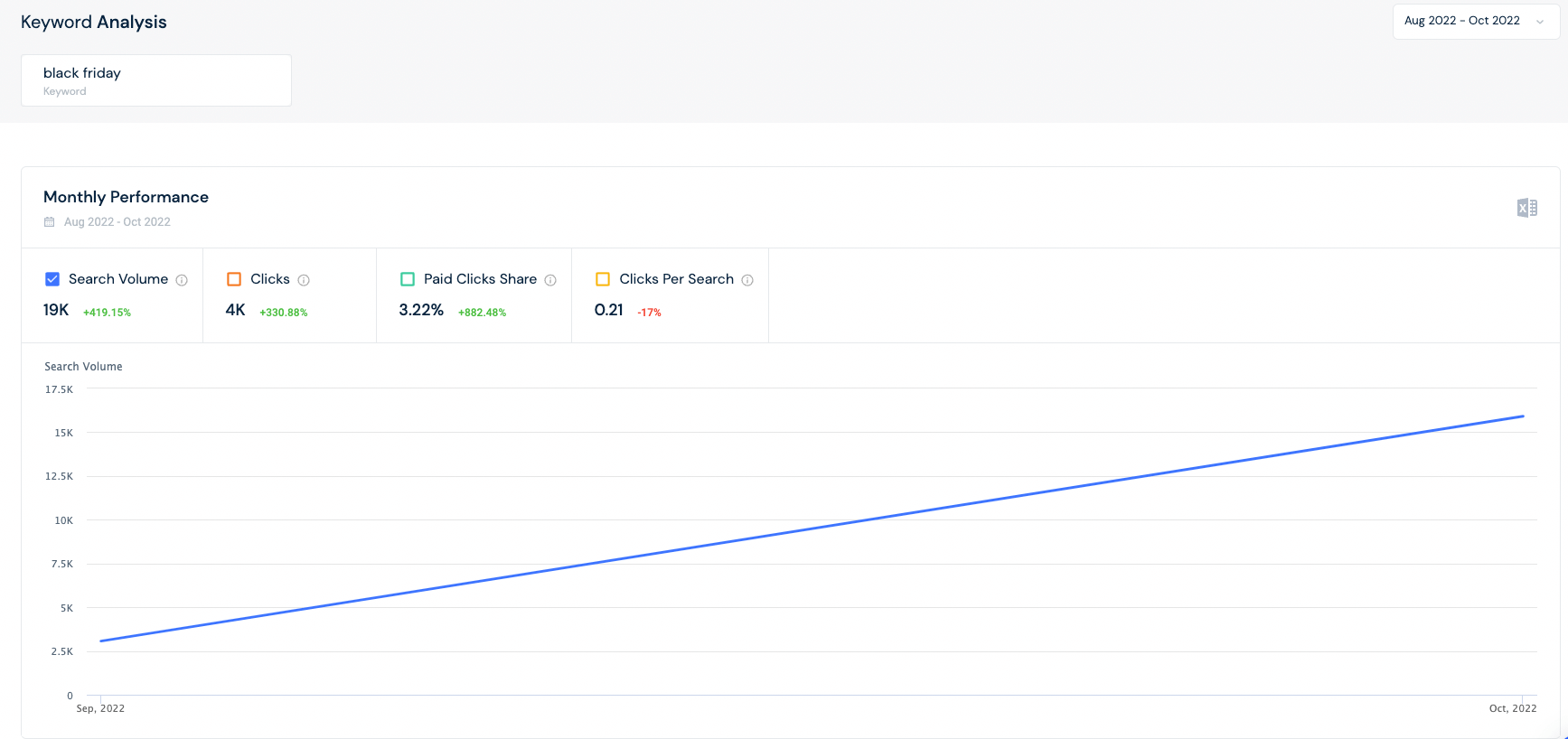

And what does this year have in store? We’ll tell you using data from Similarweb’s unique data, providing insights on traffic, trends, and shopper behavior.

Data trends from 2020-2021

Black Friday statistics 2020

Black Friday Statistics 2021

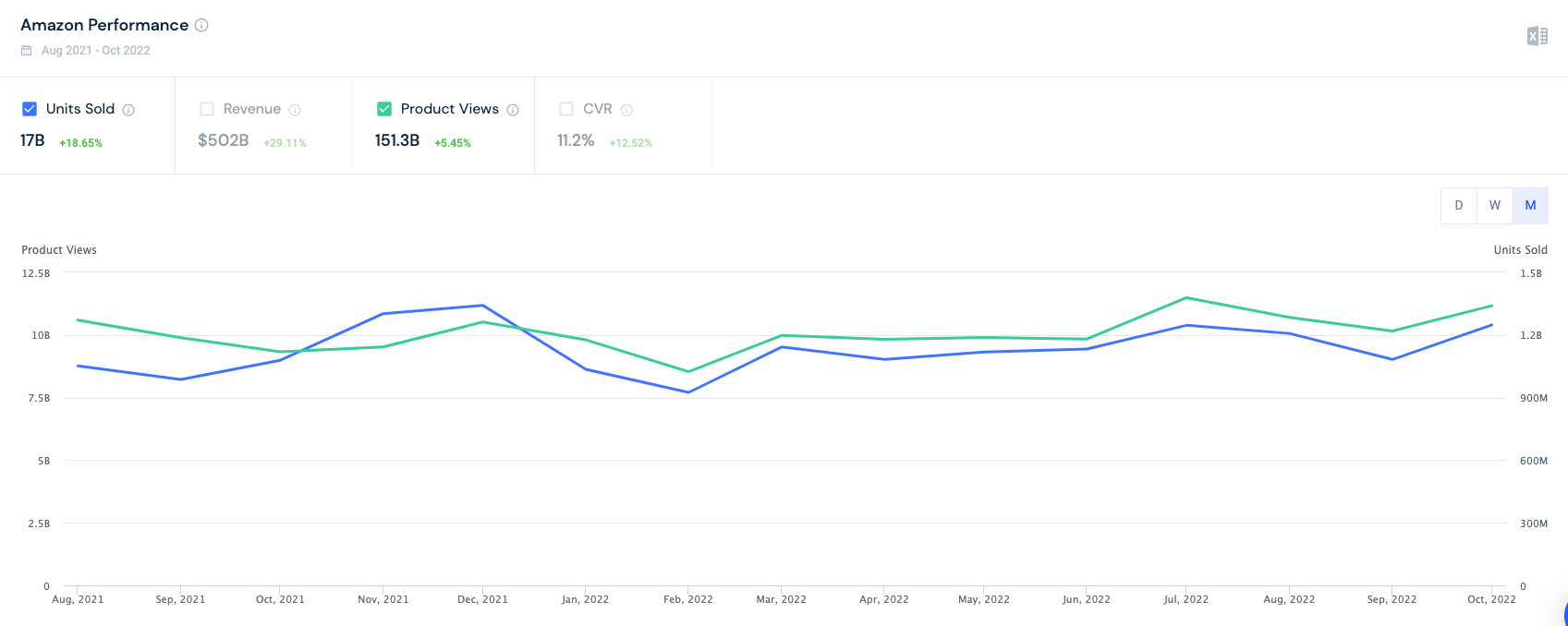

Black Friday 2022: Amazon trends and statistics

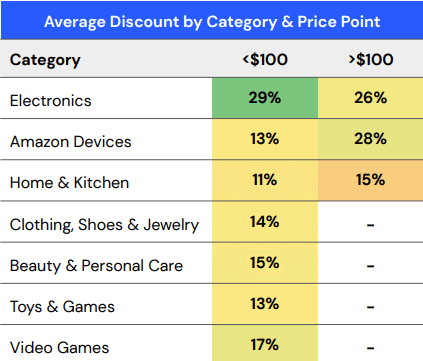

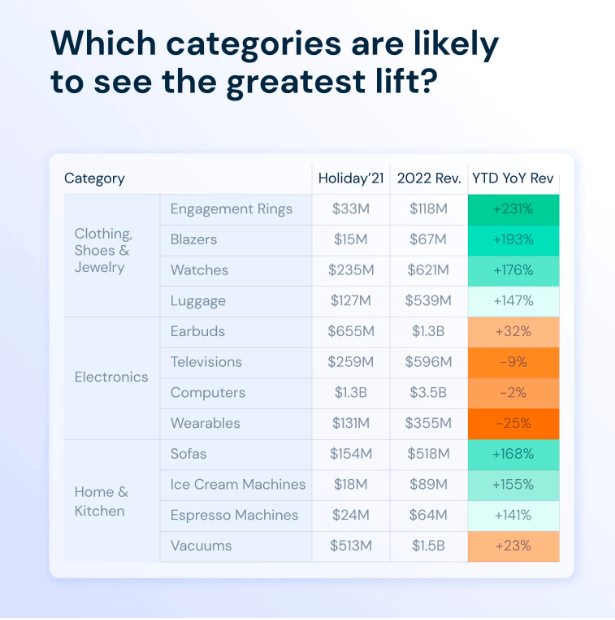

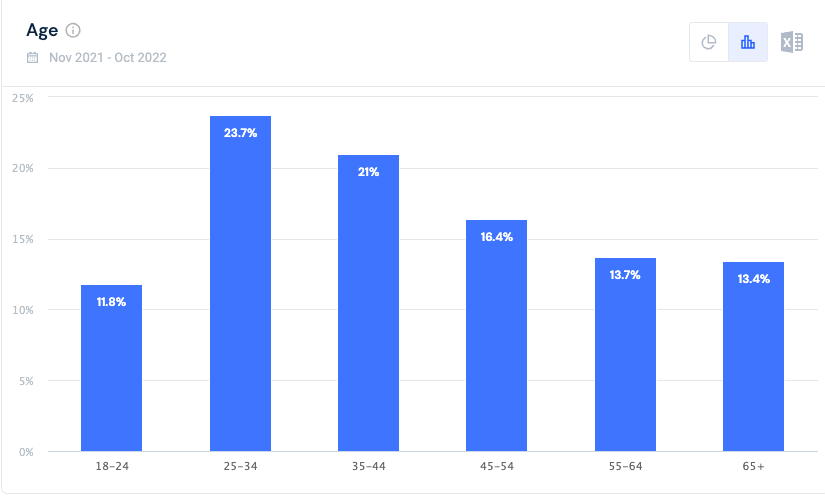

Similarweb Shopper Intelligence data shows that in this year’s ramp-up period clothing, electronics and home are the three biggest categories shoppers are interested in.

More than 74% of U.S. consumers start their product searches on Amazon, suggesting that Bezos’s monopoly isn’t just limited to Black Friday, as reported by emarketer.

Black Friday 2022: General ecommerce and shopper trends

What is the history of Black Friday?

The term began in Philadelphia in the 1960s referencing the day between Thanksgiving (Thursday) and the annual Army-Navy football game (Saturday). The police nicknamed it “Black Friday” because officers had to work long hours while dealing with horrible traffic and crowds. Since local retailers wanted to use those crowds to increase profits businesses reclaimed the name, saying that the day was when stores’ finances went from red ink to black.

The reclaimed term stuck and spread first across America, and now thanks to the globalized economy, to worldwide retailers.

Black Friday vs. Cyber Monday

Cyber Monday takes place on Monday immediately following Black Friday. With retailers offering exclusively online discounts, it acts essentially as Black Friday’s eCommerce counterpart. It’s also fair to say it’s just about the only Monday in the year anyone looks forward to!

2020 Cyber Monday – accounted for the biggest online shopping day in U.S. history, bringing in an astounding $10.7 billion. However, in 2021, shoppers spent about $100 million less than that.

While Black Friday certainly has a richer history, Cyber Monday is becoming the more hotly-anticipated event. Here are three key stats to help you best leverage the day:

Make ‘em shop ‘til they drop

There’s just enough time left to tweak your Black Friday strategy. Data is power and it’s all right at your finger tips. Leverage the statistics and trends in this blog to drive as much traffic as you can for the big day.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.