Retail foot traffic picked up again in October ahead of a much anticipated holiday season. We dove into the visit data to find out which categories are making the biggest comeback and how this year’s extended holiday season stacks up against 2021.

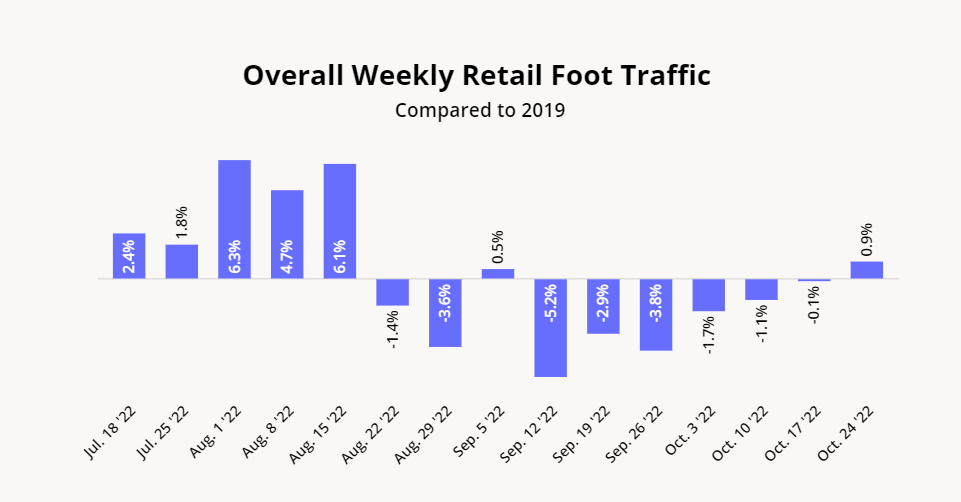

Year-over-Three-Year Foot Traffic Swings Positive

September was difficult for much of the retail landscape, as inflation took a toll on consumer spending. But the tide has turned in recently, with weekly visits since mid-October up relative to pre-pandemic 2019. Early holiday shoppers stocking up on gifts and consumers making peace with the current prices drove an October retail rebound ahead of a critical holiday season.

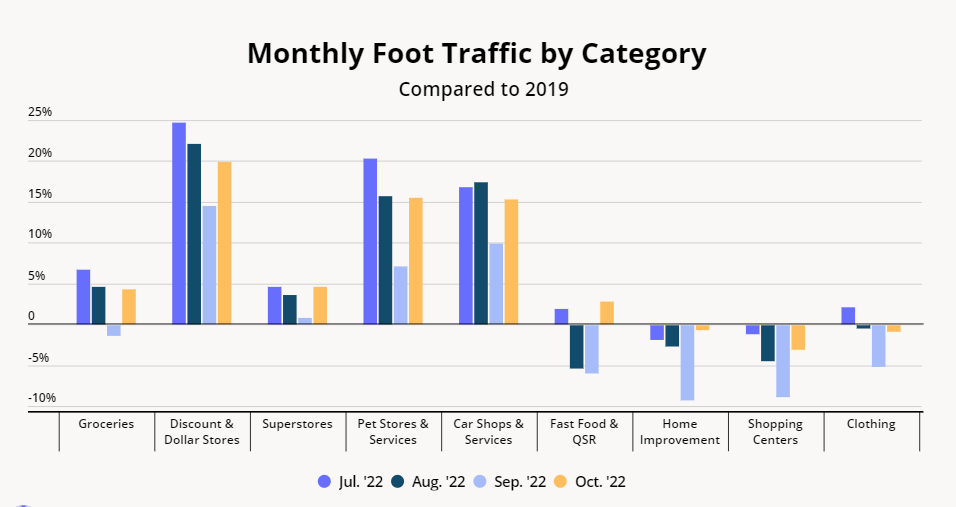

Positive Trends Across the Board

Critically, the October rebound was not limited to just a few retail segments – diving into key categories reveals that year-over-three-year (Yo3Y) foot traffic trends improved across the board. Sectors that were already on a Yo3Y growth path increased further, while segments that sustained foot traffic losses in previous months saw their visit gaps narrow.

Following a brief decline in September, the Grocery segment returned to growth with October visits up 4.3% relative to 2019. Discount & Dollar stores saw its Yo3Y foot traffic grow from 14.5% in September to 19.9% in October, while Yo3Y visits to Superstores rose from 0.8% to 4.6% in the same period. Yo3Y foot traffic growth to Pet Stores and Car Shops also accelerated.

October QSR visits were also up compared to 2019, reversing the Yo3Y declines of August and September. And Home Improvement, Shopping Centers, and Clothing didn’t quite reach 2019 levels, but still succeeded in narrowing their visit gaps significantly. The growth is critical, especially ahead of the holiday season and in the final stages of a year defined by tremendous volatility.

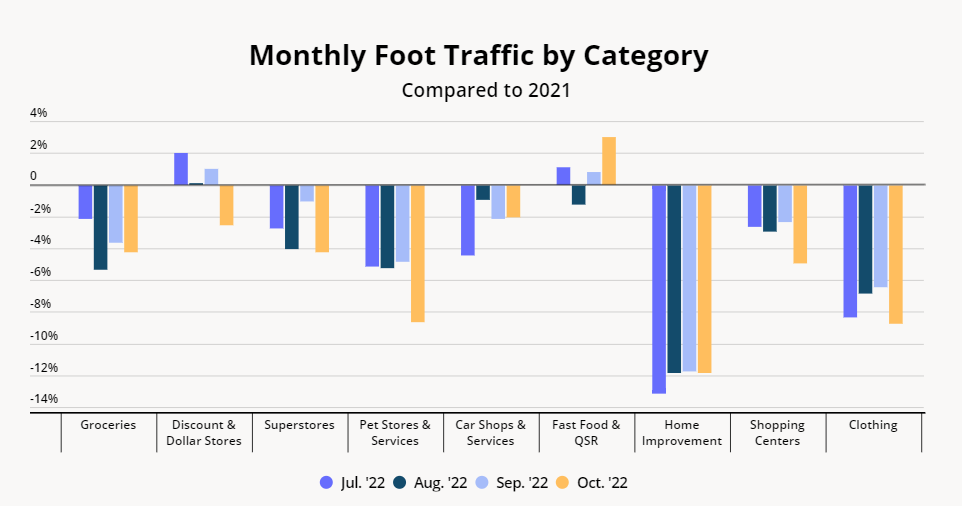

Critical Context For Year-over-Year Declines

And while many categories saw visits fall relative to 2021, the year-over-year (YoY) declines should also be understood within the context of the wider brick-and-mortar resurgence. Last year, as shops and services reopened, the pent-up demand of 2020 and early 2021 led to considerable retail visit surges – and now, foot traffic in many segments is normalizing. But the YoY declines are more a testament of the success of last year’s retail performance than they are indicative of any true contraction, especially given the wider picture of Yo3Y strength.

2022’s Extended Holiday Season

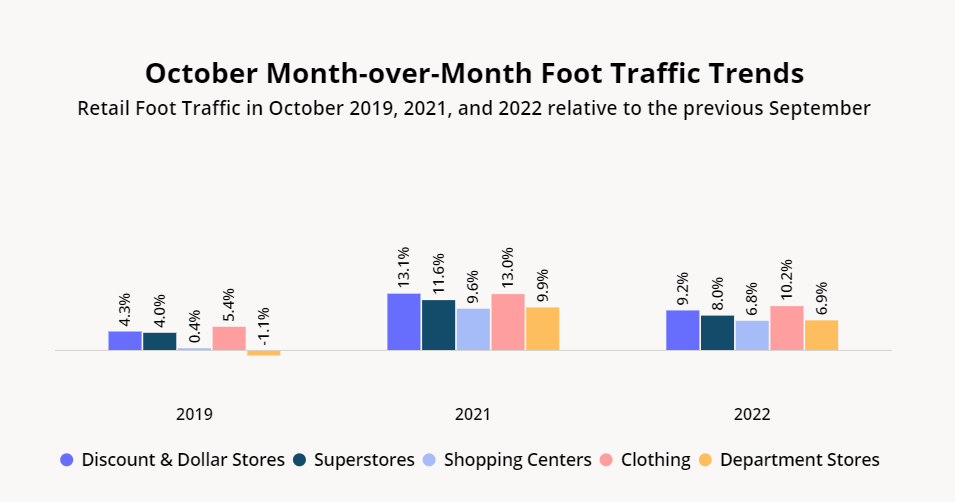

Month-over-month (MoM) data also provides another reason for optimism ahead of the holidays. Pre-pandemic, holiday shopping usually began in November, with Black Friday marking the official start of the season. This is illustrated by pre-pandemic October MoM visit trends – foot traffic data also shows that October 2019 visits to key retail categories such as Shopping Centers and Department Stores stayed relatively close to September 2019 levels.

But last year’s holiday season extended into the early fall, as retailers called on customers to shop for gifts ahead of time in anticipation of supply chain related shortages. Customers listened and drove the start of the holiday shopping season up, with key retail categories seeing a significant MoM boost in October 2021.

This year also saw a noticeable MoM increase in October retail visits, although the growth was not as dramatic as in 2021. Critically, however, many retailers have recently reported inventory excesses – so this year’s extended holiday season is likely not driven by customers looking to avoid last-minute empty shelves. Instead, the early start to the 2022 holiday season may be motivated by consumers excited to shop for the first “normal” holiday season since the end of the pandemic. So while this year’s October MoM increases are not as sharp as last year’s, the customer-driven extension of the holiday season beyond November despite inflation and tighter budgets is an extremely positive sign for what lies ahead.

It is also important to remember that, although 2021’s holiday season started early, its peaks were limited by the impact of Omicron in mid-December. But this year, the holiday season is both starting early and expected to continue all the way through, which should give retailers even more time than last year to serve consumers looking to make the most of this year’s holidays. If current trends continue, then, 2022’s extended holiday shopping season may well outperform 2021’s.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.