Pandemic-driven shifts away from retail shopping during the 2020 holiday season raised the question of whether sales events such as Black Friday would draw shoppers back to stores in 2021. Looking at in-store consumer trends for major department store companies—Macy’s Inc (NYSE: M), Kohl’s (NYSE: KSS), Dillard’s (NYSE: DDS), J.C. Penney, and Nordstrom Inc (NYSE: JWN)—during Black Friday week over the past three years, only Dillard’s retail sales during Black Friday week in 2021 reached pre-COVID levels. Among the public department store companies in this peer group, Kohl’s also saw the highest share of its fiscal quarter sales occur during Black Friday week.

Did in-store shopping make a comeback for department stores during Black Friday week in 2021?

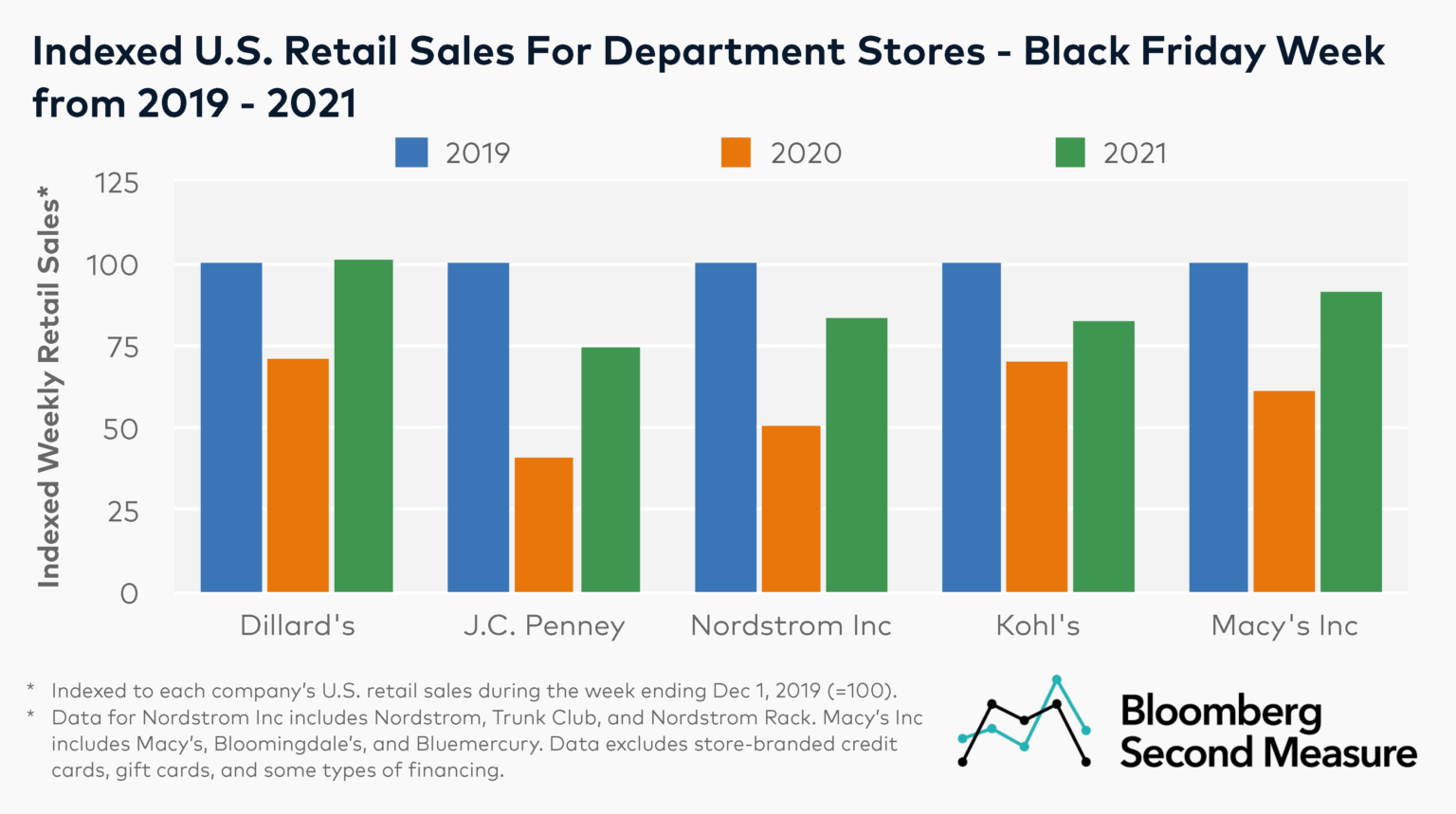

Consumer spending data shows that between Black Friday week in 2019 and 2020, in-store sales declined 29 percent at Dillard’s, 30 percent at Kohl’s, 39 percent at Macy’s Inc, 50 percent at Nordstrom Inc, and 59 percent at J.C. Penney. For the department store companies within our analysis, only Dillard’s in-store sales reached pre-pandemic levels during Black Friday week in 2021. Dillard’s sales during that week were 1 percent higher than in 2019.

Although below 2019 levels, Black Friday week retail sales at the other companies grew between 2020 and 2021. Compared to Black Friday week in 2019, retail sales during the comparable week in 2021 were down 9 percent at Macy’s Inc, 17 percent at Nordstrom Inc, 18 percent at Kohl’s, and 26 percent at J.C. Penney. Notably, J.C. Penney experienced the most year-over-year growth in retail sales during Black Friday week in 2021, with an increase of 81 percent.

One of the in-store consumer trends potentially affecting sales is that all of these companies kept their stores closed on Thanksgiving Day in 2020 and 2021. Dillard’s and Nordstrom Inc were also closed on Thanksgiving in 2019.

How did Black Friday week sales compare to sales during the rest of the holiday fiscal quarter in 2021?

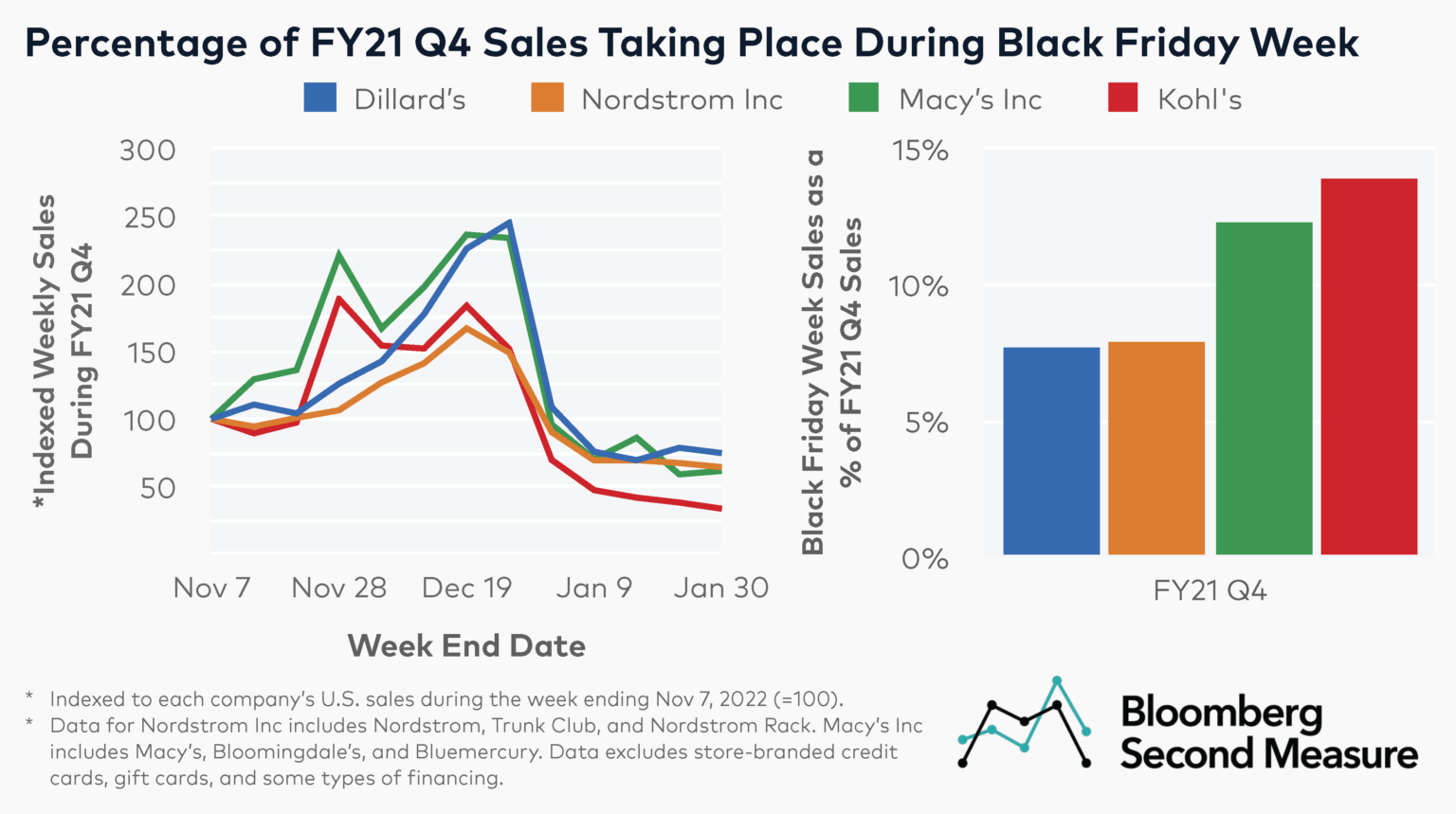

Transaction data reveals that for the public department store companies in our analysis, Black Friday week sales accounted for the highest share of sales in FY21 Q4 at Kohl’s. In FY21 Q4, 14 percent of sales at Kohl’s occurred during Black Friday week, compared to 12 percent at Macy’s Inc and 8 percent at Nordstrom Inc and Dillard’s.

Looking at weekly sales trends during the holiday fiscal quarter, all four of these retailers saw their highest sales volume in mid-December, followed by declines in the new year. Among the companies, Kohl’s and Macy’s Inc experienced the highest week-over-week sales growth during Black Friday week in 2021, with respective increases of 94 percent and 62 percent. Dillard’s week-over-week sales growth during Black Friday week was 21 percent, while Nordstrom Inc’s was 6 percent.

Shoppers reportedly found fewer deals on Black Friday 2021 than in prior years. Within the overall consumer discretionary sector, some companies have also been extending the holiday shopping season by holding sales prior to Black Friday. For example, Nordstrom, Kohl’s and Macy’s launched early access Black Friday deals during the first week of November in 2021. In 2022, companies such as Walmart, Target, and Amazon also held sales events in early October.

Department stores are preparing for 2022 holiday shopping

Department store companies have been on a hiring spree in advance of the 2022 holiday season. Macy’s also recently launched an in-store partnership with Toys ‘R Us. Nordstrom is planning a variety of in-store and virtual events for holiday shopping, in addition to offering Christmas tree lots at some locations. Ahead of the holiday shopping season in 2022, Dillard’s also exceeded investors’ expectations in its recent third-quarter earnings report.

Leadership changes are forthcoming, too. Kohl’s recently announced that its CEO would be leaving the company by the end of the year. Kohl’s had previously been in talks about a potential buyout, but terminated discussions over the summer.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.