Overview

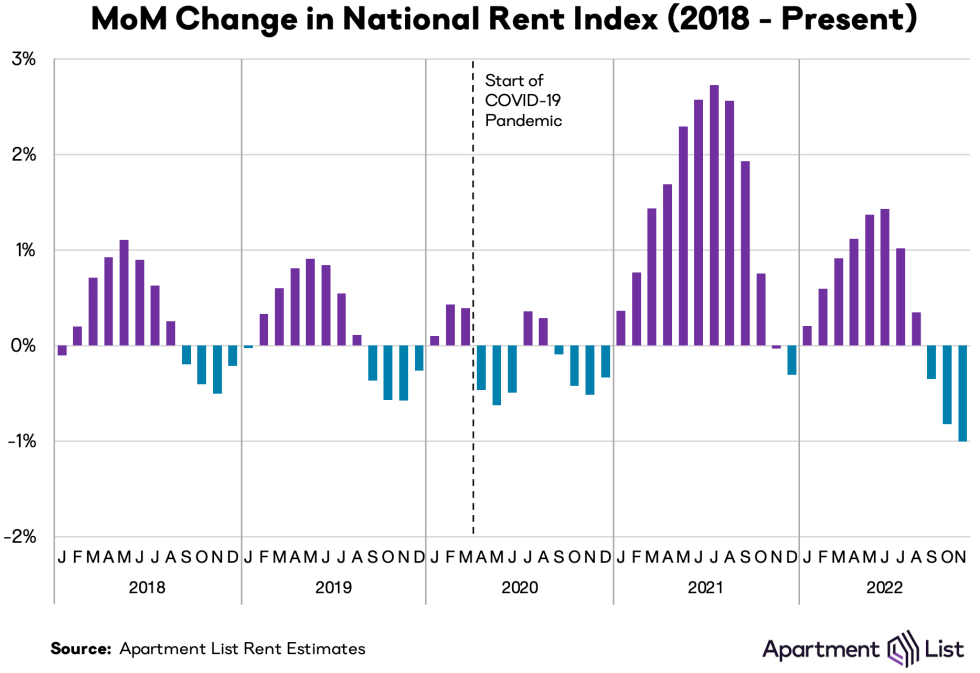

Welcome to the December 2022 Apartment List National Rent Report. Our national index fell by 1 percent over the course of November, marking the third straight month-over-month decline, and the largest single month dip in the history of our index, going back to 2017. The timing of the recent cooldown in the rental market is consistent with the typical seasonal trend, but its magnitude has been notably sharper than what we’ve seen in the past, suggesting that the recent swing to falling rents is reflective of a broader shift in market conditions beyond seasonality alone. Going forward it is likely that rents will continue to dip further in the coming months as we move through the winter slow season for the rental market.

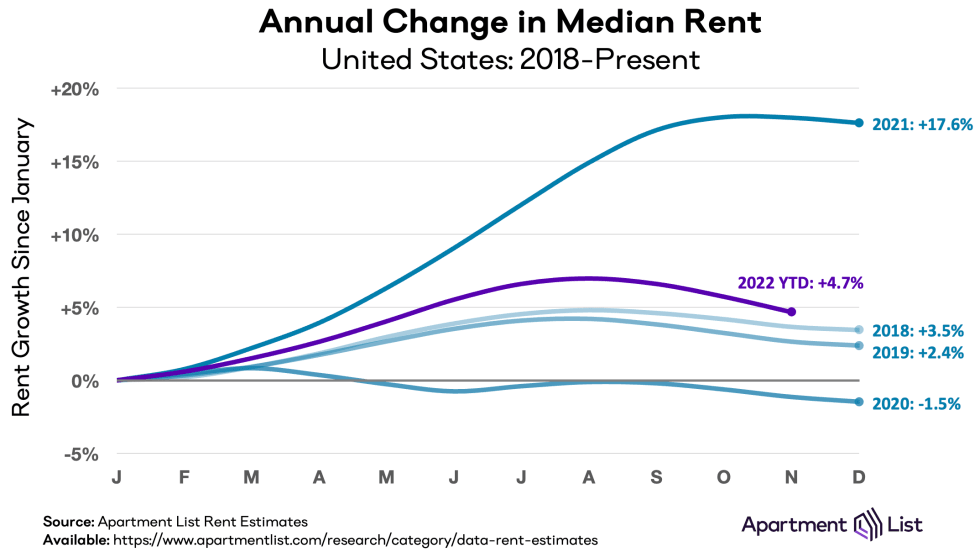

Over the course of the year as a whole, rent growth is continuing to outpace pre-pandemic years, but by an increasingly small margin. From January through November of this year, rents are up by a total of 4.7 percent, which is much closer to the growth rates we saw in 2018 and 2019 than it is to the astronomical 18 percent growth that we saw at this point last year. Year-over-year growth has decelerated rapidly since the start of the year, and is quickly converging back to pre-pandemic levels.

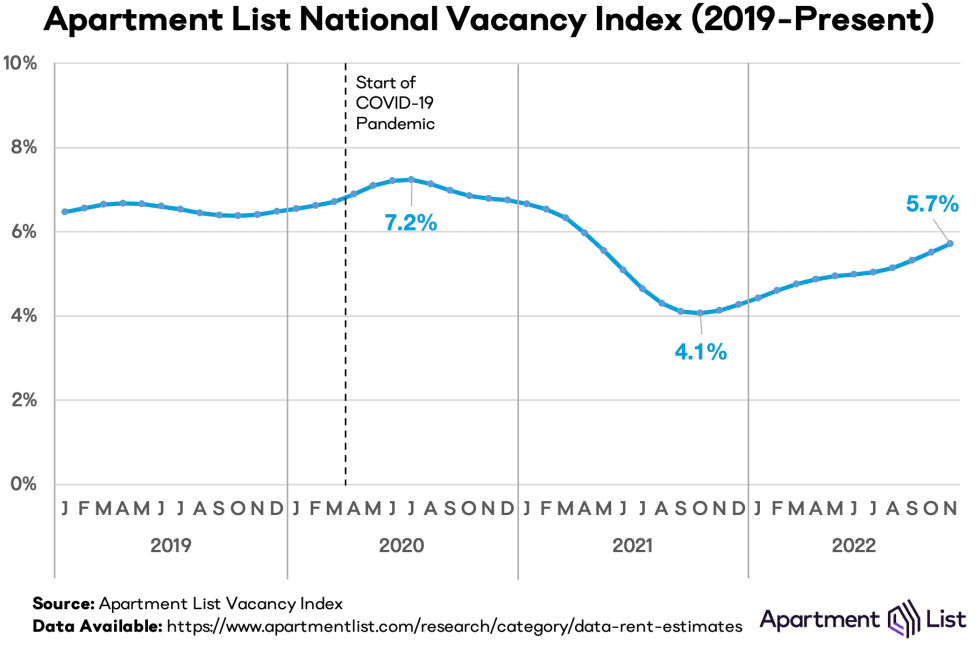

The cooldown in rent growth is being mirrored by continued easing on the supply side of the market. Our vacancy index now stands at 5.7 percent, after more than a year of gradual increases from a low of 4.1 percent last fall. And in the past three months, this easing of the vacancy rate has picked up steam again, after plateauing a bit over the summer. Today’s vacancy rate still remains below the pre-pandemic norm, but could get back to that benchmark as early as next spring, if the current rate of easing continues.

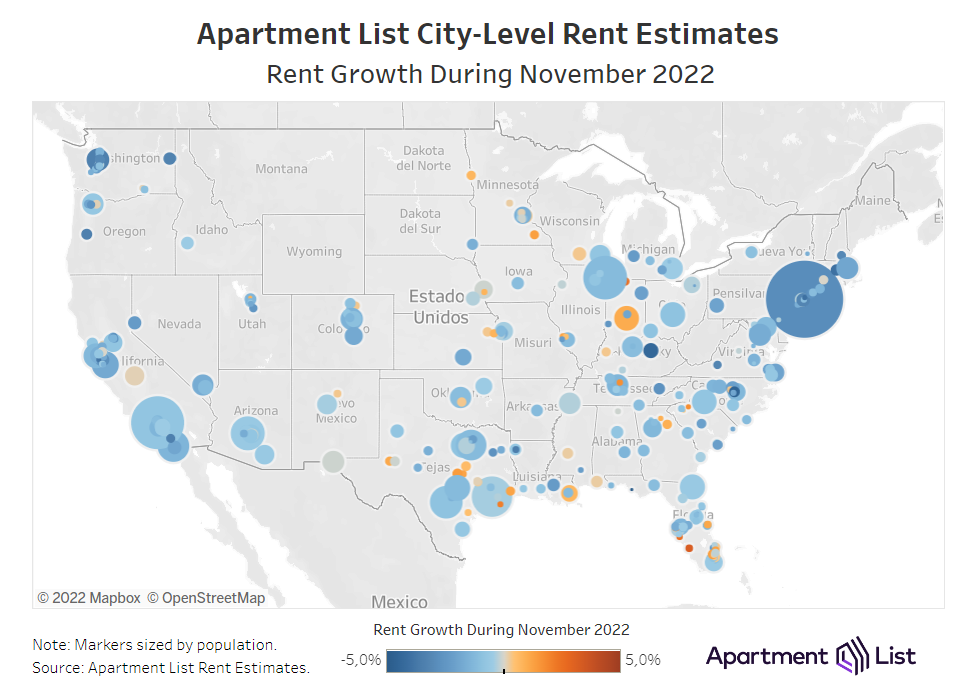

The recent slowdown has been geographically widespread. Rents decreased this month in 93 of the nation’s 100 largest cities in October. Among large metros nationwide, Seattle saw the sharpest decline in November, with prices down by 2.6 percent month-over-month. And over a longer horizon, we are continuing to see an ongoing cooldown in many of the recently booming Sun Belt markets. Las Vegas, Phoenix, Jacksonville, and Riverside have all seen rent growth of 30 percent or more since March 2020, but none of these metros has seen rents increase by more than 1 percent over the past twelve months.

Rents nationally fall by 1% month-over-month; prices still up 4.6% year-over-year

The national median rent increased by a record-setting 17.6 percent over the course of 2021. This rapid growth in rent prices is a key contributor to overall inflation, which is currently rising at its fastest pace in four decades.1 With inflation top-of-mind for policymakers and everyday Americans alike, our rent index is particularly relevant, since movements in market rents lead movements in average rents paid. As a result, our index can signal what is likely ahead for the housing component of the official inflation estimates produced by the Bureau of Labor Statistics. Thankfully for the country’s renters, our national rent index has shown rent growth decelerating quickly in recent months. In fact, for the past three months, our index has actually been declining.

We estimate that the national median rent fell by 1 percent month-over-month in November. This is the third consecutive monthly decline, and the second straight month in which our index has broken the record for the largest monthly decline in its history, which starts in January 2017. A modest decline in rents at this time of year is consistent with the normal seasonal trend that we typically see in our rent index, as rental activity tends to slow down in the fall and winter months. That said, this year’s dip has so far been sharper than what we typically see. Prices have now fallen by a total of 2.2 percent since August, which is the sharpest three-month decline in the history of our index. For comparison, from August through November of last year, prices increased by 2.7 percent, as the market continued on an unprecedented stretch of record-setting rent growth which disrupted seasonal trends. The recent dip suggests that we may be entering a new phase of the rental market rollercoaster, with changing economic conditions now driving a cooldown rental demand just as supply constraints are easing. It’s likely that rents will decline further in the months ahead, as rental market activity continues to slow during the winter months.

It should be noted that even as the market cools, rent growth in 2022 is still trending faster than in pre-pandemic years, but the gap is quickly narrowing. From January through November of this year, our national rent index has increased by a total of 4.7 percent. At this time last year, rents were growing nearly four times as fast, with an increase of 18 percent through November. Instead, this year’s growth is now looking much closer to that of pre-pandemic years. For comparison, rent growth from January to November totalled 3.7 percent in 2018, 2.7 percent in 2019, and -1.1 percent in 2020. If December marks another sharp decline, full year rent growth for 2022 could end up right around the modest level we saw in 2018 (+3.5 percent).

As rent growth slows, vacancies ease

As we’ve explored in detail, much of the 2021 rent boom was attributable to a tight market in which more households were competing for fewer vacant units. Our vacancy index spiked above 7 percent in the early months of the pandemic in 2020, as many Americans consolidated households and moved in with family amid the uncertainty and economic disruption of the pandemic’s onset. After that, however, rapid household formation drove a sharp tightening of the vacancy rate, which eventually fell to a low of 4.1 percent last fall.

But after bottoming out at 4.1 percent in October 2021, our national vacancy index has been on a trend of gradual easing. As of this month, it has now over a full year of continued, albeit slow, improvements. In fact, the pace at which the vacancy rate is easing has been picking up a bit of steam in recent months, as rent growth has turned negative. From April through August, our vacancy index ticked up by a total of just 0.2 percentage points, from 5.1 percent to 5.3 percent. But from August through November, it has increased by 0.6 percentage points, reaching 5.7 percent this month.

After a prolonged period of skyrocketing rent growth, and with non-housing related costs also getting more expensive as a result of broad-based inflation, it seems that some Americans are moving back in with family or roommates, or delaying striking out on their own. At the same time, new apartment construction is picking up steam again after facing pandemic-related delays in recent years. This combination of slowing household formation and rising inventory is driving the recent shifts that we are seeing in both our rent growth and vacancy indexes.

Vacancy trends are highly localized, and they have been a key indicator of rapidly evolving conditions in local markets across the U.S. throughout the pandemic. To explore the topic in greater detail, monthly vacancy data are now available for download for hundreds of cities, metros, and states, and can be easily linked to our existing rent estimates using Federal Information Processing System (FIPS) codes.

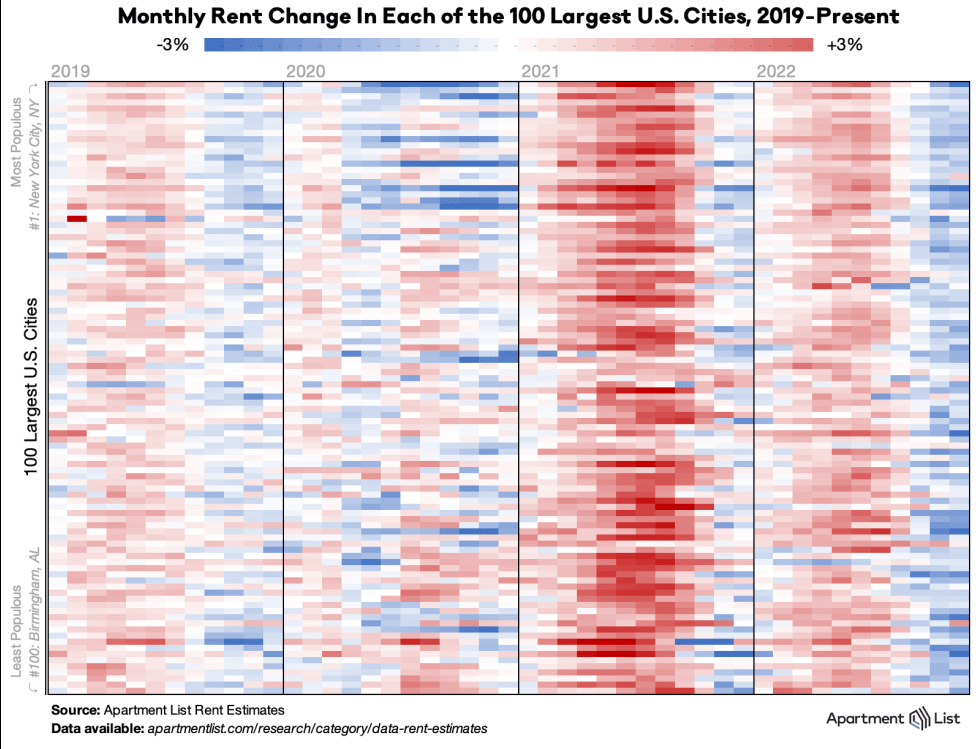

Rents fall month-over-month in 93 of 100 largest cities

The chart below visualizes monthly rent changes in each of the nation’s 100 largest cities from January 2019 to present. The color in each cell represents the extent to which prices went up (red) or down (blue) in a given city in a given month. In 2020, we can see that rents fell sharply in many of the nation’s largest and most expensive cities, while smaller and more affordable ones picked up steam, leading to some convergence in prices. Meanwhile, the dark red band in 2021 depicts last year’s rent heatwave, which peaked in July and August 2021 when all 100 cities in this chart saw prices go up. The rightmost columns show that the recent cooldown has also been geographically widespread.

Rents decreased this month in 93 of the nation’s 100 largest cities, while only seven cities saw prices increase. And nearly across the board, local rent growth has cooled down since last year – 97 of the top 100 cities have seen slower year-to-date rent growth in 2022 than they did over the same months of 2021. The largest city-level decline this month was in Lexington, KY, where rents fell sharply by 4.4 percent from October to November. Seattle had the second sharpest month-over-month decline, with the median rent there down by 3.4 percent. Seattle saw one of the nation’s biggest rent declines in the early phases of the pandemic, with prices falling by 21 percent from March through December of 2020. In the time since, Seattle rents rebounded strongly and more than made up that lost ground, but with this month’s dip, the median rent in Seattle is now back below it’s pre-pandemic level by 0.8 percent, making it one of just four cities in the country where rent prices are currently lower than they were in March 2020.

Midwest markets picking up steam

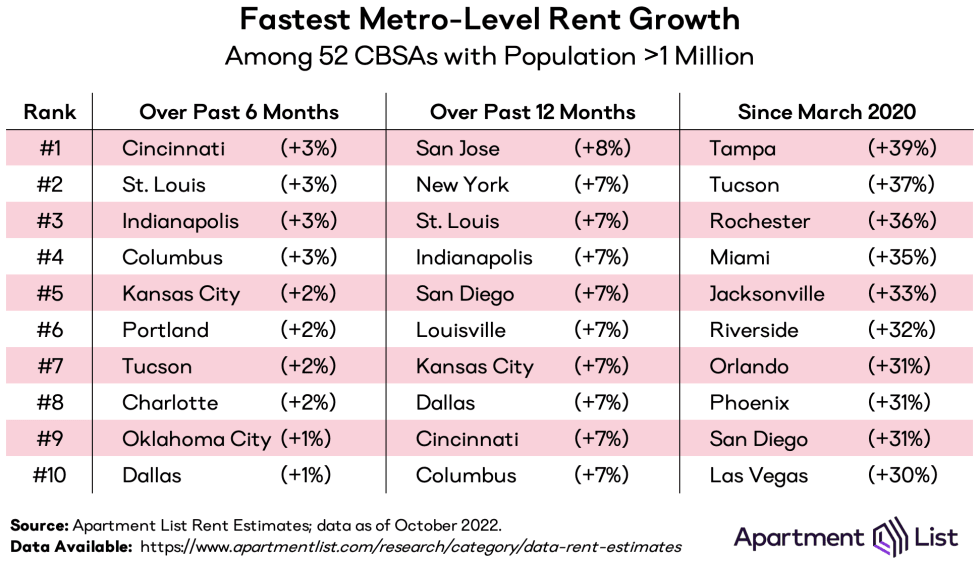

Major markets throughout the Sun Belt have experienced truly disruptive levels of rent growth since the start of the pandemic, but over the past six months, the fastest growth has actually been occurring in the Midwest. The following table shows the ten metropolitan areas that have experienced the fastest rent growth over the past six months, over the past year, and since the pandemic started in March 2020:

The six month column is topped by five Midwestern metros – Cincinnati, St. Louis, Indianapolis, Columbus, and Kansas City. With many previously affordable Sun Belt markets having seen rents spike by 30 percent or more over the past two and a half years, markets in the Midwest may now represent some of the last bastions of affordability, and could therefore be drawing new attention. That said, given the recent nationwide cooldown in rent growth, even the metros currently topping this list are experiencing relatively modest growth compared to what we were seeing last year. Even though Cincinnati tops the six-month list, the metro has seen prices rise by just 3.3 percent since May.

Over the past year, the San Jose metro has seen the nation’s fastest growth. But again, the levels of growth that we see here offer more evidence of the rapid national slowdown in rent growth. Currently, no large metro has experienced double digit rent growth over the past twelve months. In contrast, as recently as July, 36 of the 52 metros with a population over one million had year-over-year growth rates above 10 percent.

Some booming Sun Belt markets have plateaued

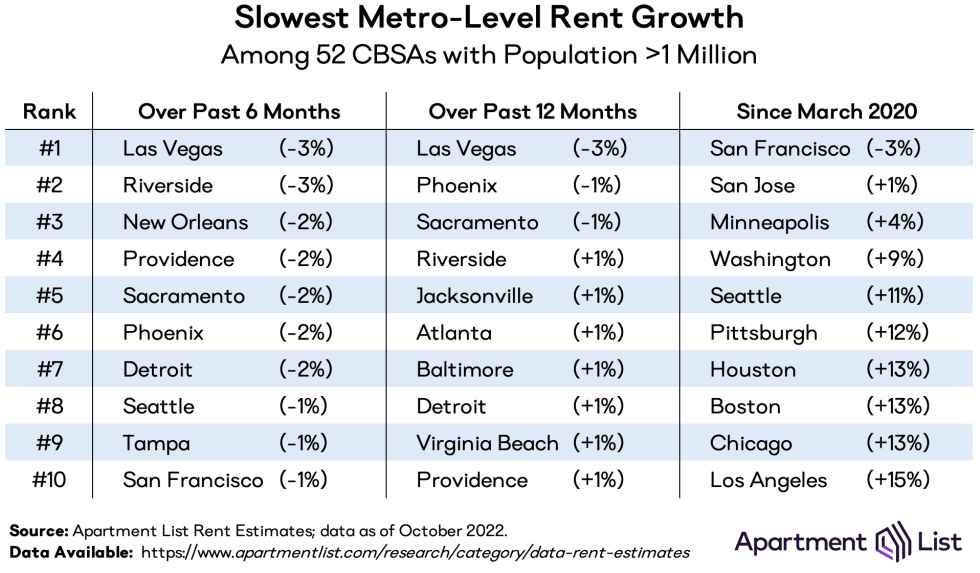

The San Francisco metro experienced the sharpest rent decline in the first year of the pandemic, and has been the slowest market to recover in the time since then. It now looks as if this sluggishness could be set to continue with a seasonal slowdown. Metro-wide, Bay Area rents fell by 1.5 percent in October and are down by 3.3 percent since August, both figures representing a sharper cooldown than the national average. This dip has brought the metro’s median rent back below its March 2020 level, making it the only large metro where the median rent is currently cheaper than it was at the pandemic’s onset. And at the city-level, some markets in the San Francisco Bay Area are recovering even more slowly, particularly in the more densely populated core cities. In Oakland, rents are still down 13.5 percent compared to March 2020 – the biggest discount among the 100 largest cities – while in San Francisco proper, rents are still down 10.9 percent.

After San Francisco the right-most column of the table is largely populated by other pricey coastal metros, including San Jose; Washington, D.C.; Seattle; Boston; and Los Angeles. Even as many of these markets have rebounded over the past year and a half, they have still had among the most modest rent growth over the course of the pandemic as a whole. That said, just four metros have experienced rent growth of less than 10 percent over the past two and a half years.

Notably, the table above also shows how some of the markets that had been booming fastest are now showing signs of cooling off. For example, over the past year, prices are slightly down in Las Vegas (-3 percent) and Phoenix (-1 percent), despite the fact that both metros rank among the top ten for fastest pandemic-era rent growth, with increases of 30 percent or more since March 2020. Jacksonville and Riverside similarly rank in the top 10 for both fastest growth since March 2020 and slowest growth over the past year. And in the Tampa metro, which has seen the single largest rent increase since the start of the pandemic (+39 percent), prices are down by 1 percent over the past six months. After booming consistently for two years, these markets are finally beginning to plateau.

Conclusion

Rent prices have dipped nationally for three straight months, and November’s 1 percent decline represents a record in our data. Year-over-year rent growth now stands at 4.6 percent, and is quickly falling back to pre-pandemic levels. The recent cooldown seems to suggest a shift in market conditions that goes beyond seasonality alone, as demand cools and supply constraints continue to abate. In the winter months ahead, we expect rental activity will continue to slow and we are likely to see continued price decreases to close out the year. That said, the recent declines are still quite modest in comparison to the skyrocketing growth of last year, and the national median rent is still 23 percent higher than it was in January 2021.

****

****

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.