Through October 2022 with Forecasts through October 2023

Introduction

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through October 2022 with forecasts through October 2023.

CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes home price indices (including distressed sales); home price forecast and market condition indicators. The data incorporates more than 40 years of repeat-sales transactions for analyzing home price trends.

HPI National Change

October 2022 National Home Prices

Home prices nationwide, including distressed sales, increased year over year by 10.1% in October 2022 compared with October 2021. On a month-over-month basis, home prices declined by 0.1% in October 2022 compared with September 2022 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).

Forecast Prices Nationally

The CoreLogic HPI Forecast indicates that home prices will increase on a month-over-month basis by 0.0% from October 2022 to November 2022 and on a year-over-year basis by 4.1% from October 2022 to October 2023.

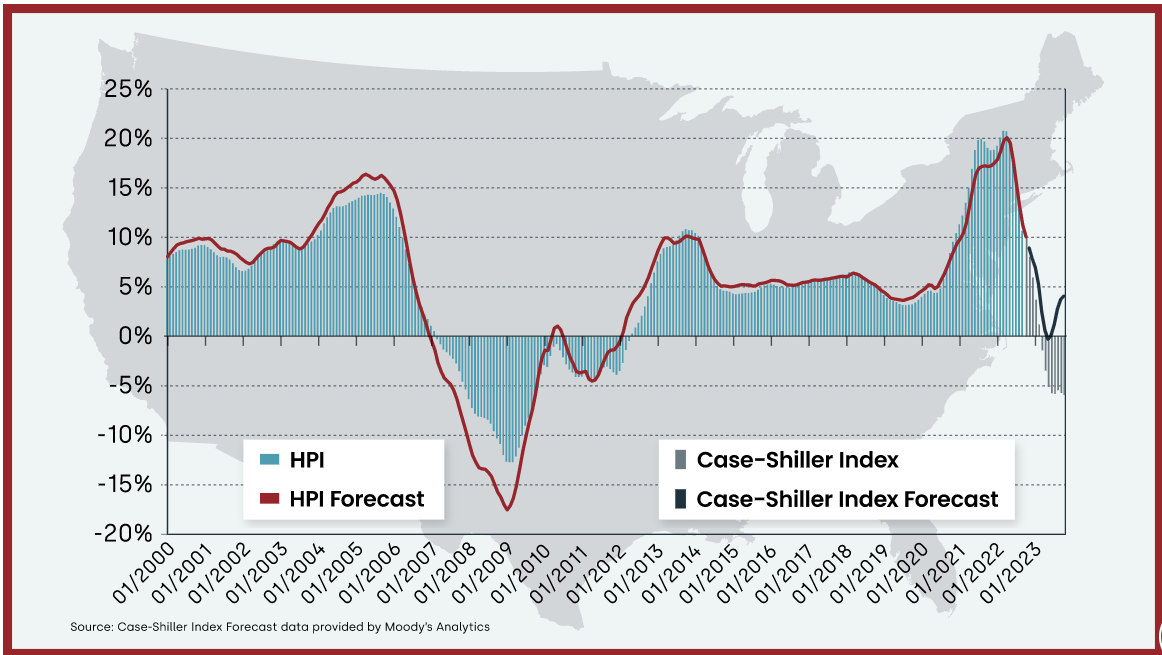

HPI & Case-Shiller Trends

This graph shows a comparison of the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to present month with forecasts one year into the future. We note that both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

Annual Home Price Growth Nears Single Digits in October

Year-over-year home price growth remained in double digits in October, at 10.1%, but continued to cool and was the lowest recorded since early 2021. Several factors are contributing to slowing appreciation: low inventory due to seller preferences to keep affordable mortgage rates that they have already locked in, homebuyer loss of purchase power and current economic uncertainty. Annual U.S. price growth is expected to taper off in the coming months, perhaps moving into negative territory by spring 2023, but then slowly ticking back into single digits as the year progresses.

”Following the recent mortgage rate surge above 7%, real estate activity and consumer sentiment regarding the housing market took a nosedive. Home price growth continued to approach single digits in October, and it will move in that direction for the rest of the year and into 2023. However, while some housing markets have seen significant recalibration since the spring price peak and are likely to post losses in 2023, further deteriorating for-sale inventory, some relief in mortgage rate increases and relatively positive economic news may help eventually stabilize home prices.”

– Selma Hepp

Interim Lead, Deputy Chief Economist for CoreLogic

HPI National and State Maps – August 2022

The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

Nationally, home prices increased 10.1% year over year in October. No states posted an annual decline in home prices. The states with the highest increases year over year were Florida (20.2%), South Carolina (16.1%) and Georgia and North Carolina (both 15.3%).

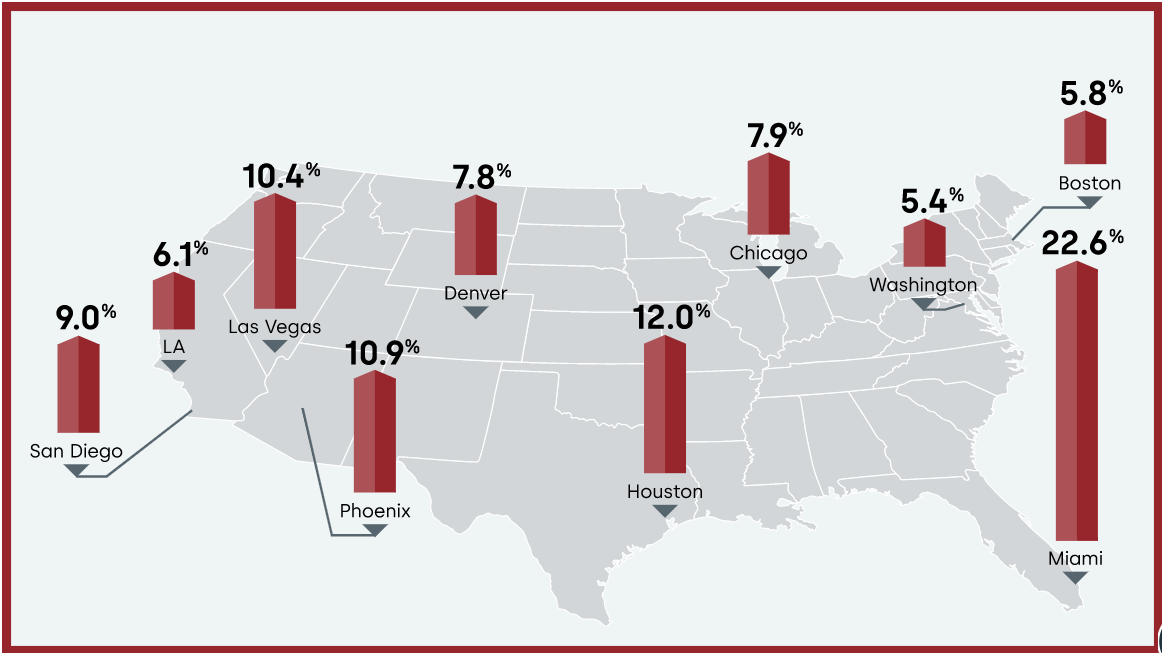

HPI Top 10 Metros Change

The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

These large cities continued to experience price increases in October, with Miami again on top at 22.6% year over year.

**

Markets to Watch: Top Markets at Risk of Home Price Decline**

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that Bellingham, WA is at a very high risk (70%-plus probability) of a decline in home prices over the next 12 months. Bremerton-Silverdale, WA; Crestivew-Fort Walton Beach-Destin, FL; Tacoma-Lakewood, WA and Salem, OR are also at very high risk for price declines.

Summary

CoreLogic HPI features deep, broad coverage, including non-disclosure state data. The index is built from industry-leading real-estate public record, servicing, and securities databases—including more than 40 years of repeat-sales transaction data—and all undergo strict pre-boarding assessment and normalization processes.

CoreLogic HPI and HPI Forecasts both provide multi-tier market evaluations based on price, time between sales, property type, loan type (conforming vs. non-conforming) and distressed sales, helping clients hone in on price movements in specific market segments.

Updated monthly, the index is the fastest home-price valuation information in the industry—complete home-price index datasets five weeks after month’s end. The Index is completely refreshed each month—all pricing history from 1976 to the current month—to provide the most up-to-date, accurate indication of home-price movements available.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.