HM.B-OME’s most recent sales report for 4Q2022, which ended in November, raised concerns that the Swedish fast fashion company isn’t moving fast enough to keep up with established rivals like Zara and newer entrants like Shein. In today’s Insight Flash, we take advantage of our newly launched Continental European data – tracking spend in Austria, France, Germany, Italy, and Spain – to understand the company’s performance across continents, digging into brand trends and how their higher priced brands are faring around the world.

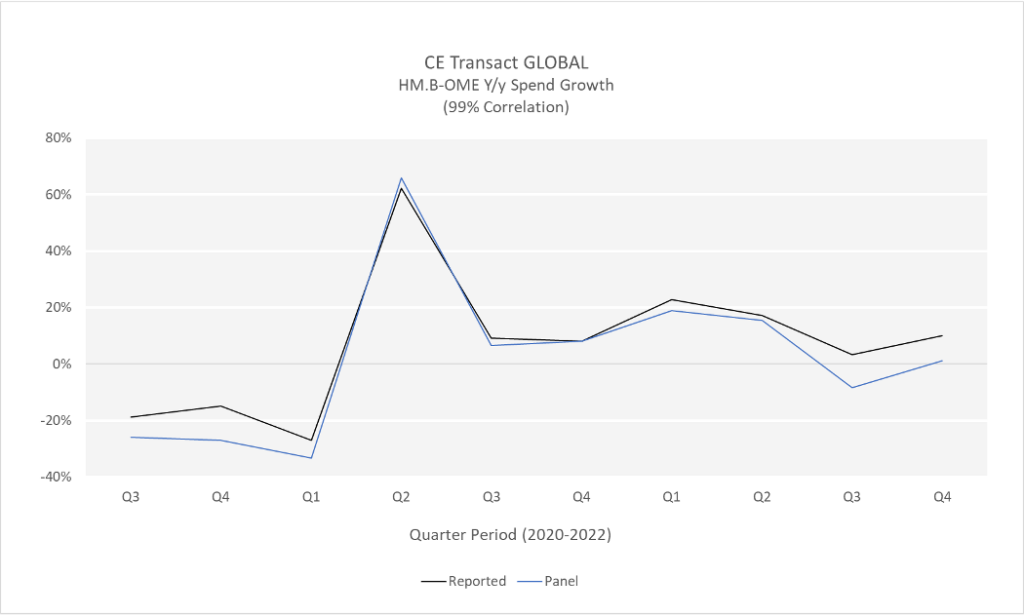

Our CE Transact data was highly predictive of H&M’s Global 4Q report:

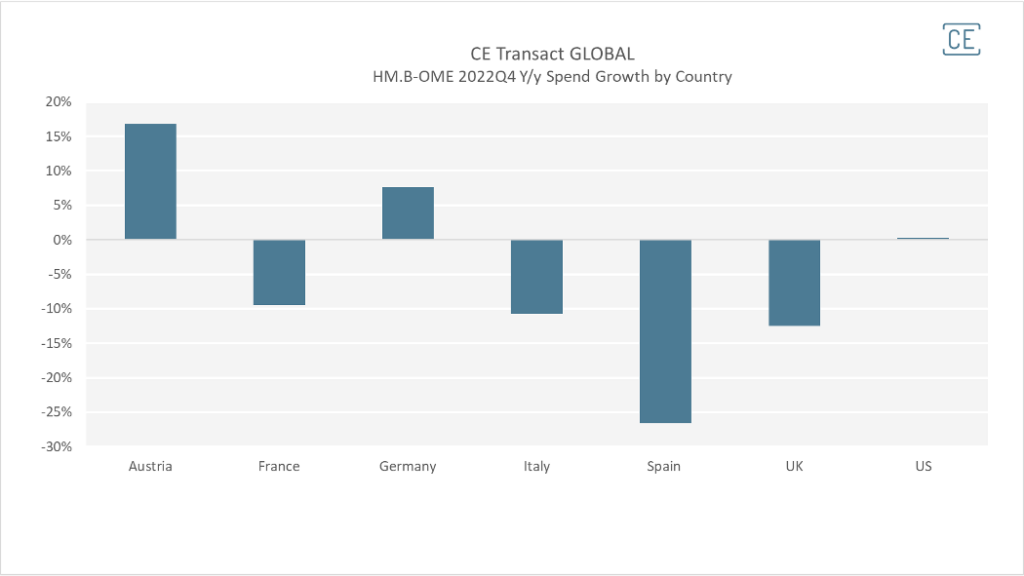

H&M is seeing varied growth rates across the different countries tracked by Consumer Edge data. On a local currency basis, the company saw the strongest y/y growth in Austria and Germany, where spend was up 16.8% and 7.7% respectively. Y/y spend in the US was relatively flat. Y/y spend was roughly similar in the UK, Italy, and France, down ~-10% in their respective local currencies. The most negative trends were in Spain, the home market of competitor Inditex, where spend was down -26.6%.

Spend Growth by Country

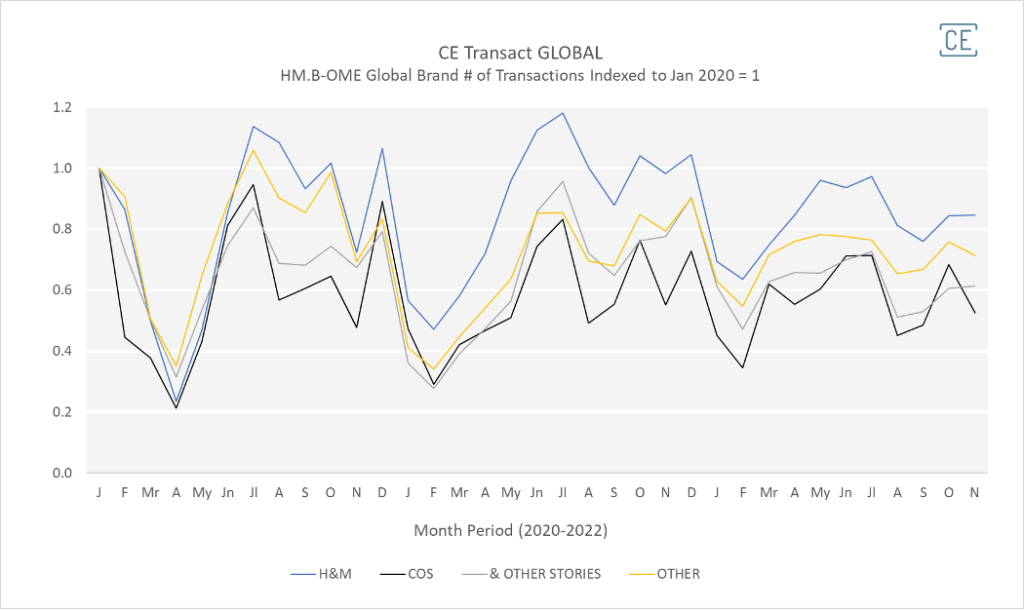

Trends within H&M’s brand portfolio may seem to shed light on the company’s overall performance. On a global level, the H&M flagship brand has been the strongest performer over the last three years. In the holiday shopping month of November 2022, the number of transactions was only 15% lower than it had been in January 2020. Meanwhile, among H&M’s higher end brands, Cos was seeing half the transactions it had in January 2020 while & Other Stories was only seeing 60% as many. Some of the company’s smaller brands, which haven’t transitioned as broadly geographically, were faring better with only a 30% decline in transactions versus January 2020.

Global Transaction Growth

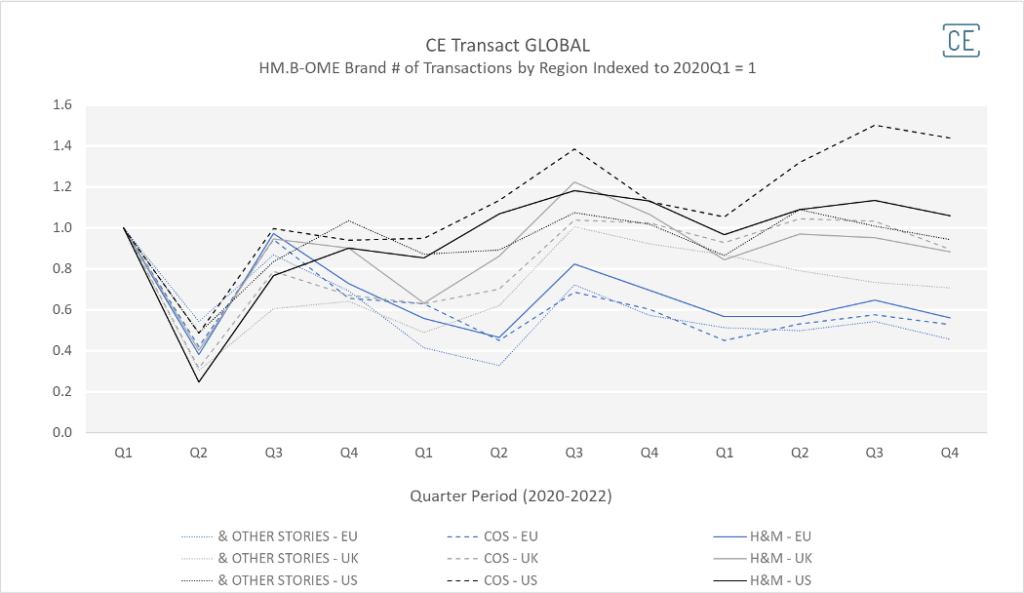

However, looking at each brand regionally tells a different story. The relative success of the H&M flagship brand is largely due to its outperformance versus the higher-end banners in the EU. In both the US and UK, Cos has been the most successful brand throughout the last year. This implies that H&M may need different strategies in different geographies tailored to local consumers. Across regions, however, the & Other Stories brand has seen the largest decline in transactions since January 2020. This brand may need a larger global overhaul if it is to contribute to the future success of H&M.

Regional Transaction Growth

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.