The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from 800 office buildings across the country. It only includes commercial office buildings, and commercial office buildings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

Despite moves by some companies to cut down on remote work, a full-time return to the office still appears unlikely. But what will remote and hybrid work patterns look like in 2023? How many people are coming into the office each day, and what are their schedules? What trends can be identified in different major cities across the country? With the new year upon us, we dove into our office index data for 2022 to get a better understanding of evolving work habits.

Nationwide: A Hybrid Model Takes Hold

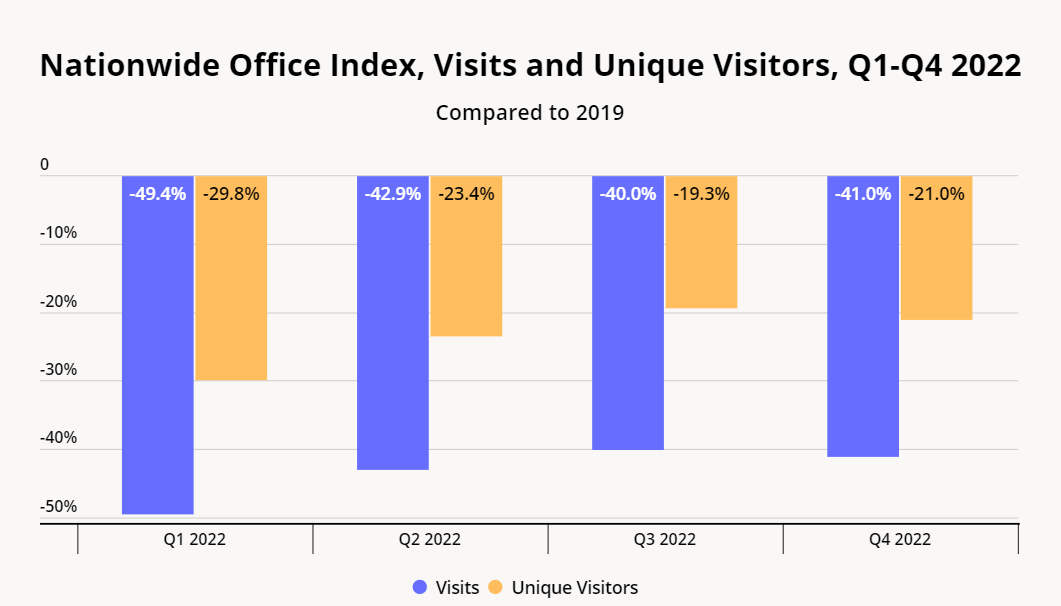

The post-COVID office recovery, which was in full swing during the first two quarters of 2022, began to taper off towards the second half of the year. Between Q1 and Q2 2022, the year-over-three-year (Yo3Y) visit gap decreased from 49.4% to 42.9%. But while Q3 2022 saw the visit gap continue to shrink to 40.0%, it increased slightly during the last three months of the year to 41.0%.

At the same time, the number of unique visitors to office buildings continues to tell a somewhat different story. Unique visitors refer to the total number of individuals who visited an office building – so one unique visitor can account for several visits. While total visits are still only about 60% of what they were in 2019, the number of visitors has bounced back to close to 80% of what it was three years ago – meaning that the vast majority of workers appear to have returned to the office, even if they don’t come in as often as they used to. As we’ve noted, these metrics seem to reflect the growing popularity of hybrid work arrangements, where individuals come into the office two or three times a week and work from home the rest of the time.

While the quarterly analysis appears to indicate a plateaued recovery process, weekly data shows that the Yo3Y visit total visit gap may have begun to shrink once again in December 2022. The last month of the year also saw a renewed increase in foot traffic compared to 2021. While the unique distribution of work days during this period clearly played a role in this trend, the recent uptick may portend a return to accelerated office recovery in the new year.

Thank God It’s Friday (TGIF)

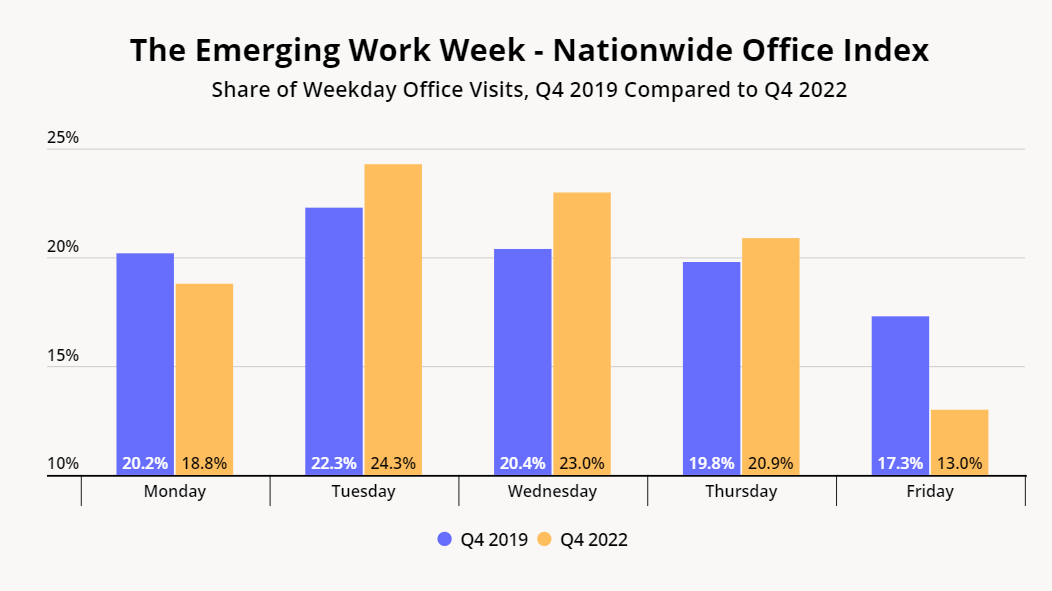

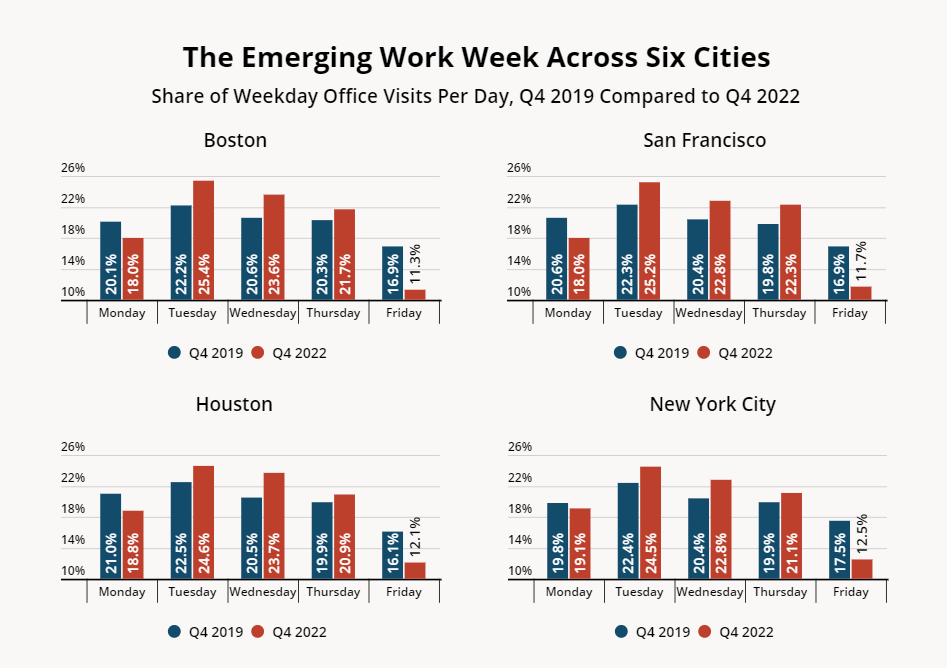

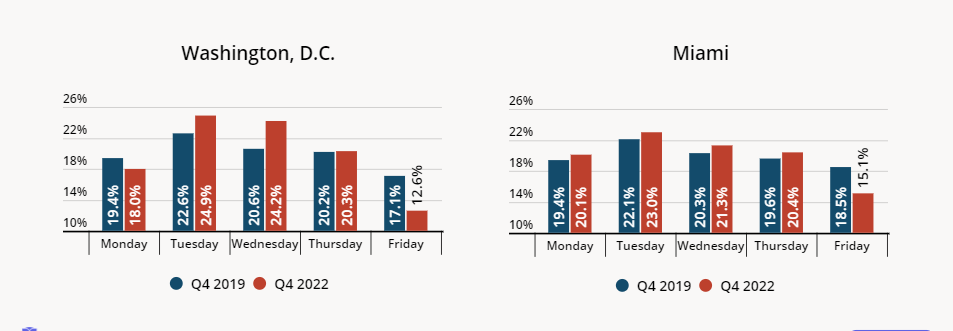

To gain insight into the emerging contours of the hybrid work week, we analyzed the daily breakdown of employees’ weekday office visits, comparing Q4 2022 to Q4 2019. And the results were striking. Even before the pandemic, fewer employees came into the office on Fridays than on other days of the week – and slightly more came in on Tuesdays. But while in Q4 2019 17.3% of weekday office visits took place on Fridays, by Q4 2022 this share plummeted to 13.0%. Mondays saw a small relative decrease in the office visit share, while Thursdays saw a slight increase. Tuesdays and Wednesdays, for their parts – with respective employee visit shares of 24.3% and 23.0% – emerged as the most popular in-office days.

Regions in Flux

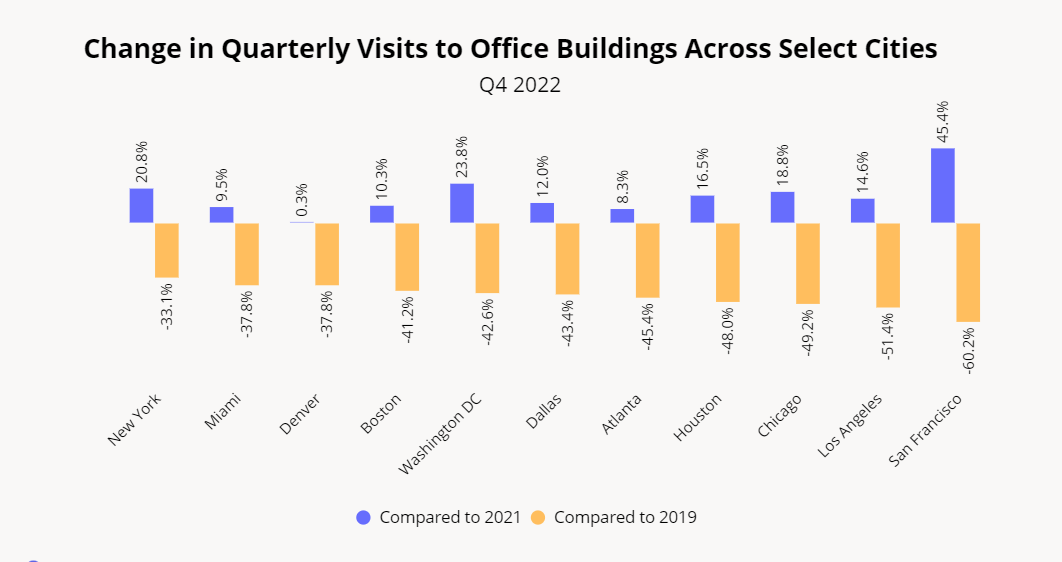

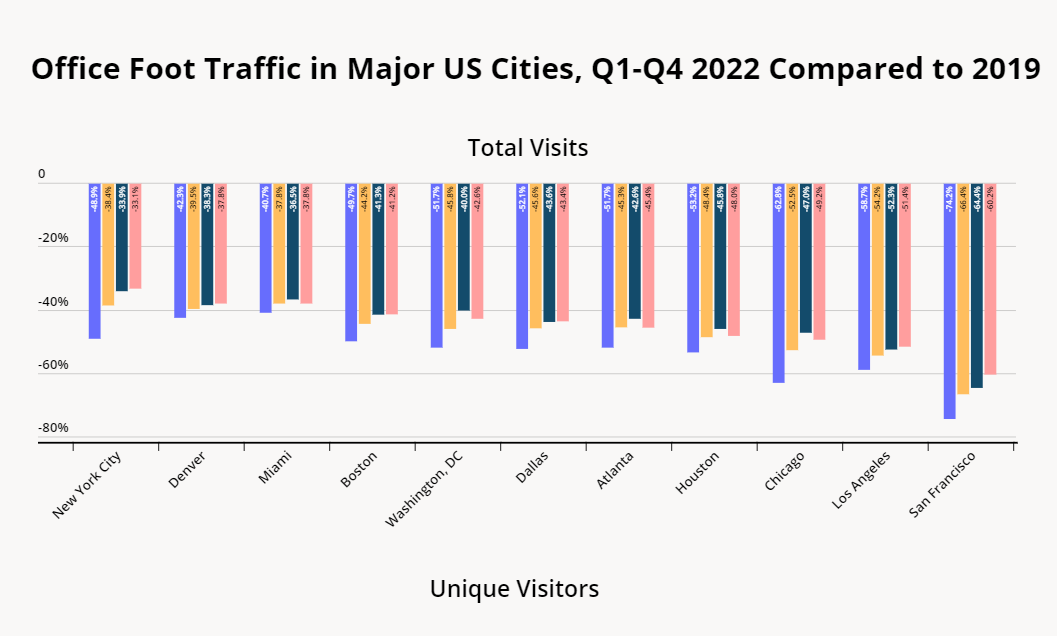

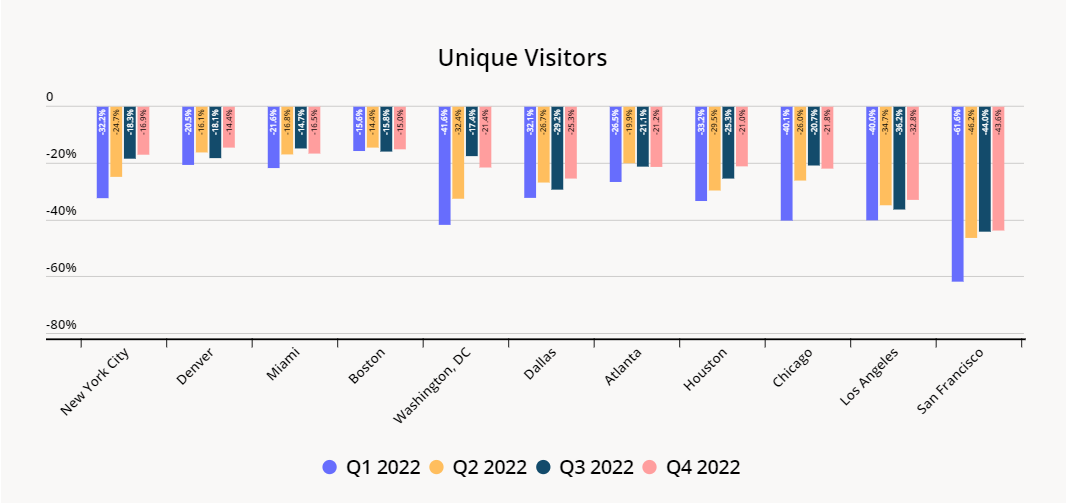

A closer look at office visits in 11 cities nationwide highlights some important regional differences. The Yo3Y visit gap in New York City shrunk consistently throughout the year, and now stands at just 33.1%. Meaning that visits to office buildings in the Big Apple are almost back to 70% of what they were before COVID hit. At the other end of the spectrum lies San Francisco. Although the Golden Gate City has also seen its visit gap shrink consistently throughout the year, including during Q4 2022, office visits are still only about 40% of pre-pandemic levels.

Broadly speaking, East Coast hubs tended to see smaller visit gaps than cities in other regions of the country, and West Coast cities experienced the biggest visit drops of all. In some urban centers – including Miami, Washington, D.C., Atlanta, Houston, and Chicago – the Yo3Y visit gap actually increased slightly during Q4 2022, with visits down between 37.8% (in Miami) and 49.2% (in Chicago) compared to 2019. Denver and Los Angeles – and to a lesser extent Boston and Dallas – continued to see their visit gaps diminish slightly during Q4.

Here too, however, the data on unique visitors reveals a more complex picture. In Denver, for example, while the total number of visits was down 37.8% in Q4 2022 compared to 2019, the number of unique visitors was down just 14.4% – meaning that nearly 85% of workers returned to the office by the final quarter of the year, even if they came in less frequently. Houston, which saw its Yo3Y visit gap increase in Q4 to 48.0% (compared to 45.8% in Q3), saw its unique visitor gap continue to shrink to just 21.0% (down from 25.3% in Q3). This could indicate a growing number of both remote and in-office workers transitioning to a hybrid model. Even in San Francisco, where a combination of significant outbound migration and particularly marked changes in tech industry work patterns brought office visits down to just 40% of pre-pandemic levels, close to 55% of workers are back in the office at least some of the time.

The TGIF Work Week: A Regional Breakdown

And the same trend observed nationwide – with employee office visits increasingly concentrated in the middle of the week, and more workers than ever staying home on Fridays – appears to be taking root in urban centers throughout the country. In Boston, San Francisco, Houston, New York, and Washington, D.C., Fridays accounted for just 11.3% – 12.6% of employees’ weekday visits in Q4 2022. In these cities, about a fourth of employee visits took place on Tuesdays. Miami remained somewhat of an outlier in this regard, with Fridays still accounting for 15.1% of employee visits during the fourth quarter of the year, and the share of Monday visits slightly increasing compared to 2019.

Key Takeaways

A Gallup poll from June 2022 showed that 60% of employees whose jobs can be done remotely prefer a hybrid work arrangement to either fully on-site or wholly remote alternatives. While working from home can be more convenient and efficient, people want to get out of their pajamas for at least part of the week and interact in person with colleagues. And while there are signs that some employers may be pushing to return to the office full time, hybrid work arrangements don’t appear to be going away anytime soon.

For hybrid employees – particularly those who have relocated to more distant suburban or rural communities – concentrating in-office days in the middle of the week can bring significant advantages. As workplaces continue to adjust to the new post-pandemic normal in 2023, the TGIF work week may be here to stay.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.