With 2022 in the rear-view mirror, we checked in to see how the grocery sector is faring at the start of the new year, zooming in on two chains that are outperforming industry averages: H-E-B and Trader Joe’s. Since H-E-B is located in Texas, we focused our analysis on the Lone Star State.

Despite somewhat different strategies, both chains have succeeded in garnering highly devoted and loyal customer bases, thanks in part to their focus on in-store customer experience. And the foot traffic data shows that both chains are doing remarkably well, demonstrating that there is room at the top for a variety of grocery chains.

The State of Grocery: Nationwide and Statewide Benchmarks

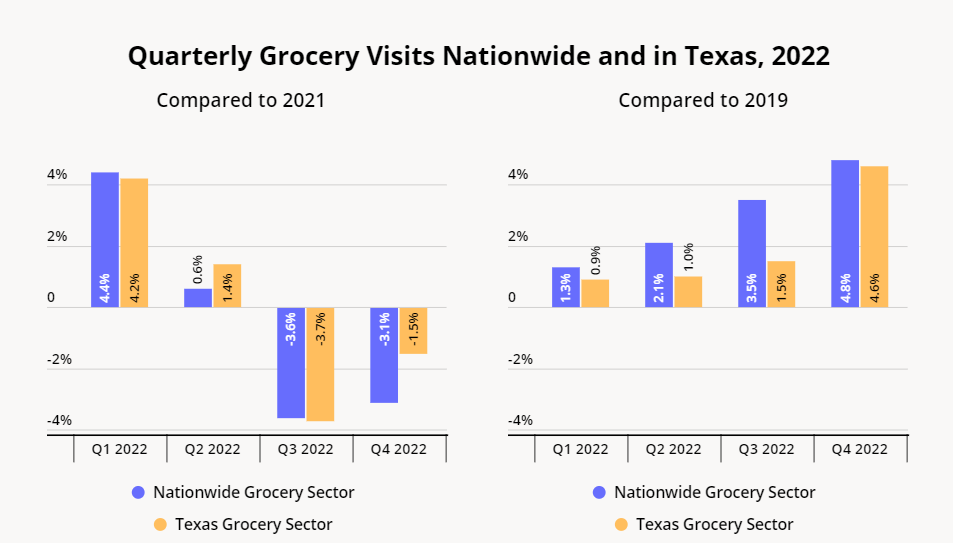

While grocery’s strong 2021 performance continues to make for a tough year-over-year (YoY) comparison, nationwide visits to the category outperformed pre-pandemic levels throughout 2022. In Q4 2022 foot traffic to grocery stores was 4.8% higher than in 2019. In Texas, too, grocery visit levels remained higher than they were three years ago.

H-E-B: Deep in the Heart of Texas

H-E-B is the most dominant grocery store in Texas, enjoying a statewide visit share of over 40% as of November 2022. Established in 1905 and named after founder Howard E. Butt, H-E-B boasts over 300 stores across the Lone Star State (and several more in Mexico).

And Texans are just a little bit obsessed with the popular grocer. With Texas-themed product lines that appeal to the strong sense of local identity, and a reputation for stepping up to help the community in times of crisis, H-E-B has been dubbed the “cultiest cult grocer in America.” Its low prices, unique private-label foods, and hyperlocal strategy – which seeks to customize each branch to reflect the needs of the surrounding area – attracts a customer base so loyal that people apparently crave more of its merch. Ranked one of the best places to work in the nation, H-E-B also cultivates a friendly in-store environment, where chefs prepare free samples and staff has been known to hand out freshly baked tortillas. In recent years H-E-B has also leaned into omnichannel capabilities – reaching the top of dunnhumby’s list of most preferred online grocers this year.

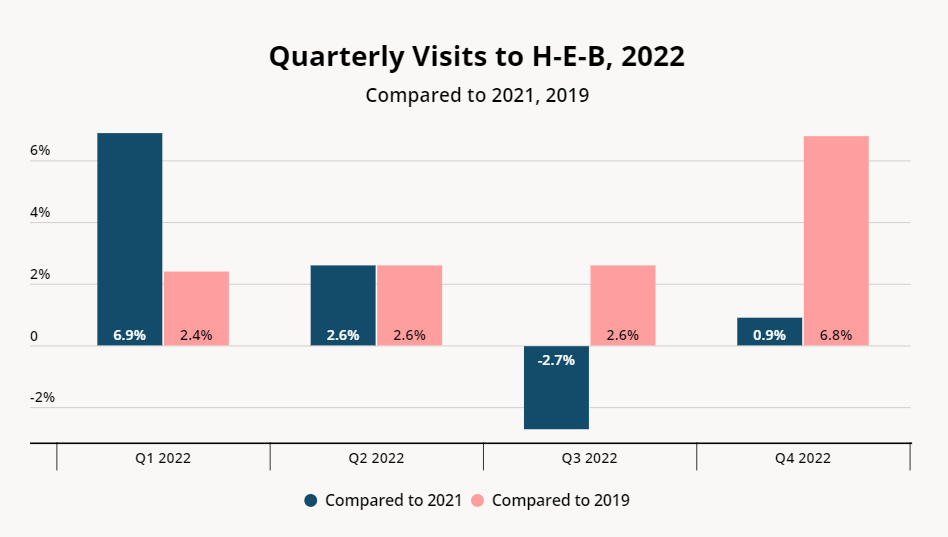

Against this backdrop, H-E-B’s continued success should come as no surprise. With the exception of Q3 2022 – which saw a quickly-reversed YoY visit gap of 2.7% – the grocery giant experienced positive foot traffic growth throughout the year, in comparison to both 2021 and 2019. In Q4 2022, the Texas-based grocer experienced 6.8% more visits than it did three years ago.

Trader Joe’s: Another Fan Favorite

But Texas, it would seem, has room for more than one cult grocer.

Since its 1967 founding in Pasadena, California, Trader Joe’s has expanded to over 500 venues throughout the country, and now has some 20 locations in the Lone Star State. Known for its up-beat, friendly atmosphere and affordable specialty offerings, the chain boasts a loyal fan base of its own. Trader Joe’s keeps its prices low by stocking mainly private-label products (over 80% of its merchandise is own-label), limiting store size, and avoiding pricey advertising.

Like H-E-B, Trader Joe’s relies on an enhanced in-person shopping experience to keep people coming back, investing in a highly-motivated staff that engages visitors with free coffee and samples of its unique product line (Trader Joe’s was also ranked, alongside H-E-B, as a top U.S. workplace). Unlike H-E-B, however, the chain remains stubbornly offline, bucking the omnichannel trend that has swept the grocery sector in recent years. Trader Joe’s doesn’t have a loyalty program, and its products can only be purchased in-store.

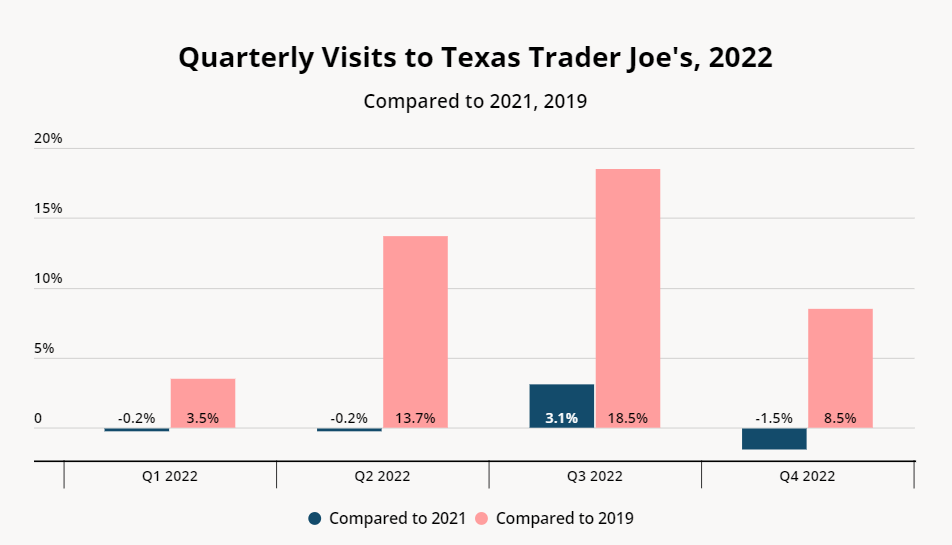

And Trader Joe’s brick-and-mortar-only strategy also seems to be working. While YoY foot traffic growth at Trader Joe’s Texas stores lagged behind state and nationwide grocery benchmarks in Q1 and Q2 2022 – due primarily to a particularly strong first half of 2021 – in Q3 and Q4 YoY visits outperformed or matched state and nationwide foot traffic growth. And compared to 2019, Trader Joe’s visit growth has been remarkable – reaching 18.5% in Q3 2022 and 8.5% in Q4.

Appealing to (Somewhat) Different Audiences

A deeper dive into the data shows that one chain’s success need not come at the expense of the other’s. Indeed, according to cross-shopping data, 59.6% of people that visited a Texas Trader Joe’s during Q4 2022 also shopped at H-E-B over the same period.

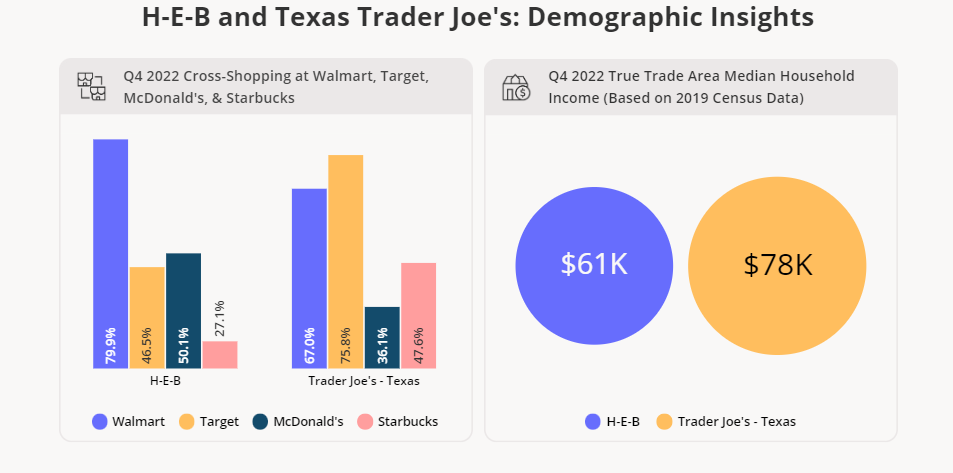

But the two grocery giants also target somewhat different demographics. Additional cross-shopping data reveals that while Trader Joe’s shoppers tend to frequent Target and Starbucks, H-E-B customers are more likely to shop at Walmart and get their fast-food fixes at McDonald’s. Trader Joe’s also attracts, overall, a more affluent audience than H-E-B. So while many shoppers frequent both chains, H-E-B and Trader Joe’s aren’t necessarily competing for the same audiences.

Key Takeaways

2023 has been heralded as the year of the omnichannel grocer. But while online shopping is certainly here to stay, the data shows that people continue to seek out positive in-store experiences. And although loyalty programs can be an effective way to build customer commitment, attracting shoppers the old fashioned way – by building trust and investing in human interaction – is also important for sustaining retail success. Trader Joe’s and H-E-B, each of which attracts a somewhat different customer base, both appear poised to flourish in 2023.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.