There are some established indicators of how confident the airline industry is in the long-term future of aviation, some are obvious: aircraft orders, airport expansion and the seemingly daily job fairs being hosted by airports throughout Europe. Another indicator and one that occasionally grabs headlines is the availability and swapping of slots at London Heathrow, one of the world’s busiest and most lucrative airports for many airlines.

In the last week there have been a number of developments around slots for summer 2023 which seem to confirm that the market is now in full recovery mode and that Heathrow has its “mojo’ back!

An Expensive Moment in Time

The concept of purchasing slots is not new, some call it secondary trading. Sometimes airlines swap slots and occasionally they loan them out whilst they await new aircraft deliveries or adjust their wider networks to accommodate new services to Heathrow.

The headlines occur when one airline purchases a set of matching slots - the record purchase is some US$75 million paid by Oman Air to Air France/KLM for a set of slots in 2016, which would make any route profitability challenging if those costs were allocated purely to their Heathrow service. Other airlines that have notably sold slots in the last few years include Air New Zealand (US$ 27m), Scandinavian Airlines (US$ 75 million for two slot pairs) and Croatia Airlines (US$ 22m) all of course pre-pandemic but reflective of the demand. Interestingly, research from CAPA suggests that the price of slots depreciates over the course of the day, with a midday pair being some 30% below the peak rate and for mid-afternoon slots there’s a further 20% reduction. Timing is clearly crucial for those airlines wishing to buy.

Not surprisingly then, with summer 2023 schedules now being finalized by carriers, any additional slots that become available at Heathrow create a frenzy of activity and as the market hardens in Europe slots may have suddenly become available from several sources.

FlyBe Goes Again…or Does It?

The recent collapse of FlyBe was not a surprise to many as the carrier had struggled since relaunching, operating a cluster of scheduled services across several locations and repeating many of its previous mistakes of limited market focus and critical mass at any one base. Indeed, during the refinancing and ownership changes before the relaunch of FlyBe there was much speculation about the real deal being around maintaining the Heathrow slots and their value at a later date.

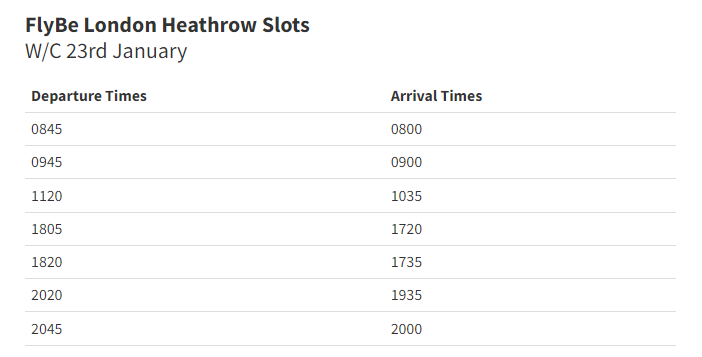

Prior to their collapse FlyBe operated seven slot pairs at Heathrow with a broad spread across the day, as the table below highlights. With the two earliest arrival slots at 08:00 and 09:00 and accepting that the earlier the slot the better value at Heathrow, then the slots were perhaps of mid-market value whilst some of the later slots would seemingly be valued at less than 50% of the peak value. That said, a seven-slot portfolio would be interesting to any airline either for its own use or perhaps as part of a wider alliance play at the airport. That explains where the intrigue around FlyBe and perhaps a Mark 3 version lies.

Apparently, there may be life left in the FlyBe name with at least two major European airlines expressing interest in acquiring it so that they can operate those slots and add them to their own portfolios. Such a broad spread throughout the day could be used to increase frequency to a major European hub and the onward connecting flows, or even perhaps be loaned to a strategic alliance partner. Leaving the slots to be returned to the regulator would probably result in them being spread across a few airlines with the probability of interested airlines not receiving perhaps more than one slot pair at best, making this an appealing opportunity. Of course, the question will be around the price to be paid and how those historic FlyBe slots can be transitioned across the purchaser’s own operations and needs, but a bit of creativity can generally overcome such issues.

And ITA Seems To Definitely Be Going….Well Maybe!

ITA Airways, the former Alitalia, have been operating to Heathrow using a series of Etihad slots that the carrier now wants to take back and share around other carriers, leaving the airline without any access to the airport, at least for the time being. A victim of Alitalia’s former partnership with Etihad in which the UAE-based carrier acquired a 49% share, the Heathrow slots became Etihad’s for a book value of some 39 million Euros. It seems that Etihad have now struck deals with American Airlines, JetBlue and BA for those slots not required and ITA are the loser, or are they?

It appears that the proposed Lufthansa/ITA partnership could see the airline secure access to a different set of slots at Heathrow and they are indeed continuing to sell seats to the airport although they are yet to secure slots. Either ITA are confident of a solution or will at some point have to bite the bullet and pull the services, undertaking a raft of customer cancellations. Only time will tell on that front. Whatever the outcome, ITA will at least in the short term continue to operate on a series of loaned slots with all the long-term risk that can bring.

For any airline, grabbing a new pair of slots at London Heathrow is a big win and as the pre-pandemic prices confirm, the right timings can represent a once-in-a-lifetime opportunity to sell for some carriers. The current level of activity highlights both how quickly airlines can move for those slots when they become available and how vulnerable access can be for those carriers operating on loaned slots. Just as importantly in a wider context, the events of the last few weeks have perhaps confirmed that most airlines are now past the pandemic and looking forward rather than backward, that has to be the most positive takeaway!

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.