In our pre-holiday department store check-in, we noted positive trends for both the mid-range and luxury department store segments. In this blog, we’ll analyze the latest visit metrics for the department store space. Specifically, we’ll dive into Nordstrom, the visits share leader in the luxury department store category, and the impact of some of its brick-and-mortar strategies aimed at increasing efficiency and driving visits.

Pandemic Bounce-Back

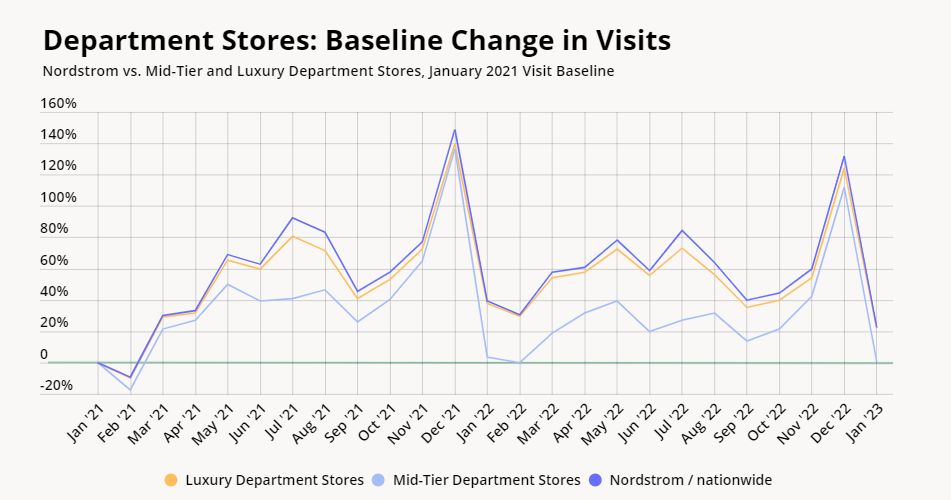

The pandemic brought much of brick-and-mortar retail to a halt in 2020, department stores included. But COVID vaccination and waning restrictions in 2021 – as well as stimulus dollars in the hands of consumers – contributed to strong brick-and-mortar foot traffic. And since the wider retail reopening in 2021, the demand for quality goods put the luxury department store segment – including Nordstrom, Saks Fifth Avenue, and Neiman Marcus – on top of its mid-tier peers Macy’s, Dillard’s, Kohl’s, and the like. Analysis of visit growth from a January 2021 baseline confirms that the luxury department store category consistently outperformed the mid-tier category in baseline visit growth. And Nordstrom, in its own right, outperformed both the mid-tier and luxury department store chains.

For most of 2022, visit growth for luxury department stores compared to the January 2021 baseline was significantly larger than that of their mid-tier counterparts. This likely had to do with soaring inflation in 2022 and the relative imperviousness of high-end shoppers in the face of macroeconomic headwinds.

So far in 2023, the luxury segment has sustained growth ahead of the department store pack, giving every indication that the luxury chains will continue to dominate the department store space. January 2023 visits to luxury department stores were up 22.0% while visits to mid-tier department stores were just 0.2% above the January 2021 baseline.

Nordstrom Finds its Rightsize

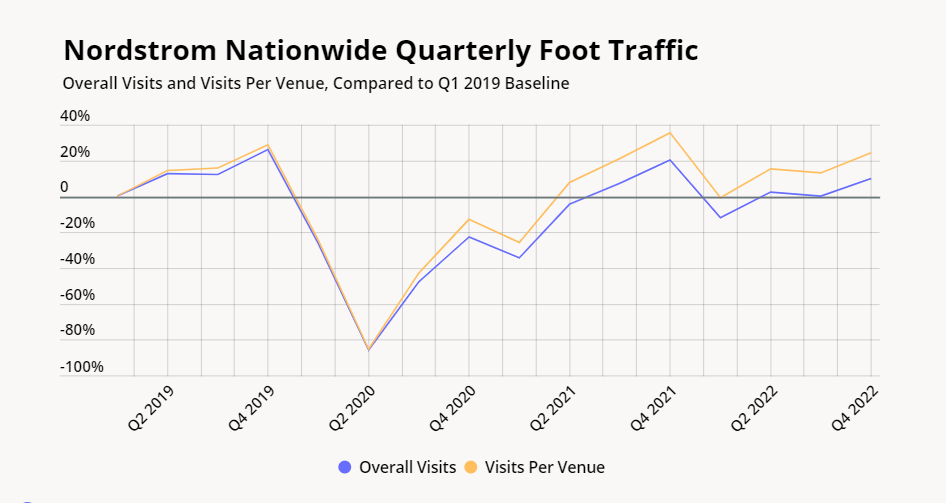

One way Nordstrom – the largest of the upscale department store chains – has sustained growth ahead of its peers is by undertaking a decisive rightsizing strategy. Even before the pandemic, Nordstrom closed stores and continued to do so as the pandemic’s impact on brick-and-mortar retail became more pronounced. And there are rumors the brand is not finished with its rightsizing efforts.

These efforts have so far proven to be an effective strategy for driving more visits to Nordstrom’s locations. And as more consumers headed out of their pandemic-casual wardrobes, strong demand for occasion wear brought many visitors to the remaining Nordstrom stores.

Comparing Nordstrom’s visits to a Q1 2019 baseline shows that since the majority of closures in 2020, visits per venue have been well ahead of overall visits, indicating that more visitors are frequenting Nordstrom’s remaining locations.

A Growing Audience

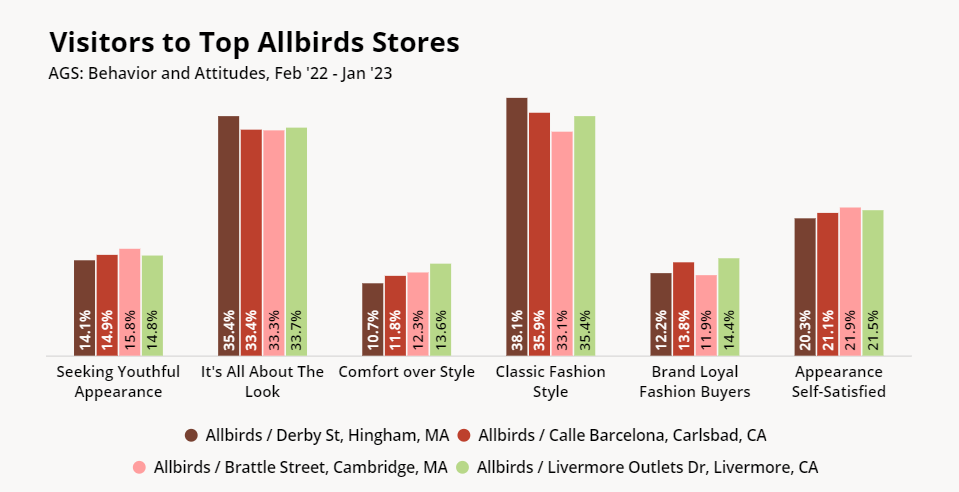

Along with optimizing its fleet, Nordstrom has demonstrated that partnerships with digitally-native brands (DNBs) have the potential to drive foot traffic to the chain. In general, pairing with an established brick-and-mortar retailer allows a DNB to efficiently build brand recognition among the larger retailer’s visitors while the larger retailer receives an exciting new line of products to drive fresh foot traffic. Nordstrom has long-term partnerships with Casper and Bonobos and in 2022 entered a partnership with Allbirds, the popular digitally-native shoe brand, which began to sell its products at Nordstrom’s stores and on its website.

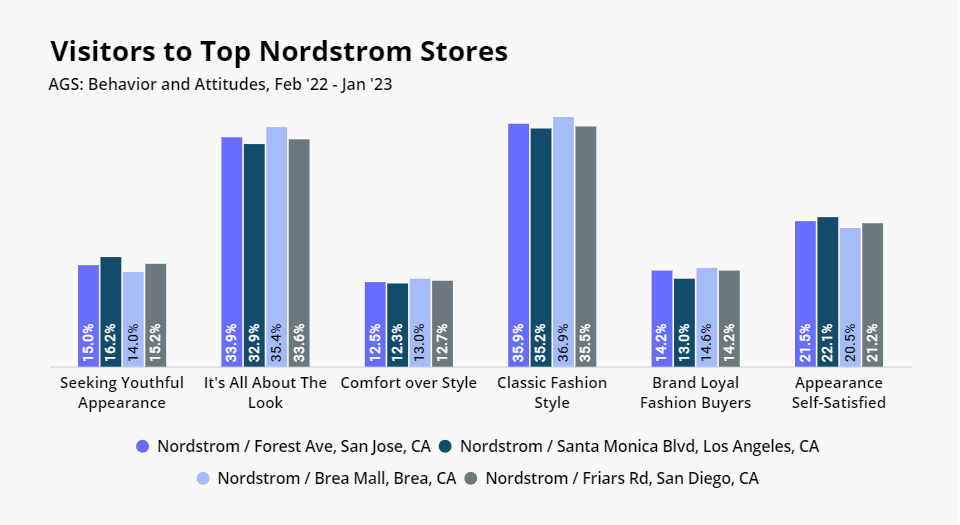

Diving deeper into Allbirds’ and Nordstrom’s decision to collaborate provides a better understanding of the rationale behind the partnership strategy. By embarking on the shared venture, there is significant potential for both brands to grow their audiences. Based on the AGS: Behavior & Attitudes dataset, the typical psychographic profile of visitors to Allbirds’ top stores in the last year was nearly identical to that of Nordstrom’s most popular locations. A large percentage of visitors to both brands fell into the “Classic Fashion Style” and “It’s All About the Look” segments along with several others.

Since Allbirds and Nordstrom already appeal to visitors with similar values, their partnership is poised to drive mutual growth. As the audiences intersect, both brands can benefit from reaching a wider audience.

The Lap of Luxury

In the current economic landscape, luxury department stores continue to outperform their mid-tier counterparts. And within the luxury category, Nordstrom appears to have found a recipe for success. The brand’s rightsizing campaign and partnerships with digitally-native brands allow it to grow its reach and separate itself from the department store pack.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.